Summary:

- Microsoft unveiled a lot of changes at their Ignite conference this week.

- The most major changes came for their AI and cloud platforms.

- Azure just got a lot better, more competitive, and potentially more profitable based on announcements made at Ignite.

- I am upgrading MSFT to a strong buy on the market’s unappreciation for these upgrades.

- MSFT remains competitive, and fared well through this conference, despite some disappointments.

Robert Way

Introduction

Microsoft Corp. (NASDAQ:MSFT) started its annual Ignite conference this week, where they had teased that exciting announcements about changes to their product line would be made. This would almost certainly also come with announcements about Microsoft’s AI products, something I have touted in the past as a strength for MSFT. I even went so far as to title that article, Microsoft is Going to Win the AI War.

So, I was very excited to see what they would reveal with their OpenAI partnership still in full swing, despite challenges from both sides to the relationship.

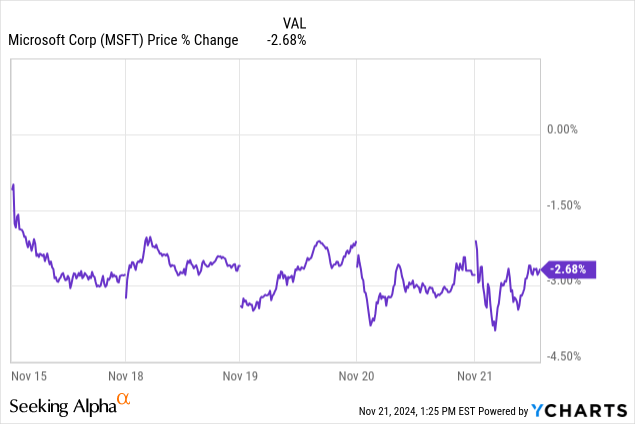

I left the first day disappointed. So did the market. The stock has been flat and down the last five days.

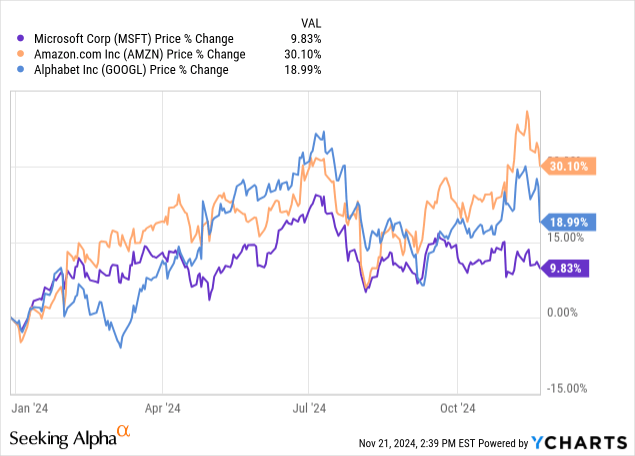

Along with this past week’s performance, MSFT has been lagging its cloud peers, Amazon and Google, YTD.

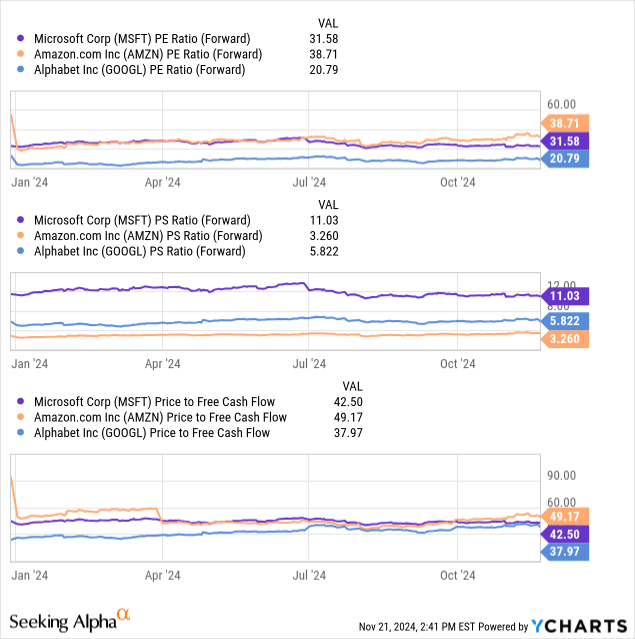

The valuations have roughly stayed the same over this year, with MSFT falling middle-of-the-pack.

