Summary:

- Microsoft Corporation has comfortably surpassed the $3 trillion market cap threshold previously held by Apple, highlighting market optimism on its AI prospects and sustained growth.

- Recent outperformance reinforces its outlook for gaining share within expanding AI opportunities, which also bolsters Microsoft’s unmatched streak of long-term double-digit growth and margin expansion at scale.

- Two key tailwinds ahead include shifting dynamics in AI infrastructure demand driven by scaled deployment, alongside returning cyclical tailwinds from post-optimization trends.

David Becker

Microsoft Corporation (NASDAQ:MSFT) has kicked off calendar 2024 by surpassing mega-cap peer Apple Inc.’s (AAPL) market cap for the first time since November 2021. The development continues to underscore market optimism on Microsoft’s AI prospects, which have been accretive to its sustained trajectory of growth and earnings margin expansion. And the company’s in line Fiscal Q2 results, alongside the solid outlook current period AI monetization continues to reinforce confidence.

Despite the slight post-earnings slip, we believe in line results across the productivity and business processes and more personal computing segments (including Activision Blizzard integration), and outperformance in Intelligent Cloud, reinforce Microsoft’s longer-term growth story, particularly in AI. The results also reinforce durability in the stock’s current market cap premium in the $3+ trillion territory. The figure represents a milestone that makes Microsoft the second publicly traded company, after Apple, to ever surpass the eye-watering threshold – and with greater fundamental support, too, in our opinion.

In addition to maintaining its moat across mission-critical technology verticals (e.g., cloud-based productivity software, AI, cloud computing, etc.), Microsoft has also demonstrated strong execution in preserving profitable growth at scale. Looking ahead, we see two themes that Microsoft will likely outperform its peers in capitalizing on in 2024: 1) an improved spending environment on peaked optimization trends in 2023; and 2) the gradual transition from training to inference in generative AI developments.

Admittedly, the stock has become expensive at current levels on both a relative and intrinsic basis. But the fact that Microsoft continues to present as an attractive risk-on/risk-off opportunity, underpinned by sustained double-digit growth and margin expansion at scale despite its massive market share, could be a boon to its multiple expansion prospects. Taken together, we believe Microsoft remains a defensive name, with its favorable outlook reinforced by early-stage adoption of accretive AI features recently introduced to its product portfolio.

Optimization Has Peaked

Based on repeated industry commentary on stabilizing optimization trends in recent quarters, we believe the restraints on IT spending officially peaked in calendar 2023. The newly reduced baseline after a year of pullback reinforces prospects for a gradual return to growth in the year ahead. However, we are still cautious about the prospects of a full rebound in tech this year, given ongoing macroeconomic uncertainties and volatile dynamics pertaining to AI adoption and related spending.

The combination remains a particular tailwind for Microsoft, nonetheless, given its diverse product coverage across mission-critical technology verticals spanning cloud, productivity software, and AI. This is already corroborated by likely continued Office 365 seat count expansion exiting calendar 2023 given strong commercial growth, following F1Q24’s 10% gain, despite weak industry job posting trends in recent years. Meanwhile, stabilizing growth in Azure in F2Q also builds on slowed deceleration (ex-AI contributions) observed in the quarter prior.

The PBP segment is likely to experience the strongest recovery out of other Microsoft businesses in calendar 2024. With expectations that IT spending optimization trends have peaked, Microsoft’s SaaS-oriented PBP business is likely to benefit through both ARPU and seat expansion.

ARPU Expansion

As mentioned earlier, recovering Office 365 seat count expansion is further complemented by ARPU gains that are expected to continue through the year. In addition to robust demand for mission-critical add-ons, such as E5 and Teams Premium, accelerated Copilot penetration represents an incremental reinforcement to ARPU expansion.

The recent expansion of Copilot availability alongside sustained double-digit growth in Office commercial products in F2Q is consistent with recent management optimism on continued mass market generative AI adoption. Specifically, management had recently equated momentum for Copilot with “the lines outside shops to purchase Windows 95 software nearly three decades ago.” It also reinforces Microsoft’s prospects ahead of a stabilizing IT spending environment as optimization trends normalize. AI integration has also been viewed by the industry as a key efficiency gainer, which reinforces Copilot’s appeal.

