Summary:

- Despite rising macroeconomic risks, cloud computing remains one of the most promising segments of the tech sector.

- Azure’s integration with popular Microsoft products and the company’s AI innovation lead are two key differentiators that lend the company a competitive edge.

- Yet, Amazon’s AWS is arguably the largest and most evolved ecosystem, giving it a breadth of applications and solutions that extend its appeal.

Jian Fan

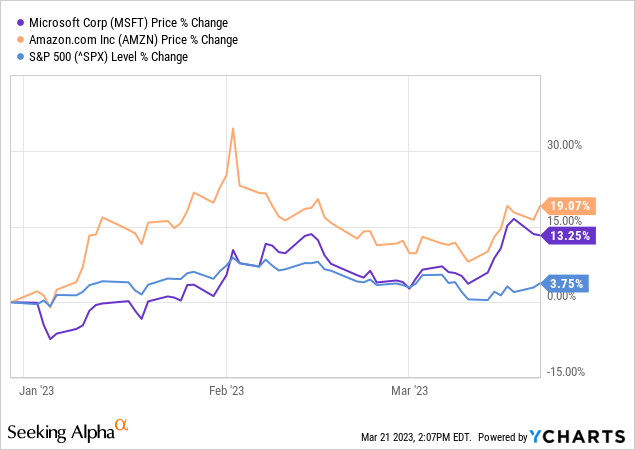

Cloud titans Microsoft (NASDAQ:MSFT) and Amazon (NASDAQ:AMZN) have had a healthy start to 2023. Despite rising macroeconomic risks, cloud computing remains one of the fastest growing segments of the tech sector. Both companies are projected to deliver solid revenue growth over the next few years, as the cloud continues to transform the way businesses manage their IT workloads.

Although the market is highly competitive, the two largest players dominate the global cloud infrastructure services market. According to data from Synergy Research Group, Amazon Web Services (AWS) is the market leader by a significant margin, representing about a third of all spending in the public cloud. Meanwhile, second-place Microsoft Azure has been steadily closing the gap on Amazon’s lead, with a current market share of 23%.

Secular Drivers

The growth outlook for cloud infrastructure is underpinned by long-term secular drivers, including digital transformation, remote working, productivity and cost efficiency.

Cloud providers allow companies to easily scale their computing resources up or down as needed, without businesses having to directly invest in additional capacity themselves. This flexibility is essential for businesses that experience cyclical or sudden spikes in demand, or for those that are rapidly expanding or contracting.

In the past, computing resources were limited by the amount of physical hardware that was available. As such, businesses and government agencies alike were forced to invest in expensive computer equipment, often spending huge sums on systems that quickly became outdated. Infrastructure as a service (IaaS) upended this conundrum, by providing access to however much resources are required at any time, on a pay-per-use basis.

Through a diversified client base, cloud platforms can more readily adapt to shifts in demand and better manage underutilization than individual networks. Additionally, cloud providers benefit from economies of scale, which allow them to offer competitive pricing and still maintain healthy profit margins.

Pandemic Tailwinds

During the pandemic, cloud growth accelerated as work went virtual and businesses focused on the delivery of digital services. Amid social distancing requirements, cloud computing provided a common platform for sharing information and applications, which made it easier for people to collaborate together, regardless of their physical location.

But after a period of unbridled cloud spending and as macroeconomic risks have mounted, the pace of cloud growth has moderated.

Amazon said revenue at AWS increased by 20% in Q4 2022 – slower than many analysts had expected. It was also lower than the 27% growth rate reported in Q3 2022, as well as the 40% growth in AWS from Q4 2021. Despite slowing growth, though, AWS revenues continue to outpace the group’s other operations. By comparison, net sales at the group grew by 9% year-on-year in Q4 2022, or 12% on a constant currency basis.

Microsoft is seeing growth at Azure slow too in recent quarters, but to a lesser extent. Azure and other cloud services revenue growth slowed to 31% in the quarter to December 31, 2022 – down from 35% in the previous quarter and 46% from a year ago.

Azure’s Enterprise Appeal

Microsoft’s market share gains in the cloud infrastructure services space reflects Azure’s growing appeal among the larger enterprise crowd. The company has invested heavily in new product and services development, which has helped to create unique features and capabilities that differentiate Azure from its rivals.

