Summary:

- Microsoft stock gains have only kept pace with market averages since November, despite the excitement surrounding Copilot Search and OpenAI ChatGPT.

- The company’s valuation has become ever more extreme, making it the most expensive since late 2021’s top, if not the Dotcom technology boom peak of 2000-01.

- There is a risk of significant share price downside if operating realities fail to meet lofty expectations or inflation/interest rates rise unexpectedly.

- Upside trading momentum appears to be fading fast.

dem10

I last wrote an article on Microsoft (NASDAQ:MSFT), the largest U.S. company by equity market capitalization, in October here. I moved from a Hold/Neutral rating to a Sell, based on expectations shares would start to underperform the market. Luckily for bulls and owners, the Big Tech AI bubble has gotten even larger since October, carrying MSFT even higher in price.

The +30% total return in headline nominal terms since my last effort has been extraordinary, no doubt. However, the S&P 500 is up about +26% and the Big Tech heavy NASDAQ 100 index has jumped +29%. Basically, all of the Copilot Search, OpenAI ChatGPT excitement has only been able to keep Microsoft’s share gains at a market average clip.

Microsoft Edge Browser – Copilot Window, April 6th, 2024

The remaining problem is MSFT’s valuation has gotten ever more extreme, especially since interest rates have not moved down much and are currently at risk of rising as inflation potentially turns higher into the summer.

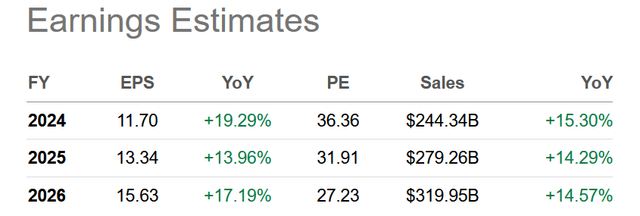

So, my investment view has not really changed. I remain on the Sell side of the argument, with valuations the most expensive since the original Dotcom technology boom peak of 2000-01. The bad news: if interest rates rise unexpectedly, pushing the global economy into recession, current Wall Street estimates of decent business growth could prove exceptionally rosy.

Seeking Alpha Table – Microsoft, Analyst Consensus Estimates for 2024-26, Made April 5th, 2024

In terms of consequences, assuming operating realities fail to inspire and actually disappoint vs. expectations, -40% to as much as -60% in price downside is now part of the investment setup, just to get financial ratio valuations back to 10-year normal ranges.

My summary view is nothing can go wrong with the current goldilocks economic scenario or hyped-up management execution. For me, based on 37 years of trading experience, the risk part of the equation far outweighs the opportunity for small share gains during 2024-25. Let me explain.

Overvaluation Setup

Buying into a fully-valued to overvalued equity carries unusual downside possibilities. An investor’s goal buying a blue-chip or growth stock is to acquire a stake when prices are low and not fairly representing future business progress. Clearly, that is not the position Microsoft finds itself for new investment today.

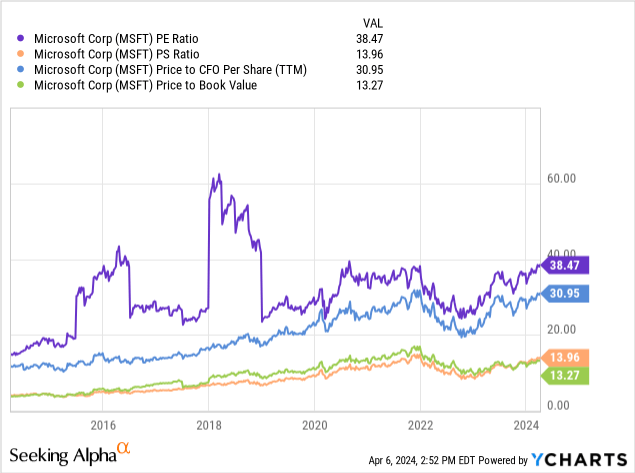

On a combination of price to trailing earnings (38x), sales (14x), cash flow (31x), and book value (13x), Microsoft has only been more overvalued about 5% of the time over the last 10 years (specifically in late 2021).

