Summary:

- Microsoft’s Azure, Google’s GCP and Amazon’s AWS make up 67% of the cloud infrastructure services market. As a mix of overall revenues, Microsoft has the highest gearing to cloud.

- This greater focus on the Cloud business can continue market share gains and strong customer adoption. Azure may be the leader in the cloud vendor market in 3–5 years.

- Copilot-driven ARPU growth can pave the way for multiple expansion as investors raise long-term growth expectations due to the sticky nature of Microsoft’s enterprise productivity software.

- Cloud gross margins are a key monitorable as a higher Azure sales mix can offset some of the pricing gains in the Office 365 products.

- Relative technicals of MSFT vs S&P500 suggests a breakout of the weekly range, leading to a positive active return expectation.

Olemedia

Performance Assessment

Since my last article on Microsoft (NASDAQ:MSFT) from January, the stock has generated an active total return vs the S&P500 (SPY) (SPX) of +0.18%:

Performance since Author’s Last Article on Microsoft (Author’s Last Article on Microsoft, Seeking Alpha)

The realized performance, however, is -0.19% active return as I had changed my stance to a ‘Neutral/Hold’ after the Q2 FY24 earnings release, communicating this in a pinned comment:

Author’s Pinned Comment on Last Article on Microsoft, Seeking Alpha (Author’s Last Article on Microsoft, Seeking Alpha)

I believe this decision was acceptable; however, I am a bit peeved about the higher turnover I’ve been having recently. The good news is going forward, I have adjusted my process to still have accurate views but without as much turnover.

Thesis

I have believed that Microsoft would be an early leader in the AI boom since May 2023. Since my last update, Microsoft’s operational execution momentum has continued. After the last 2 quarters, I believe a few themes have become clearer, which is why I am upgrading my stance to a ‘Buy’. The thesis:

- Microsoft’s Azure is gaining over the competition

- ARPU growth can pave the way for multiple expansion

- Relative technicals suggest a breakout of the weekly range

Microsoft’s Azure is gaining over the competition

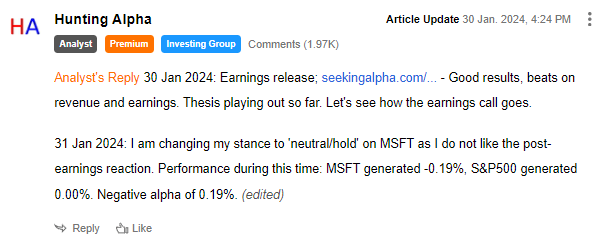

Among major cloud vendors, it is a tough fight between Microsoft, Google (GOOG) and Amazon (AMZN), who collectively make up 67% of the market, having gained global market share at the expense of Alibaba (BABA) and others:

Cloud Market Shares (Statista, Author’s Analysis)

More recently, Microsoft has been winning vs both Google and Amazon as its share has grown from 22% to 25% over the last 4 quarters. Management’s commentary in the latest earnings call is also much more bullish, as both the size and length of Azure deals have been increasing:

Overall, we are seeing an acceleration in the number of large Azure deals from leaders across industries, including billion-dollar-plus multiyear commitments… The number of $100 million-plus Azure deals increased over 80% year-over-year, while the number of $10 million-plus deals more than doubled

– CEO Satya Nadella in the Q3 FY24 earnings call

…bookings increased…significantly ahead of expectations, driven by Azure commitments

– CFO Amy Hood in the Q3 FY24 earnings call

I note that among these 3 large cloud vendors, Microsoft is the most heavily geared to its cloud platform Azure:

| Company | Cloud Business Mix of Overall Revenues |

| Microsoft | 30.7% |

| Amazon | 17.5% |

| Alphabet | 11.9% |

Source: Company Filings, Author’s Analysis

I believe the higher top-line contribution is leading to a greater focus on Cloud in Microsoft vs Amazon and Alphabet. Due to this, I suspect Microsoft will continue making greater strides in the cloud businesses vs its competition. Over the next 3-5 years, I anticipate that Microsoft’s Azure would take over Amazon’s AWS as the leading cloud vendor.