Integration with popular Microsoft products, including Office 365, Windows Server and SQL Server, is another key differentiator, while strong existing enterprise relationships give it an edge in understanding its client needs. This network effect helps it to provide better solutions, improve customer satisfaction and loyalty, and gain a competitive edge in the market.

Looking ahead, Microsoft’s innovation lead in artificial intelligence and machine learning could help Azure to further narrow the gap with AWS, as data and advanced analytics will become increasingly vital capabilities. The company is an early adopter of AI tools and has made big investments in the area.

Most recently, Microsoft announced a new multiyear, multi-billion dollar investment with ChatGPT-maker OpenAI to accelerate AI development. It’s Microsoft’s third partnership agreement with the artificial intelligence lab, following an earlier $1 billion investment in July 2019.

“With Azure OpenAI Service, over 1,000 customers are applying the most advanced AI models – including Dall-E 2, GPT-3.5, Codex, and other large language models backed by the unique supercomputing and enterprise capabilities of Azure – to innovate in new ways… We’re already seeing the impact AI can have on people and companies, helping improve productivity, amplify creativity, and augment everyday tasks.”

Eric Boyd, Corporate Vice President of Microsoft’s AI Platform

AWS’s Appeal Remains Strong

This doesn’t mean that Amazon is resting on its laurels. Amazon also continues to invest heavily in research and development to bring new features and services to its platform. And thanks to its market leadership, the company has arguably the largest and most evolved ecosystem of partners and developers. This contributes to the AWS platform by providing a breadth of applications and solutions that extend its appeal, making it particularly attractive to customers who want a one-stop shop for their cloud computing needs.

As a market leader, AWS has the advantages of scale. In addition to the usual cost savings, operating the biggest network of data centers makes it easier to provide a fast and reliable service to customers across multiple regions. This helps to reduce latency and increase performance for customers who are using its services.

Amazon is also at the forefront of innovation, particularly when it comes to migration services and tools for clients to manage the transition to the cloud. The company has a robust track record on execution for complex migration projects, especially when it comes to moving ‘mission-critical’ workloads to the cloud.

This can be seen in the financial services industry, where AWS has been tasked to operate high-performing, resilient systems which have been built to meet the requirements of the most secure and performance-demanding applications. AWS’s partnership with Nasdaq to migrate its North American trading systems to the cloud, demonstrates that Amazon is at the cutting edge of ultra-low-latency capabilities in cloud infrastructure.

Amazon’s E-commerce Losses

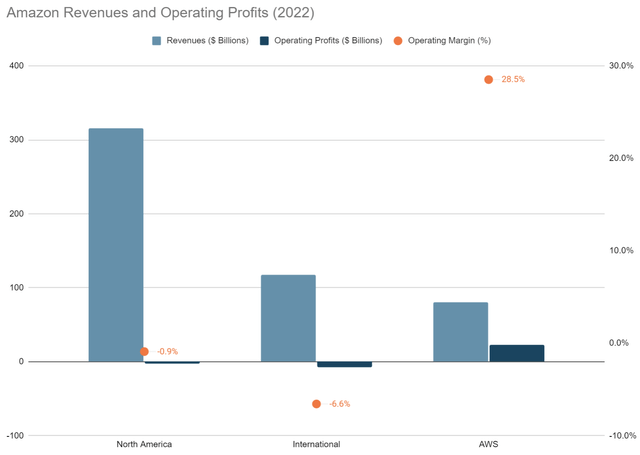

Of course, we cannot look at each company’s cloud businesses in isolation, as both Amazon and Microsoft generate an overwhelming majority of their revenues from other sources. E-commerce is obviously Amazon’s main contributor to the group’s revenues – of the $514 billion revenue in 2022, e-commerce accounted for $434 billion, or 84% of the total.

The company further breaks down its North America e-commerce business, which contributed $316 billion in net sales, or 61% of the group’s total. Meanwhile, the International segment generated $118 billion – 23% of the group’s revenue.

Data Source: Amazon Investor Relations

Amazon, however, struggles to make consistent profits from e-commerce; AWS has been its biggest operating income contributor in each year since the cloud unit became its own reportable segment since 2015.