YCharts – Microsoft, Price to Trailing Fundamentals, 10 Years

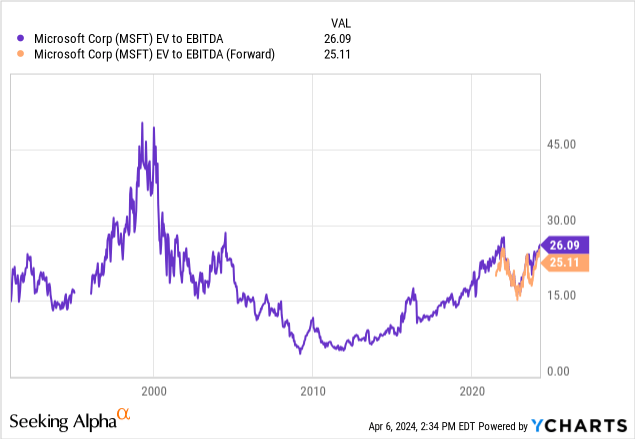

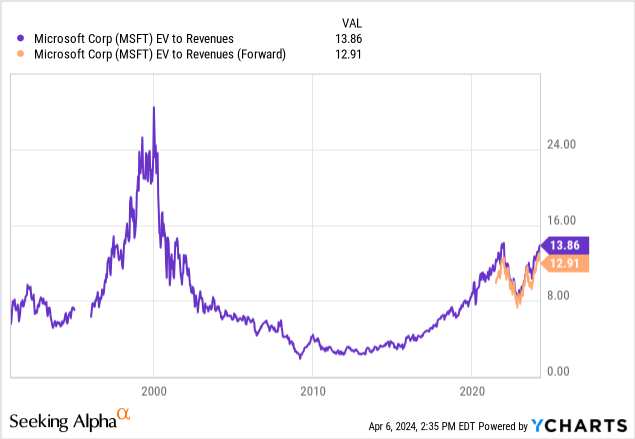

Enterprise valuations back to 1990 also highlight an extended (ahead of itself) price similar to the end of 2021, only surpassed by the Dotcom period of 1998-2001, a period when company growth rates were much stronger.

Even on forward estimated core cash EBITDA (25x) or sales (13x), Microsoft today is fully owned and loved by hedge funds and the masses alike. So, outsized investment gains appear to be rather unlikely statistically speaking, especially on a record $3.2 trillion in enterprise value (equity + debt – cash) base, which makes growth compounding difficult (law of large numbers).

In terms of the opposite side of the coin, nobody wanted to own MSFT during 2010-13, when I was writing bullish articles on its “undervaluation” setup. Since my 2013 bull article here, shares have outlined a total return of +1,300% vs. the equivalent S&P 500 gain of +196%!

YCharts – Microsoft, EV to EBITDA, Since 1990 YCharts – Microsoft, EV to Revenues, Since 1990

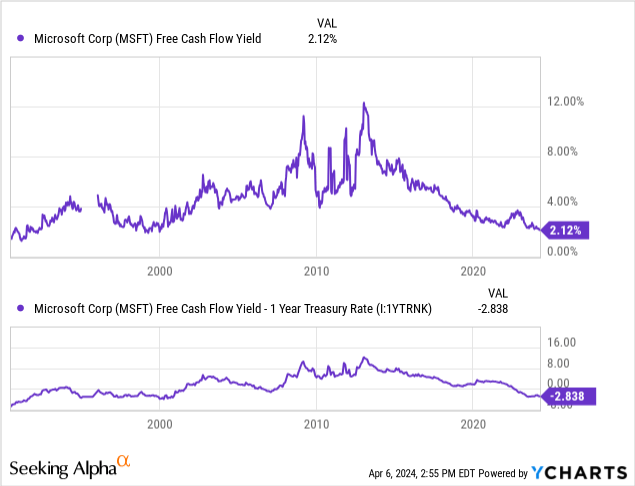

What’s more, the free cash flow yield of 2.12% today is woefully inadequate vs. risk-free 1-year Treasury rates approaching 5%. At a projected 15% growth rate, it would take 6.5 years to get the MSFT investment FCF yield to match the risk-free cash rate available now. Yet, equity ownership includes the risk of substantial price loss given rising interest rates or a recession in software/cloud demand. You have to go all the way back to the 2000-01 bubble peak to find a similar overvaluation setup, with a negative relative FCF yield vs. prevailing cash yields of -2.84%.

