Summary:

- Microsoft is a diverse technology titan, which owns the worlds most popular operating system Windows, Xbox and the popular video conferencing platform MS Teams.

- The company is in talks to acquire 49% of the A.I company Open AI which created the viral ChatGPT product, for ~$10 billion.

- Microsoft reported strong financials in Q1,FY23 as the company beat both revenue and earnings growth estimates.

- The technical chart shows an area of consolidation that could break through to higher levels if the Open AI and Activision Blizzard deals are closed.

Jean-Luc Ichard

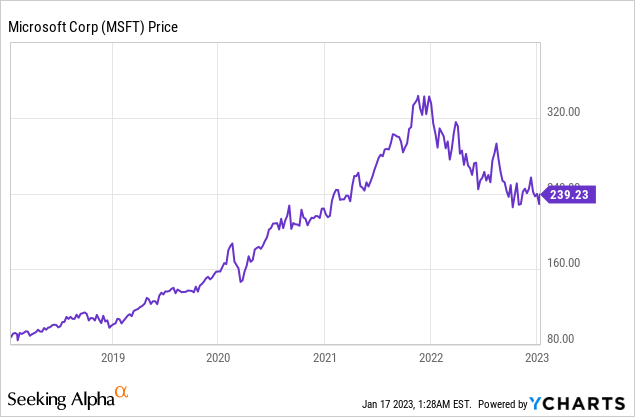

Microsoft (NASDAQ:MSFT) is a technology titan and one of the highest-quality businesses on the planet. Tough economic times act as a filter for the “best” and “worst” companies with the weakest or strongest business models. Microsoft has a diverse business model and continued to produce strong financial results in the recent quarter. In addition, its technical chart is showing signs of stability and even bullish momentum, if certain pending deals close. In this post, I’m going to break down Microsoft’s technical chart before reviewing its recent business catalysts (related to AI) and its valuation, let’s dive in.

Technical Analysis

Generally, when investing I analyze the “fundamentals”, which include the earnings and the revenue of a company. However, it also makes sense to combine this with technical analysis to understand historic buying activity, where investors previously saw value. No matter how skeptical I am with technical charts, I still see many obvious opportunities to “buy” or “sell”. In this case, I have analyzed the technical charts for Microsoft. If you haven’t read technical charts before, don’t worry I will walk you through it step by step.

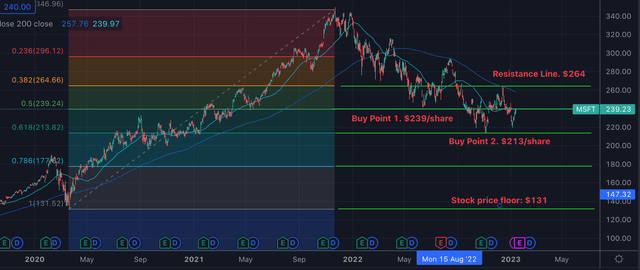

On the chart below I have added a “Fibonacci Retracement” indicator which is the colored boxes/lines to the left. This is a great indicator to help identify “support” and “resistance” lines. Starting at the bottom of the below chart I have identified a “stock price floor” at $131/share, this is the same level as the March 2020 low/crash. Now although this is a long way off for Microsoft, many other technology companies such as Meta, Google, and Amazon, have approached or crossed their low’s in 2020. Microsoft has not which indicates the high quality of the company.

Microsoft Technical Chart 1 (Created by author Deep Tech Insights)

On the right side of chart 1 (above), we can see Microsoft’s stock previously found “support” at my “Buy Point 2” zone of ~$213 per share. The stock bounced twice at this level in 2022/2023. In the third quarter of 2021, the stock was moving sideways at this level for a substantial period. From this information, we can gather that this is a consolidation zone, where both buyers and sellers are in deadlock.

On chart 2 (below), I have zoomed in on the right side. We can see Microsoft’s stock started to rise higher and is now “stroking” the Buy Point 1 support/resistance line of $239/share. We are now looking for it to “break through” this line and then the stock is likely to move upwards. However, the stock won’t “go to the moon” right away, as a resistance line at $264/share will likely stop it…as it has done previously in December 2022. Thus this is another key buying zone to watch as if Microsoft can break through the $264, it is likely to go higher, till at least $296/share. These are all useful metrics to write down and it can make sense to set up automating buying triggers, but this is not financial advice.

