Summary:

- We’re upgrading Microsoft Corporation to a buy.

- We think the tougher global IT spending environment weighing on Azure revenue growth has been factored into the stock and outlook for H1FY24.

- We continue to expect A.I.-driven growth to be gradual but see positive signs of A.I. monetization.

- Microsoft Office 365 Copilot is set to be priced at $30/month for enterprise customers starting in November.

- We see a more favorable risk-reward profile for the stock towards H2FY24.

BlackJack3D

We’re upgrading Microsoft Corporation (NASDAQ:MSFT) to a buy. We now see a more favorable risk-reward profile for the stock towards H2FY24. While we understand and previously shared investor concerns over slower cloud growth last quarter and the weaker global IT spending environment in 2H23, we believe the macro headwinds have been priced into the stock and outlook for Q1 2024.

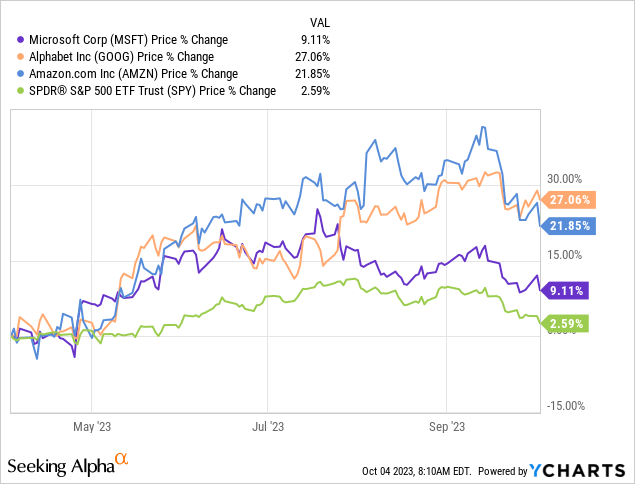

The stock is down roughly 8% since our upgrade to hold in late July, relatively in line with the S&P 500 (SP500). Microsoft has underperformed the peer group over the past six months but slightly outperformed the S&P 500. Our upgrade is based on our belief that the macro uncertainty has been priced in. Now, Microsoft Corporation is better positioned to leverage the A.I. growth opportunity as it monetizes Microsoft 365 Copilot starting November 1st, sticking an additional $30/month price tag on Copilot for enterprise customers.

The following graph outlines MSFT’s stock performance against Alphabet (GOOG) (GOOGL), Amazon (AMZN), and the S&P 500.

YCharts

Our main concern for Microsoft in 1H23 was investors being too excited and too early about A.I. tailwinds without considering the softer cloud spending environment and macro weakness impacting other core segments. We think investors woke up to the materiality-softer cloud spending environment last quarter when Azure cloud growth slowed to 26% Y/Y from 27% a quarter earlier. The stock was up roughly 42% in 1H23; in comparison, since 2H23 began, the stock is down 7%, underperforming the S&P 500 down 5%. We see a clearer path to outperformance towards 2024 and recommend investors explore entry points at current levels.

A.I. monetization is here & demand picks up elsewhere, too

We think Microsoft is now better positioned to experience financial outperformance driven by A.I. due to the pricing of Copilot coupled with the wide installed base of Microsoft 365. The Microsoft 365 A.I. subscription service adds A.I. to the company’s Office products, including Word, Excel, and Teams; the subscription will cost an additional $30 per month, which would increase the monthly price for enterprise customers by as much as 83%. We think this 83% increase will act as a boost in revenue from recurring subscriptions and drive top-line growth for Microsoft towards H2FY24. While we continue to expect the weaker global IT spending environment to persist due to higher interest rates, we don’t see customers cutting back on their A.I. investments in 2024.

We have been waiting for Microsoft to monetize A.I. to upgrade the stock back to a buy and now believe the moment is here; Microsoft now has a competitive edge over Alphabet’s Bard and other chatbots in the software space. We see a gradual but profitable A.I. growth runway for the company into H2FY24.

Additionally, we think the PC market is in recovery for 2024, and Microsoft will experience a reacceleration in More Personal Computing revenue in H1FY24 as a result; we also see tailwinds from the Win7 EOL benefit. We now expect the PC total addressable market, or TAM, to increase 5% Y/Y in 2024 to around 263M units; this is not an outstanding number, but it is a notable increase, considering the 2023 PC TAM contracted significantly this year.

What about Azure’s slower growth?

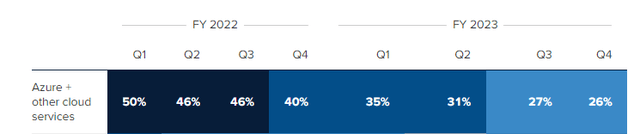

Azure cloud growth has slowed in FY23, consistent with our expectations in 1H23; the following outlines Azure and other cloud services’ Y/Y growth in FY22 and FY23 – the slower growth is not due to any shortcoming from Azure but due to softer cloud spending QoQ in the post-pandemic environment.

