Summary:

- Microsoft shares are underperforming the market in 2024, with technical indicators suggesting a potential price breakdown below $400 soon.

- Valuations are very high historically, with forward EV to EBITDA of 20x and sales of 11x, indicating the real potential for a 20% to 30% price decline.

- Dividend and free cash flow yields are exceptionally low, making the stock unattractive compared to risk-free Treasury rates.

- AI competition and rising CAPEX costs could flatten growth – I rate Microsoft a Sell, with a price target closer to $300 during 2025.

DNY59/E+ via Getty Images

Microsoft (NASDAQ:MSFT) (NEOE:MSFT:CA) is a Big Tech leader I have mentioned as a Hold or Sell idea over the past year on Seeking Alpha. My latest article, in early August here, explained the horrific weakness in the 14-day Ease of Movement indicator as a warning of larger price declines to come. And, MSFT has morphed into a clear “underperformer” vs. either the S&P 500 or NASDAQ 100 index since the summertime.

Seeking Alpha – Paul Franke, Microsoft Article, August 4th, 2024

Well, the chart pattern today continues to look truly rotten over the intermediate term, with the honest likelihood of a price breakdown under $400 soon. Let’s cut right to the chase.

Technical Analysis

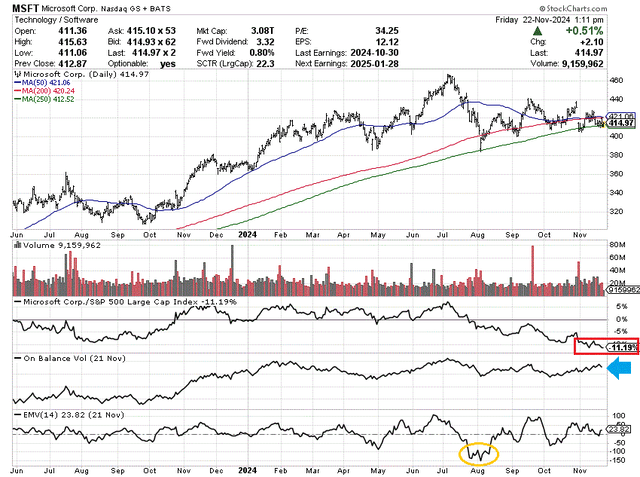

Below is Microsoft’s bearishly sliding price and momentum pattern in the second half of 2024, reviewing an 18-month chart of daily price and volume changes. The main problem I see today is price appears ready to slip below its 250-day (1-year) moving average for the first time since early 2023. It’s been increasingly stuck below the 200-day MA in November, and the 50-day has been zigzagging lower since July.

For technical purists, something of a head-and-shoulders top looks to be in the process of completing, with the head formed in July, one shoulder in March-April, and the other shoulder since September.

StockCharts.com – Microsoft, 18 Months of Daily Price & Volume Changes, Author Reference Points

Relative price momentum vs. the S&P 500 has been a disappointment since last November, with underperformance of -11% since May 2023 (boxed in red) and lagging numbers of -18% since July.

On Balance Volume has been fading since January (blue arrow), after being quite strong during 2023. And, we can again review the record low 14-day Ease-of-Movement reading in late July and early August (circled in gold).

When buyers disappear, small-volume sell orders can move price dramatically lower. Similar EMV implosions in a range of equities have usually proven a smart time to take profits and wait for a better technical setup. What happens when buying interest is sparse and selling volumes explode? Answer: price sinks to find enough buyers to execute transactions. It’s a simple supply/demand equation in action.

Overvaluation Stats

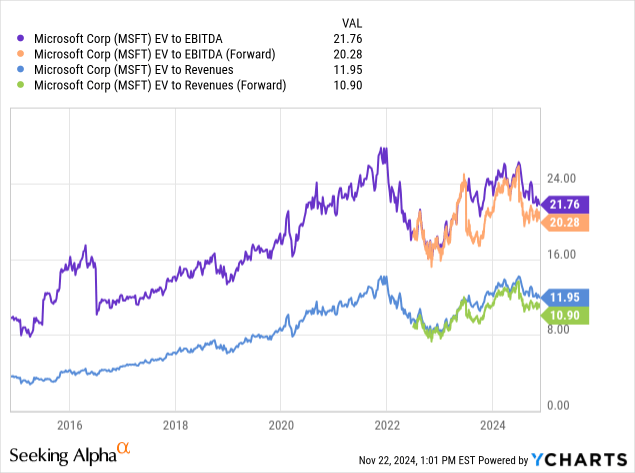

That’s not all the bad news for Microsoft shareholders. Valuations remain far above the readings of five or ten years ago. On a decade review of enterprise value (equity market cap + net debt) to core cash EBITDA or basic revenue generation, you can see how extended shares have become (all other variables remaining the same vs. ten years ago, which they are not).

Forward EV to EBITDA of 20x and sales of 11x are not exactly the bargain levels of 2015. I figure a 20% to 30% share price decline is now necessary to get back to 10-year averages for a valuation (assuming corporate income and sales grow in the 10%-15% range as forecast by Wall Street brokerages).

