Summary:

- Microsoft’s financial health and growth prospects are the focal points of this analysis, revealing a promising investment case.

- Under the default scenario, with a 10.48% expected revenue growth rate, Microsoft offers an 8.3% potential stock price increase and a 14.2% annual return.

- Incorporating Activision-Blizzard’s growth potential results in a 29.8% upside and a potential annual return of 21.3%.

- Even under a conservative scenario, with a 16.3% cloud growth rate, Microsoft presents a 13.4% upside and the potential for annual returns of up to 15.8%.

- While potential risks include significant cloud revenue declines or unprofitable ventures, Microsoft’s financial resilience and diverse business segments position it as a strong candidate for sustained growth in the technology and cloud computing sector.

HJBC

Thesis

Microsoft Corporation (NASDAQ:MSFT) successfully completed its acquisition of Activision Blizzard, Inc. (ATVI) on October 13th. According to my models, this acquisition has the potential to boost Microsoft’s annual return to up to 20% from its current stock price of 327.7.

Furthermore, the slight decrease in Microsoft’s Intelligent Cloud growth, from 28% to 26%, seems unwarranted, considering that Microsoft still offers a compelling annual return of approximately 16%. Coupled with the substantial free cash flows that Microsoft consistently generates, which essentially provides them with ample opportunities for growth through mergers and acquisitions (M&As), I firmly believe that Microsoft is a strong buy.

Overview

Productivity & Business Processes

Microsoft’s Productivity and Business Processes segment comprises a diverse array of products and services aimed at enhancing productivity, communication, and information services across various platforms and devices. This segment includes Office Commercial, which encompasses Office 365 subscriptions, Office 365 within Microsoft 365 Commercial subscriptions, and on-premises Office licenses, providing a comprehensive suite of productivity tools. Additionally, it features Office Consumer, which includes Microsoft 365 Consumer subscriptions and other Office services. LinkedIn, with its Talent Solutions, Marketing Solutions, Premium Subscriptions, and Sales Solutions, is also a part of this segment, along with Dynamics business solutions, featuring Dynamics 365’s intelligent, cloud-based applications for ERP, CRM, Power Apps, and Power Automate. This market is expected to deliver a CAGR of around 13% from 2023 to 2030, as I previously explained in my first article about Adobe, Inc. (ADBE).

The SaaS market can be categorized into three segments: Business & Productivity, Transportation & Logistics, and Circular Economy. As evident, Adobe primarily focuses on the Business & Productivity segment. This specific segment is projected to reach a valuation of $149 billion by 2030, reflecting a 13% annual growth rate from its current value of approximately $47.3 billion.