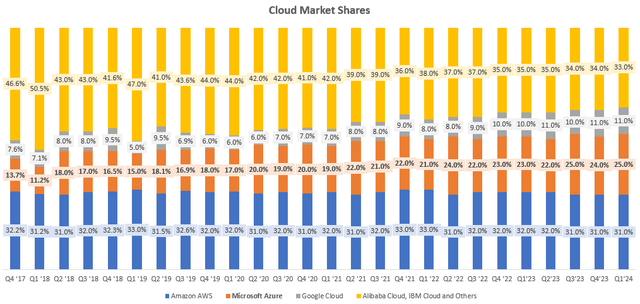

ARPU growth can pave the way for multiple expansion

Microsoft’s Office 365 products business makes up 19% of overall revenues as of Q3 FY24. The infusion of Copilot and other AI-related productivity boosts into the products portfolio is allowing Microsoft to increase pricing, leading to ARPU (average revenue per user) growth:

Office 365 ARPU YoY (Company Filings, Author’s Analysis)

As we are still in the early stages of AI-features monetization, I believe there is further scope for pricing increases. Management’s commentary gives reassurance to this view:

ARPU growth from continued E5 momentum and early Copilot for Microsoft 365 progress… In Office Commercial, revenue growth will again be driven by Office 365 with seat growth across customer segments and ARPU growth primarily through E5.

– CFO Amy Hood in the Q3 FY24 earnings call

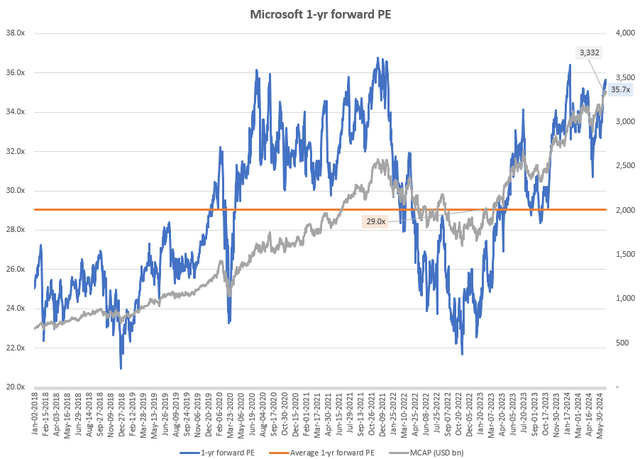

Now, enterprise software and productivity tools tend to be sticky, subscription products as users get habituated and reliant on these tools. This generally makes gradual price hikes a powerful growth driver that are rarely reversed. In the case of Microsoft, I expect this effect to play out, thus boosting long-term earnings growth potential. From a valuation perspective, I think this would lead to multiple expansion in the stock from the current 1-yr fwd PE levels of 35.7x:

Microsoft 1-yr fwd PE and MCAP (Capital IQ, Author’s Analysis)

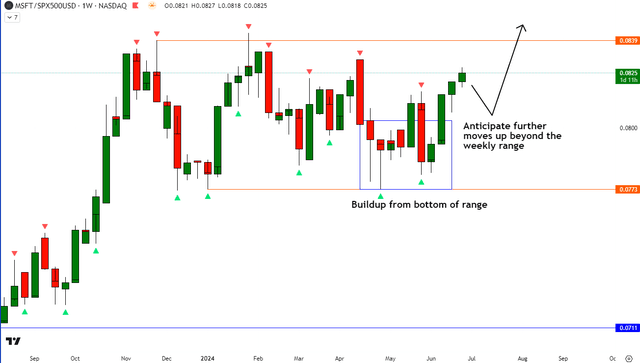

Relative technicals suggest a breakout of the weekly range

If this is your first time reading a Hunting Alpha article using Technical Analysis, you may want to read this post, which explains how and why I read the charts the way I do. All my charts reflect total shareholder return as they are adjusted for dividends/distributions.

