Summary:

- Microsoft Corporation is accelerating data center capacity to catch up to AI demand, partnering with Oracle and other hyperscalers to offset some of the pressure.

- FY24 capital investments increased by 58% to $44.5 billion, primarily for data centers, CPUs, and GPUs, with further increases expected in eFY25 and eFY26.

- Power constraints and sourcing base load capacity are critical challenges and may potentially impact the rate of data center buildouts and revenue generation.

- Intelligent Cloud is the primary growth driver for Microsoft. I’m forecasting growth to accelerate as the firm seeks to improve available capacity in the coming years.

Jonathan Kitchen

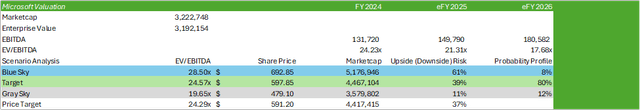

Microsoft Corporation (NASDAQ:MSFT) is reaching a major paradigm shift as the firm accelerates its plan to catch up data center capacity to meet demand. This has led Microsoft to both collaborate with peer hyperscalers for hosting services, and outsourcing 20 data center builds to Oracle Corp. (ORCL) to help fulfill capacity needs. Given the growth of the “everything AI” market, I believe Microsoft will further entrench operations to support this growing demand. I recommend MSFT shares with a BUY rating with a price target of $591/share at 24.29x eFY26 EV/EBITDA, providing investors a 37% upside potential from today’s trading range.

Microsoft Operations

Microsoft remains in a strong position of growth, as demand across AI applications has grown faster than Microsoft’s current capacity. This has led to the firm investing extensively into their data centers as well as partnering up with 3rd party hyperscalers like Oracle Corp. (ORCL) to cater to this level of demand. FY24 capital investments grew by 58% on a year-over-year basis to $44.5b in FY24 with the majority of capital going towards data centers, specifically CPUs & GPUs.

Accordingly, the data center space is expected to grow at a 23% CAGR through 2030 to support the growing demand for AI training and inferencing. Oracle alone is constructing 100 data centers globally to support regional restrictions as they pertain to privacy laws. Though the data is dated, Oracle announced in their q2 ’24 earnings call that they are constructing 20 data centers in partnership with Microsoft to support both OSI and Azure. These will be in addition to Microsoft’s 300+ global data center footprint spanning 60+ regions.

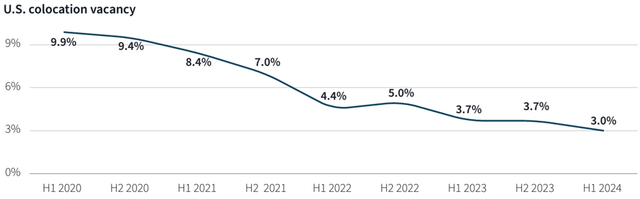

One of the biggest concerns with this level of growth is whether the trend will continue. According to JLL, vacancy rates at data center sites sit at an all-time low at 3%.

This is like looking in the rearview mirror as a significant amount of capacity has yet to hit the market. However, I believe the trend presented by JLL, along with Satya Nadella’s comments relating to supply/demand imbalances for CPU + GPU capacity, suggests that the market is far from saturated and will likely continue to grow.

Mr. Satya made clear in the FY24 earnings call that Microsoft will remain prudent in building out capacity and lighting up facilities. Electricity has been at the forefront of headlines as sourcing baseload capacity and costs remains at the top of the mind. According to the JLL report linked above, electricity demand increased by 9x to 2.8GW in 1H ’24 when compared to 2020 levels. Consistent, reliable power demand is so crucial to operations that Constellation Energy (CEG) is restarting Unit 1 at the Three Mile Island nuclear facility under a 20-year agreement.

Electricity is a major component to the TCO, with servers and data equipment accounting for 55% of the energy used in the data center, cooling equipment accounting for 30%, and 12% going towards uninterruptible power supply.