Zoomed In Microsoft technical chart 2 (Created by author Deep Tech Insights)

Microsoft is also hovering between its 50-day moving average line (blue line) and 200 day moving average line (green). This indicates further sideways movement until a catalyst, such as a strong earnings report, positive news on its Activision deal, or even confirmation of its Open AI/ChatGPT investment, which I will discuss in the next section.

ChatGPT – Gamechanging AI Catalyst

Microsoft was recently in talks with Open AI to acquire ~49% of the company which owns the viral AI platform ChatGPT. Microsoft plans to invest approximately $10 billion into Open AI, at a substantial valuation of $29 billion. This may seem a lot for a company that is burning capital, but Microsoft aims to keep 75% of profits until the cash is paid back. In addition, the applications of AI are tremendous. ChatGPT can be used to write books, and even write AI code. Wedbush Securities believe the investment could be a “game-changer”. Microsoft also has an advantage when it comes to the bidding process as the company previously made a $1 billion investment into Open AI back in 2019. In addition, Microsoft already uses Open AI in a number of its products. For example, its cloud customers have been able to pay for access to GPT-3, (which is similar to the ChatGPT, a text-based chatbot) since 2021. The Dall-E 2, AI image generation platform, was also integrated into a Microsoft graphic design platform called designer. In addition, this text-to-image generator can be used through the “Bing search engine”. AI-generated images aren’t anything new and there are products such as Midjourney and Google’s Imagen. However, as these platforms improve the possibilities are endless, as they can be effectively be used to create custom images and videos. For example, I created a custom set of images of the legendary investor Warren Buffett, in a “metaverse” style with Midjourney.

Warren Buffett A.I generated image (created by author Ben at Deep Tech Insights)

Strong Cloud Engine

Morgan Stanley analyst Keith Weiss, has an “overweight rating” on Microsoft. He believes the company will benefit from increased IT spending. The company is also “thought of higher” according to a survey of chief information officers. The survey expects Microsoft to capture a net of 40% share gains in I.T spending. This is greater than Amazon, which is forecast to capture ~24% of gains.

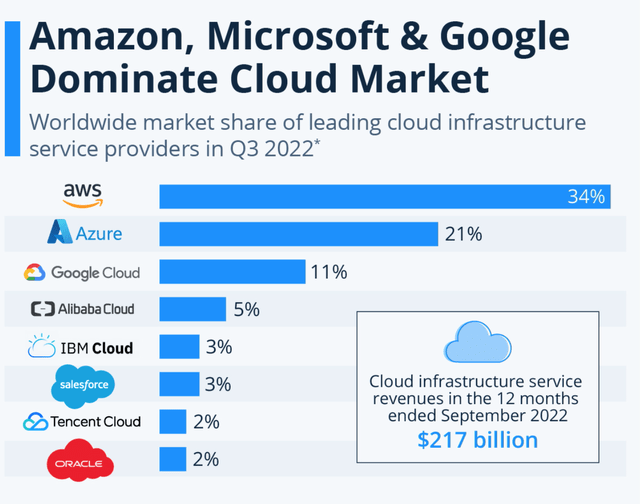

I believe Microsoft’s Cloud business (Azure) will also be a key growth engine moving forward. Its platform has the second-largest market share in the world, with ~21% reported. This is behind AWS at 34%, but well ahead of Google Cloud at just 11%. The cloud industry is forecast to grow at a rapid 19.9% compounded annual growth rate [CAGR] and reach $1.7 trillion by 2029.

