Summary:

- Microsoft’s 365 offerings and ChatGPT form a foundational ecosystem for future AI advancements, positioning the company as a leader in AI-driven productivity solutions.

- Microsoft Copilot Studio and AI agents enable automation of tasks without programming knowledge, enhancing productivity and efficiency in tools like Excel and PowerPoint.

- Microsoft’s AI infrastructure investments are crucial for long-term dominance, with a strong ROIC-WACC spread of 20.54%, indicating value creation for shareholders.

- And yet, the market is predicting less growth from AI than I think is realistic for Microsoft.

Robert Way

The Microsoft Investment Thesis

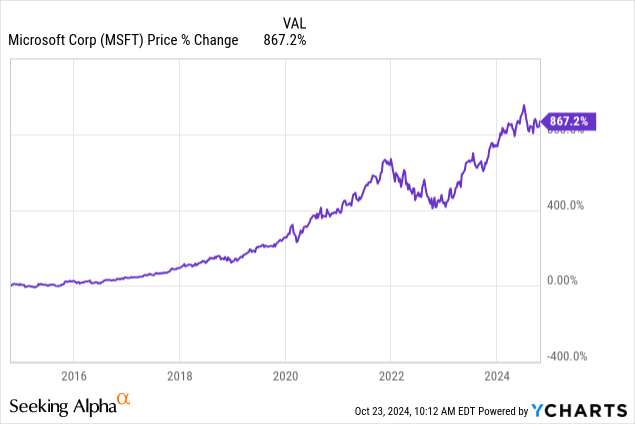

Microsoft Corporation (NASDAQ:MSFT) (NEOE:MSFT:CA), which has benefited greatly from the computing trend over the last few decades, will also benefit from the artificial intelligence trend, in my opinion. Microsoft probably knows from its experience with operating systems how important and powerful an operating system is and what it can do. So I would be surprised if they didn’t try to become the dominant operating system or underlying platform in the AI space.

And by working closely with OpenAI, I think they have taken a first step in that direction, especially since existing Microsoft applications could benefit greatly from AI. Therefore, I believe that Microsoft is slightly undervalued from a share price perspective and that the upside from AI is not yet fully priced in.

Summary Of My Old Article

At this point, I would like to return to the theses of my February article and see how they have evolved over time. I said back then that I thought Microsoft could make gains in search market share, and here they have now increased the market share by 1% to 3.95%, while Google has dropped from 91.5% to 90.01% over the same period. While Google is still the dominant player, it looks like Bing is gaining share in small increments.

In the area of AI and its development, we can see that the models are becoming more powerful and the applications more extensive, but the idea that AI will significantly improve office applications is still in the testing phase. So I think this is more of a long-term project, and the really big improvements will come in a year or two. But I still believe that Microsoft, with its data, with its trained models, has one of the best positions to leverage AI for its customers.

Microsoft Phi And Small Language Models

Right now, everyone likes to talk about large language models, but the small language models get less attention. And this is a bit surprising because I think that SMLs will probably be used much more by normal users in the future because they are more cost-effective and can also run on smaller devices like smartphones.

Microsoft’s open-source SLM solution PHI 3 is currently slightly more powerful than ChatGPT 3.5, but lags behind ChatGPT 4.0. However, these SLMs are not meant to beat the latest versions, but only to ensure that they offer strong performance that can be run locally. But since they are trained on a dataset that is much more specific to a problem, they can still outperform the secondary LLMs, which have access to a much larger pool of data that is not always appropriate for the problem being solved.

This means that data quality is important, and maybe it can avoid overfitting, but the size of SLMs makes them unsuitable for the really complex stuff. But for niche applications, they are likely to be better suited because they can be inexpensively trained to do so. So I think that in the future there will be a lot of small devices that will be powered by SLMs and will become part of everyday life.

Microsoft AI Agents

With Microsoft Copilot Studio and its pre-built AI agents, people will soon be able to run multiple AI agents to perform specific tasks for them. This, and the fact that even people without much programming experience should be able to create their own agents, should ideally lead to the automation of boring tasks.

An improvement has also been made in Excel, where Python and its advanced analysis can now be used without programming knowledge with the help of Copilot. And the improvements in PowerPoint also help speed up the process by allowing you to create a design based on prompts. In addition, I have often heard that many people also appreciate the automatic meeting summary and analysis.

