Summary:

- Microsoft’s proposed takeover of Activision Blizzard was blocked by the UK’s Competition and Markets Authority (CMA), citing concerns over the company’s position in the cloud gaming market.

- Microsoft CEO Satya Nadella hinted at considering all options, including potentially pulling Activision Blizzard out of the UK to complete the merger, which would make the company’s IP unavailable to UK gamers.

- Despite the ongoing Activision Blizzard debacle, Microsoft’s gaming business continues to grow with the recent acquisition of Bethesda bearing fruit soon with the release of “Starfield”.

- Microsoft is slightly more expensive than video game peers, but perhaps justified given Microsoft’s Xbox console and Game Pass subscription service.

lightphoto/iStock via Getty Images

Introduction

Microsoft’s (NASDAQ:MSFT) gaming business only represents about 8% of the company’s overall revenue, but investors should still pay attention, especially as the market starts to heat up with some big upcoming releases and some interesting developments in the Activision Blizzard (ATVI) saga.

I’ve covered Microsoft’s gaming division before, but it’s been nearly 3 years since my previous article when Microsoft launched its current generation Xbox consoles. It’s time for an update.

Activision Blizzard Blocked – There May Still Be Hope.

First, Microsoft’s proposed takeover of Activision Blizzard at $95 per share was blocked by the UK’s Competition and Markets Authority back in April. The CMA cited concern over Microsoft’s dominant position in the cloud gaming market. My personal opinion on this is that it’s simply an excuse to block big tech from making a substantial acquisition. I do not buy the cloud gaming argument. In fact, I firmly believe this merger was in the best interest of consumers. But the CMA is not going to listen to me, so there’s not much I can do about it.

Interestingly, the EU approved the deal shortly after the UK blocked it. Microsoft and Activision will appeal the UK’s decision, but given the nature of the excuse used by the CMA and the fact that the UK can unilaterally block such mergers without any sort of court process, I think it will be hard to see a world where the deal is suddenly approved upon appeal. Nonetheless, the European Union’s commentary that this merger would actually be beneficial for the cloud gaming space in direct contrast to the UK (I agree with the EU here) is fascinating.

EU Commentary on Microsoft’s acquisition of Activision Blizzard (Reuters)

Despite the stubbornness of the CMA, the deal still might not be dead. What is incredibly interesting here is that Microsoft CEO Satya Nadella recently said on CNBC that Microsoft would consider all options when responding to a question regarding whether Microsoft could pull Activision Blizzard out of the UK and still complete the merger. This would likely mean Activision Blizzard’s IP is not available to UK gamers if it were to occur.

Xbox, Bethesda, and the Upcoming Console Seller Starfield

Activision Blizzard isn’t the only developer Microsoft has attempted to acquire. Back in 2021, Microsoft successfully acquired ZeniMax Media, the parent company of several developers, most notably of Bethesda, known for the Elder Scrolls and Fallout games.

Bethesda has been working on a new IP called Starfield for several years. It is the studio’s first new universe in 25 years and is a space exploration RPG game with 1000 planets. The technology used to make the game has only recently been powerful enough to support such a large universe. It is easily one of the most anticipated games of the year. And it is expected to sell more Xbox consoles simply because people want to play this game (thus the game is being dubbed a “console-seller”). The game will be exclusive to Xbox consoles and PC, meaning Sony’s PlayStation console gets left behind on earth here so to speak.

Regardless of whether Microsoft sees a significant impact on its financials, gamers at least will be taking a rocket ship to outer space when the game launches in early September 2023.

Valuation

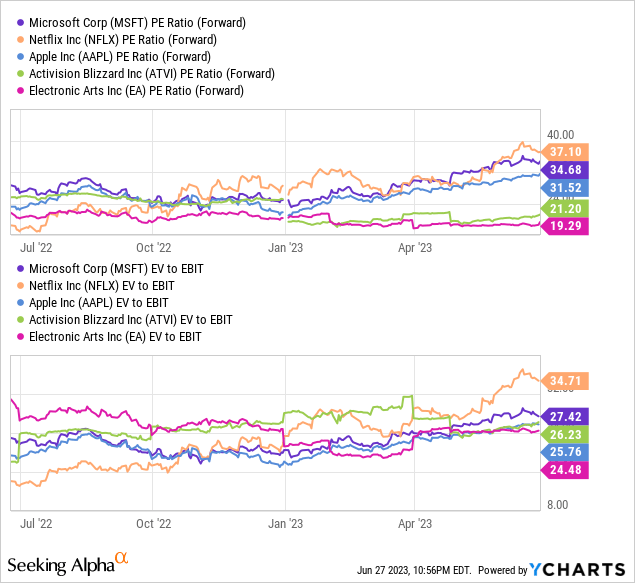

Given this article has focused on gaming, it would make sense to compare Microsoft to other video game and subscription entertainment stocks (Microsoft’s Game Pass subscription service is like the Netflix or Disney+ of gaming).

There is no doubt that Microsoft is one of the more expensive tech stocks relative to peers. That said, Microsoft’s multiples are only slightly higher than video game peers. Microsoft has the advantage of owning the Xbox console. It is perhaps justified that they would receive a higher multiple. Furthermore, Netflix still trades at higher multiples than Microsoft. This suggests that Microsoft’s Game Pass revenues could be valued even higher than the overall company.

Conclusion

I’m bullish on Microsoft’s gaming division. They’ve been making some interesting moves in the space, and supporting a consumer-focused and consumer-friendly approach for the most part, which I believe will ultimately lead to Microsoft growing its gaming division relative to Sony.

Microsoft overall is perhaps not particularly cheap at this time. The stock currently finds itself in the low $300s when it was in the low $200s mere months ago. For that reason, I’m not sure I’d go out and make Microsoft a huge holding right now, but I do believe their prospects going forward are good and that shareholders should do fine long term holding the stock from here.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.