Summary:

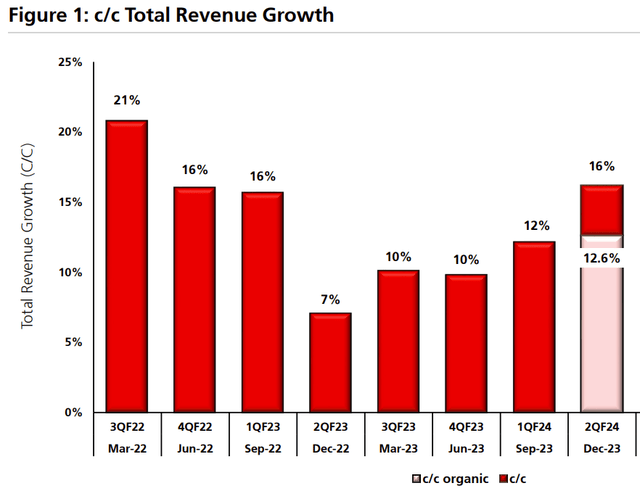

- Microsoft Corporation’s Q2 FY2024 revenues reached $62 billion, with 16% growth on a constant currency basis and 12% growth excluding the Activision deal.

- The company raised its FY2024 margin guidance, expecting a 100 to 200 basis points improvement in full year operating margins.

- Azure’s growth was boosted by AI, contributing to a 6-point lift in the company’s fiscal Q2, indicating strong demand and a positive return on infrastructure investments.

- Microsoft did signal an end to the heavy spend optimizations that have been negative to Azure growth in the last 18 months in the current quarter.

David Becker

Microsoft Corporation (NASDAQ:MSFT) posted its fiscal Q2 2024 quarter results recently, so let’s dive right into the quarter to see what insights we can get from their results.

FY2Q24

In the FY2Q24 quarter, revenues came in at $62 billion.

This amounted to 16% revenue growth on a constant currency basis and 12% revenue growth excluding the Activision deal.

While this revenue came in $600 million above expectations, almost two-third of that came from Activision.

An organic revenue growth rate of 12% at Microsoft’s scale is quite an achievement, but the beat is relatively low quality given most of it came from the Activision acquisition.

Microsoft total revenue constant currency growth (Author generated)

Microsoft guided for FY3Q24 total revenues of $61 billion at the high end. This implies a similar ex-Activision organic growth of 12%.

Upside for FY2024 margin

Another positive in the quarter was an unexpected FY2024 margin guidance raise, from the earlier flat margins to +100 to +200 basis points improvement in full year operating margins.

While Microsoft is investing heavily into AI capital expenditures, which is likely to drive growth in COGS and weaken margins, the 100 to 200 basis points upside to full year operating margins comes as management looks to scale these investments into AI and remain disciplined on cost and continue to drive efficiencies in all the layers of its technology stack.

For reference, in FY1Q24, management shared that the high COGS growth in FY2024 will be offset by control in operating expenses that will result in flat operating margins for the full year of FY2024.

Given that its commitment to investing in the cloud and AI opportunity is driven by the strong results delivered thus far and the demand that it continues to see in the second half of FY2024, these investments are expected to reap solid returns for Microsoft in the longer term.

Azure

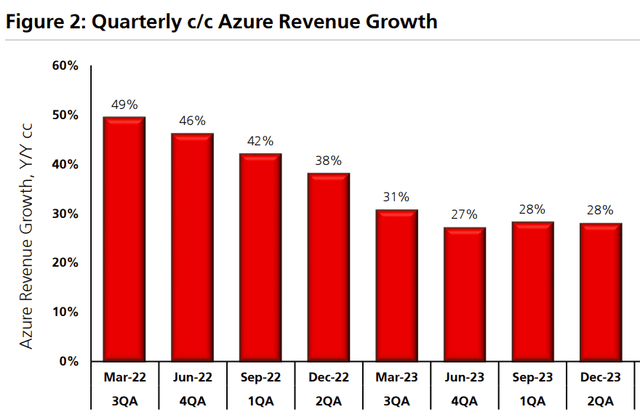

Azure grew 28% in FY2Q24 on a constant currency basis. This was stable relative to FY1Q24, but the highlight was the comment that AI contributed a 6-point boost to Azure’s growth.

Azure c/c revenue growth (Author generated)

Interestingly, though, there was a small nuance where in FY1Q24, Microsoft guided for “stable” Azure growth in the second half of FY2024, but in FY2Q24, it only guided for stable Azure growth for FY3Q24.

While Microsoft did not explain this, I don’t necessarily see this as a material negative, but it is certainly one to watch for FY4Q24.

AI lifted Azure growth

In FY2Q24, AI provided a 6-point lift in Azure’s growth.

This compared to a 3-point lift in FY1Q24, and a 1-point lift from AI to Azure’s growth in FY4Q23.

I think that this is a very strong evidence that Azure is seeing strong AI demand coming into Azure and a decent return on its prior infrastructure capital expenditures spent to leverage on the AI opportunity.

The fact that Microsoft disclosed the AI contribution to Azure suggests that there is strong investor demand and also obviously because the number was so strong and likely to be a positive addition. That said, based on my conversations with management, they are unwilling to comment if the AI boost would be larger in the next quarter and it remains to be seen whether this metric will continue to be disclosed next quarter. That said, Microsoft did comment that AI will continue to be a strong contributor in FY3Q24.

In addition, I think it’s important to note that Microsoft shared that majority of the AI boost we saw in FY2Q24 came from inference and not just training workloads.