In order for the data center buildouts to continue, I anticipate that Microsoft may seek to co-develop dedicated power facilities to ensure adequate, uninterrupted power supply, whether they are natural gas or nuclear. Data centers are expected to use upwards of 9% of the US electricity by 2030, creating the need for more baseload capacity. Relating to data center buildouts, dedicated resources may be a part of the capital investment outlay going into the back-half of the decade as the grid becomes more and more constrained.

Though management didn’t provide firm figures for capital investments for eFY25, they provided some general guidance, suggesting that eFY25 investments towards infrastructure will be larger than that of FY24 with a sequential increase in eq1’25. For eq1’25, I’m forecasting $14b with eFY25 coming out to $58b, a 31% increase from FY24.

Though I do not expect power to necessarily be a major constraint in eFY25, I believe it will gradually work its way into the capital budget, whether Microsoft co-invests in a dedicated power supply or outright owns the facilities. Accordingly, a simple gas-powered facility can generate upwards of 571MW with a combined cycle more than doubling the capacity. A small modular reactor can generate upwards of 300MW per unit, providing enough power for one of the scaled AI factories currently being constructed.

Given that power remains one of the costlier items in running these large-scale data centers, management’s strategy is somewhat a “land and expand” type of theme. Microsoft will build out the facility, implement the CPUs & GPUs, and keep the lights off until customer demand catches up. Judging by management’s verbiage towards more demand than capacity and the limited vacancy across existing data centers, I suspect this wouldn’t be an issue in the near term.

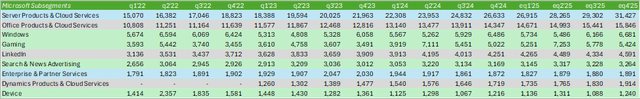

For the sake of mapping out segments to subsegments, I color-coded the subsegments for ease of use. Green ties to Personal Computing, Blue to Intelligent Cloud, and gray to Productivity & Business Processes.

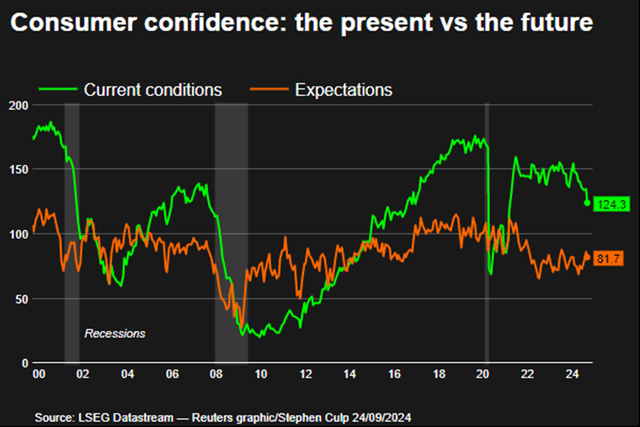

Touching up on a few of the subsegments, I anticipate the Device group to perform relatively flat with a sequential decline going into Q3 ’25 with some improvement in Q4 ’25 given the inflationary environment. Consumer confidence dropped the most in three years as reported in the September print as consumers fret over the increasingly challenging labor market. Research by McKinsey suggests that more consumers are expecting to spend less on electronics over the next 3 months, with 50% of general consumption changing to lower price or discount retailers. In addition to this, consumers are leveraging BNPL services more in CYQ3 ’24 when compared to CYQ2 ’24.

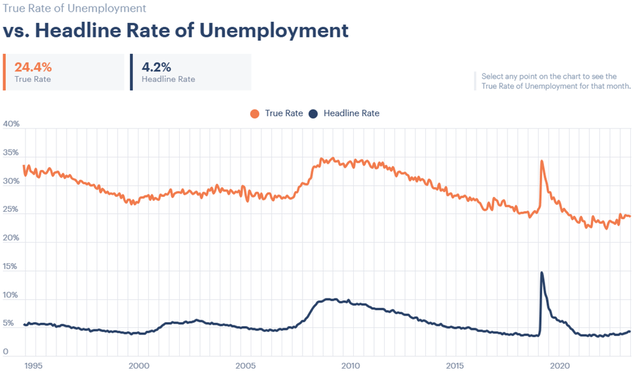

As it relates to these macroeconomic factors, LinkedIn utilization may increase as employment grows in concern. Headline unemployment has increased to 4.2% and may continue in this direction as more administrative tasks are automated through the use of AI applications. If the unemployment rate continues to climb, Microsoft may see some additional pressure on licensing and personal computing.