Relative Read of MSFT vs SPX500

On the relative weekly chart of MSFT vs S&P500, I notice that there has been some accumulation or buildup from the bottom of the weekly range, followed by a strong expansion up. I anticipate this thrust up to continue, leading to an eventual breakout of the weekly range. But do note that an initial multi-week pullback is not unusual:

MSFT vs SPX500 Technical Analysis (TradingView, Author’s Analysis)

Key Margin Levers To Track

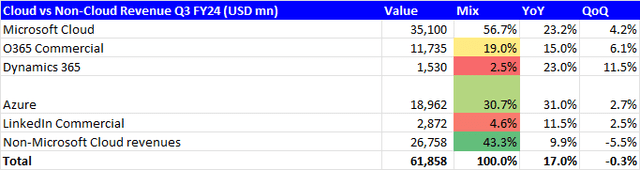

Microsoft Cloud as a business segment makes up 56.7% of revenues. It is mostly driven by Azure and Office 365:

Cloud vs Non-Cloud Revenue Q3 FY24 (USD mn) (Company Filings, Author’s Analysis)

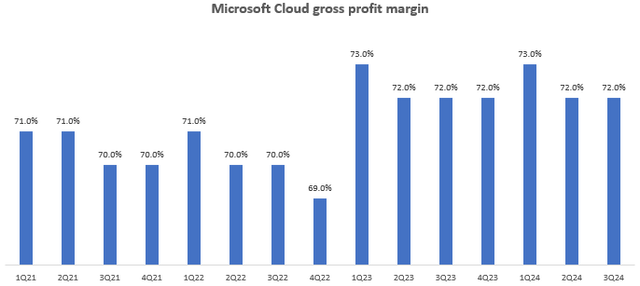

Microsoft Cloud’s overall gross margins have been ticking at 72% so far:

Microsoft Cloud Gross Profit Margin (Company Filings, Author’s Analysis)

The accretive moving parts here include the price hikes from Office 365 and some Azure services. But this is offset by a higher Azure revenue mix, which has a lower gross margin profile than Office 365:

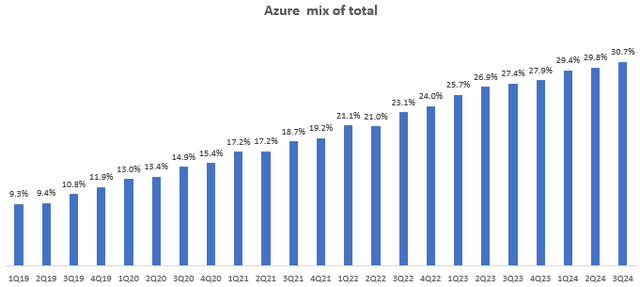

Azure Mix of Total Revenues (Company Filings, Author’s Analysis)

Going forward, I expect the Azure’s revenue mix to continue rising as it is the growth leader in Microsoft’s diverse portfolio (management has guided for 30-31% YoY growth in Azure). This would be a drag on Microsoft’s gross margin levels. On a net basis, I am not sure if the ARPU increases would be enough to compensate. Hence, this is a key monitorable for my thesis, as it may endanger the likelihood of further multiple expansion in the stock.

Takeaway & Positioning

Overall, I am bullish on Microsoft, as I think Azure is gaining momentum over its competition. On a sales contribution basis, Microsoft is more heavily geared toward its cloud platform than Google or Amazon. I expect this higher level of focus to translate into further market share gains going forward, overtaking Amazon’s AWS in 3-5 years time.

The infusion of Copilot also provides Microsoft with opportunities to hike up product pricing. Due to the sticky nature of Microsoft’s enterprise and productivity software, I expect these price hikes to be more or less permanent, giving grounds for multiple expansion led valuation upside. However, a key risk to monitor for this part of the thesis is the overall Microsoft Cloud’s gross margin levels because increasing sales contribution from the lower-margin Azure may offset the pricing hikes in Office 365.

On the relative technicals vs the S&P500 side of things, I am bullish as I expect a breakout of the weekly range.

Hence, I rate the stock a ‘Buy’.

How to interpret Hunting Alpha’s ratings:

Strong Buy: Expect the company to outperform the S&P500 on a total shareholder return basis, with higher than usual confidence

Buy: Expect the company to outperform the S&P500 on a total shareholder return basis

Neutral/hold: Expect the company to perform in-line with the S&P500 on a total shareholder return basis

Sell: Expect the company to underperform the S&P500 on a total shareholder return basis

Strong Sell: Expect the company to underperform the S&P500 on a total shareholder return basis, with higher than usual confidence

The typical time-horizon for my views is multiple quarters to around a year. It is not set in stone. However, I will share updates on my changes in stance in a pinned comment to this article and may also publish a new article discussing the reasons for the change in view.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.