Summary:

- Microsoft faces investor caution due to rising capital expenditures, OpenAI drama, margin pressures, and Copilot product uncertainty, leading to 2024 underperformance.

- AI’s significance since ChatGPT’s launch has driven tech stock volatility, with hyperscalers like Microsoft investing heavily in capex with uncertain ROI.

- Despite short-term noise, Microsoft’s long-term investment thesis remains strong, with attractive valuation and mid-teens growth potential.

- As fiscal Q1-25 approaches, I reiterate a ‘Buy’ rating.

jewhyte

Microsoft (NASDAQ:MSFT), initially perceived by the market as the cleanest AI story, one of its biggest beneficiaries, and a clear early winner, is now seeing investors turning cautious.

Amid rising capital expenditures, Open AI drama, near-term margin pressures, and uncertainty regarding the Copilot product lines, Microsoft has been a significant underperformer in 2024, trailing the market by 9%.

As the fiscal Q1-25 report quickly approaches, it’s time to revisit our investment thesis and dive into key aspects to monitor.

Recapping Two Years Since The ChatGPT Launch

On November 30, 2022, OpenAI took the world by storm with the introduction of ChatGPT. Up until that point, AI was a talking point reserved primarily for developers, and Wall Street didn’t really pay much attention.

Ever since then, AI pretty much became the only thing that mattered for investors in the technology sector. Stocks are punished and rewarded solely based on their AI opportunities and execution, with extreme sensitivity to long-tail scenarios like AI replacing the entire software industry, becoming our low-cost personal assistant, or fuelling robots that will replace humans.

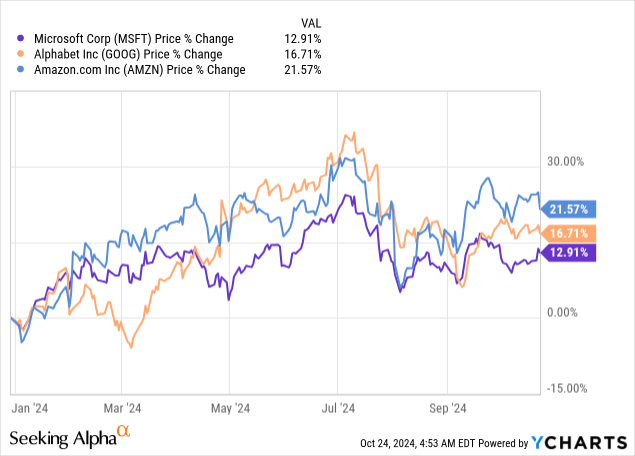

In light of this constantly developing story, many companies are constantly jumping from the ‘AI Winners’ basket to the ‘AI Losers’ basket. Perhaps the most notable ones are the hyperscalers, Amazon (AMZN), Alphabet (GOOG), and Microsoft, who are the ones spending hundreds of billions of dollars in capex to enable this shift, while the market is suspicious of the ROI.

A quick glance at their stocks’ fluctuations paints the changing sentiment throughout the year. Each has their own specific headwinds and tailwinds, but generally speaking, I think we can say the market is not yet settled on whether or not this extreme capex cycle will end up being good for shareholders.

Furthermore, for Microsoft, there are even more questions about the application layer, specifically about its Copilot stack, and the potential of disruption to its old and very successful SaaS seat-based model.

With that backdrop in mind, let’s revisit the Microsoft investment thesis, and then tackle the biggest concerns heading into earnings.

When Noise Is Increasing, Focus On The Long-Term Thesis

Let’s make this simple and short. Microsoft has three reported segments, and each of them has a different growth trajectory, business model, tailwinds, and headwinds.

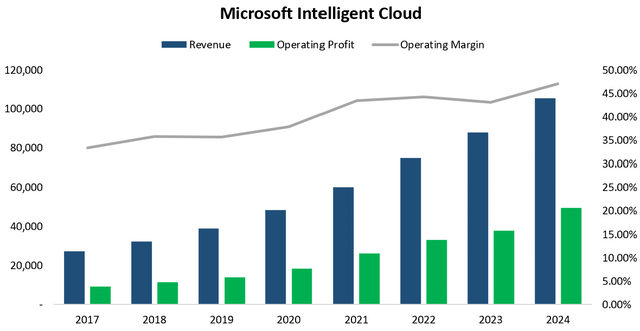

Starting with the Intelligent Cloud arm, which after the recent reporting changes, should be essentially the Azure segment. This segment is the number one driver of future returns, and what investors focus on the most.

Created by the author using data from Microsoft’s financial reports.

This is a segment that grew at a 21% CAGR since 2017, while operating margins expanded by 14 percentage points, approaching 50%. After the recent changes, growth in this segment should accelerate to over 30%, while margins will decline.

I don’t see anything that slows this down in the foreseeable future, considering more than 50% of workloads are still done on-prem, and AI contribution is just beginning, and accelerating. Management already said we should expect an acceleration in calendar H1-25, as capacity expands.

