Summary:

- Microsoft could shrewdly turn its weakness into strength against Google in the generative AI-driven search wars: minuscule market share.

- The third-party commercial integrations will prove to be a game-changer, creating a new uphill battle for Microsoft.

- The generative AI-driven transformation of Bing supports the bull case for Microsoft stock.

jewhyte

The rise of ChatGPT is transforming the Search industry at a rapid pace. The evolution of search into chat-based conversations is allowing these tech companies to grasp users’ intent in unimaginable ways. Though new opportunities invite new problems, as both Microsoft (NASDAQ:MSFT) and Google (GOOG) grapple with re-imagining the advertising process for the era of generative AI. Google is much more desperate than Microsoft in designing new ad solutions, given how heavily reliant it is on advertising revenue, which Microsoft can use to its advantage. The generative AI-driven transformation of Bing supports the bull case for Microsoft stock.

Commercial search queries offer the most lucrative opportunities for advertising revenue, as users express their intent to buy a good/service. While the shift towards chat-based searches enables search giants to understand what people are seeking in a more comprehensive manner, it also complicates the advertising process.

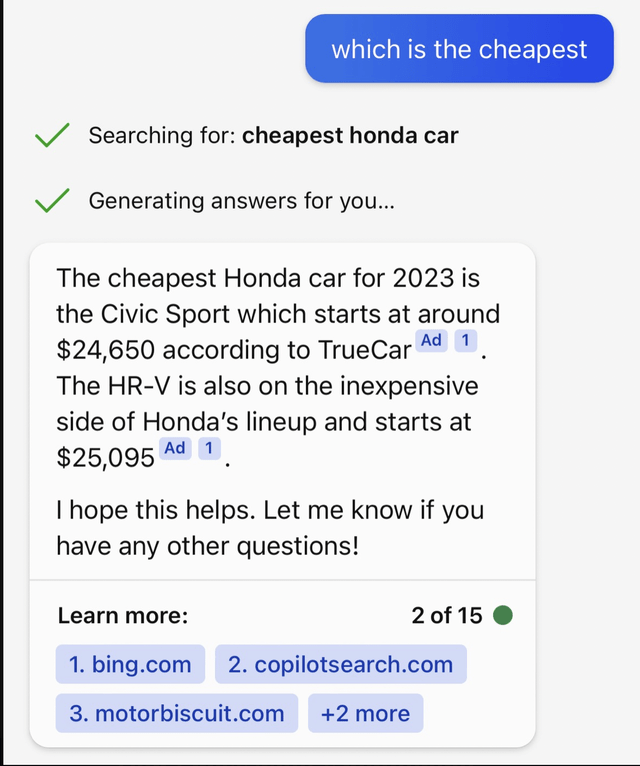

In March, we got a glimpse into how Microsoft is experimenting with ads in Bing Chat through a tweet:

In response to the shopping query above, it is unclear whether the results were actually based on the cheapest cars available across Bing-listed websites, or simply based on the highest-bidder for such keywords, meaning there could actually be cheaper cars available than claimed by the chat response. The traditional auction-bidding advertising system is likely to compromise chat responses to commercial queries, hindering users from completely trusting the answers given.

On the other hand, if the chatbot is programmed to prioritize factuality over the highest-bidding advertisers, in the interest of winning users’ trust and engagement with the platform, Microsoft’s Bing Chat may indeed be forced prioritize results from the website with the most relevant and useful commercial content related to the query, even if that website is a lower bidder/ non-bidder in advertising auctions, distorting the advertising business.

Microsoft faces less risk than Google

Amid the revolutionary transformation of the Search industry, Microsoft has a paradoxical edge over Google. As of May 2023, Google holds 93.11% of the worldwide search engine market, while Microsoft’s Bing holds a mere 2.77%, according to statcounter (though note that the data provider may not have incorporated queries from the new chat-based services of these tech giants, given the absence of ChatGPT from the data).