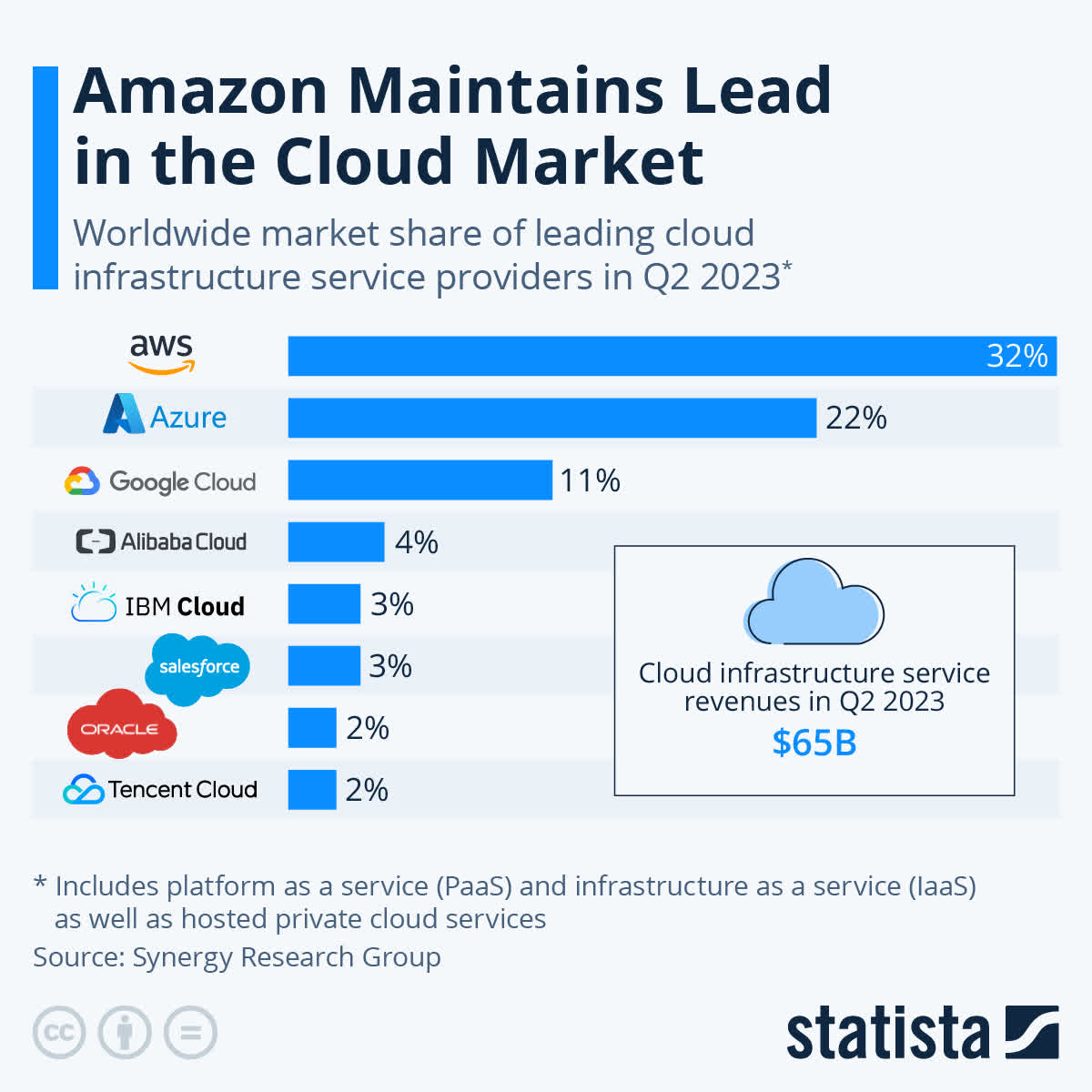

Intelligent Cloud

Within the Intelligent Cloud segment, Microsoft offers an extensive range of public, private, and hybrid server products and cloud services, empowering modern businesses and developers. This segment comprises server products and cloud services like Azure, SQL Server, Windows Server, Visual Studio, System Center, and related Client Access Licenses.

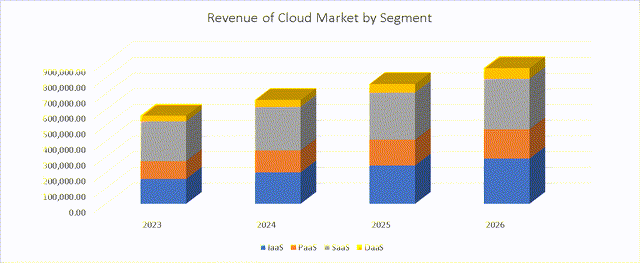

In their Q4 2023 earnings report, which was released in July, it was noted that their cloud business grew at 26%, down from the 27% growth in the previous quarter. This was perceived as a sign of a slowdown. However, as you will see in my valuation, even if it grows at a rate of 16.3%, Microsoft would still be undervalued. It’s essential to highlight the role of AI, as it’s not merely a new revenue source; it acts as a complement to Azure, helping it remain competitive and dominant for years to come. Satya Nadella emphasized this during the earnings report.

Every customer I speak with is asking not only how but how fast they can apply next-generation AI to address the biggest opportunities and challenges they face and to do so safely and responsibly,

Cloud Market (Statista)

More Personal Computing

Finally, the More Personal Computing segment focuses on creating a customer-centric technology experience. It offers Windows operating system products, including OEM licensing, Windows Commercial volume licensing, and Windows cloud services. This segment also encompasses Devices, featuring Surface, HoloLens, and PC accessories. The Gaming aspect includes Xbox hardware, gaming content, Xbox Game Pass, and related subscriptions. Furthermore, Search and news advertising encompass Bing, Microsoft News, Microsoft Edge, and third-party affiliates, fostering a user-centered approach to technology and entertainment within this segment.