YCharts – Microsoft, Enterprise Valuations, 10 Years

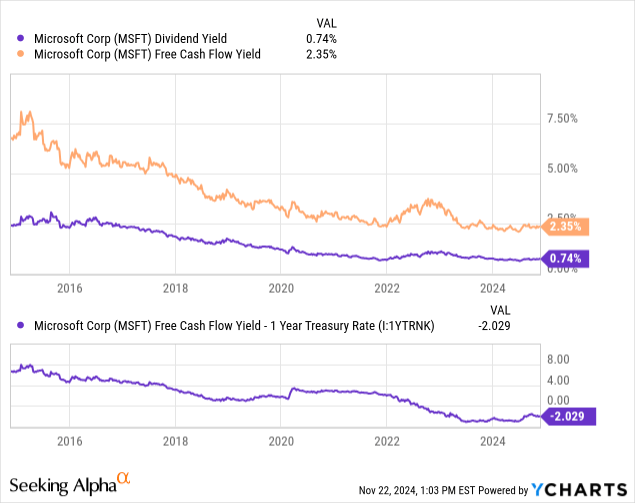

Even worse news is found in the cash yield department. The trailing dividend yield of 0.74% and free cash flow yield of 2.35% are incredibly lacking (both vs. its trading history and alternative equity investments in 2024). In fact, the free cash flow yield relative to prevailing 1-year Treasury rates of 4.4% is a complete disaster for new buyers of the stock, siting at (a minus) -2.03%. Why are you willing to give up risk-free returns of 4.4% and the 100% guaranteed return of your upfront investment capital, for 2.35% in free cash flow annually alongside the potential for large capital losses in a recession?

YCharts – Microsoft, Cash Yield Comparisons, 10 Years

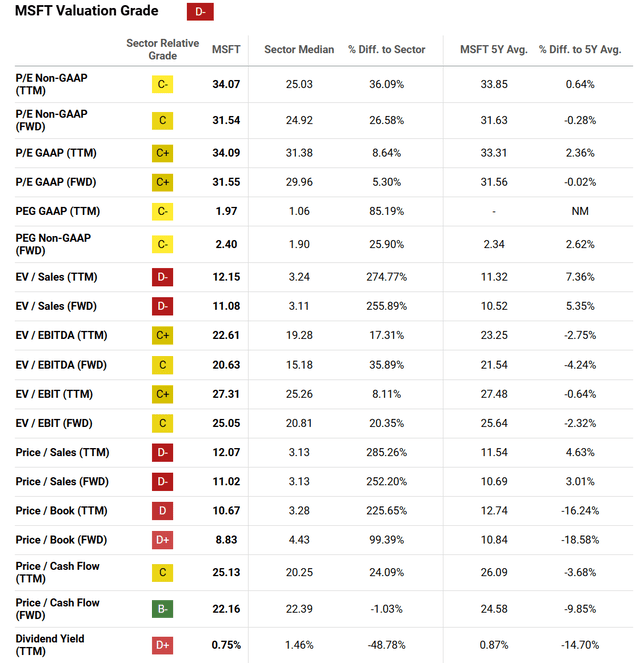

However, you want to slice the data, Seeking Alpha’s comprehensive Quant Valuation Grade for Microsoft is a “D-” today. To me, this says the risk inherent in paying $415 a share is amazingly high right now, for long-term buy and hold investors.

Seeking Alpha Table – Microsoft, Quant Valuation Grade, November 21st, 2024

Final Thoughts

Artificial Intelligence [AI] hoopla has been the one constant/argument to buy Microsoft and pay a valuation premium vs. the company’s recent past. The operating business has one of the best combinations of search, cloud, and enterprise software offerings to utilize AI inventions, including ChatGPT and GPT-4 as a partnership with OpenAI. However, AI/cloud datacenter buildout expenses are climbing, where total sales and EPS growth rates could easily flatten in a recession scenario. Rising CAPEX costs are the main reason free cash flow numbers have not grown much since 2022.

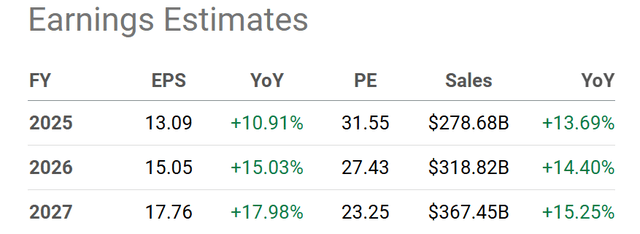

My personal view is current Wall Street analyst forecasts will prove on the high side of what’s possible during 2025-26.

Seeking Alpha Table – Microsoft, Analyst estimates for 2024-26, Made November 21st, 2024

In what could be a seismic shift for MSFT investors, OpenAI is rumored to be considering entry into the search market with its own browser to directly compete with Microsoft’s Edge/Bing and Alphabet-Google‘s (GOOG) (GOOGL) Chrome/Google software. So, it’s obvious MSFT is not without serious AI competition in the future.

What are the bullish arguments for Microsoft ownership? You have to believe the economy will improve nicely under President Trump and Republican policy changes starting in late January. You have to believe interest rates will stay low to prop up Microsoft’s extended valuation. Plus, you have to believe AI cloud demand will remain robust for the industry. At this point in time, all three variables seem possible. But, things do change.

Putting all the investment ideas together, any further stock price erosion could open the potential for a new bear market in Microsoft shares. If you will, a price slide below $390 a share could be the “tripwire” for unsure shareholders on the bull/bear fence. One idea: intelligent traders might want to place stop-sell orders at this level. Another suggestion is selling covered calls may be a terrific battle plan right now, to hedge some downside while providing extra cash income.

I continue to rate Microsoft shares as a Sell for a 12-month outlook, waiting for a better valuation to appear. Prices closer to $300 are possible in 2025, even without a recession. Such would bring 10-year normal valuations for a “fair value” estimate (ex. EV to EBITDA of 16x and sales of 8x). Of course, a recession which pulls operating results out of today’s growth mode could tank the quote well under $300 next year.

If Trump/Republican policy changes actually slow the economy and cause uncertainty for profitable AI cloud development (big business cuts back spending plans), and/or OpenAI starts to compete directly and effectively with Microsoft, several years of flat to lower quotes could be MSFT’s future.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I am short S&P 500 and NASDAQ 100 products, with a high weighting in MSFT shares. This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.