Summary:

- Microsoft is a well-diversified business with a top-tier management team and a rock-solid balance sheet.

- CEO Satya Nadella has successfully run the company, with revenue and EPS compounding at double digits.

- The company’s large customer base, SaaS business model, and diversification serve as a safe haven for investors.

- My DCF analysis indicates the stock is still trading at 23% below its value.

lcva2

Investment Thesis

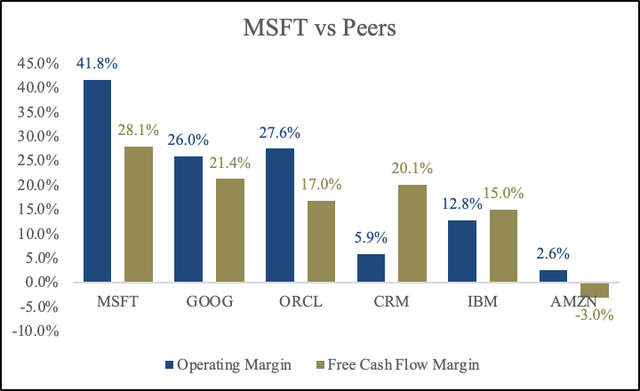

Microsoft (NASDAQ:MSFT) is one of the best businesses out there. The company is well-diversified, has excellent management, and strong financials. Unlike most software companies, MSFT’s diversified product set aims at enterprise efficiency, collaboration, cloud transformation, and business intelligence. A big portion of revenue is recurring and underpinned by a large and loyal customer base. MSFT enjoys higher margins than peers (ORCL), (CRM), (GOOG), (IBM), and (AMZN) due to its cost advantage. (Figures below are from 2022)

Created by the author

Before I invest in a business, I have a checklist, and one of the items on that checklist is to look for how management is compensated. Are their views aligned with those of shareholders? If the CEO has huge stock ownership and gets compensated in stock or options, that boosts my confidence. Mr. Nadella owns more than 1,337,768 shares of MSFT worth over $400 million. In 2022, his compensation was ~$55 million. Of it, $42 million was in stock. Mr. Nadella has been with the company since 1992 and was appointed CEO in 2014. He shifted the company from mainly selling software licenses and maintenance contracts to cloud computing. He invested heavily in Azure, which paid off. Nowadays, enterprises are realizing the potential of cloud computing, and Azure is well-positioned to capitalize on this continued shift due to its dominant position.

So far, Mr. Nadella has done a brilliant job running the company, and I expect that to continue. Under his leadership, revenue, and EPS have compounded at 11% and 15%, with Azure fueling most of that growth (intelligent cloud segment revenue experienced 18% growth in the past eight years). The company’s moat, derived from its network effect, cost advantage, and switching costs, has protected the business and enabled an excellent return on invested capital (29% 5-year average). Plus, The company has solid balance sheet with strong liquidity and low leverage.

Business Summary

Co-founded by Bill Gates and Paul Allen in 1975. Microsoft offers various services, including cloud-based solutions that provide customers with software, services, platforms, and content, as well as solution support and consulting services. The company’s products include operating systems, collaboration applications, business solutions, and video games. Microsoft operates in 190 countries through three segments: productivity and business processes, intelligent cloud computing, and more personal computing.

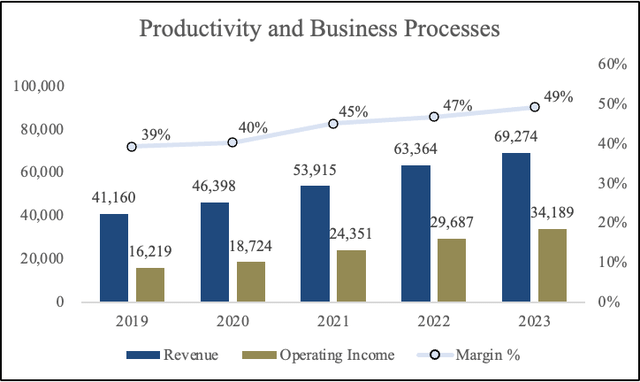

Productivity and Business Processes (33% of revenue) comprise products and services in MSFT’s productivity, communication, and information services portfolio. Offerings in the segment include Office 365 subscriptions, LinkedIn, Dynamics 365, and more. As you can see, the segment’s margins have been consistently improving, up by 10%, or 1000 bps, over the past five years partially due to pricing power in Office 365 subscriptions.