Financials

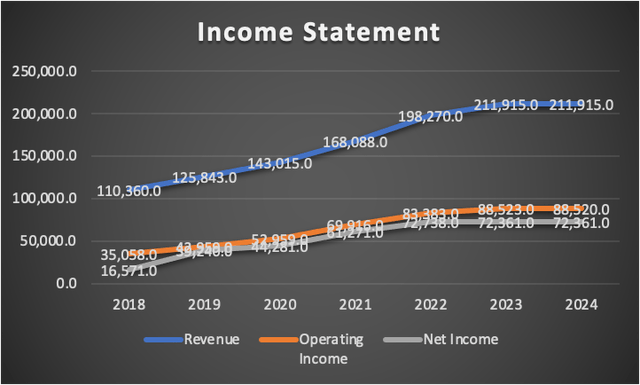

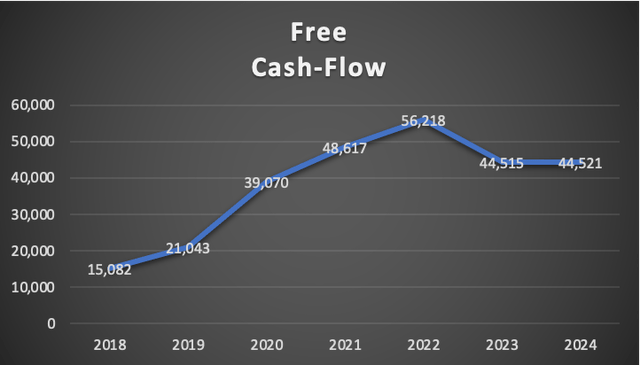

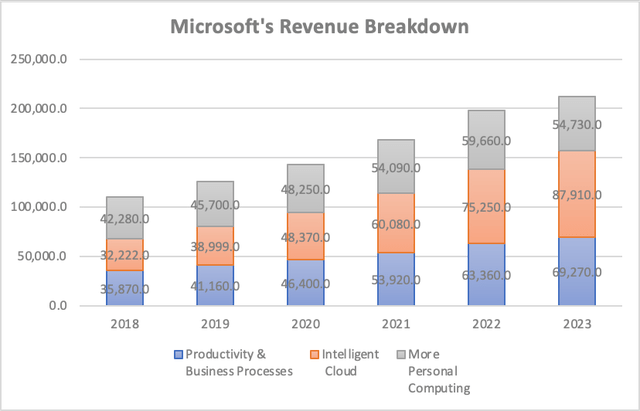

Microsoft experienced substantial revenue growth during the pandemic period, with an impressive annual revenue growth rate of 14.38% from 2019 to 2022. This growth was primarily attributed to the well-known factors. However, since 2022, there has been a slight lag, with revenue growing by approximately 6.56% from 2022 to 2023.

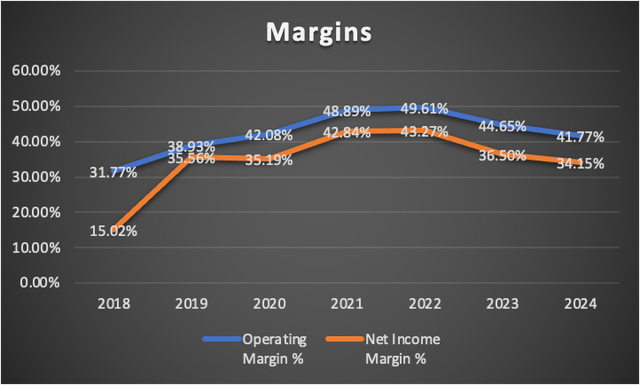

Microsoft boasts some of the highest margins among large corporations, with both operating margin and net income margin exceeding 34%. As depicted in the graph below, the operating margin stands at 41.77%, while the net income margin is at 34.15%.

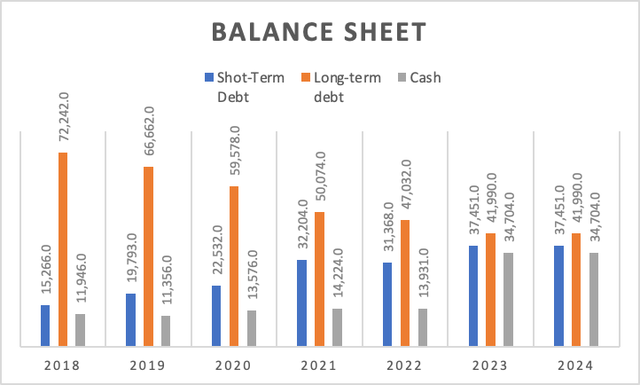

Microsoft’s balance sheet remains in excellent shape, with approximately $79 billion in total debt but offset by cash reserves of about $34.7 billion. While these reserves may not entirely cover the total debt, you’ll notice in the cash flow analysis that Microsoft could pay it off within a year.