This is a positive in terms of enterprise AI demand and suggests that enterprises are moving faster than expected with AI.

The elephant in the room

At this point, it might be useful to talk about the elephant in the room, and that is non-AI Azure deceleration.

While there was a 6-point boost from AI workloads, non-AI Azure growth decelerated by 3-points.

Non-AI Azure growth decelerated by 3-points from 25% growth in the September 1Q quarter, to the 22% we saw in the December 2Q quarter.

Microsoft did signal an end to the heavy spend optimizations that have been negative to Azure growth in the last 18 months in the current quarter.

Management stated that while Azure will continue to see customers build, then optimize and then start new workloads, at the current moment, Microsoft expects that the phase where there was only large optimizations and no new workloads starting has ended.

This, of course, is in-line with commentaries and tone from both Amazon (AMZN) and Google (GOOG) (GOOGL) about optimizations.

With the 3-point deceleration and the comment about the end of heavy spend optimizations, I think that this implies that while cloud spend is stable, we are not yet seeing an inflection in the overall cloud environment, particularly in the non-AI side of things.

One dynamic we could be seeing here, I think, is that we could be seeing some Azure customers reduce non-AI Azure spend that is then re-allocated to fund AI Azure workloads.

Based on my conversations with Microsoft and some of my checks with its customers, there are some customer that may actually be doing so.

Capital expenditures

Microsoft has been accelerating its capital expenditures since a year ago and scaling up and adding more capacities in things like servers and new data center footprints in order to facilitate the strong growth in AI we saw in the quarter.

I expect we will continue to see Microsoft accelerate capital expenditures in the near-term to add more capacities in the coming quarters given their visibility into their own pipeline.

Microsoft guided for a material sequential increase in capital expenditures in the prior FY1Q24 quarter.

That said, the FY2Q24 capital expenditures came in only at $11.5 billion, falling short from the $11.2 billion capital expenditures in FY1Q24.

The lower than expected capital expenditures in FY2Q24 was due to the shifting of the delivery for a third-party capacity contract from FY2Q24 to FY3Q24.

To me, this means that it relates to accessing infrastructure capacity and not GPU or other components from suppliers, and thus, leads me to conclude that the delay may have been related to access to some owned or leased data center facility.

The reason I explain this in detail is because a shortfall in capex can be viewed as a negative signal of future AI demand. That said, the strong 6-point contribution to Azure growth in FY2Q24, along with the description of a modest and temporary shortfall suggests to me that there is unlikely to be any negative implications on AI workload demand.

For FY2Q24, Microsoft expects capital expenditures to increase materially sequentially in FY3Q24.

This is, as expected, driven by its investments in cloud and AI infrastructure along with the delivery for a third-party capacity contract mentioned earlier.

Office 365 comes in in-line

Microsoft’s Office 365 segment was in-line, with FY2Q24 growing 16% constant currency growth and guidance for 15% growth in FY3Q24.

That said, we did not get additional disclosures or mentions about Copilot revenue contribution to the Office 365 segment in FY2Q24.

Management did comment that Microsoft 365 Copilot has seen a stronger early uptake than any of the E3/E5 SKUs, which I think is encouraging. In addition, management commented that it remains early days for Microsoft 365 Copilot, and the team is also optimistic about the adoption it has seen thus far and expect revenues to grow with time.

For reference, Copilot will need to add $100 million in FY3Q24 revenues to drive a 1-point lift to the Office 365 growth for the next quarter.

For FY3Q24, the guidance is for the Office 365 growth to decelerate by 1-point.

This does suggest that despite the positive commentary on the early uptake, that copilot revenues are slow to ramp.

Valuation

Price targets

My 1-year and 3-year price targets are thus based on a 30x P/E multiple.

I think that this is a reasonable valuation multiple to be applied given that this is somewhat in-line with its average P/E multiple since 2018, while still highlighting the quality and strength of its business model and competitive advantages that it has.

With that, my 1-year and 3-year price targets are $406 and $525, respectively.

Intrinsic value

I roll forward my Microsoft forecasts by another calendar year to 2028.

Similarly, I used the same assumptions as before, including a terminal 2027 27x P/E and cost of equity of 11%.

Take note that I applied a discount to the 2027 terminal multiple given we never really know what will happen in 2027 and whether Microsoft can continue to support its average P/E ratio of 33x till then.

As such, my intrinsic value goes up to $355.

Conclusion

This was a somewhat mixed to mildly positive quarter for Microsoft Corporation.

The AI side of things was positive given the 6-points boost in Azure growth from AI workloads.

Also, the rise in operating margins for the full year was also a positive surprise.

That said, the deceleration in non-AI Azure growth by 3-points, along with no concrete evidence of ramp in Copilot to life Office growth and the lower-than-expected capex were things that made the quarter mixed.

The current narrative around AI and Microsoft’s success around the area will likely sustain its valuation in the near term until we look for more catalysts.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Outperforming the Market

Outperforming the Market is focused on helping you outperform the market while having downside protection during volatile markets by providing you with comprehensive deep dive analysis articles, as well as access to The Barbell Portfolio.

The Barbell Portfolio has outperformed the S&P 500 by 50% in the past year through owning high conviction growth, value and contrarian stocks.

Apart from focusing on bottom-up fundamental research, we also provide you with intrinsic value, 1-year and 3-year price targets in The Price Target report.

Join us for the 2-week free trial to get access to The Barbell Portfolio today!