Summary:

- Microsoft delivered both a top and bottom line beat for FQ2’24.

- The Personal Computing segment rebounded nicely. The Azure Cloud continued to do well and saw 30% Y/Y growth due to strong corporate spending and lower inflation.

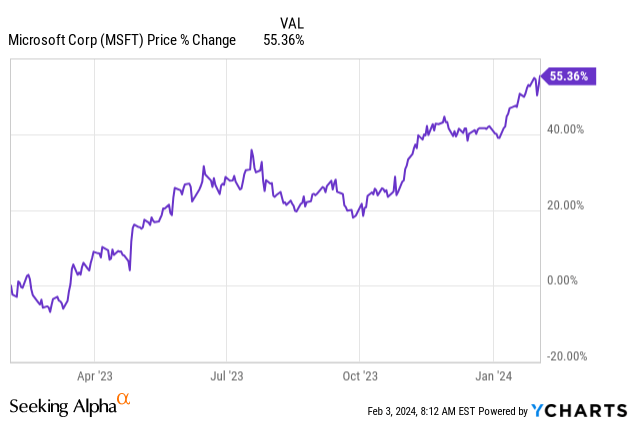

- Investor sentiment towards Microsoft has improved greatly due to the strong growth in the Cloud business and the stabilization of the PC market.

- Shares may be fully valued here, and I have decided to take profits.

David Becker

Over the last two years, a considerable change in investor sentiment with regard to Microsoft (NASDAQ:MSFT) has taken place. Two years ago, Microsoft was not an investor favorite, chiefly due to its exposure to the personal computing market which plummeted in 2023 and caused some uncertainty around Microsoft’s hardware and Windows sales. With the PC market bottoming out, I believe this may be a great time to exit. I have decided to sell Microsoft last week following a decent FQ2’24 report and I see shares at approximately fairly valued now!

Previous rating

I previously rated Microsoft as a strong buy — A Top Bet On Cloud Growth — due to Microsoft’s Cloud business producing strong revenue results and the company pulling ahead of Google in the race for Cloud growth. Although Microsoft still showed very decent top line momentum with Azure in FQ2’24, I believe Microsoft are now about fairly valued and I see limited upside from here.

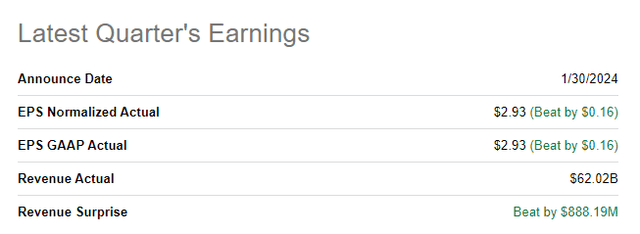

Microsoft beats top and bottom line estimates

Microsoft easily beat expectations for FQ2’2 on both the top and bottom line. The technology company reported $2.93 per-share in adjusted earnings, beating the consensus estimate by $0.16 per-share. Revenues came in $888M ahead of the average prediction.

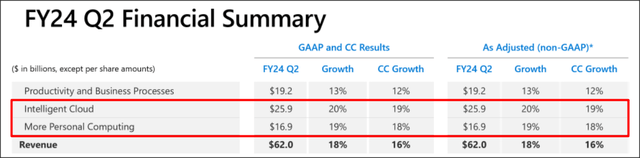

Solid execution in the December quarter

Microsoft generated decent results for its last quarter that included double-digit top line momentum, resilient Azure-related Cloud growth and a major comeback in the Personal Computing segment that suffered so greatly during the PC market downturn of 2022 and 2023.

Microsoft generated $62.0B in revenues in the second fiscal quarter, showing 18% year over year growth and a 5 PP revenue growth acceleration relative to the previous quarter. Intelligent Cloud saw a 1 PP acceleration of growth in the December quarter and continued to generate the majority of revenues, $25.9B, for Microsoft. The Personal Computing, which relies on hardware and Windows OEM sales, saw 19% Y/Y growth and a 16 PP revenue acceleration relative to FQ1’24.

