Summary:

- Microsoft’s Dynamics 365 offering, which incorporates AI, can help companies improve communication, access critical data, and reduce workloads and costs.

- It’s no surprise Microsoft is investing in its AI offering. We believe it’s a $7 trillion opportunity to say the least.

- Our state-of-the art DCF model has a $402 target price for MSFT.

jewhyte

Background

In contrast to what one might believe, we think many business leaders might still lack understanding of the benefits or functions of AI. Results from a 2017 US survey conducted by Deloitte provided that out of 1500 senior business leaders, only a mere 17% were familiar with AI or how it could affect their companies. Although the term was familiar to the subjects, they did not grasp how AI could be used to improve the processes in their businesses. However, among those respondents that were familiar with AI, the majority stated that AI was important to both internal business processes and their product and service offering. Furthermore, a stunning 76% believed that AI would transform their businesses substantially within three years time.

These somewhat older survey results corresponds perfectly to the current view on the future of AI in our view. For instance, in a fresh article from April this year by Goldman Sachs state that AI could increase global GDP by almost $7 trillion in the next ten years, constituting a 7% increase in global GDP.

Catalysts

Microsoft’s CEO anticipates the technology sector to double as a percentage of GDP in the coming years. We believe AI will be crucial for those who want to benefit from this sector growth, and Microsoft is well positioned here with their Dynamics 365 offering. If Microsoft can help its customers utilize and integrate AI into their daily processes, there are tremendous savings to be made, both from improved efficiencies and increased productivity. Microsoft is well aware of this angle, something that becomes apparent when digging deeper into their enterprise offering, Dynamics 365.

Fact is, lots of AI development is classified and applied within governmental agencies working on national security. So, having a multinational giant like Microsoft embracing AI helps democratize it. And it’s no surprise Microsoft is investing in its AI offering. It’s a $7 trillion opportunity to say the least in our view.

Dynamic 365 and its impressive AI

With Dynamics 365 and using AI, Microsoft help companies manage their physical operations by improving communication across business units, facilitating access to business-critical data as well as improving efficiencies in customer handling, all to free up resources, boost revenues and reduce costs for enterprise customers. The artificial intelligence side of the offering has been successfully implemented in a wide range of business settings.

Taking sales as an example, according to Microsoft, “people in sales spend less than a third of their time actually selling, and more than 66 percent of their day managing email.” Microsoft’s AI solution can help in prioritizing leads, engaging the buyer and assist in crafting the customer follow-up. When following up on customers, Microsoft AI offers help that goes far beyond templates, using information you’ve summarized from the sales call together with relevant account data to automatically compose an email tailored to the specific buyer.

As a showcase, MVP Healthcare transitioned to Dynamics 365 and expects $6 million in savings by implementing AI-driven process improvements and much more.

Microsoft’s enterprise customer track-record

We are especially pleased with Microsoft’s ability to onboard industry giants such as Coca-Cola (KO), HP (HPQ), Chevron (CVX), Phillips, Heineken, Maersk, Siemens, MVP Healthcare and Mercedes-Benz, to name a few, as trusted users of Dynamics 365. It’s impressive that this enterprise solution has the ability to improve business processes and efficiency for such a wide range of industry giants.

The public sector opportunity

However, there is another customer segment that might be overlooked – namely the public sector. In the US alone, a majority of the cities are investing in what is known as smart city technology, using AI to improve service delivery, environmental planning, resource management, energy utilization, and crime prevention, among other things. And as the company state, “Microsoft is uniquely positioned to help governments begin their AI journey”.

Valuation

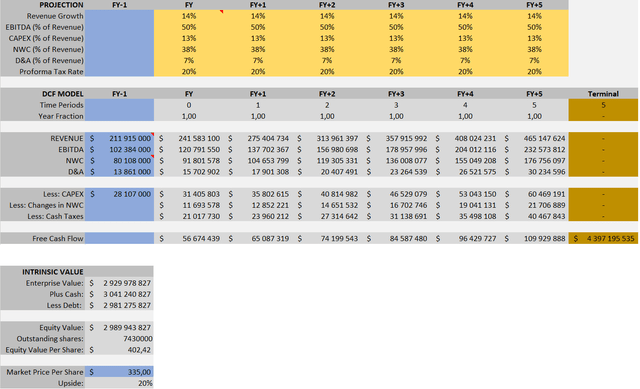

Using income, balance sheet and cash flow statements we produce our very own DCF model using the latest historical data as predictor for the next 5 years.

Assumptions made are as follows:

Revenue Growth: 14%, 3-year average. EBITDA margin: 50% of revenue, 2023 years level.Capex: 13% of revenue, 2023 years level.Net working Capital: 38%, 2023 years level. Perpetual growth rate: 5.5%Discount rate: 8%

For our DCF model, we use 2023 year revenue data as our starting point. Microsoft’s annual revenue for 2023 was $211.915 billion. We then add an annual growth rate of 14% for each consecutive year, which was the 3-year average. Once we have our revenue predictions all set, we deduct and add to the revenue numbers using our above assumptions (also made based on the latest data) to estimate our Free Cash Flow and generate our target price. Based on our model, the target price for Microsoft is $402 with a potential 20% upside.

Conclusion

Based on Microsoft’s strong position in AI, we do recommend the stock as a constituent of your portfolio. Microsoft has the opportunity to leverage its position through Windows and Office with AI to generate substantial revenue growth for the years to come, in our view. We are not alone in our views. AI is a major catalyst for Microsoft. Fellow analysts expect the shares to outperform and appear to see AI as a key player for the company’s future growth prospects, as do we.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it. I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.