And ARPU expansion is expected to be reinforced by Microsoft’s recent extension of Copilot availability to consumer end-markets and small- and medium-sized businesses. Specifically, the company has removed the 300-subscription minimum for Copilot, currently priced at +$30 user/month for enterprise users, which effectively improves accessibility to small and medium-sized businesses, or SMBs. SMBs represent a substantial opportunity for Microsoft. The company has recently disclosed that there are “11 million SMBs that now rely on Microsoft 365 solutions.” Full Copilot monetization of this cohort could add another $4 billion to annual PBP revenues, on top of baseline Microsoft 365 subscription fees.

Microsoft has also introduced “Copilot Pro,” which is the equivalent AI-enabled assistant for Office 365 tailored for consumer end-markets. Currently priced at +$20 user/month, Copilot Pro resembles OpenAI’s ChatGPT Plus functionality, which had a blockbuster debut. Specifically, ChatGPT Plus, which is tailored for consumer end-markets and also priced at $20 per user per month, had to briefly suspend sign-ups in November due to “overwhelming demand.” If there is one takeaway from initial interest observed in ChatGPT Plus subscriptions, it is the substantial pent-up consumer demand for paid advanced generative AI solutions.

This represents strong prospects for Copilot Pro uptake. In addition to built-in generative AI functions within Office 365 apps – such as data summarization, content creation, and conversational inquiries – Copilot Pro also extends DALL-E 3 access for image creation. With Office 365 representing a critical productivity tool in the consumer segment’s day-to-day setting, Copilot Pro integration shows potential as a superior alternative to off-app extensions such as ChatGPT Plus. By enabling greater convenience and accessibility for the consumer end-market to enhanced generative AI solutions, Copilot Pro represents an accretive factor to ARPU expansion for Microsoft.

Paid Seat Expansion

Ensuing ARPU tailwinds are expected to be reinforced by continued seat count expansion in the current year, given stabilizing job postings in the industry. Specifically, job cuts observed in the tech industry, which Microsoft has an inherently high exposure to, have slowed substantially in recent months. Recent industry checks show that software job postings were down -11% in 2023, improving from -63% observed in 2022 when boardrooms were coping with overexpansion during the pandemic era. Improvements were particularly evident in 2H23, as companies started shifting personnel budgets to high productivity roles (e.g., engineers) in favor of restoring growth in 2024.

This accordingly reinforces Microsoft’s prospects in maintaining sustained double-digit growth in its PBP segment. Specifically, PBP growth in recent years has tempered as a result of ongoing macroeconomic uncertainties. The aggressive workforce reductions observed across the enterprise spending segment amid tightening financial conditions have essentially led to a consistent battle between churn and ARPU expansion. But with the emergence of stabilizing job posting trends ahead, the development essentially lifts a substantial pressure point off of PBP growth ahead. This is expected to complement ARPU tailwinds stemming from the introduction of add-ons and upgrades, such as E5 and Copilot, in driving sustained double-digit growth in the PBP segment.

The Transition from Training to Inference

Management commentary indicates that generative AI contributions remain a key driver of Azure’s reacceleration in recent quarters. This is also consistent with the Intelligent Cloud unit’s F2Q revenue outperformance by 2% compared to the top range of management’s previous guidance.

We’ve moved from talking about AI to applying AI at scale…By infusing AI across every layer of our tech stack, we’re winning new customers and helping drive new benefits and productivity gains across every sector.

Source: Microsoft F2Q24 Earnings Release.

We believe much of AI service demand experienced at Azure so far continues to stem from training needs. The advent of AI and the subsequent surge of interest has essentially dialed up urgency across all industries to integrate the nascent technology into their operations. While some are developing their own proprietary large language models, or LLMs, from the ground up, most have been leveraging existing APIs and SDKs to access pre-trained models for further customization. This has been the key driver of LLM-as-a-service platforms such as Azure OpenAI Service, which provides developers with access to popular LLMs such as OpenAI’s GPT-4. Azure AI Studio, which is currently in public preview, is another common tool for building generative AI applications with existing foundational models. And this “building” process has accelerated compute capacity demand for training purposes over the past year.