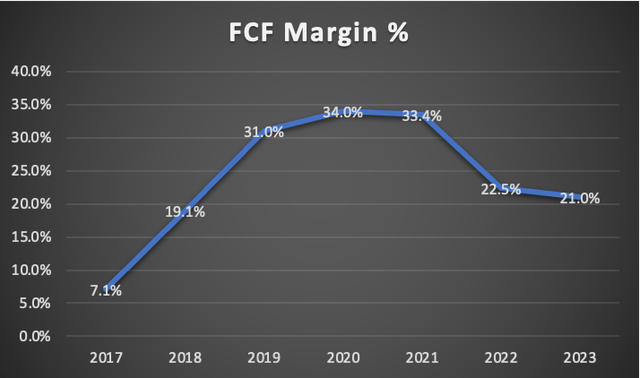

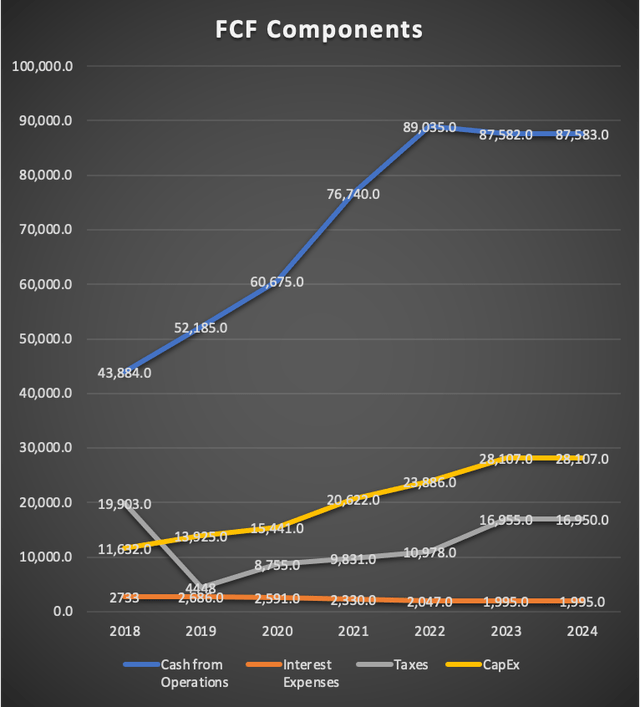

Turning to free cash flow, Microsoft generates around $44 billion, a sum more than sufficient to acquire entire companies or combine with its cash reserves to pay down its debt. The current FCF margin is at 21%, a decrease from its 2021 peak of 33.4%. The graph labeled “FCF Components” illustrates that in 2022-2023, Microsoft increased its capital expenditure while growth in cash from operations lagged. This caused Microsoft to allocate a larger percentage of its cash from operations to CapEx. However, this situation is reversible if Microsoft desires, so there is no significant cause for concern.

Author’s Calculations Author’s Calculations Author’s Calculations

In summary, Microsoft’s financial health is enviable, marked by substantial free cash flow, providing the company with ample resources to pursue mergers and acquisitions or invest in the development of new products. This strategy can help secure its dominance in the computing market.

