Summary:

- Activision Blizzard, Inc. shares have plummeted due to heightened concerns about Microsoft’s ability to complete the acquisition, but the risk to reward scenario remains favorable for investors.

- The deal faces significant regulatory hurdles, but even if it fails, Activision Blizzard’s improving financial performance and recent success with Diablo IV suggest limited downside.

- Microsoft will miss out on acquiring an industry leader if the deal falls through, but the company’s overall gaming performance remains strong despite recent declines in Xbox revenue.

David Becker

Purely from a share price perspective, things are not going well for Activision Blizzard, Inc. (NASDAQ:ATVI) and its shareholders. Because of heightened concerns regarding the ability of Microsoft Corporation (NASDAQ:MSFT) to complete the acquisition of the business, shares of the video game producer have plummeted. They now trade substantially lower than the agreed-upon buyout price.

I can understand why there would be some pessimism given the circumstances. There seems to me to be a very high probability that the deal will ultimately be scrapped. But even if this does come to pass, I would imagine that shares of the business have rather limited downside. This creates a very favorable risk to reward scenario, with a completion of the transaction translating to significant upside, while a failure to complete said transaction would likely result in limited, if any, downside.

Recent developments don’t bode well

In early 2022, news broke that software giant Microsoft had agreed to acquire Activision Blizzard in an all-cash transaction valuing the video game producer at $95 per share. Generally, you would expect to see a significant move higher in the share price of the company that’s being acquired. However, there should exist some spread between its price and the price that it should be bought out at to reflect both the risk that the deal will fall through and the time value of money between the present moment and the time the deal should be completed. The closest that shares of Activision Blizzard ever got to the $95 purchase price occurred earlier this year, when units totaled $87.01. That implied a spread of about 9.2%. Considering that the deal was slated to be completed this year, that implied a meaningful amount of risk still that the transaction might not be completed.

Recently, however, renewed uncertainty has sent shares plummeting. At one point in early May of this year, they even dipped below $75. But as of this writing, they have recovered some to $79.77. Should the deal be completed as agreed upon, that would offer investors short term upside of 19.1%. This is an astronomical spread that translates to a high degree of certainty that the deal will not be completed.

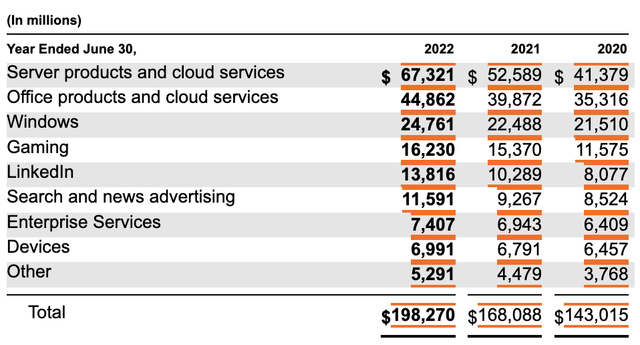

To be honest, this is not all that surprising. Microsoft is a behemoth in the market, valued at $2.43 trillion. By comparison, Activision Blizzard is much smaller. But even so, it is a very large company with a market cap of $62.7 billion. For perspective, it was estimated that, for 2021, the global video game industry was responsible for around $229.2 billion in revenue per year. So even though Activision Blizzard is substantially smaller than its suitor, it is a large player in the space to begin with. If Microsoft was not already in the gaming market, pushback from regulators might not be so great. However, in 2022 alone, the company generated about $16.2 billion from its gaming activities. That same year, Activision Blizzard generated revenue of $7.5 billion. So it’s not that difficult to see why regulators would take a hostile approach to this transaction.

The latest strike from regulators came on June 12th when the US FTC asked a federal court for a preliminary injunction stopping Microsoft from completing the $69 billion purchase of the video game producer. This follows a lawsuit that was originally filed in December aimed at blocking the deal. Presently, Microsoft is supposed to defend its position in court this August. But it’s not the only party that’s pushing back. So far, regulators in the UK have also blocked the deal, but an appeal for that is scheduled for July 24th.

Activision Blizzard still makes sense

I do not want to labor under any delusions. At this point, there is an incredibly high chance that the deal will not go through. If I were a betting man, I would peg the probability of failure north of 80%.

But this does create a rather interesting opportunity for investors. In the unlikely event that the deal is completed, the upside potential for investors is significant. So what we do need to ask ourselves is what the picture might look like if the deal does not go through. Ideally, I would like for that picture to be rather clear. However, there has been some volatility in the financial performance of Activision Blizzard over the past year or so.

