Summary:

- Microsoft focuses on infusing generative AI across its products and services to drive growth and mitigate PC revenue headwinds.

- The company is expected to maintain its lead in generative AI and strengthen its dominance against its SaaS and hyperscaler peers.

- Still, MSFT buyers have failed to lift it higher after it topped out in July 2023. I explain why buyers must heed the caution indicated by astute sellers.

- With MSFT consolidating over the last three months, a disappointing fiscal first-quarter release on October 24 could set the dominoes falling. Caution is urged.

jewhyte

The King of SaaS: Microsoft Corporation (NASDAQ:MSFT) is slated to report its fiscal first-quarter or FQ1’24 earnings results on October 24. It would likely be a highly-anticipated quarter for investors to assess the recent momentum from its AI co-pilot services. Keen investors should recall that Microsoft has moved quickly to monetize its AI leadership. It is looking to infuse generative AI across all its products and services in the retail and enterprise space.

I believe Microsoft’s strategic approach is timely, as the downstream PC and notebook supply chain has shown signs of bottoming. As such, refresh rates could improve further as the industry recovers from the pandemic boom and bust. Bolstered by Microsoft’s integration of generative to Windows, it could spur downstream consumers into a new upgrade cycle, mitigating the revenue headwinds on Microsoft’s topline.

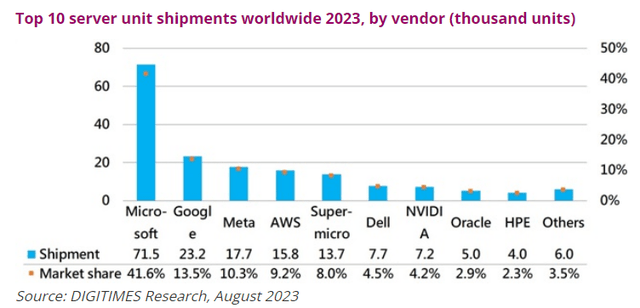

Moreover, the cloud optimization cycle is expected to have bottomed in CQ2. Based on Digitimes Research’s most recent server shipments update, global server shipments fell by 5.7% QoQ in CQ2. However, global server shipments are expected to inflect back into growth in CQ3 with a 1.5% QoQ growth before a further uptick of 5.6% QoQ in the fourth calendar quarter.

Top Global Server Shipments for 2023 (Digitimes)

As seen above, Microsoft is expected to lead its hyperscaler peers in total shipments. As such, the Redmond-based company is expected to continue leading from the front for generative AI. Accordingly, Digitimes Research stressed that the company has already “established a leading position in algorithms and hardware equipment.” As such, its leading competitors would find it challenging to supplant Microsoft’s leadership “unless groundbreaking products in other areas emerge.”

In an early September conference, Microsoft CFO Amy Hood emphasized that the AI monetization cycle is “relatively short compared to the past.” Given Microsoft’s substantial leadership, I believe the company remains well-primed to continue its dominance as the King of SaaS and as it looks to catch up with IaaS leader Amazon Web Services or AWS (AMZN).

A case in point. Recall that OpenAI was reported to have crossed a $1.3B annualized revenue run rate based on an update by The Information in October. It’s 30% higher as compared to a few months earlier. Given OpenAI’s revenue surge, I believe Microsoft’s strategic partnership and investment in OpenAI has paid off incredibly well. Therefore, I think it corroborates that generative AI is far from just being hype for SaaS behemoths like Microsoft as they ramp up their monetization strategies to drive growth and outperform peers.

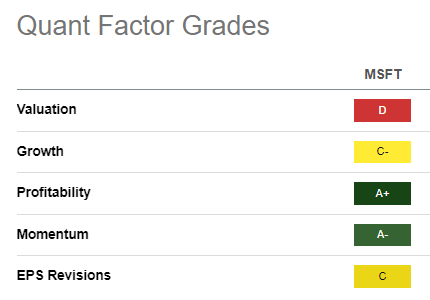

MSFT Quant Grades (Seeking Alpha)

Notwithstanding its AI dominance and market leadership, MSFT is priced at a premium relative to its tech peers. Seeking Alpha’s Quant assigned MSFT a “D” valuation grade. However, its best-in-class “A+” profitability grade underpins its wide-moat business model and its ability to continue gaining operating leverage through AI monetization.

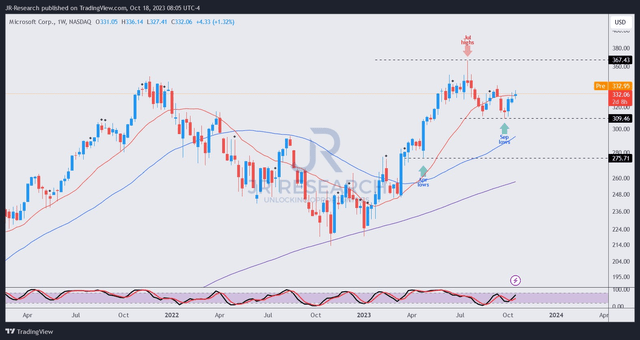

MSFT price chart (weekly) (TradingView)

Despite my optimism about Microsoft’s leadership, it seems like buyers have failed to regain its July 2023 highs at the $367 level. Also, it was a bull trap (false upside breakout) on MSFT’s monthly chart, suggesting significant selling resistance at those levels.

Moreover, I gleaned that MSFT’s buying momentum has weakened over the past three months, even as buyers have attempted to hold the $310 zone. While MSFT is less expensive than in July, I suspect MSFT sellers are distributing before a steeper selloff could follow to improve its risk/reward for more aggressive dip buying.

With expectations still running high for MSFT as we head into its fiscal first-quarter earnings release, a worse-than-expected report by the company could send holders running for cover. That could open up a more attractive opportunity for patient investors to capitalize.

Rating: Maintain Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Please always apply independent thinking and note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

We Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of AMZN, MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!