Looking ahead, we expect the deployment and scaled usage of said generative AI solutions and apps to increase inference-driven compute capacity demand. Specifically, inference refers to the process of running generative AI solutions/software already deployed, such as generating output on your day-to-day ChatGPT queries. And over the longer term, inferencing is expected to become the key driver of AI workload volumes, as new projects started in 2023 enter deployment and scaled usage across end markets. Industry currently forecasts inferencing activity to represent “2x the number of cycles and spend as training by mid-2025.”

2024 will be about starting to move some of these [AI workloads] into production and then gradually scaling them up. Training activity [is estimated to] contribute [less than] 500 bps to overall cloud growth while inferencing, where most spend should eventually be, will be slower to ramp but compound quickly over the next few years and could hit 2x the number of cycles and spend as training by mid-2025.

Source: Deutsche Bank Research.

As generative AI solutions become more pervasively used, the inference is expected to accelerate demand for compute power. Admittedly, Microsoft Azure has been a key beneficiary in the nascent surge of interest in generative AI. In addition to accelerated demand for foundation LLMs to support enterprise customers’ needs, Azure has also been a key facilitator of training needs for said AI workloads. Yet, in our opinion, the company is even better positioned for sustained market share gains in the transition to inferencing. This is the piece that we believe will preserve Azure’s continued share gains within the increasingly competitive hyperscaler market, and further narrow its gap from industry leader Amazon Web Services, or AWS, Amazon.com, Inc. (AMZN).

Specifically, Azure remains the leading provider of cloud computing services based on “H100 virtual machines” – or supercomputers that run on NVIDIA Corporation’s (NVDA) highest performing H100 accelerators. Specifically, Microsoft’s next-generation “NCads H100 v5 Series” virtual machine is optimized for both AI training and inferencing. This essentially paves the way for Microsoft to capitalizing the next phase of opportunities as AI app deployments start to scale. The H100 virtual machines also complement the preceding generation that we had discussed in previous coverage, which had “[strung] together tens of thousands of Nvidia’s A100 graphics cards” to enable scalability.

However, the availability of Nvidia’s H100 accelerators remains extremely constrained. And a similar trend is expected for the chipmaker’s upcoming introduction of the next-generation H200 chips. This makes Microsoft’s recent in-house development of proprietary silicon – the Cobalt 100 CPU and Maia 100 accelerator – a critical reinforcement to its longer-term moat in cloud computing and AI services. Specifically, the Arm Holdings plc (ARM) based Cobalt 100 CPUs are optimized for general-purpose compute workloads. The proprietary alternative is capable of 40% faster performance than Arm-based machines used by Azure today. Meanwhile, the Maia 100 accelerators are optimized for AI workloads.

The next-generation in-house developed AI chips, based on the 5nm process node, will make a competitive alternative to virtual machines running on Nvidia accelerators. The combination of Cobalt 100 CPUs and Maia 100 accelerators will be key to diversifying and expanding Azure’s GPU capacity. It also takes a page from rivals AWS and, to a lesser extent, Alphabet Inc.’s (GOOG, GOOGL) Google Cloud, which has been offering in-house silicon-based instances for years. Recall that much of Azure’s GPU capacity is currently used for facility internal inferencing workloads (e.g., Copilot, Bing Chat, ChatGPT, etc.). By complementing capacity expansion with instances based on in-house developed alternatives, Microsoft improves GPU availability for facilitating longer-term demand stemming from the steepening ramp of inference workloads.

In addition to improved GPU capacity to facilitate the anticipated acceleration of inferencing-led compute demand, the company has also continued to scale complementary services like “Azure Arc.” We view this as a key product in reinforcing Microsoft’s market share gains in longer-term AI service demand alongside expanded GPU capacity. Specifically, Azure Arc is a recently introduced solution that enables accessibility and convenience by streamlining customers’ ability in “running apps across different cloud environments.” It also facilitates the increase of multi-cloud adoption across enterprise customers as cloud spend optimization trends persist.

