Summary:

- I think Netflix, in the event of an acquisition, would likely be included in some sort of super subscription where the customer gets Microsoft’s Game Pass and Netflix’s videos.

- Such a merger has enormous synergy effects. Currently, Netflix uses Amazon Web Services as its cloud platform.

- I think in the long term, it’s all about AI and feeding these systems with as much data as possible, including biometric data, from as many people as possible.

- Maybe a Netflix acquisition is a backup plan for Microsoft if the Activision acquisition fails.

MrIncredible/iStock Editorial via Getty Images

Thesis

There is a new rumor on the acquisition horizon. Although the takeover of Activision (ATVI) by Microsoft (NASDAQ:MSFT) hasn’t even been completed yet, there are already rumors about the next target, and it’s supposed to be an even bigger fish: Netflix (NFLX). I want to discuss where the rumor comes from and how it could fit into Microsoft’s strategy.

Microsoft is all-in on gaming

Our oldest currently supported software franchise is in fact our game Microsoft Flight Simulator, which we released three years before the first version of Windows, even. Gaming is fundamentally aligned and woven into our mission as a company. When you talk about Xbox’s mission to bring the joy and community of gaming to everyone on the planet, which I absolutely love, this is precisely what I think of when we think about Microsoft’s mission, which is to empower every person, every organization on the planet to achieve more.

That Microsoft is fully committed to games are not my words, but come from Microsoft CEO Satya Nadella in 2021. He justifies this historically and also with Microsoft’s recent successes. After all, Microsoft is already one of the very few manufacturers of game consoles and already offers a subscription model with Xbox Game Pass. They are already the leader in cloud computing and dominate the PC market with Windows. I recently switched to Windows 11 and was initially a bit annoyed by the intrusiveness of the references to the Xbox Game Pass since I don’t own an Xbox. But this shows that it plays a significant role in Microsoft’s long-term plans.

In addition, Google (GOOG) (GOOGL) has only recently withdrawn from this market, which came as quite a surprise, and in my opinion, came too quickly. Google Stadia was a decent product, but they needed to communicate the advantages more. I never saw any serious advertising for it, and many casual gamers and those I spoke to had never heard of Google Stadia.

So while Google is withdrawing from this market, Microsoft is going all in. At the same time, they offer HoloLens VR goggles and supply the US military with goggles for testing. Even though the first tests apparently did not go well, it is only a matter of time before the technology improves.

Overall, you can already get a pretty good idea of how everything could work together. Microsoft has consoles, the computer operating system, the largest cloud, and VR glasses. And who knows what else is being worked on in secret at this very moment. Another point is that games, especially with VR glasses in the future, will be another enormous source of data about users. And a data source with speedy feedback for artificial intelligence.

Yuval Noah Harari talked about this in his excellent book “Homo Deus: A Brief History of Tomorrow.” Artificial intelligence combined with the biological data of a human being would create incredible possibilities. The AI could play just the right song to cheer us up when we are sad. Or create just the right character in a game to make us laugh. And the AI would get feedback from millions of people quickly and daily.

I imagine that in the future, every player will get his own game tailored to him in real time. This could be possible if data such as heart rate, the width of the pupils, etc., flow into the game creation. An AI would then adapt the dialogues of the non-player characters, the game world, and the objects to the respective player in real time. With access to biometric data, the AI would get feedback on what the changes it causes a trigger in the player. And over time would get better and better at giving the player a pleasant experience. If you get scared quickly but don’t want to be scared, your game will be funnier. If you want more action and rough language, you’ll get that.

In fact, one of the things we have learned from all of the work you all have done is in some sense, it starts after the game is launched because you want to be able to experiment, learn through analytics, and continuously change gameplay. And one of the things I’m most excited about is how we are enabling game developers to do just that with Azure PlayFab, which now holds more than 2.5 billion player accounts. It’s being used as the backend for more than 5,000 games, so a lot of exciting things that the cloud can enable.

How does Netflix fit in?

I have read the rumors about a takeover this week on various platforms, but they probably originated on Reuters. The article refers to a long list of acquisitions that Microsoft has already completed under Satya Nadella.

The two companies are already closely aligned. Netflix chose Microsoft as its advertising partner for a new advertising-supported subscription service. Microsoft President Brad Smith also sits on the Netflix board.