In 2022, both its North American and International e-commerce segments were loss-making, with an operating loss of $2.85 billion and $7.75 billion, respectively. North America had historically been profitable though, with positive operating income in each year since 2015, except for the most recent year. Last year’s operating loss was attributed primarily to increased fulfillment and shipping costs. Meanwhile, the increase in investments in technology and fulfillment did not match the pace of revenue growth, which slowed to 13% in 2022.

International, on the other hand, has made operating losses in all but one of the past eight years, with 2020 being the sole exception. Still, it was disappointing to see international revenues in 2022 decrease by 8% in 2022, owing to a sharper slowdown in unit sales, combined with the adverse impact of a stronger dollar.

It’s clear that Amazon is playing the long game here – prioritizing its e-commerce market leadership over short-term profitability. Sales of physical goods via the digital channel is the fastest growing segment of the retail sector, and the proportion of internet sales is expected to increase further.

Nevertheless, making the trade-off to prioritize growth will get more difficult, given the more challenging macro backdrop ahead. Weaker consumer confidence means the market is growing at a slower pace; while at the same time, the e-commerce landscape is getting more competitive.

Microsoft’s Other Revenue Sources

Microsoft doesn’t report its cloud financial metrics in the same way as Amazon. The company reports regular growth figures for Azure, together with some other cloud services, including enterprise tools, security and other software – but does not break down revenues or operating profits in dollars.

It’s not even clear if Azure is currently profitable. A leaked document from rival Google (GOOG) (GOOGL) showed it believed Azure made an operating loss of around $3 billion in the year to June 30, 2022, owing to the huge sales and marketing costs needed to win over new clients. Not everyone agrees though – Derrick Wood, an analyst at Cowen, reckons Azure could have an operating margin of above 30%.

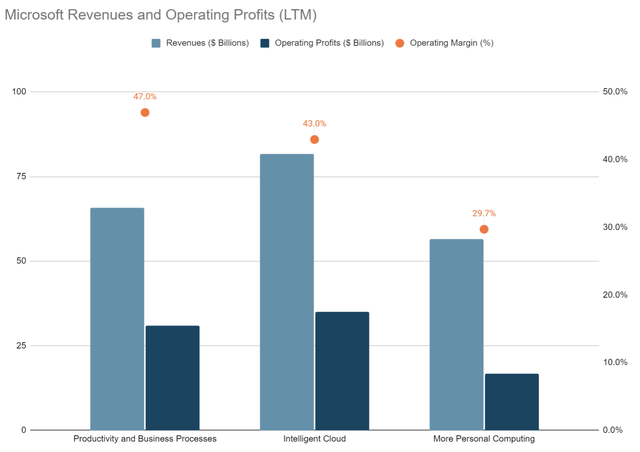

Instead of reporting revenue directly, Azure’s financial performance is incorporated under Microsoft’s Intelligent Cloud segment. It is one of only three reported segments – along with Productivity and Business Processes and More Personal Computing.

The Intelligent Cloud segment also comprises Microsoft’s server products, such as Windows Server, SQL Server, and its enterprise services. It’s the company’s fastest growing segment, and already the group’s biggest contributor to both revenues and operating profits. In the three months leading up to December 31, 2022, Intelligent Cloud revenues grew by 18% year-on-year to $21.5 billion.

This compared to 7% growth in revenues from the Productivity segment, which benefited from continued resilience in demand from commercial users and LinkedIn growth in the quarter. Against this, More Personal Computing revenues declined by 19%, owing to continued softness in new PC purchases and tough comparables in 2021 for gaming.

Data Source: Microsoft Investor Relations

Despite this, Microsoft generates profits across the board, from a diversified range of revenue sources – including Surface devices, Xbox, Windows OEM, Office 365 and numerous other products. These consistent profits generate healthy free cash flows, which underpin big investments in innovation, as well as a growing dividend and share repurchases.

Final Verdict

For me, Microsoft appears to be the better play here. Although Azure is smaller – and likely less profitable – compared to Amazon’s AWS, revenues are growing at a significantly faster rate.

The company may not be immune to macro headwinds – it is exposed to the same FX pressures, and a slowdown in PC and gaming sales is already apparent. However, wide margins and resilient enterprise demand put Microsoft in a strong defensible position to weather the economic trouble ahead.

Valuations are more appealing too, with Microsoft trading at 29.0 times its expected earnings this year, compared to Amazon’s 69.2x multiple.

Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.