Fundamental Considerations

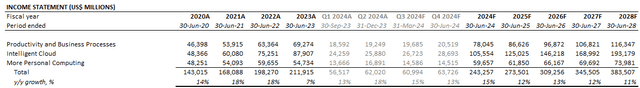

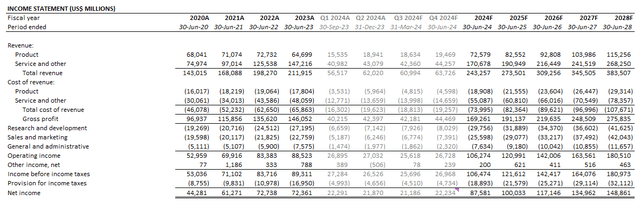

Adjusting our fundamental forecast for Microsoft’s actual fiscal Q2 performance, and the anticipated ramp of AI-related monetization opportunities ahead in its core businesses, we expect total revenue to grow 15% y/y in fiscal 2024 to $243.3 billion.

The Intelligent Cloud and PBP segments are expected to remain core mix contributors and growth drivers, underpinned by the continued monetization of AI opportunities. Over the longer term, Intelligent Cloud is expected to be the dominant driver of growth. Specifically, ongoing GPU capacity expansion, and ramping adjacent AI services to scale will be key components for Azure in capturing incremental AI-enabled cloud opportunities, especially given compounding inferencing workloads. The continued ramp of integrated generative AI solutions in Microsoft’s productivity software slate will also be accretive to expanded monetization of its expansive subscriber base. This will be a key reinforcement to sustained long-term double-digit growth for the PBP segment, despite its large market share size by volume.

On MPC, the segment is expected to benefit from a stabilizing PC market ahead, which will be accretive to the reduced baseline in prior year Windows OEM sales. The recent integration of Activision Blizzard will also continue to drive a lapping benefit for the gaming business. The combination is also expected to complement resilient Xbox content and services sales (F1Q: +13% y/y; F2Q: +61% y/y including 55-point M&A contribution), while partially offsetting continued moderation in underlying Xbox hardware sales.

On the cost front, we expect continued margin expansion, ex-Activision integration costs, in the underlying business. Although management continues to anticipate an incremental quarterly cost headwind driven by Activision-related integration activities through fiscal 2024, ongoing scale of AI-related deployments will be key to enabling organic margin expansion. This is already corroborated by the relatively flat operating margin in F2Q from the previous quarter as management had guided, despite incremental Activision-related integration costs, and elevated spending pertaining to generative AI investments.

Microsoft_-_Forecast_Financial_Information.pdf.

Valuation Considerations

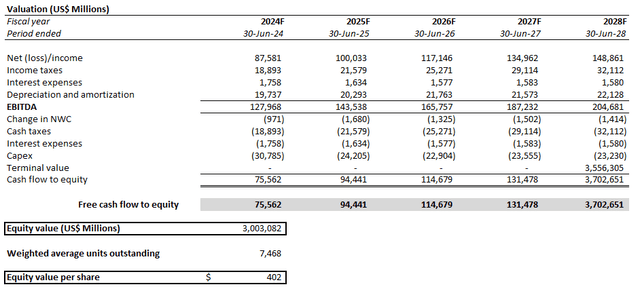

We are setting our base case price for Microsoft at $402 apiece. This reflects confidence in Microsoft’s staying power above the highly coveted $3 trillion market cap threshold within the near term. Admittedly, the stock has already benefitted from substantial margin expansion over the past year, driven primarily by market’s optimism on its AI prospects. Yet the durability of this AI premium continues to be reinforced by consistent positive progress in monetizing AI opportunities in recent quarters. And our expectation for longer-term capitalization of inferencing opportunities stemming from wider-scale deployment of generative AI solutions at Microsoft and across the broader industry will likely underpin further upside potential. This accordingly reinforces a “buy the dip” or “accumulative on weakness” narrative for Microsoft, given limited risks of structural impact to its sustained double-digit growth trajectory at scale.

