Summary:

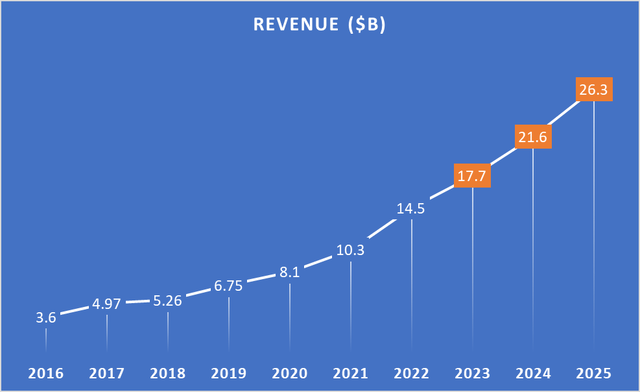

- LinkedIn standalone revenue in Microsoft suites of business will be close to $25B by 2025.

- Deep integration of LinkedIn Premium solution with Dynamic 365 will redefine social marketing.

- The integration of LinkedIn into Microsoft’s ecosystem enhances productivity, collaboration, and professional development.

- LinkedIn’s revenue surpassed $15 billion for the first time in Q4 FY23.

hapabapa

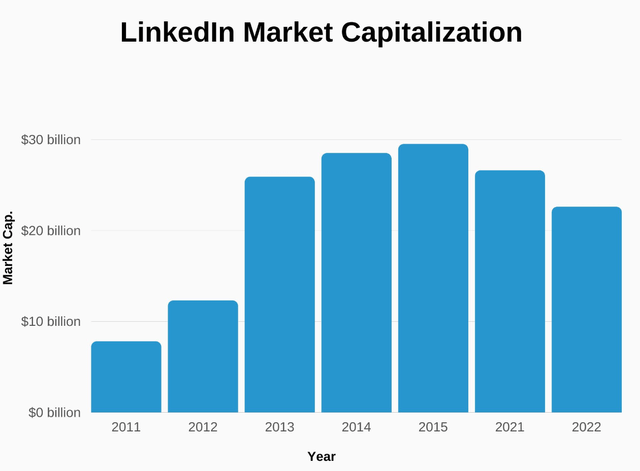

Around four years back, I wrote an article on LinkedIn and how it’s expected to play out for Microsoft (NASDAQ:MSFT) in long run. I argued that LinkedIn will generate ~10B revenue in 2022. LinkedIn generated over ~14B revenue in 2022 surpassing my expectation by 40%. Considering LinkedIn’s recent growth, I am more optimistic now in its long term story and how it can generate over $25B revenue by 2025.

In 2016, Microsoft made a bold move by acquiring LinkedIn, the world’s leading professional networking platform, for a staggering $26.2 billion. Initially met with speculation, this strategic investment has evolved into a transformative endeavor that is poised to yield significant benefits for Microsoft. As the digital landscape continues to evolve, the integration of LinkedIn into Microsoft’s ecosystem is shaping up to be a visionary move that goes beyond traditional expectations. In this article, I delve into the reasons why LinkedIn is proving to be a bet that will pay off better than expected for Microsoft.

LinkedIn stands uniquely as a platform where individuals are willing to invest approximately $40 per month for premium features—a contrast to other platforms like Facebook and Twitter. The appeal of LinkedIn’s value prompted Microsoft’s substantial $26 billion investment. A notable observation arises when analyzing Microsoft’s earnings reports and accompanying commentary: a recurring tendency to offer limited insights into LinkedIn’s performance, encompassing revenue generation, profitability across product segments, and recent enhancements undertaken by LinkedIn’s management to refine the platform.

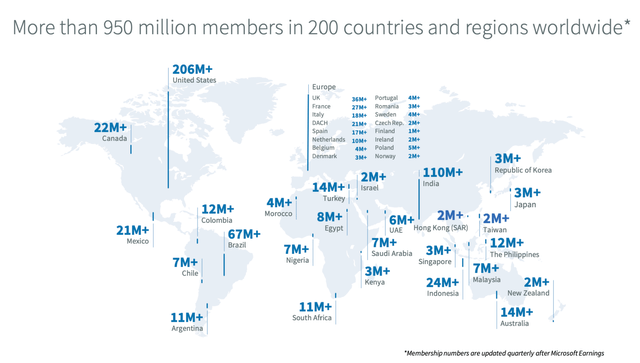

Let’s review some LinkedIn official statistics:

- LinkedIn has approx. 950M members in 200 countries

- More than 75% of LinkedIn users are from outside the US

- LinkedIn now has over 63M+ listed companies with 20M+ people open for work

- 61M people uses LinkedIn for job search every week with 117 job application every second

LinkedIn official website

How these numbers are translating into business outcome:

- LinkedIn’s revenue surpassed $15 billion for the first time in Q4 FY23

- 5% Year-over-year growth in revenue (7% in constant currency) in Q4 FY23

- LinkedIn Talent Solutions surpassed $7 billion in revenue for the first time over the past 12 months in Q4 FY23

- 8th Consecutive quarter of accelerating member growth in Q4 FY23

Why LinkedIn matters to Microsoft:

LinkedIn holds significant strategic importance for Microsoft for several compelling reasons:

Diversification of Revenue Streams: LinkedIn’s various business segments, including Talent Solutions, Marketing Solutions, Learning Solutions, and Premium Subscriptions, provide Microsoft with a diversified revenue stream. This diversification reduces reliance on any single product or service and enhances Microsoft’s overall financial stability.

Professional Networking and Collaboration: LinkedIn’s integration into Microsoft’s ecosystem enhances the value of Microsoft’s productivity tools, such as Microsoft 365. Professionals can seamlessly connect their LinkedIn profiles, making it easier to network, collaborate, and share insights within their professional and personal spheres.

Data Insights and Personalization: LinkedIn’s vast user base contributes to Microsoft’s data insights capabilities. The data collected from LinkedIn users helps Microsoft refine its products and services, enabling more personalized and targeted experiences for users across various platforms.

Global Reach and Influence: LinkedIn’s international user base spans more than 200 countries and territories, making it an ideal platform for Microsoft to extend its global reach and influence. This is especially valuable as Microsoft aims to expand its cloud services and other offerings to diverse markets.

Enterprise Solutions: The integration of LinkedIn enhances Microsoft’s enterprise offerings. The combination of LinkedIn’s professional networking capabilities with Microsoft’s cloud services, such as Azure and Dynamics 365, creates a powerful suite of tools for businesses seeking comprehensive solutions for productivity, customer relationship management, and more.

Learning and Professional Development: LinkedIn Learning, formerly Lynda.com, offers a platform for individuals and organizations to access online courses and tutorials. This aligns with Microsoft’s commitment to continuous learning and professional development, which is increasingly essential in today’s rapidly evolving digital landscape.

Innovation and Future-Proofing: The integration of LinkedIn positions Microsoft at the forefront of the future of work. As remote work, digital collaboration, and professional networking continue to evolve, Microsoft is well-prepared to provide tools and platforms that meet the changing needs of professionals and businesses.

Long-Term Value Creation: LinkedIn’s integration allows Microsoft to cultivate long-term relationships with users, fostering loyalty and engagement. This not only contributes to immediate revenue streams but also positions Microsoft for sustained growth and value creation over time.

Synergistic Integration: Microsoft’s foresight in integrating LinkedIn into its suite of products has unlocked unparalleled synergies. By weaving LinkedIn’s professional networking capabilities into Microsoft’s productivity tools and cloud services, users can seamlessly tap into a unified ecosystem that enhances both their professional and personal endeavors.

How LinkedIn fits into Microsoft overall business segments:

Productivity and Business Processes: This segment includes Office products, LinkedIn, and Dynamics business solutions. While LinkedIn is a significant part of this segment, Office products (like Microsoft Office 365) have historically been the major revenue driver within this category.

Intelligent Cloud: This segment includes server products and cloud services, such as Azure. Azure has been a substantial growth driver for Microsoft’s cloud services, contributing significantly to the Intelligent Cloud segment’s revenue.

More Personal Computing: This segment includes Windows, Surface, Xbox, and search advertising. LinkedIn’s revenue is likely smaller compared to some of the other segments within More Personal Computing.

LinkedIn’s revenue, while noteworthy, may not be as substantial as some of Microsoft’s core segments like Office and Azure. However, it’s important to consider that LinkedIn’s value extends beyond direct revenue contribution. Its integration into Microsoft’s ecosystem enhances other segments, such as Dynamics and Office, by providing data insights, networking capabilities, and learning opportunities.

LinkedIn is Microsoft’s milking cow for Data:

Unlike the land, oil, machines – data(content) is everywhere it can move with the speed of light and can easily be copied/mined to cater different needs. In thrust of capturing the quality content(data) where does LinkedIn platform stands now?