At Ignite, there were two major announcements that got the largest reactions from me, CoPilot and Azure. Let’s talk about them.

CoPilot isn’t All That…

Satya Nadella, Microsoft’s CEO, started his keynote off with the line, “Today, I want to focus on AI as it drives growth in business.” He says that it is going to improve efficiency and operating leverage.

Immediately, this takes us to CoPilot, Microsoft’s new helper AI. It is supposed to be great at a lot of tasks that LLMs are, but specifically it is helpful for developers.

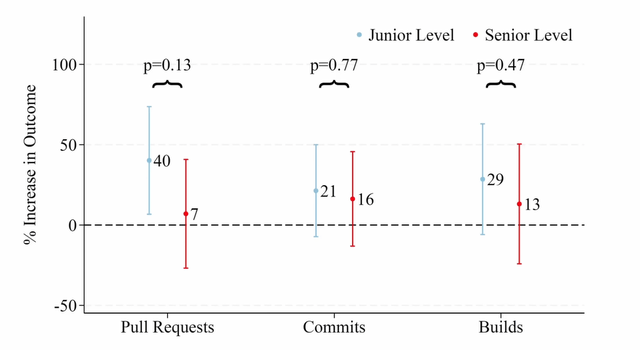

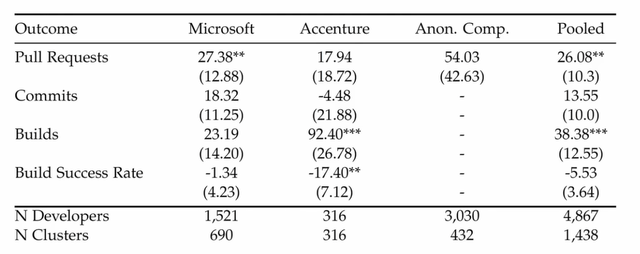

On the efficiency front, I am skeptical of this. I am skeptical of AI tools being truly more efficient than humans at software development. A study done with Microsoft employees using CoPilot showed a 26% increase in pull requests (lines of code ready to go into the main project), but really only among junior level devs, who saw a 40% increase in pull requests, while senior level devs saw a negligible change.

At both Microsoft and Accenture plc (ACN), devs saw a lowered build success rate, ACN by 17%! So while more lines of code were created, builds were not, on the whole, more successful. This means that the AI is introducing errors in its code creation that devs do not on their own.

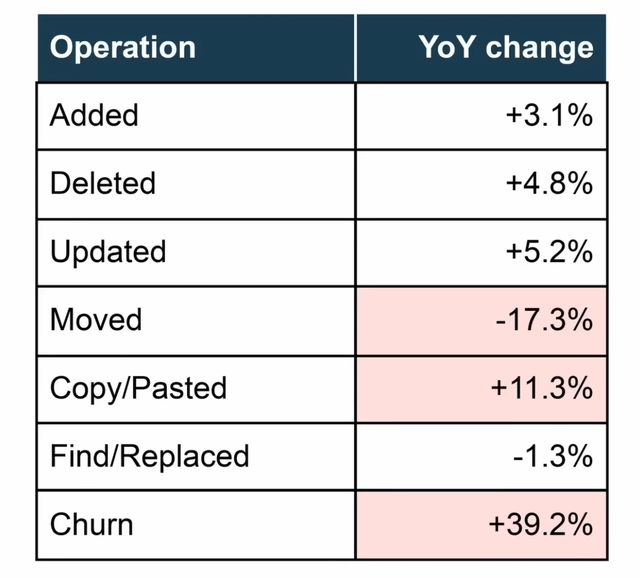

A study done by UpLevel last month following 800 devs using AI tools saw no gains in efficiency, but a 41% increase in bugs needing to be dealt with. we’ve also found that churn was also increased by a significant amount, far more than code added. We have seen a marked increase in copy+paste operations from devs while using AI tools, indicating that they are taking suggestions more often, at a higher rate than they were pulling from libraries before, despite the increase in debugging time.

The jury is out on AI coding tools, but the next thing that caught my eye about CoPilot changed my perspective.

…Until it Meets Azure

Then Nadella introduced AI Foundry, the CoPilot integration into the Azure cloud platform. AI analytics was something that Microsoft has been missing in its business tools suite, as its current analytics platform hasn’t had the same capabilities as competitors like Google Cloud Platform (although I don’t think Google makes good AI, I used Bard and Gemini extensively and disliked both). This is a huge game changer for Microsoft as it can now truly compete with some of its cloud-platform competitors like Snowflake Inc. (SNOW) and others which sold this kind of service to be run atop Microsoft Azure. Now, MSFT is looking to steal their business.