Besides, I believe that we are still at the very beginning and that in the future one person who is very well versed in agents will probably be able to handle as much work as 10 more or less motivated employees today.

And I think that Microsoft, with its 365 offering and ChatGPT, will provide the foundation on which many others will build. Just as most people today use a cell phone, in the future most will probably use some form of AI, especially if it is capable of performing complex actions and learning on its own. And Microsoft will be the company that provides the underlying ecosystem.

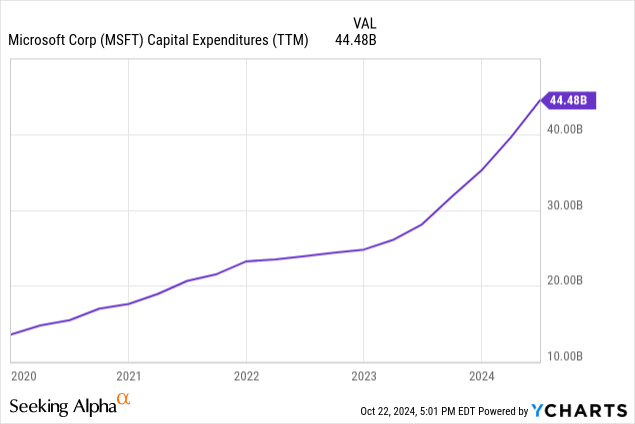

The AI Infrastructure

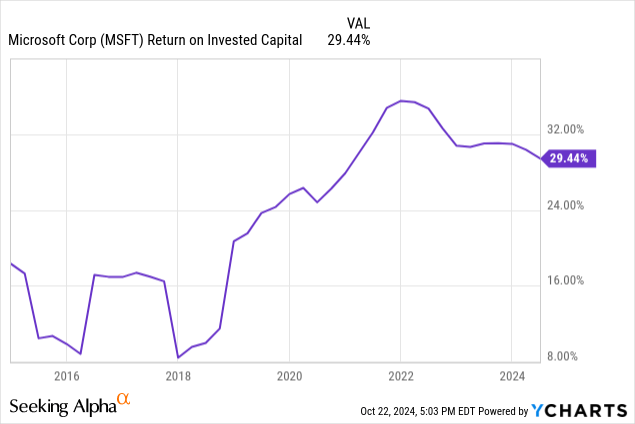

At the moment, the models are often still coming to their limits or hallucinating, so the limit of what is possible is still very far away. So I think the investments in growth capex are important and right for the long-term direction of achieving dominance in AI. I also don’t think the spending is excessive because Microsoft has a history of generating far above-average returns on capital over long periods of time, which creates value for shareholders.

Except for small periods of weakness, ROIC has always been in the double digits, often above 20%, which, with a WACC of 8.9%, results in a current ROIC-WACC spread of 29.44% – 8.9% = 20.54%. So Microsoft is clearly creating value with their capital allocation, as they have a really strong spread, which is even higher than the ROIC numbers of many strong companies.

Shareholders should therefore be pleased with any investment in growth capital, as it creates value for them over the long term.

Valuation

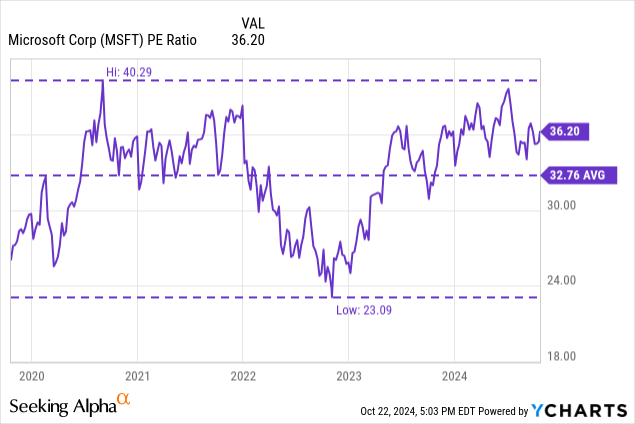

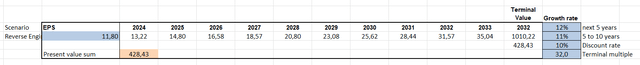

Right now, Microsoft is trading above its 5-year average P/E multiple but still below its 5-year high. But for my valuation I will use a 32x multiple, which is the average because I think this is a fairly conservative assumption, as Microsoft’s competitive advantage justifies such a multiple to me, and possibly even more.