Valuation

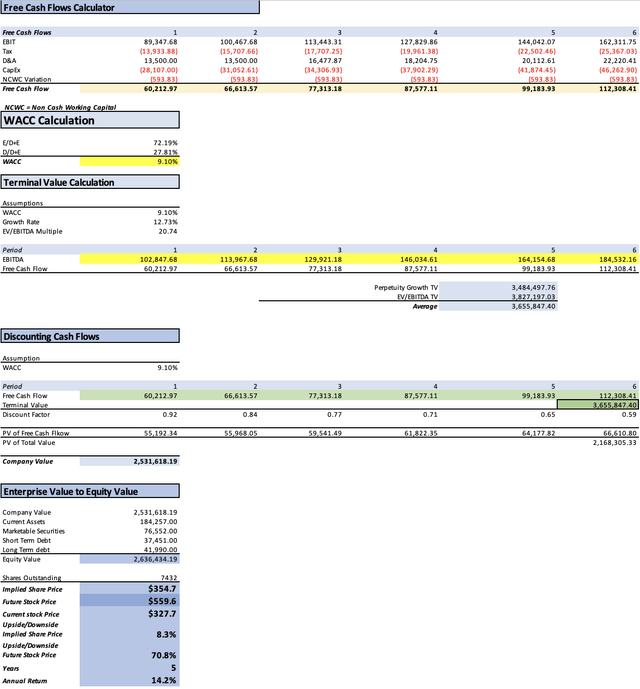

In this valuation I will do three models, the first one will be with the expected revenue growth rate of 10.48%, and the expected EPS growth rate of 12.73%. The second scenario is summing Activision’s financials which according to analysts, its revenue is expected to grow at a rate of 5.20% while its EPS will grow at a rate of 9.97%. The third and final scenario will be made by projecting the revenues of the intelligent cloud business with a revenue growth rate of 16.3% which is the expected revenue growth for the cloud computing market, and where previously discussed in my article about Oracle Corporation (ORCL).

Below is the table of assumptions which is filled with all the current financial data available on Microsoft, as you can see D&A, interest expenses and CapEx are projected using margins tied to revenue, this way I think I will achieve more realistic figures.

| TABLE OF ASSUMPTIONS | |

| (Current data) | |

| Assumptions Part 1 | |

| Equity Value | 206,223.00 |

| Debt Value | 79,441.00 |

| Cost of Debt | 2.51% |

| Tax Rate | 18.98% |

| 10y Treasury | 4.61% |

| Beta | 1.2 |

| Market Return | 10.50% |

| Cost of Equity | 11.68% |

| Assumptions Part 2 | |

| EBIT | |

| Tax | 16,950.00 |

| D&A | 13,500.00 |

| CapEx | 28,107.00 |

| Capex Margin | 13.26% |

| Assumption Part 3 | |

| Net Income | 72,361.00 |

| Interest | 1,995.00 |

| Tax | 16,950.00 |

| D&A | 13,500.00 |

| Ebitda | 104,806.00 |

| D&A Margin | 6.37% |

| Interest Expense Margin | 0.94% |

| Revenue | 211,915.0 |

Default Scenario – 10.48% growth rate

In the initial valuation scenario, we consider Microsoft’s expected revenue growth rate of 10.48%, which aligns with analysts’ predictions. This scenario, as the default revenue growth rate, requires no further explanation.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2024 | $211,915.0 | $73,418.80 | $87,352.68 | $100,852.68 | $102,847.68 |

| 2025 | $234,123.7 | $82,765.02 | $98,472.68 | $111,972.68 | $113,967.68 |

| 2026 | $258,659.9 | $93,301.00 | $111,008.25 | $127,486.12 | $129,921.18 |

| 2027 | $285,767.4 | $105,178.22 | $125,139.60 | $143,344.35 | $146,034.61 |

| 2028 | $315,715.8 | $118,567.41 | $141,069.87 | $161,182.48 | $164,154.68 |

| 2029 | $348,802.9 | $133,661.04 | $159,028.07 | $181,248.48 | $184,532.16 |

| ^Final EBITA^ |

As demonstrated in the discounted cash flow [DCF] analysis, this scenario yields a current fair price of $354.7. This suggests an 8.3% potential increase from the current stock price of $327.7. Furthermore, it indicates an annual return of 14.2% until the stock reaches the suggested future value of $559.6.