The SaaS version of Azure SQL DB is coming to Fabric now, allowing companies to streamline all of their Azure data into its built-in AI analytics tools. This allows for real-time integrations of data, something that Microsoft has previously not been able to offer.

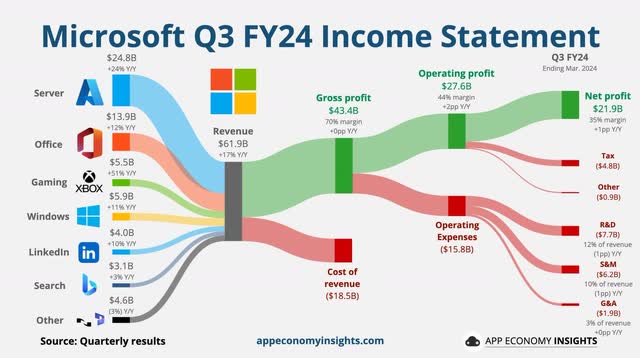

The reason this is such a big deal is that MSFT makes a massive chunk of its revenue from Azure; so much so that it’s not really worth mentioning the little Mac Mini-looking cloud PC they announced.

Azure and Office make up over half of MSFT’s revenue.

Azure Analytics could be a huge game changer for MSFT that I don’t think the market priced in correctly, because this came amid a slew of other announcements that were fairly disappointing, like the aforementioned tiny cloud PC, or the announcement of the Microsoft 365 app’s icon change to include a label with the name on it instead of just the abstract symbol.

This came alongside the announcement of an in-house DPU, or a data processing accelerator chip. These DPUs will be helpful in processing the Azure analytics workloads and makes them competitive in a way that no other company is right now, if the chips work as MSFT claims that they will.

They will hopefully work very well, because they will have to keep up with the next big change, NVIDIA’s (NVDA) Blackwell AI chips being added to Azure servers. This isn’t a game-changer, but it does signal MSFT’s willingness to pay up for the best-of-the-best hardware, something that has not always been true.

They also expanded on Azure with a new local platform, which will expand their customer base to include companies that want offline/intranet solutions for their cloud needs; until now, they weren’t able to use Azure. This change is good because it opens up MSFT’s TAM farther, but it’s unclear by how much.

This analytics announcements (and subsequent Azure announcements) is why I am giving MSFT an upgrade to a strong buy, something I rarely do. I believe in their ability to capitalize on the need for cloud infrastructure and AI analytics, something I do believe AI is fairly good at, and is useful for businesses. We’ve seen this with the success of rival cloud SaaS companies, who thrive on the analytics business. MSFT is butting into this, and setting themselves up to be the best cloud provider for an all-in-one solution.

Suitability & Risks

I recommend that equity investors consider adding MSFT up to 5% of an aggressive equities portfolio, or 2% in a conservative equities portfolio.

It is important to note that there are still risks to MSFT’s business, such as:

- NVDA’s ability to sell the same architecture to Google and Amazon, making it not unique in its AI architecture offerings.

- It is uncertain is DPUs will add enough to convince or sway any customers.

- The market doesn’t seem to appreciate the Azure updates as much as I do, and could continue to undersell MSFT.

- MSFT is still undergoing data sovereignty issues with the EU, which could hamper their abilities to sell the analytics platform in Europe.

- Microsoft is not alone in developing in-house chips, with Amazon and Google also having developed in-house hardware.

- Dedicated analytics companies like SNOW can still respond and start offering services that may take MSFT longer to compete with due to their massive size, which causes them to move slower on many things like changing software.

Conclusion

Ultimately, I am giving Microsoft Corp. (MSFT) a strong buy on the market’s underpricing of its new analytics platform and associated upgrades like dedicated DPUs, NVIDIA’s Blackwell architecture, and CoPilot integration. I expect revenue from Azure to increase beyond the market expectation, as it takes customers not previously available to them via Azure Local and Analytics, stealing not just from Google and Amazon but cloud SaaS providers as well.

Microsoft is a behemoth in the tech world for good reason, but there still may be room to grow based on its dominance in cloud computing. Margins are very high, and the platform continues to grow and become more and more encompassing of business operations, cutting out competitors.

Thanks for reading.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MSFT, GOOGL either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.