According to research firm Gartner (Source), the PC market returned to positive growth in the December quarter with device shipments increasing 0.3% year over year. Throughout FY 2023, global shipments of PCs, laptops, and smartphones declined rapidly as consumers and businesses upgraded their equipment during the COVID-19 pandemic and demand fell off-the cliff post-pandemic. The rebound in Personal Computing is one reason why I have decided to sell shares of Microsoft and rotate some of my investment capital into Alphabet (GOOG).

Turning to Microsoft’s Cloud business.

Microsoft’s Cloud platform continued to grow rapidly, as expected. The Azure Cloud business generated 30% year over year growth, showing a 1 PP acceleration over FQ1’23. Azure is Microsoft’s Cloud business that allows companies to scale applications and assists them in their digital transformations. Azure is the second-largest Cloud service provider after Amazon Web Services.

As with Google, Microsoft saw strong spending from the corporate sector in its Cloud business in the fourth-quarter. High inflation has been a key reason why companies slowed their spending on IT and Cloud services last year. Since we seem to be moving back towards a low-inflation world, corporations are willing to open up their wallets again. For FY 2024, I expect a continuation of this trend, especially after the U.S. economy is crushing expectations right now.

Microsoft

Microsoft continues to bring in a ton of free cash flow

Microsoft remained a highly profitable enterprise in the second fiscal quarter and the software business generated $9.1B in free cash flow on revenues of $62.0B which calculates to a free cash flow margin of 14.7%. Relative to last year’s FQ2, Microsoft’s free cash flow soared 86%, despite 55% higher capital expenditures. On average, Microsoft earned $16.9B in free cash flow each quarter in the last year and the company achieved a rolling 12-months free cash flow margin of 29.6%.

| $billions | FQ2’24 | FQ1’24 | FQ4’23 | FQ3’23 | FQ2’23 | Y/Y Growth |

| Revenues | $62,020 | $56,517 | $56,189 | $52,857 | $52,747 | 18% |

| Cash Flow From Operating Activities | $18,853 | $30,583 | $28,770 | $24,441 | $11,173 | 69% |

| Capital Expenditures | ($9,735) | ($9,917) | ($8,943) | ($6,607) | ($6,274) | 55% |

| Free Cash Flow | $9,118 | $20,666 | $19,827 | $17,834 | $4,899 | 86% |

| Free Cash Flow Margin | 14.7% | 36.6% | 35.3% | 33.7% | 9.3% |

58% |

(Source: Author)

Microsoft’s valuation

Microsoft is significantly more expensive than Google, especially after shares of Google have plummeted after a solid Q4’23 earnings release. Shares of Microsoft are valued at a price-to-earnings ratio, based off of FY 2025 earnings, of 30.3X while Google can be bought for a much lower P/E ratio of 18.4X.

Google’s free cash flow and earnings, however, may be much more volatile than Microsoft’s because the company continues to generate almost 80% of its revenues from the volatile and less predictable digital advertising market. Nonetheless, Google’s estimates for long term EPS growth slightly exceed Microsoft’s, indicating that Microsoft, relative to Google, may be overvalued here.

In my opinion, Microsoft could be valued at about 30X earnings, given its Cloud momentum, free cash flow strength and impressive rebound in the Personal Computing market. Microsoft’s 3-year average P/E ratio is 27X which may indicate that Microsoft is slightly overvalued. Based off of my fair value P/E ratio I calculate a fair value just shy of $400. Since shares today are priced at $411, I consider Microsoft to be more than fully valued.

Risks with Microsoft

The biggest risk for Microsoft, in my opinion, is currently the valuation. Microsoft also as non-valuation risks, such as growing competition in the Cloud market and the possibility of weaker hardware sales during the next downturn in device sales, etc. What would change my mind about Microsoft is if the company saw either a Cloud revenue acceleration or significantly higher free cash flow margins (which I monitor).

Final thoughts

Microsoft reported decent results for its second fiscal quarter and smashed both the consensus top and bottom line prediction by a large margin. The business itself is moving in the right direction: Azure is growing aggressively and seeing double-digit top line growth, and Personal Computing is no longer losing revenues due to a downturn in the device market. While I generally like Microsoft’s business trajectory, I believe that shares of Microsoft are now fairly valued, maybe slightly overvalued, and it doesn’t hurt to take profits. As a result, I am selling into the strength!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of GOOG either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.