YCharts – Microsoft Free Cash Flow Yield vs. 1-Year Treasury Rates, Since 1990

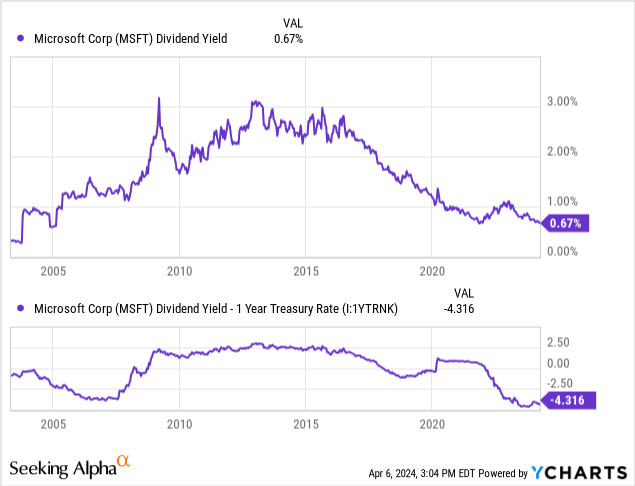

In addition, the cash distribution yield available from Microsoft of 0.67% is the worst relative setup to 1-year Treasury securities (-4.31%) since the company began paying a dividend in 2003. So, it’s hard to make an argument for ownership to the income crowd.

YCharts – Microsoft Dividend Yield vs. 1-Year Treasury Rates, Since 2003

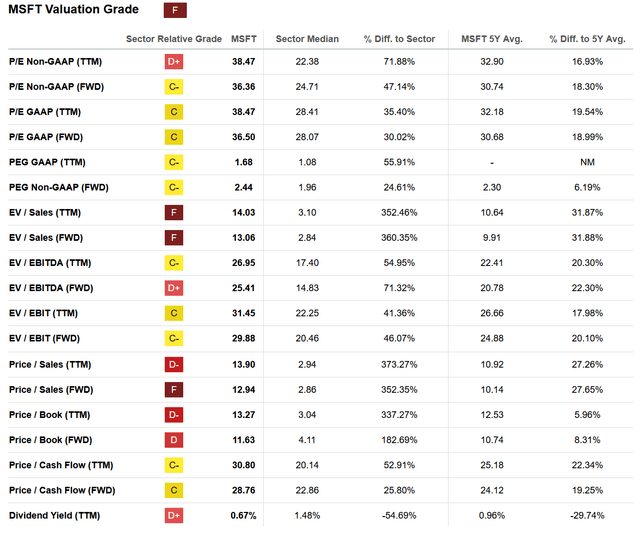

Don’t believe my take on Microsoft? Well, Seeking Alpha’s computer ranking formula puts a Quant Valuation Grade of “F” on MSFT. Below is a table comparing various financial ratios and investment yields to industry peers today and MSFT’s 5-year trading history.

Seeking Alpha Table – Microsoft, Quant Valuation Grade on April 5th, 2024

Rising Inflation & Interest Rates

Just like late 2021 or the end of the Dotcom technology bubble, rising inflation interest rates called into question the high valuation of shares. Honestly, when interest rates are providing a winning proposition for investors vs. stocks in terms of upfront yield, while holding far less price risk, the odds of a major stock market decline increase materially. And, high interest rates almost always lead to weaker economic growth and recessions, although this cycle is taking a while to roll over from all the COVID money creation during 2020-21.

This double whammy of falling valuation multiples on weaker-than-expected forward business results is the explanation for both bubble and regular economic cycle pricing peaks on Wall Street. I doubt 2024 will prove any different.

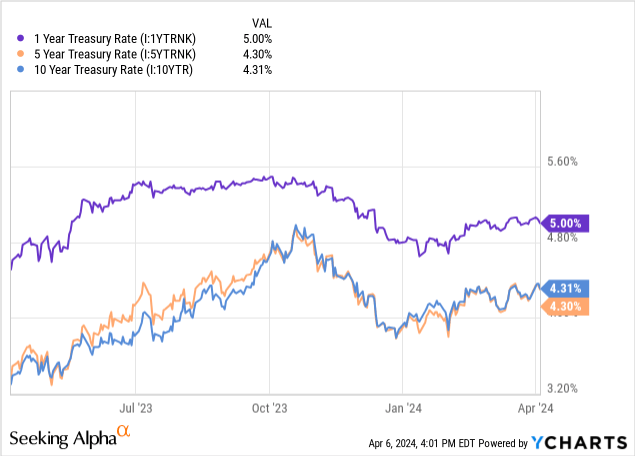

In the end, if inflation turns higher again with commodities, and foreigners really begin to question America’s $34 trillion in Treasury obligations, free-market trading and Fed policy may actually surprise with higher interest rates by early summer. What I am saying is that, the Wall Street expectation a few months ago trending near 100% for a June Fed rate cut, could prove incorrect. In fact, this view could be turned upside down, which could spark a mass exodus from U.S. equities, including the most valuable company by market cap, Microsoft. Already, Treasury yields have been rising off their December-January bottoms.