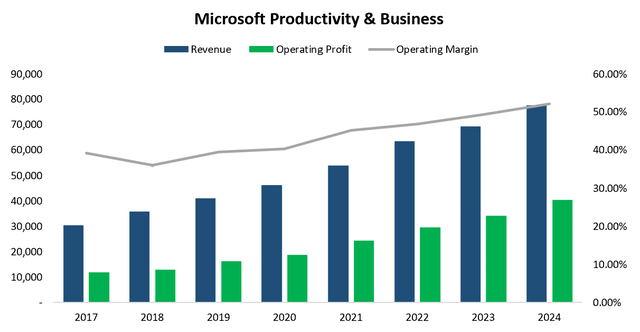

Transitioning to Productivity & Business, the second-largest segment for Microsoft, which aggregates the Office suite, Dynamics, and certain LinkedIn revenue streams.

Created by the author using data from Microsoft’s financial reports.

This is yet another impeccable division, which grew at a 14% CAGR between 2017-2024, while margins expanded by 13 points to 52%. Looking ahead, growth should remain in low-to-mid teens, driven by seat growth, and higher ARPUs from more attachments and higher prices.

This segment includes arguably the stickiest SaaS products at this scale. Even if AI does end up transforming the way people work, I think we can safely say it’ll take more than a decade before it starts slowing down products like Word, PowerPoint, and Excel, which are used by essentially every organization in the world.

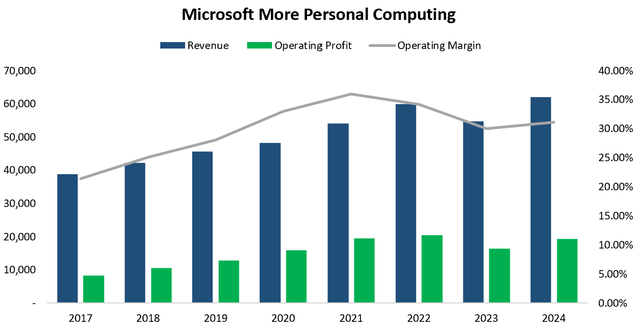

Lastly, we get to More Personal Computing, the least important segment, and yet it has the power to detract or add to the overall appeal of Microsoft.

Created by the author using data from Microsoft’s financial reports.

More Personal Computing grew revenue at a lackluster 7% CAGR over the past seven years, and that includes a big contribution from the Activision acquisition.

The biggest component of the segment, gaming, is suffering from an industry-wide slowdown, but Microsoft hasn’t been exactly doing its part to mitigate the problems. It has an unclear strategy in gaming, for both the Xbox console and the Game Pass, and so far it seems that the Activision acquisition was more of a financial play than anything strategic.

Besides that, we have the Windows OEM and devices lines, which are fairly mature businesses that should grow roughly in line with the PC market.

The shiny outlier in this segment is search and news advertising, which is a mid-to-high teens grower, although it’s relatively small.

Bottom Line, Long-Term Growth Algorithm Remains Very Attractive

There’s no scenario under which I see Microsoft growing revenues slower than 12%-13% in the foreseeable future, with EPS growth that exceeds that, in the mid-teens range.

This should remain the growth algorithm for at least the end of this decade, and assuming it does, investors will not even remember what they worried about back in the early days of AI.

However, near-term concerns remain important, with the primary one being Microsoft’s near-term cash expenditures.

Primary Concerns Weighing On The Stock – Capex And The Application Layer

Let’s start with the single most important concern, which is capital expenditures.

In some cases, the stock follows EPS growth, but in most cases, the stock follows free cash flow per share growth. The primary differentiators being the earnings profile and the cash cycle. In Microsoft’s case, FCF per share is more important.

As those historically capital-light businesses enter into a capital intensive stage, investors are questioning a) How long? b) How Much? and c) Will it generate good ROI?

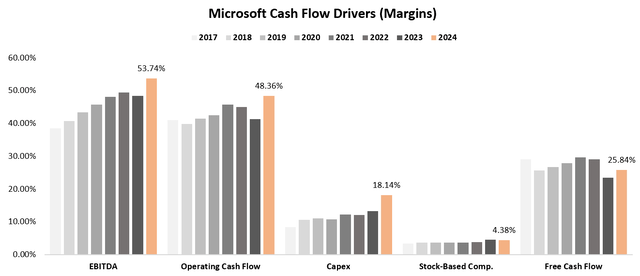

Created by the author using data from Microsoft’s financial reports.

We can see that Microsoft’s free cash flow margins have been stuck in the mid-twenties for eight years now, despite EBITDA and operating cash flow margins rising.

This is because of the huge increase in capex, as Microsoft builds and invests heavily to meet what it expects to be huge demand. This rise in capex is also supporting OpenAI’s very big ambitions, which we’ve recently learned shouldn’t turn a profit until the end of this decade.