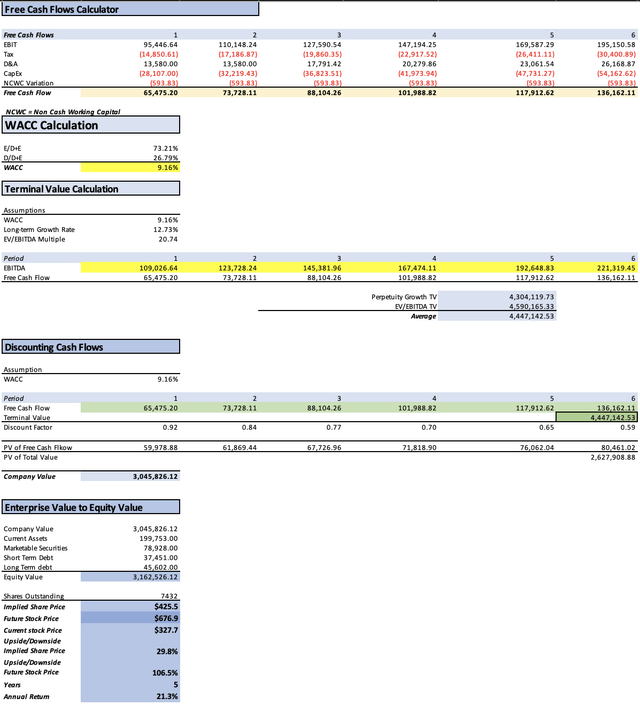

With Activision-Blizard

In this second valuation scenario, we factor in Microsoft’s anticipated revenue growth rate of 10.48% and also Activision-Blizzard’s expected revenue growth rate of 13.83%. Below, you’ll find the projected revenue and net income (calculated using the expected EPS growth rate of 9.97%) that will be added to Microsoft’s revenue.

| Revenue | Net Income | |

| 2024 | $8,706.0 | $2,166.00 |

| 2025 | $9,158.7 | $2,359.42 |

| 2026 | $9,635.0 | $2,570.12 |

| 2027 | $10,136.0 | $2,799.63 |

| 2028 | $10,663.1 | $3,049.64 |

| 2029 | $11,217.5 | $3,321.97 |

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2024 | $220,621.0 | $78,601.03 | $93,518.43 | $107,573.04 | $109,650.00 |

| 2025 | $253,652.1 | $90,966.37 | $108,230.53 | $122,285.15 | $124,362.11 |

| 2026 | $291,515.5 | $105,116.51 | $125,066.17 | $143,637.10 | $146,381.47 |

| 2027 | $334,907.0 | $121,297.47 | $144,318.06 | $165,653.24 | $168,806.10 |

| 2028 | $384,621.8 | $139,788.28 | $166,318.17 | $190,820.42 | $194,441.31 |

| 2029 | $441,568.2 | $160,905.30 | $191,442.91 | $219,572.92 | $223,729.91 |

| ^Final EBITA^ |

The DCF suggests a fair price per share of $425.5, indicating a 29.8% upside from the current stock price of $327.7. Additionally, the DCF projects that by 2028 (FY 2029), Microsoft’s stock price could reach $676.9, representing an upside of approximately 106.5%, or a 21.3% annual return.

My Estimates

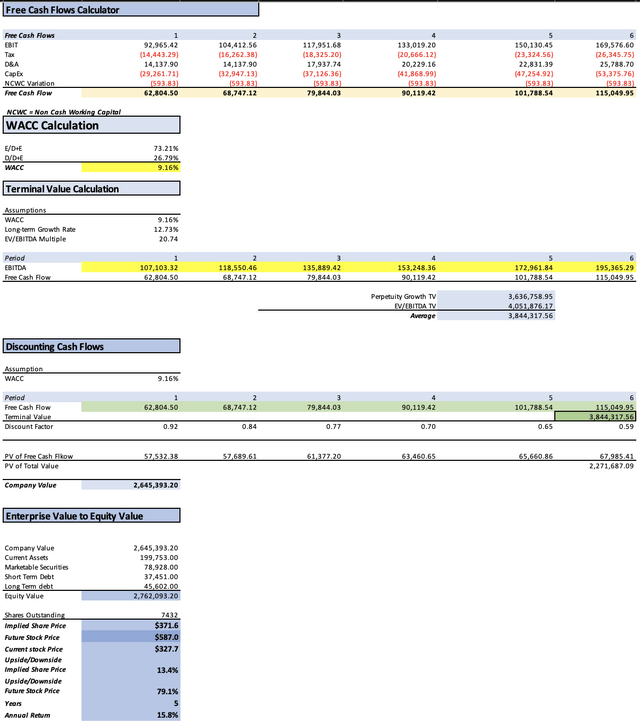

In this section, I will demonstrate how Microsoft can still offer a solid security margin, with an annual return of around 16%, even if its cloud business growth reduces all the way down to 16.3%.