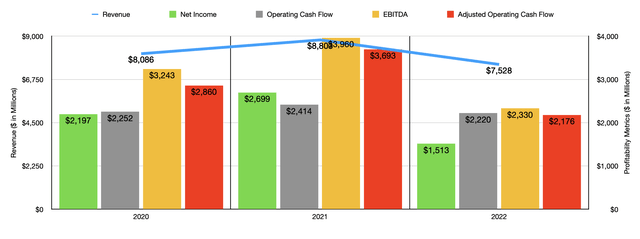

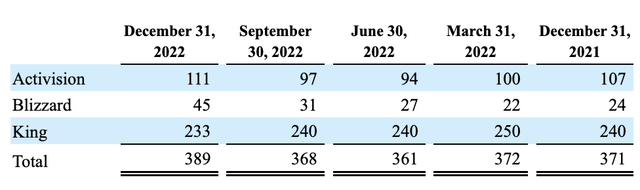

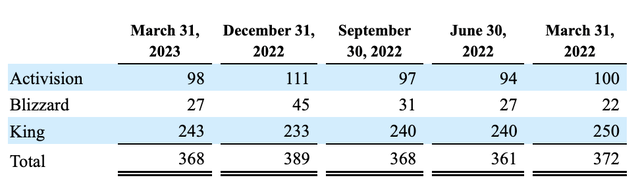

In 2022, for instance, the company had a rather difficult year. Sales came in at $7.5 billion. That was down from the $8.8 billion reported only one year earlier. This plunge in revenue came even as the number of MAUs (monthly active users) utilizing the company’s platforms grew from 371 million at the end of 2021 to 389 million at the end of last year. The decline came because of weaker results across a number of the company’s properties. For instance, revenue suffered to the tune of about $2 billion because of weakness associated with Call of Duty: Vanguard compared to Call of Duty: Black Ops Cold War, World of Warcraft, Diablo II: Resurrected, and Call of Duty: Mobile. The firm’s distribution business also suffered as part of this. Even though it has been around a decade since I have played the Call of Duty franchise, even I recall hearing complaints about Call of Duty: Vanguard, particularly when it came to the Zombies mode that was initially launched with it. On the other hand, the company benefited to the tune of $871 million because of greater revenue associated with Call of Duty: Modern Warfare II compared to Call of Duty: Vanguard, Diablo Immortal, and its famous Candy Crush franchise.

This plunge in revenue brought with it a decline in profitability as well. Net income of $1.5 billion was almost half the $2.7 billion reported in 2021. Operating cash flow went from $2.4 billion to $2.2 billion. Though if we adjust for changes in working capital, we would have gotten a more substantial decline from $3.7 billion to $2.2 billion. Meanwhile, EBITDA for the company also fell, dropping from just under $4 billion to $2.3 billion.

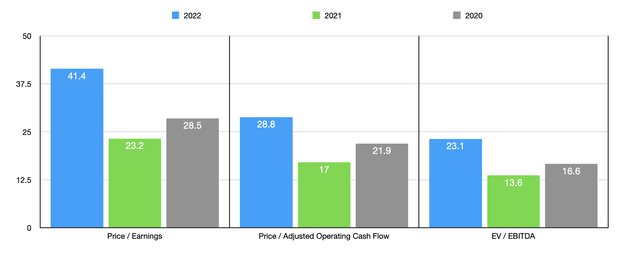

When you look at the value of the company in a vacuum and factor in this financial performance, shares initially look rather pricey. As you can see in the chart above, the price to earnings multiple of the business right now is 41.4. The price to adjusted operating cash flow multiple is 28.8. And the EV to EBITDA multiple is 23.1. By comparison, the data for 2021 looks far more appealing. If this were all we were going off of to determine what kind of downside the company might experience in the event that the deal does fall through, I would be concerned as well. However, there are two important data points to workout.

First, when you look at a major comparable firm, Electronic Arts Inc. (EA), you see that shares are rather lofty on a price to earnings basis there. And if you assume a return to the levels of profitability seen in 2021 for Activision Blizzard, shares of the business actually look cheaper than Electronic Arts does right now.

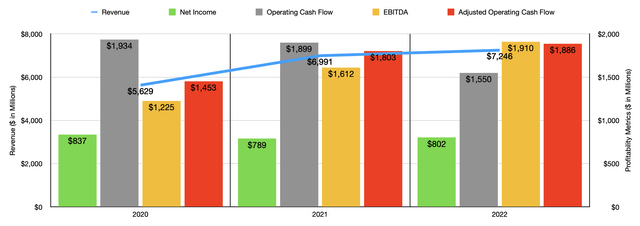

Those who disagree with my assessment could justifiably point out two facts. For starters, Electronic Arts has not experienced the same revenue troubles that Activision Blizzard has. As you can see in the chart below, revenue for the company actually grew from 2021 to 2022. Net profits also improved. While operating cash flow did decline, the adjusted figure improved while EBITDA also increased. Second, there is no guarantee that financial performance for Activision Blizzard will improve from this point on.

*3 Years Financial Results for EA.