Netflix recently expanded into gaming, so it’s coming from streaming and expanding where Microsoft is already strong. At the same time, Microsoft comes from the gaming space and may want to expand it. An acquisition of Netflix would make Microsoft an entertainment giant and unrivaled in terms of the broadness of its offering. Amazon (AMZN) has Prime Videos and Twitch, but Twitch is not a gaming platform. Alphabet has YouTube and had Stadia but does not want to continue with them.

In the event of an acquisition, Netflix would likely be included in some super Subscription where the customer gets Microsoft’s Game Pass and Netflix’s videos. Therefore, Microsoft could also actively refer to the Game Pass directly on Netflix and achieve synergy. Netflix already has hundreds of millions of customers, and Microsoft could use this data for better game recommendations. If you only watch comedies on Netflix, you probably won’t play horror games. Or conversely, those who only play action games probably won’t watch romance movies.

Such a merger also offers enormous synergy opportunities. Currently, Netflix uses Amazon Web Services as its cloud platform. This means that a switch to Microsoft would result in significant potential savings. According to cloudzero, hosting costs $1B annually. So it could be a merger from which both profit. Netflix’s gaming offer has been sparse and is rarely used. In addition, Netflix is slowly reaching its growth limits and getting more competition simultaneously. This was one of the reasons why I wrote a bearish article about Netflix recently.

Microsoft would get the opportunity to offer a super subscription and probably manage to get many Netflix users to start gaming. But I think the long-term goal is to own and collect as much data as possible from as many people as possible to develop their AI ambitions. I can also imagine a push on the part of Microsoft to connect the VR glasses with Netflix. Microsoft could try to get biometric data of the users to learn which scenes in the movie make the consumer laugh or cry. This would result in an unbelievable data pool. For example, movie producers would know exactly which scene didn’t appeal to viewers at all, or which ones they found particularly funny.

Takeover costs

Netflix currently has an enterprise value of $149B. So an acquisition could easily cost $200B. That would be a lot, even for Microsoft, especially if the Activision acquisition is approved. But if it doesn’t get approved, they have over $100B cash in the bank and more money coming in every quarter ($16.7B last quarter). Even a $200B acquisition would be possible with these monstrous earnings in my opinion. We’ll see. Maybe a Netflix acquisition is a backup plan for Microsoft if the Activision acquisition fails. Possibly they would like to take over both but could wait a while longer with Netflix. Of course, whether this would be approved is another question. From today’s perspective, however, I do not believe this would create a monopoly-like position. Microsoft has competition in gaming, Netflix has competition in streaming, and I think both together would not create a monopoly.

Microsoft’s Valuation

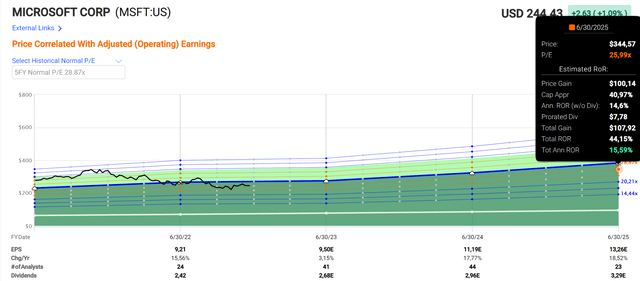

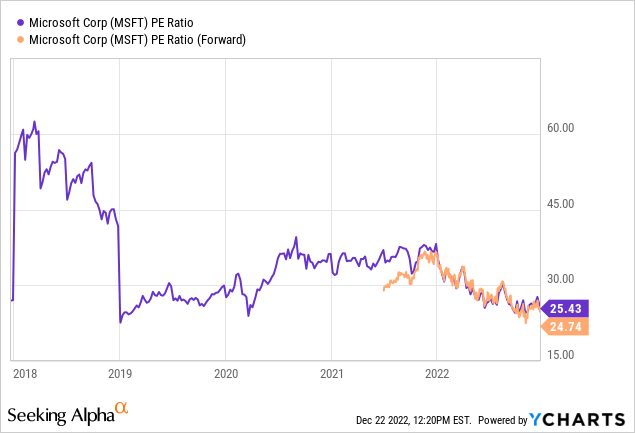

Microsoft has been trading at higher P/E ratios than the average market multiple for years. In calculating future returns, it plays a significant role whether this will still be the case in the future. I assume so because Microsoft is one of the world’s safest companies due to a lot of cash, immense profitability, a strong moat, and strong growth prospects in several areas. From a P/E perspective, Microsoft is trading at around 25, one of the lowest levels in the last five years.