Advanced Valuation

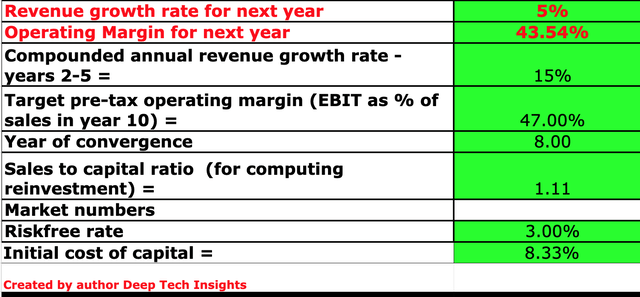

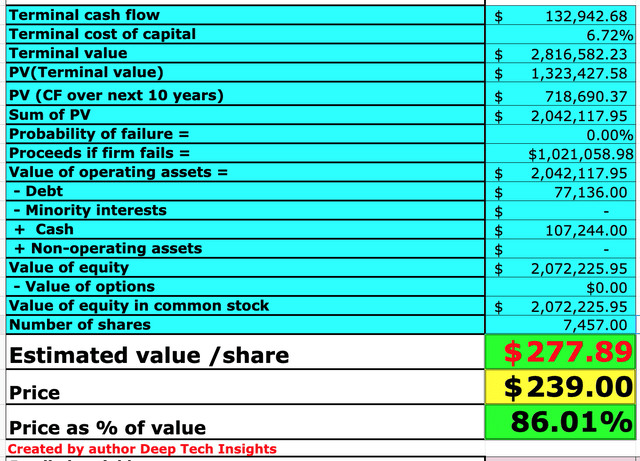

In previous posts on Microsoft, I have covered its financials in great detail, here is a very brief recap. For the first quarter of fiscal year 2023, Microsoft reported $50.12 billion in revenue which surpassed analyst estimates by $435.2 million and increased by 11% year over year. Its revenue was impacted by a tepid personal computing and gaming market. However, its cloud business reported outstanding growth. Microsoft’s cloud business generated $20.33 billion in revenue, which increased by a rapid 20% year over year or 26% on an FX-neutral basis. Interestingly, the Cloud now contributes to 40% of its total revenue. In terms of the valuation, I have plugged the latest financial data for Microsoft into my discounted cash flow model. I have forecast 5% revenue growth for next year. This is fairly conservative and driven by a forecasted recession, which I will discuss in the “Risks” section. In years 2 to 5, I have forecast revenue to increase at a faster growth rate of ~15% per year. I expect this to be driven by a cyclical rebound in the economy as well as Microsoft’s personal computing and gaming segments.

Microsoft stock valuation 1 (created by author at Deep Tech Insights)

In the first quarter of fiscal year 2023, Microsoft reported solid earnings per share [EPS] of $2.35, which surpassed analyst expectations by $0.06. To increase the accuracy of the model, I have capitalized R&D expenses which has lifted net income even more so. In addition, I have forecast a pre-tax operating margin of 47% over the next 8 years, which I expect to be driven by continued growth in the cloud segment.

Microsoft stock valuation 2 (created by author Deep Tech Insights)

Given these factors I get a fair value of $277 per share, at the time of writing Microsoft is trading at ~$239 per share and thus it is 14% undervalued. This is not really cheap, but for such a high-quality company with a huge number of tailwinds, this is expected.

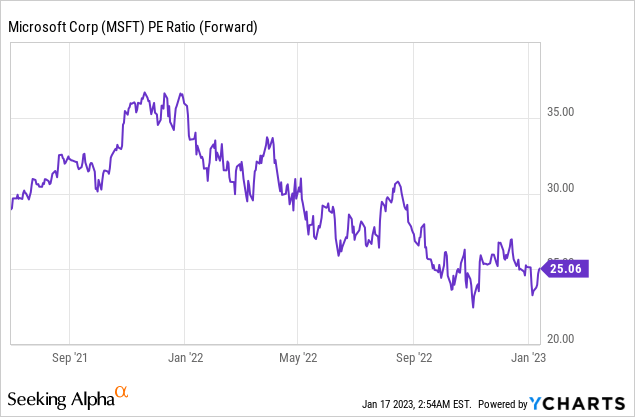

Microsoft also trades at a Price to earnings [P/E] ratio = 25, which is 18% cheaper than its 5 year average.

Risks

Recession/Activision Deal

Many analysts have forecast a recession in 2023, thus I believe Microsoft will see its personal computing and gaming segment further impacted. The good news is that the economy and both these segments tend to be cyclical, thus I have forecast a rebound long term. A negative catalyst for Microsoft would be if its planned acquisition of gaming company Activision Blizzard gets blocked. This is a huge acquisition worth ~$69 billion and the EU is reportedly coming up with a “statement of objections”. Thus it will be interesting to watch how this plays out.

Final Thoughts

Microsoft is one of the highest-quality companies on the planet and its cloud business is growing at a tremendous rate. The company’s possible acquisition of Open AI and ChatGPT is likely to act as game-changer and enable it to compete (or beat) rival Google on the AI front. This acquisition would follow Microsoft’s classic “fast follow” strategy. I would not say Microsoft is an innovator (they were later than AWS to the cloud), but they are great at spotting opportunities. Its technical chart shows an interesting consolidation period and its stock is undervalued intrinsically.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.