As a result, Microsoft is considerably less dependent on search ad revenue than Google. In 2022, advertising made up 79% of Google’s total revenue, with ‘Google Search & other’ contributing 57% to company-wide revenue, according to company filings. Comparatively, only 6% of Microsoft’s total revenue came from advertising over the same period, which includes both Bing and LinkedIn.

Consequently, Google is forced to tread a lot more cautiously in rolling out new generative AI-powered search features, as they threaten to cannibalize its own core search advertising revenue without effective monetization strategies in place.

On the Q1 2023 earnings call, Google CEO Sundar Pichai mentioned:

We have launched Bard as a complementary product to search. But we will be bringing LLM experiences more natively into search as well. I do think, first of all, on – we will be rolling it out in an incremental way so that we can test it, create and innovate. So I think we will approach it that way.

Such a revolutionary shift in search will require search engine operators to re-imagine the advertising approach, which could indeed incur multiple iterations. Hence, Google will want to avoid hastily introducing new features it is not ready to effectively monetize yet, as search advertising revenue is the bread and butter of its business.

Microsoft, on the other hand, can afford to roll out generative AI features faster, even if it means fewer traditional Bing-searches, without a magnified impact on total revenue. In fact, knowing the risks that the fast-paced generative AI revolution poses to Google’s core business, it could indeed encourage Microsoft to roll out new features faster, to intensify the pressure on its biggest rival.

On Microsoft’s last earnings call, when an analyst asked about the outlook for profitability on a company-wide basis, CEO Satya Nadella and CFO Amy Hood responded with an emphasis on taking market share in all the markets it competes in:

Amy Hood

…It’s probably a good opportunity to explain a bit about how I think about where we are, which is — if you look at all of the businesses we’re in and we look about our competitiveness in those businesses. And this is before Satya started to comment a bit about our relative performance versus absolute. And I’ll tell you that the energy and focus we put right now is on relative performance and share gains.

… it is, in fact, how we think about long-term success, in being well positioned in big markets, taking share in those markets, committing to make sure we’re going to lead this wave, staying focused on gross margin improvements where we can.

Satya Nadella

Yeah. I mean, just to add to it, during these periods of transition, the way I think as shareholders, you may want to look at is what’s the opportunity set ahead. We have a differentiated play to go after that opportunity set, which we believe we have. Both the opportunity set in terms of TAM is bigger, and our differentiation at the very start of a cycle, we feel we have a good lead and we have differentiated offerings up and down the stack.

And so therefore, that’s the sort of approach we’re going to take, which is how do we maximize the return of that starting position for you all as shareholders long term. That’s sort of where we look at it. And we’ll manage the P&L carefully driving operating leverage in a disciplined way but not being shy of investing where we need to invest in order to grab the long-term opportunity. And so obviously, we will see share gains first, usage first, then GM, then OPInc, right, like a classic P&L flow. But we feel good about our position.

Given the executives’ focus on market share gains first, they are definitely willing to make the required investments to enhance the competitiveness of Bing, regardless of near-term impact on profitability, and will also not shy away from bringing new products to market swiftly.

In fact, CEO Satya Nadella proclaimed on the call that:

Search and news advertising revenue ex TAC increased 10% and 13% in constant currency, including 2 points from the Xandr acquisition. Results were driven by higher search volume with share gains again this quarter for our Edge browser globally and Bing in the U.S.

After years of lagging Google in the AI race, Microsoft’s incorporation of generative AI into Bing allows the software giant to better attract traffic towards its platform. In order to sustain interest in Bing, Microsoft will need to move aggressively with further generative AI advancements.

Generative AI innovation advancing aggressively

In March 2023, Microsoft introduced the Bing Image Creator, powered by OpenAI’s DALL-E technology, a text-to-image generator. CEO Satya Nadella proclaimed the popularity of this new feature on the last earnings call, just one month after its launch:

Over 200 million images have been created to date and we see that when people use these new AI features their engagement with Bing and Edge goes up.

Google has not yet incorporated such a feature into Bard, though it intends to introduce similar technology soon, by integrating with Adobe’s Firefly, which will challenge Microsoft’s ability to sustain engagement with Bing/Edge.