The next point is what the revenue looks like in 5 years and here the estimates range from $438 billion to $516 billion with an average of $464 billion. Since the revenue estimates have been beaten 9 times in the last 10 years, mostly by 0.5% to 1%, I also adjust the average by 0.5%. But it seems like the estimates are always relatively accurate for Microsoft. Personally, though, without wanting to be conservative, I tend toward the upper end of the estimates.

$464b x 1.005 = $466b

The net income margin has a 5-year average of 34.81% and is currently at 35.96%, so I am assuming 35% because I think that is a realistic estimate.

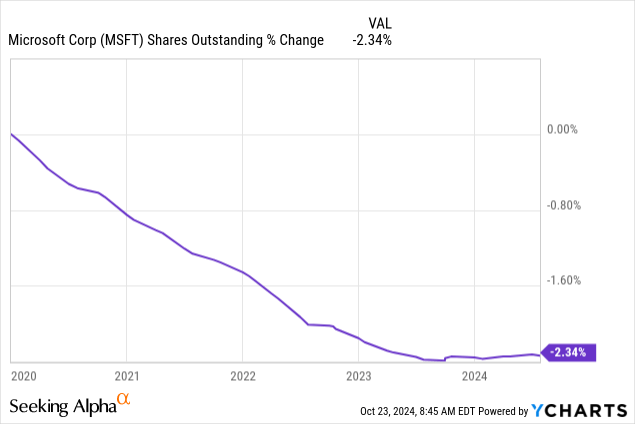

Outstanding shares have declined by 2.34% over the last 5 years, and since share buybacks are likely to continue, I expect them to decline by another 2.5% over the next 5 years. That means shares outstanding could be around 7.25 billion.

| Revenue TTM | $245b |

| Revenue 5Y | $466b |

| Net Income Margin (35%) | $163b |

| Shares Outstanding | 7,25b |

| EPS | $22,48 |

| Multiple | 32x |

| Share Price | $719 |

| Upside | ~69% ($719/$425) |

So that gives me a total upside of about 69%, or approximately 11% per year. Of course, the dividends come on top of that, which would increase the total return a bit. However, if the multiple stays the same as it is now, 36x, then the upside would be 90% ($809 / $425).

All in all, Microsoft looks attractive even with a contraction in the multiple, and if the multiple remains the same, depending on the extent of dividend increases and buybacks, one can even reckon with strongly above-average results. So I think there is some margin of safety in my calculation due to the conservative assumptions, but the upside is relatively large if Microsoft performs as I think they will.

What Will I Look For In The Next Earnings?

The points I am interested in are the size of the share buybacks and whether they could be reduced by more than the 2.5% I am forecasting. In addition, the development of capital expenditures will also be of interest to me, as I believe that any investment in R&D or capital expenditures, even if it seems large at first glance, will create a lot of value for shareholders in the long run.

I also believe that OpenAI will do an IPO in the near future, so comments on OpenAI and its direction or collaboration with Microsoft could provide very interesting insights. Although with OpenAI PPUs and the initial non-profit mission, an IPO could be very complex. Especially since Microsoft is only a minority economic shareholder in OpenAI’s capped profit company.

What Is The Market Pricing In Right Now?

Author

Based on TTM diluted EPS of $11.80, the market is currently pricing in EPS growth of 11% to 12% when we do a backward calculation. Historically, however, EPS has grown 16% annually over the past 10 years and 18% annually over the past 5 years, which suggests that the stock may be undervalued. When I first wrote about Microsoft in February, the market was pricing in 12% to 13% EPS growth, so the stock is cheaper now than it was then.

If Microsoft achieves the dominant position in the AI market that I believe it can, then the growth rates that are priced in are lower than what, I think, is realistic. As a leading player, they would likely be able to achieve growth rates in the 20% range, which makes the upside huge.

Conclusion

Right now, the market has priced in that Microsoft is going to have lower growth rates going forward than it has in the past, which is what most companies typically have, but I see Microsoft in an exceptional position to outperform. There are many opportunities for Microsoft to benefit from AI, whether it’s Office products, search market share, the cloud, or even AI agents that perform everyday tasks.

In addition, SLMs are likely to be found in small electronic devices in every home in the future. So I really cannot see a future where Microsoft’s growth rates are flat or even declining. I think they will go up.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.