Ludwig Institute For Shared Economic Prosperity

In terms of growth drivers, I’m expecting cloud services to be what moves the needle for Microsoft. Though I’m forecasting intelligent cloud to increase at a decreasing rate in eFY25, I believe eFY26 will realize an acceleration of growth with more capacity built out to support Microsoft’s consumption model.

Betting on cloud growth comes with its risks given the market’s reaction to Q2 ’24 Azure’s weaker-than-expected growth. Microsoft shares have since recovered from their post-earnings sell-off; however, capacity constraints could weigh in on Microsoft’s performance in the near-term if the firm cannot implement enough GPUs to cater to demand.

Microsoft Financials

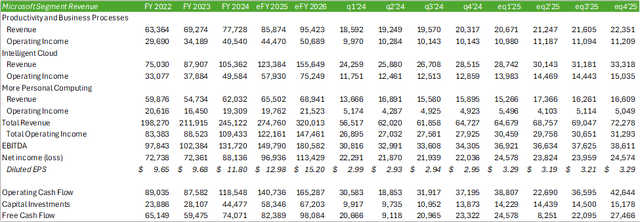

Forecasting financials through eFY26, I’m forecasting Microsoft to experience growth across each segment, with Intelligent Cloud being the primary growth driver. For eFY25, I’m forecasting Intelligent Cloud to grow by 17% on a year-over-year basis, with a strong acceleration to 26% in eFY26 driven by added capacity. Given that power constraints may play into timing, growth may vary significantly as we approach eFY26.

For eq1’25, I’m forecasting Microsoft to generate $30.5b in revenue and a diluted EPS of $3.29/share. Given my operations forecast, I’m expecting Microsoft to generate $82b in free cash flow in eFY25 and $98b in eFY26. This includes $58b & $67b in capital investments for eFY25 & eFY26, respectively.

Risks Related To Microsoft

Bull Case

Microsoft is one of the leading hyperscalers in the AI mania and has experienced outpaced demand for the supporting capacity for AI training and inferencing. Between this and the significant decline in vacancy across data centers, Microsoft should experience a significant upswing in consumption as the firm scales. Given that future demand for GPU capacity is not certain, management will dynamically shift their capital investment outlay to ensure the firm doesn’t outpace demand.

Bear Case

Microsoft will be spending a substantial sum to build out its data center capacity, and may be flatfooted if interest in AI training and inferencing wanes. Given the high growth in data center capacity across the hyperscalers, supply may inevitably outweigh demand and add pressure to competitive pricing as it relates to the consumption model. Microsoft may also realize headwinds in sourcing enough electricity to power their new data centers. Permitting and sourcing baseload capacity may result in delays in bringing these new facilities online, adding a ceiling to revenue generation and pressure-free cash flow.

Valuation & Shareholder Value

MSFT shares currently trade at 24.23x TTM EV/EBITDA. Microsoft commands a strong premium above its competitors, with an enterprise value-weighted peer average of 19.15x EV/EBITDA.

Despite this premium, I believe Microsoft is well-positioned to realize continued durability given the strength in cloud and AI consumption.

Using an internal valuation model based on my EBITDA forecast and MSFT’s historical trading premiums, I value MSFT shares at $591/share at 24.29x eFY26 EV/EBITDA. Assuming Microsoft will grow at the expected rate with limited constraints on power sourcing, I believe MSFT shares can appreciate by 37% from today’s trading range.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of ORCL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.