Offering the capability to generate images through iterative text prompts offers insights into users’ interests, specific preferences and current activities, even better than text-generating AI technology. This opens the door to more advanced targeted advertising. Commercially-driven inspirational searches, whereby consumers seek to better visualize what they intend to buy (e.g. descriptions of apparel, living room interior, etc.), can help better match consumers with real products/ services that match their preferences.

Microsoft and Google will soon also be introducing the ability to search using images in chat-based searches, which is already possible in their traditional search engines, and something that will further enhance their abilities to grasp users’ commercial intentions.

That being said, the dilemma over whether to show the most relevant products/services or those of the highest auction-bidders still remains. Nonetheless, these innovations significantly advance the tech giants’ abilities to serve commercial queries.

Microsoft still fights an uphill battle as a new race emerges

Both Microsoft and Google have recently announced third-party plugins with major companies, to facilitate seamless commerce through Bing and Bard.

Microsoft Bing has announced upcoming plugins for companies including “Expedia, Instacart, Kayak, Klarna, Redfin, TripAdvisor, and Zillow”. While Google Bard will be offering integrations with “Spotify, Walmart, Redfin, Uber Eats, TripAdvisor and ZipRecruiter”.

For example, users will be able to ask Bing Chat for dinner suggestions, ask it to list the ingredients needed, and turn it into a shopping list to be ordered from a grocery retailer through Instacart.

As plugins like these grow, Bing and Bard will become powerful platforms with extensive commercial ecosystems built around them. This creates a new race of having as many commercial integrations as possible, possibly even striving for exclusivity and first-mover advantages wherever possible, in order to keep users entangled within their ecosystem.

Moreover, as users utilize these plugins to engage in all sorts of commercial activities, chat histories and user preferences will be saved on the platform, which will allow the software giants to serve these consumers more efficiently the next time, and can also feed into targeted advertising efforts. Therefore, Google and Microsoft will want to ensure that users initiate various forms of commercial activities through their chat-based platform first, as it improves the chances of that user coming back to repeat that activity, given that the platform is already acquainted with their preferences, enabling an increasingly seamless commerce process overtime.

Therefore, it will only be getting tougher for Microsoft to challenge Google’s dominance, given that Google is far ahead in enabling commerce activities through its platform, and already offers various services that consumers are habitually use. Remember, Google owns an immensely popular mobile operating system, Android, which held a market share of 71.44% in Q1 2023, trouncing Microsoft’s 0.02% market share through Windows Phone.

Google already pre-installs its own apps onto mobile devices running on the Android OS, and will likely continue to place their apps and services more prominently over those of its competitors. Given that commerce activities increasingly initiate over mobile devices, Google may be better positioned than Microsoft to keep consumers knotted into its expansive commercial ecosystem in the era of generative AI. Thanks to the popularity of apps like Google Pay and Google Maps, Google already holds vast amounts of data on its consumers, which it can leverage to offer seamless commerce experiences and targeted advertising, thereby steepening the uphill battle for Microsoft.

Is Microsoft stock a buy?

The revolutionary shift in the search industry will inevitably require commensurate changes in advertising strategies, which will likely go through multiple iterations. Given that Microsoft is much less dependent on advertising revenue than Google, it could indeed use this to its advantage by rolling out generative AI-powered features more aggressively.

That being said, the introduction of third-party plugins into Bing and Bard creates a new race to build commercial ecosystems around their respective platforms, and Google is already strongly positioned to win at this new growing opportunity.

Nevertheless, Microsoft’s tight-knit partnership with OpenAI has finally allowed the software giant to compete more effectively with Google’s AI leadership and Search dominance. Microsoft is showing promising signs of driving increased engagement with Bing through continuous generative AI advancements, better positioning it to take market share, subsequent to higher advertising revenue. Therefore, the generative AI-driven transformation of Bing supports the bull case for Microsoft stock. Nexus Research rates Microsoft a ‘buy’.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in MSFT over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.