YCharts – Treasury Yields Daily, Various Maturities, 1 Year

There’s been plenty of evidence popping up since March that inflation rates are turning higher. Friday’s (April 5th) strong U.S. employment numbers is still being processed this weekend by shocked investors. The unexpected uptick in inflation reports for two months running in America cannot completely be explained away. Spiking crude oil during 2024 (+20% from January 1st) could pull headline inflation rates higher no matter the direction of the economy (with stagflation potential). Analysts and economists may not fully understand the implications of an upturn in many core food commodities since the middle of 2023. Most worrying, a leap in gold/silver quotes since March (gold at all-time highs, silver at multi-year highs) is screaming a turn for the worse in the inflation outlook could be at hand.

My concern is that additional inflationary hits are coming this year. Expanding war in the Middle East or Eastern Europe could send crude oil well above US$100 a barrel, supply chain headaches from any new trade friction with an increasingly combative China could easily erupt, climate change could create droughts and grain shortages, foreign Treasury owners could begin to exit our bond market and cause an oversized dollar decline (remember 40% of all goods bought/sold in America have an import/export component requiring a stable home currency), and a host of other black swan events might be lurking. Each could play a significant negative role in controlling inflation rates already beginning to zigzag higher.

Final Thoughts

In conclusion, Microsoft’s current 2.0x to 2.5x PEG ratio (price to earnings growth divided by growth rate) setup is far from a bargain. 39x trailing 2023 and 35x immediate-future 2024 earnings on 15% projected underlying business growth rates are not good enough to own shares, in my view, particularly given MSFT’s raw size.

Today’s growth valuation is double to triple the PEG ratio level of 11-12 years ago. A smarter investment idea was to buy Microsoft in 2013, when the P/E was 12x and growth rates of 15% to 20% annually were about to become the new normal. At that point, PEG ratios were underneath the sought after and bullish 1.0x target number on Wall Street.

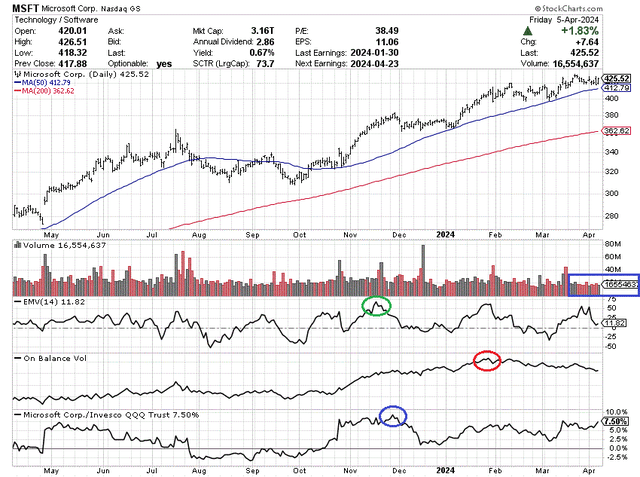

Technical trading momentum in MSFT shares is also hinting a price peak that is closer than Wall Street thinks. On the 12-month chart below, I have boxed in blue the low-volume trading reality of the latest three weeks. Blue chips tend to top in price when buying interest tails off (after everyone has already committed to buying shares). You have to go back to January 2020 to find a similar stretch of fading buying interest, just weeks before the COVID pandemic selloff.

Also noteworthy, the 14-day Ease of Movement reading has weakened in buy intensity since November (circled in green). On Balance Volume numbers reached a zenith in January (circled in red). And, relative price strength measured against the Invesco NASDAQ 100 ETF (QQQ) has been in decline for over four months (circled in blue). So, upside momentum could be in the process of reversing soon.

StockCharts.com – Microsoft, 12 Months of Daily Price & Volume Changes, Author Reference Points

How could Microsoft continue higher in price from today? My view is a goldilocks scenario of robust economic growth (supporting improving operating results at the economy) alongside FALLING inflation and interest rates are the recipe for rising stock quotes. If you are firmly in the camp expecting a soft-landing with optimistic inflation outcomes, mostly because that’s what we hear from experts on CNBC or read in the WSJ in early 2024, I suppose you can buy shares. Please understand, you are taking on extraordinary capital risk.

If you have large investment gains you don’t want taxed, selling might not be the best course of action. Perhaps you can instead sell covered call options or buy puts to protect your MSFT profits.

However, for most investors, looking at the world with a bit of common sense, selling shares in an IRA/401(k) or avoiding Microsoft altogether until lower prices appear may be the proper course of action today.

I continue to rate shares a Sell. Just to get to normalized 10-year valuations on price to earnings, sales, cash flow, book value, EV to EBITDA, and EV to sales, MSFT would need to fall -40% to -60% in price. And, that’s assuming the company continues to grow by 10% to 15% annualized over the next 12-18 months.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.