I think it’s very reasonable to be concerned about Microsoft’s capex, which should surpass $60 billion this year. Especially because unlike its competitors, it doesn’t have its own killer use-case to leverage those investments in case demand doesn’t end up being as big as expected.

For instance, Meta (META), Google, and Amazon, all have huge advertising businesses and significant products that rely on recommendation engines, which are driven by AI infrastructure. Meanwhile, Microsoft has its Copilot, of which the only really big success so far is GitHub.

This takes me to the second concern, which is the application layer. There are two separate worries here. One is that AI will hurt the long-term TAM of seat-based products by reducing the need for headcount. Two is that Microsoft won’t succeed with initiatives like Copilot, which are its own version of software 2.0.

Recently, Marc Benioff, CEO of Salesforce (CRM), has been attacking Microsoft’s AI products in his twitter account, and some people seem to agree with him. Personally, I think this shows he’s very worried that Microsoft is doing better than his own company, and consistently takes market share from Salesforce, with the Dynamics CRM.

I Put My Money On Microsoft And Believe These Concerns Will Be Short-Lived

So what do I think about these concerns? Well, regarding the capex, Satya Nadella and Amy Hood probably have the best track record in big tech when it comes to capital investments and balancing risk with reward (the best example would be avoiding the industry-wide margin declines post-Covid).

With Microsoft’s unparalleled view into enterprises, and their exclusive view into the most successful model so far through their ownership of Open AI, I believe they have very good visibility into the returns on their investment.

Further, I think the “No-ROI” argument has become too simplistic and shallow. AI already contributes a high-single-digit percentage to Azure growth. It’s already used by thousands of companies worldwide, who are seeing tangible returns, faster production, and cost savings.

I’m not sure what those ‘No-ROI’ people are expecting, but it takes time before a $1 that goes into capex turns into $2 or $3 of returns. We’re unquestionably on the way though. It’s enough to take a look at the acceleration of all public clouds growth numbers to understand there’s clear demand for AI, and the fact that Microsoft is the primary share gainer since the ChatGPT launch tells me that it’s the current leader.

Now regarding its own application layer. First, we must acknowledge the rapid rollout of solutions across security, sales, analytics, Windows, and more. Obviously, it’ll take several iterations before it reaches scale, especially relative to the existing scale of Microsoft’s Office suite.

However, everything that Microsoft discloses tells us they’re on track, and they’re uniquely positioned to drive penetration through its existing relationships and complete offering across data and infrastructure.

The bottom line here, I understand the concerns, but if we look at the signs, I think they will be very short-lived.

Valuation Is Now Undoubtedly Attractive

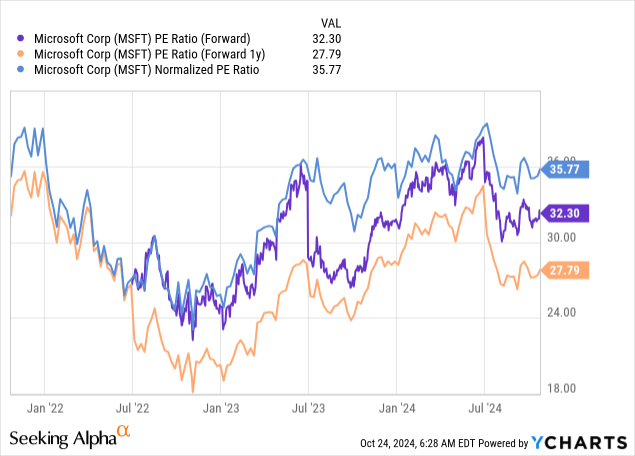

The recent underperformance drove Microsoft to a rare undoubtedly attractive valuation.

At 30 times CY25 estimates, Microsoft is trading 10% below its historical average, and below much slower-growing names like Apple (AAPL), Salesforce (CRM), and Adobe (ADBE).

Historically, this has been an attractive level to buy shares. Importantly, Microsoft has a weird fiscal year that ends in June. That makes the company’s valuation as seen on most financial websites incomparable to the majority of the market.

As I said, it’s trading at 30x calendar 2025 estimates, and this is the comparable number.

Conclusion

Investors have reasonable concerns about Microsoft’s increasing capital expenditures, and uncertainties about its success in the AI application layer.

In these situations, it’s important to take a step back and separate the fundamentals from the noise.

Microsoft is already seeing tangible returns on its investments with consistent market share gains and acceleration in Azure. It’s also demonstrating exceptional execution capabilities, rolling out products at a fast pace.

Management told us Copilot is set to be their fastest product to reach $10 billion, and I choose to believe them rather than competing CEOs.

With one of the widest moats in history, and a future of mid-teens earnings growth, buying Microsoft at a 30x multiple is attractive in my view.

Therefore, I reiterate a ‘Buy’ ahead of earnings.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.