Created by the author using 10-K

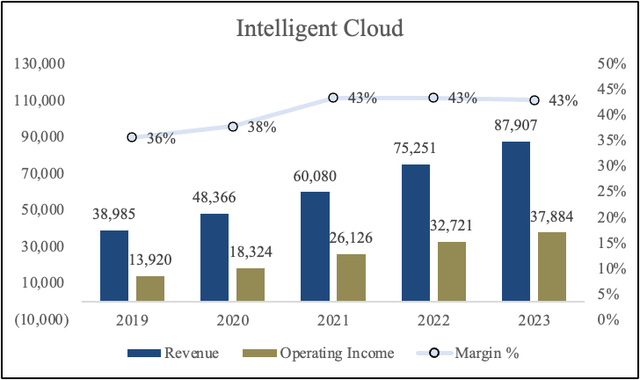

Intelligent Cloud (41% of revenue) comprises the company’s public, private, and hybrid server products and cloud services that power modern businesses and developers. This segment is mainly comprised of Azure; other cloud services include SQL Server, Windows Server, Visual Studio, System Center, and more. This division is by far the biggest contributor to MSFT’s top line. As more businesses upgraded to the cloud, this segment went from contributing 31% to total revenue in 2019 to 41% in 2023. I believe there is still more growth to be realized in the segment as the shift to cloud computing continues.

Created by the author using 10-K

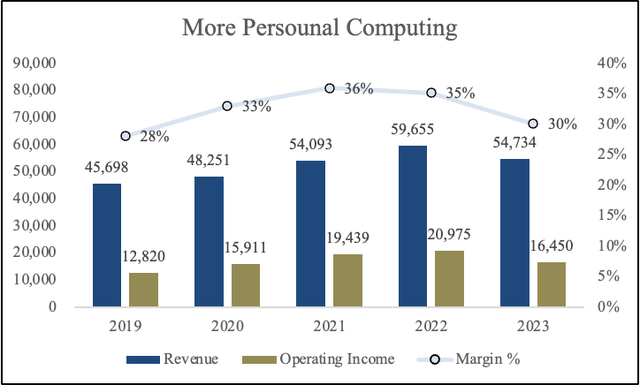

More personal computing (26% of revenue) consists of products and services that put customers at the center of the experience with our technology. Products include Windows, gaming (“Xbox”), search (“Bing”), and devices (Surface and PC accessories). This segment experienced the least growth out of the other segments. I believe the Activision (ATVI) deal will unlock new growth potential in the segment, specifically gaming.

Created by the author using 10-K

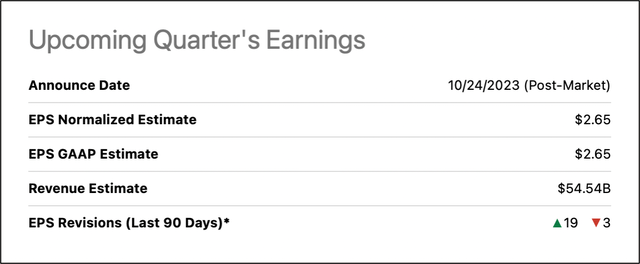

Upcoming Earnings

MSFT will report first-quarter earnings on October 24th after the market close. Consensus estimates are $2.65 EPS and $54.52 billion in revenue. Representing a 13% and 9% increase year-over-year. The big question is, will the company beat these estimates? I don’t have a crystal ball, but my two cents is that MSFT has beat expectations for the past four quarters (slightly missed on revenue in Q2 23). However, in the last two quarters, MSFT has crushed earnings due to rising interest from enterprises on AI and the ongoing cloud transition. I believe the company is definitely heading on the right track, but even if they miss and the stock ends up dipping, this might offer long-term investors the chance to buy a high-quality company at an attractive price.