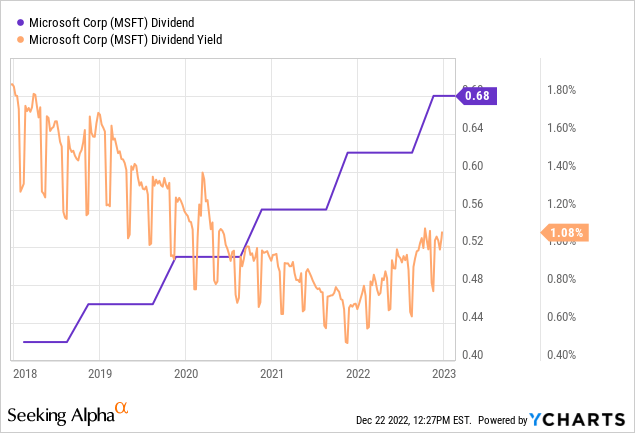

The dividend yield is still relatively low at the moment, even in a 5-year comparison, but at least it has been raised steadily for 18 years and by 10% p.a. in the last five years.

According to Fastgraphs, a solid double-digit return is possible until mid-2025 if the stock is still trading at a P/E ratio of 25. The long-term average is 28. However, this is significantly more expensive than the market average, and if the stock trades lower, for example at a P/E ratio of 20, only an annualized return of 5% would be expected.

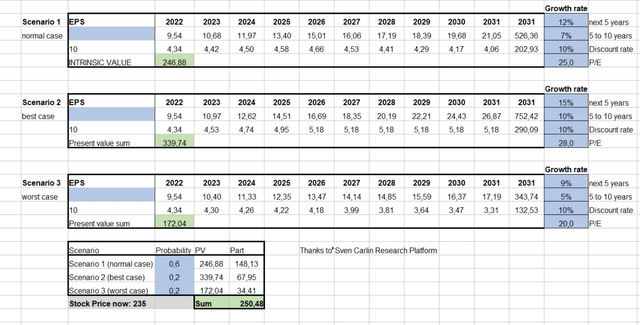

I have created a detailed analysis with three different scenarios to determine the current fair value with a discounted cash flow model. The normal scenario is indicated as the most probable variant. Of course, one has to estimate the growth figures roughly. But the growth figures of scenario 1 (normal case) are already lower than the growth figures of the last year and the analysts’ estimates for the next two years. Furthermore, I put the growth numbers for all three scenarios not as far apart as for other companies. Another distinction between the three scenarios are different future P/E assumptions. According to this estimate, the stock is trading slightly below its fair value ($250 according to this calculation).

Risks

The attempt of such a huge takeover would trigger numerous discussions that might not all end positively for Microsoft. After all, there have already been voices from politicians in the past that criticize the market power of big tech companies.

Potential antitrust concerns could arise if Microsoft acquires Netflix due to its already dominant position in the streaming media market. Microsoft could potentially use the acquisition to create a monopoly in the streaming media market, giving them an unfair advantage over other streaming media companies. Additionally, Microsoft could use the acquisition to gain access to Netflix’s extensive library of content, which could be used to create an unfair competitive advantage.

Although I consider Microsoft to be one of the safest companies overall, there are numerous other risks that can hardly be listed due to the size of the company. These risks include competition from other software companies such as Google and Apple (AAPL), the potential for technological disruption, and the risk of cyber-attacks. Microsoft is also facing legal and regulatory scrutiny, with potential antitrust violations, penalties, and increased pressure from governments to comply with privacy and data protection regulations. Additionally, Microsoft’s reliance on third-party hardware and software vendors to continue innovating and maintaining its products and services can also be a source of risk.

Conclusion

When I read the article from Reuters, I thought this didn’t make sense. But it started to make sense when you combine Microsoft’s various businesses with Netflix’s potential. And when you include long-term AI learning opportunities and the general goal of feeding an AI with as much data as possible, it makes even more sense as far as I’m concerned. So in this article, I took the Reuters report as a basis and brainstormed my thoughts. What will come out of this? We will see. Either way, I’m bullish on Microsoft in the short and long term and remain bearish on Netflix in the short term.

And when I think about our new platform, Microsoft Mesh, which enables you to interact holographically with other people with a true presence in a very natural way, one of the most exciting applications, I think, will be gaming. Niantic, for example, showed a great demo of Pokémon Go using Mesh at our recent event. We’re very excited about what creators can do going forward with the platform shifts that we are going to have in the next 10 years.

Disclosure: I/we have a beneficial long position in the shares of MSFT either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.