MSFT Azure segment results FY22/FY23

Management now guides for 25% to 26% Y/Y growth for Azure in Q1 2024; we expect Azure growth to remain in the double-digit range but continue to see slower spending due to the higher interest rate environment. We think data center and cloud spending is still under pressure into 1H24 but think Microsoft’s A.I. monetization and stabilizing Azure growth percentage better position the company to outperform.

Valuation

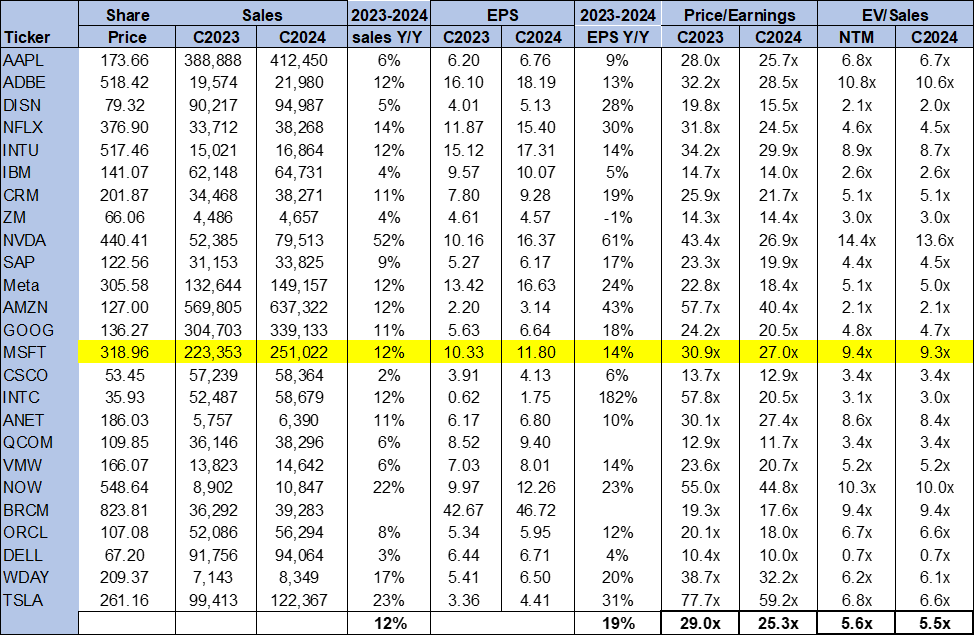

The stock is trading well above the peer group average, but we think the higher valuation is justified. On a P/E basis, the stock is trading 27.0x C2024 EPS $11.80 compared to the peer group average of 25.3x. The stock is trading at 9.3x EV/C2024 Sales versus the peer group average of 5.5x. We understand investor concern over the valuation premium, but believe the A.I. monetization tailwinds coupled with the PC recovery position Microsoft as a growth stock and justify the higher multiple.

The following chart outlines MSFT’s valuation against the peer group.

TSP

Word on Wall Street

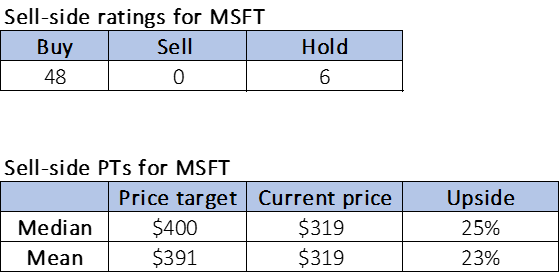

Wall Street shares our bullish sentiment, which does not happen often. Of the 54 analysts covering the stock, 48 are buy-rated, and the remaining are hold-rated. The stock is currently priced at $319 per share. The median sell-side price target is $400, while the mean is $391, with a potential 23-25% upside.

The following charts outline MSFT’s sell-side price targets and ratings.

TSP

What to do with the stock

We’re upgrading Microsoft to a buy; we see attractive entry points into the stock towards 2024 and believe the macro weakness has been priced into both the stock and outlook for H1FY24. We think Microsoft is better positioned now to leverage its position as an early mover in the A.I. space with the OpenAI partnership on ChatGPT as the company takes consolidated moves to monetize A.I. into financial outperformance. We see a more favorable risk-reward profile for the stock towards H2 FY24.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Our investing group, Tech Contrarians, discussed this idea in more depth alongside the broader industry and macro trends. We cover the tech industry from the industry-first approach, sifting through market noise to capture outperformers.

Feel free to test the service on a free two-week trial today.