created by the author

Valuation

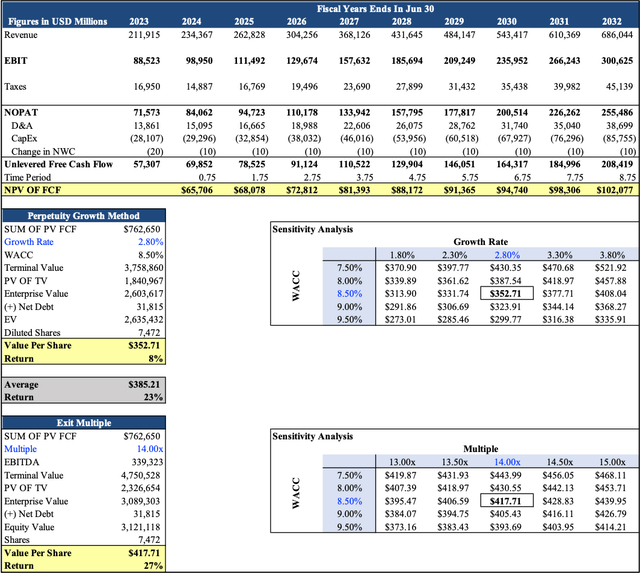

MSFT’s stock is up by 36% at the time of this writing ($328), but my DCF suggests there is still a 13% upside. The company is trading at a forward PE of 30.09x the FY24 consensus of $11.01 and 26.17x the FY2025 consensus of $12.65. On a trailing free cash flow basis, the stock yields over 2.5% relative to its enterprise value.

My base scenario includes total revenue growing by 14% from 2024–2032. This growth is underpinned by 11.72% in productivity and business processes, 17.89% in intelligent cloud driven by enterprises shifting to the cloud, and 8.54% in more personal computing driven by new products and price increases. I have gross margin expanding by 160 bps over the same time period as the intelligent cloud makes up more of the total revenue.

I used a WACC of 8.50%, a growth rate of 2.80%, and a 14.00x EV/EBITDA multiple. Other assumptions include a 12.50% R&D Margin, 11% S&M margin, 3.2% G&A Margin, and a 15% tax rate. I arrived at value per share of $352 using the perpetuity growth method and $417 using the exit multiple method, Taking the average of both methods, I arrived at a value per share of $385, translating into a 23% return from the price of this writing.

Created by the author

My downside scenario includes total revenue growing 13% from 2024–2032. This growth is underpinned by 10.72% in productivity and business processes, 16.89% in the intelligent cloud, and 7.54% in more personal computing. I have a gross margin expanding by 60 bps over the same time period. I used a WACC of 8.50%, a growth rate of 2.50%, and a 13.00x EV/EBITDA multiple.

Other assumptions include a 13.50% R&D Margin, 12% S&M margin, 4.2% G&A Margin, and 17% tax rate. I arrived at value per share of $270 using perpetuity growth method and $329 using the exit multiple method, Taking the average of both methods, I arrived at a value per share of $299, translating into a 4% downside from the price of this writing.

Risks/Mitigates

Competition is fierce in the growing cloud business, Every company is trying to compete with giants such as AWS and Azure. Competitors in the field include CRM, ORCL, GOOG, AMZN, and more. Another risk is harsh economic conditions, which will force companies to cut spending on technology. MSFT is very acquisitive and the company has had some flops in the past such as the $7.5 billion write-off for Nokia devices and Services. Similar bad acquisitions in the future could dilute capital return.

On October 11th, MSFT received a tax bill for $28 billion from the IRS for the years 2004-2013, The amount isn’t a small one even for conglomerate like MSFT, But the company is appealing the tax bill and has said that the IRS has not accounted for the $10 billion that was paid. This issue might take years to solve but I thought I should mention it.

Takeaway

In short, MSFT is a giant software company led by a top-tier management team. I believe the company offers investors a safe haven in times of uncertainty for two reasons: the large customer base and diversified business. As for a valuation, using a 9-year DCF, I arrived at a value per share of $385, implying a 23% return. Although, the company is currently trading a 30x FWD P/E, I believe it’s still cheap considering its leading position, great management, and strong cash flow generation

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I'm not a qualified financial advisor or investing professional. My content and analysis are based on my opinion and are intended to be used and must be used for educational purposes only. No content or analysis constitutes or should be understood as constituting a recommendation to enter into any securities transactions or to engage in any investment strategy. It is very important to do your own analysis before making any investment based on your own personal circumstances. Readers should always seek the advice of a qualified professional before making any investment decision. Past performance is not indicative of future performance. A reader should not make personal financial, or investment decisions based solely upon this analysis.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.