Author’s Calculations with Base on Statista Author’s Calculations

To begin, we deduct the $87.9 billion in revenue that the intelligent cloud could have generated for Microsoft. Next, we take the previously mentioned intelligent cloud revenue and project it to grow annually at a rate of 16.3%. This results in the following outcomes.

| Intelligent Cloud | |

| 2024 | $87,910.0 |

| 2025 | $102,239.3 |

| 2026 | $118,904.3 |

| 2027 | $138,285.7 |

| 2028 | $160,826.3 |

| 2029 | $187,041.0 |

Then, we add all these new revenues back to Microsoft’s overall revenue, which yields figures significantly lower than what analysts expect, and this trend is also observed with net income.

| Revenue | Net Income | Plus Taxes | Plus D&A | Plus Interest | |

| 2024 | $220,621.0 | $76,445.18 | $90,888.46 | $105,026.36 | $107,103.32 |

| 2025 | $248,407.6 | $86,073.22 | $102,335.60 | $116,473.50 | $118,550.46 |

| 2026 | $279,917.2 | $96,991.30 | $115,316.50 | $133,254.24 | $135,889.42 |

| 2027 | $315,674.7 | $109,381.27 | $130,047.39 | $150,276.55 | $153,248.36 |

| 2028 | $356,282.3 | $123,451.80 | $146,776.36 | $169,607.74 | $172,961.84 |

| 2029 | $402,430.9 | $139,442.31 | $165,788.05 | $191,576.75 | $195,365.29 |

| ^Final EBITA^ |

The current fair value is calculated to be $371.6, representing an upside of approximately 13.4%. The stock could potentially deliver annual returns of up to 15.8% until it reaches the future value of $587.

Notably, even if the intelligent cloud growth were to decline to 16.3%, the stock could still provide an annual return of around 16.3%. However, it’s crucial to consider that any decline in cloud revenue would likely be gradual, making these conservative estimates possibly too conservative. This underscores the essence of my thesis: Microsoft is, in my view, a “strong buy.”

Risks to Thesis

The first risk to consider regarding the thesis is the potential for a significant and catastrophic drop in cloud revenue. If cloud revenue were to plummet by more than 10%, such as by 20%, it could have serious implications. While unlikely, it’s essential to acknowledge that unexpected events can occur in the business world.

The second risk is associated with Microsoft’s willingness to engage in unprofitable ventures, such as re-entering the mobile phone market or attempting to become a mobile operator. These endeavors could result in Microsoft accumulating substantial debt, which might pose financial challenges.

The final risk worth mentioning is related to Microsoft’s “Productivity & Business Processes” segment. This segment includes Office 365, Teams, Exchange, LinkedIn, and more, and Microsoft has a strong foothold in this market due to the deep integration of its products, especially within the Office 365 ecosystem. However, there is a possibility that new alternatives could emerge. For example, if Apple were to create its own productivity ecosystem, it could pose near-term concerns. Apple’s strong capitalization and widespread use of its operating system make it a formidable competitor. Additionally, it’s crucial to note that the “Productivity & Intelligent Cloud” segment has exhibited robust revenue growth since 2018, at 15%, while the “More Personal Computing” segment has grown at a slower annual rate of 4.9%. This underscores the significance of the Productivity & Intelligent Cloud segments as Microsoft’s primary growth drivers.

In conclusion, while these risks are worth considering, they should not deter the overall thesis of Microsoft’s strong position and potential for growth. These potential risks should be monitored, but the company’s well-diversified portfolio and financial strength can help mitigate such challenges.

Conclusion

In conclusion, the analysis of Microsoft’s financial health and future prospects reveals a compelling investment case. The default scenario, based on an expected revenue growth rate of 10.48%, presents an opportunity for an 8.3% potential increase from the current stock price, with an annual return of 14.2%. The inclusion of Activision-Blizzard’s growth further bolsters the outlook, with a projected 29.8% upside and a potential annual return of 21.3%. Moreover, even in a conservative scenario with a reduced cloud growth rate of 16.3%, Microsoft still offers an appealing 13.4% upside and the potential for annual returns of up to 15.8%. These valuations underscore Microsoft’s financial strength, its capacity to adapt to different scenarios, and the resilience of its core business segments, particularly the “Productivity & Business Processes” and “Intelligent Cloud.”

However, it’s essential to recognize the potential risks in this investment thesis. A severe and unexpected plunge in cloud revenue, unprofitable adventures in mobile or debt accumulation, or emerging competition in the “Productivity & Business Processes” segment could pose challenges. Nevertheless, these risks should be monitored but not overshadow the overall strength of Microsoft’s diversified portfolio and financial resilience. In light of these considerations, Microsoft remains a compelling opportunity, poised for continued growth and dominance in the technology and cloud computing market.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.