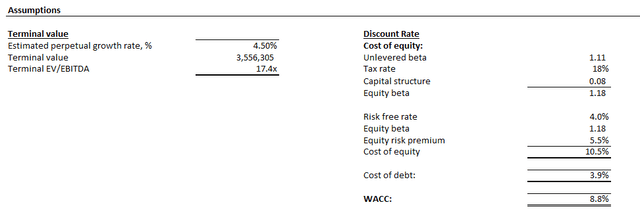

Our price target is derived using the discounted cash flow, or DCF, approach. The analysis considers cash flow projections taken in conjunction with the fundamental forecast discussed in the earlier section. A WACC of 9% is applied to reflect Microsoft’s risk profile and capital structure. Our analysis also assumes an estimated perpetual growth rate of 4.5% for Microsoft. This represents a valuation premium to peers, and exceeds the anticipated pace of longer-term economic growth in Microsoft’s core operating regions.

However, we believe the stock warrants the incremental premium, given Microsoft’s track record of sustained double-digit growth and margin expansion at scale despite its expansive market share size. The company also remains one of the first to have formed a moat in capitalizing on emerging AI opportunities that remain in the early stages. And Microsoft’s AI moat is reinforced by a diversified product slate, in our opinion. This would enable optimized capitalization on AI opportunities across infrastructure (e.g., GPU capacity), LLM-as-a-service (e.g., Azure OpenAI Service) and other end-user applications (e.g., Copilot), which effectively sustains Microsoft’s historical pace of double-digit growth through the long-run.

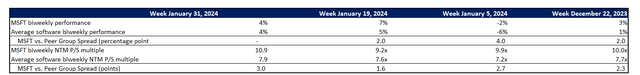

The premium valuation assumption applied is also consistent to Microsoft’s continued outperformance to peers. Market volatility has been the key theme in recent months due to mixed economic data and subsequent uncertainties to Fed policy. Yet Microsoft has consistently maintained a premium on average relative to the broader software peer group’s mean performance since December.

Final Thoughts

Admittedly, Microsoft’s current valuation premium to peers makes it an expensive stock on a relative basis. Yet on an intrinsic basis, its underlying operations continue to demonstrate resistance to the tepid demand environment in the broader technology sector.

Specifically, ongoing macroeconomic uncertainties have remained a gating factor to prospects of a full recovery in the software and cloud computing demand environment. Despite post-optimization trends and incremental AI tailwinds, management’s persistent commentary for stabilizing growth in Azure underscores conservatism to the impending rebound. However, we view this as a prudently de-risked outlook that leaves room for upside surprises ahead, as Microsoft continues to ramp its AI deployments across all operating segments.

In Intelligent Cloud, the anticipated acceleration in AI deployments across the broader industry is expected to reinforce demand for Azure computing capacity given incremental inferencing workloads. Meanwhile, continued scale of Copilot deployments will enable further monetization of the expansive Microsoft 365 subscriber base. Additional penetration into SMB and consumer end-markets will also reinforce ARPU expansion in the PBP segment, which is critical to offsetting gradual seat-count expansion in the aftermath of optimization. The impending PC upgrade cycle that follows pandemic era purchases, especially in the commercial setting, alongside the emergence of AI PCs is expected to bolster Windows OEM reacceleration as well.

Taken together, 2024 represents a year of execution of Microsoft. And the underlying business’ latest outperformance reinforces confidence in its ability to consistently deliver on positive progress that will underpin the stock’s $3+ trillion valuation with durability.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Thank you for reading my analysis. If you are interested in interacting with me directly, exclusive research content and ideas, and tools designed for growth investing, please take a moment to review my Marketplace service Livy Investment Research. Our service’s key offerings include:

- A subscription to our weekly tech and market news recap

- Full access to research coverage, exclusive ideas and complementary financial models

- Monitored and regularly updated price alerts for our coverage

- A compilation of complementary tools such as growth-focused industry primers and peer comps

Feel free to check it out risk-free through the two-week free trial. I hope to see you there!