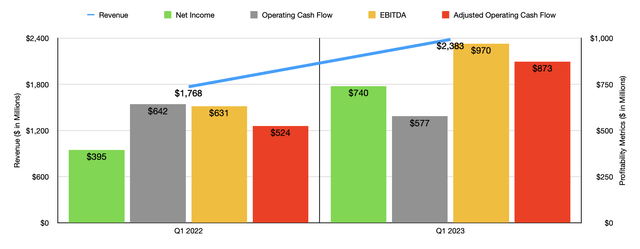

But this is where things get interesting. Although the first point does stand regarding Electronic Arts, we are already starting to see a nice turnaround for Activision Blizzard. In the first quarter of the 2023 fiscal year, the company generated revenue of $2.4 billion. That’s a meaningful increase over the $1.8 billion reported the same time one year earlier. This is despite the fact that the number of MAUs on the company’s platforms dropped from 372 million in the first quarter of 2022 to 368 million the same time this year. The driver behind these sales increased largely involved a $734 million contribution from greater sales associated with Call of Duty: Modern Warfare II, Diablo Immortal, World of Warcraft, Overwatch 2, and Candy Crush. In game net revenues for the company actually spiked an impressive $369 million year-over-year. Sales would have been higher for the company had it not been for a $66 million hit associated with foreign currency fluctuations. As the chart in this article demonstrates, bottom line performance for the business during this time has also improved drastically year-over-year.

*Q1 2023 Results for ATVI.

What’s even better than this is the fact that the company seems to have a great catalyst with the recent launch of Diablo IV. According to a press release issued by the company on June 12th, the game experienced over $666 million in global sell-through in the first five days following its June 6th launch. This makes it Blizzard’s best-selling game ever and, according to the company, players in that time already clocked more than 276 million hours playing it. That translates to over 30,000 years of time.

The game also has some aspects to it that should create stickiness, keeping users coming back. The stickiness that I speak of is in the form of the ability of players to create parties with friends. Over 166 million times has this occurred already. It’s highly probable that this, combined with continued strength from the other aforementioned games during the first quarter of the year, will translate to strong financial results for the company moving forward. Even if this does not get financial performance quite back up to where it was in 2021, which it could, shares likely won’t be priced all that differently than what Electronic Arts is priced at today.

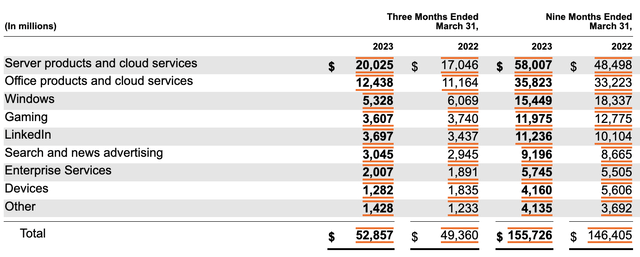

As for Microsoft, my assessment is not as rosy. I have no doubt that the company as a whole will continue to do incredibly well. I would argue that it is one of the best businesses on the planet and that it has significant upside. But if we are restricting the discussion to solely focus on this transaction, the business will clearly miss out on acquiring an industry leader that is showing significant financial improvements after a rather difficult 2022 fiscal year. This would result in reduced growth potential for the company. But it does not mean that the company is performing poorly on the gaming front. I already mentioned that revenue in 2022 for those operations totaled $16.2 billion. That’s a substantial increase over the $11.6 billion reported one year earlier.

This is not to say that everything is great. For the first nine months of the company’s 2023 fiscal year, gaming revenue came in at about $12 billion. That was down from the $12.8 billion reported one year earlier. This downside was driven by a 6% decline in Xbox related revenue. Xbox hardware revenue was hit particularly hard, falling 11% year-over-year because of lower volume and a reduction in prices on the consoles sold. Even content and services took a beating, dropping by 5%.

Takeaway

The way I see it, it is unlikely that the transaction between Microsoft and Activision Blizzard will be completed. If it does, the upside for investors who buy shares of Activision Blizzard now could be significant. But given how shares of Activision Blizzard are priced and the recent strength that the company has seen from a fundamental perspective, I would argue that downside in the event of a failure of the deal to be completed would be immaterial. And if it is material, I would say that it should be short-lived.

This creates a favorable risk-to-reward opportunity for investors. As such, I have decided to rate the gaming giant a “buy” while also assigning Microsoft a “buy” because of my belief that the company’s long-term potential, irrespective of the transaction, should be appealing.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Crude Value Insights offers you an investing service and community focused on oil and natural gas. We focus on cash flow and the companies that generate it, leading to value and growth prospects with real potential.

Subscribers get to use a 50+ stock model account, in-depth cash flow analyses of E&P firms, and live chat discussion of the sector.

Sign up today for your two-week free trial and get a new lease on oil & gas!