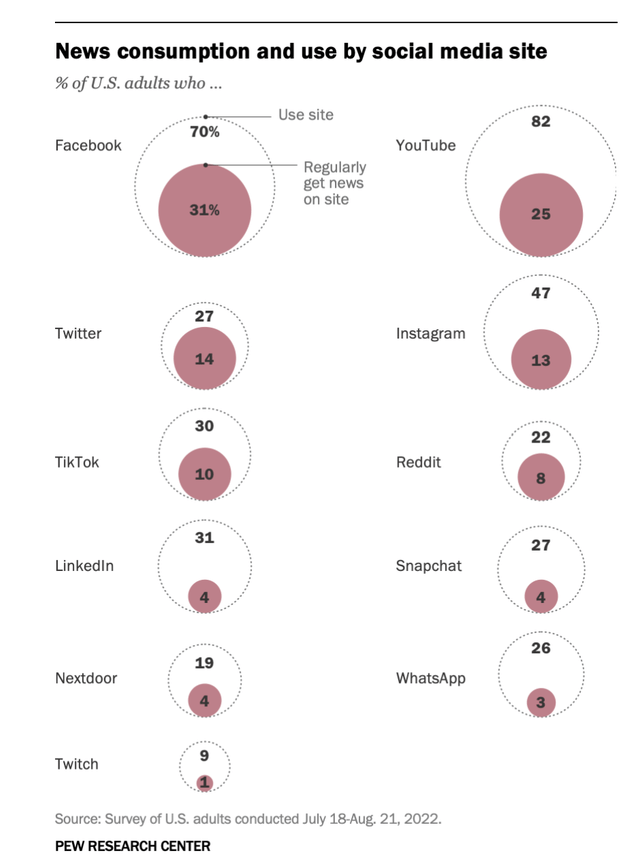

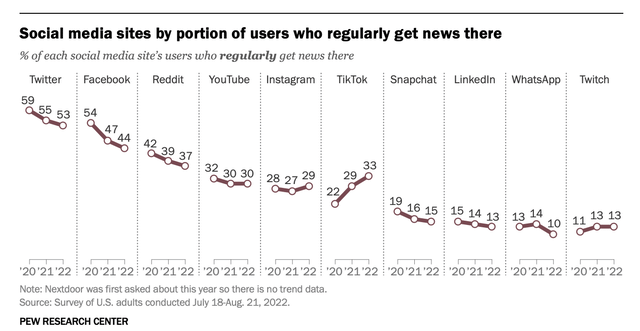

While its content volume is small in comparison to Facebook and Twitter, both in terms of overall users and monthly activity, LinkedIn boasts a distinct advantage in revenue generation per user. This is attributed to LinkedIn’s ownership of a premium audience; a notable 49% of its users earn an annual income exceeding $75,000. The propensity of LinkedIn users to invest in premium services at a higher cost significantly surpasses that of other major social media platforms.

When it comes to where Americans regularly get news on social media, Roughly a third of U.S. adults (31%) uses LinkedIn for news.

Pew Research Center

Pew Research Center

LinkedIn Revenue Streams:

LinkedIn operates across several business segments, contributing to its overall revenue. LinkedIn’s main business segments:

Talent Solutions: This segment primarily includes products and services related to recruitment and hiring. LinkedIn offers tools for companies to find and attract talent, post job listings, and engage with potential candidates.

Marketing Solutions: LinkedIn’s marketing solutions segment involves advertising and marketing services for businesses targeting LinkedIn’s professional audience. This includes sponsored content, sponsored InMail, and display advertising.

Learning Solutions (LinkedIn Learning): LinkedIn Learning (formerly known as Lynda.com) provides a platform for online learning and professional development. It offers a vast library of courses and tutorials on various topics to help users enhance their skills and knowledge.

Premium Subscriptions: LinkedIn offers premium subscription plans that provide enhanced features for individual users. These plans are designed to help professionals network, find job opportunities, and gain insights into their professional profile’s performance.

Sales Solutions: This segment focuses on tools and services that assist sales professionals in connecting with potential leads and clients. It includes features like Sales Navigator, which helps sales teams identify and engage with prospects.

Recruitment Tools: LinkedIn also offers tools and services specifically designed to assist recruiters and HR professionals in finding and managing talent for their organizations.

Impact on Microsoft Financials:

LinkedIn focuses on services which is going to transform the way customers hire, market, sell and learn. From last 5 yrs. LinkedIn revenue is growing with a CAGR of 22%. If we assume the same growth rate of 22% over next 3 yrs, LinkedIn standalone revenue in Microsoft suits of business will be close to $26 billion by 2025.

Even if we apply a 50% correlation of LinkedIn performance to overall Microsoft productivity segment that segment should continue to grow ~8% year-on-year over the next 3 years. I see the stock trading min $405 per share. (Providing investors ~25% upside from current trading price.)

Data complied using company data and projected outcome using 22% CAGR over next 3 yrs

Data compiled using Microsoft earning results

Conclusion:

LinkedIn’s integration into the Microsoft ecosystem is akin to pouring high-octane fuel into an already powerful engine. The dynamic interplay between these two industry giants has resulted in a comprehensive suite of offerings that cater to the evolving needs of professionals, businesses, and industries. As LinkedIn’s flames of innovation continue to ignite Microsoft’s growth, the tech titan stands poised to shape the future of digital collaboration, learning, and enterprise engagement on a global scale.

The integration of LinkedIn within Microsoft’s ecosystem enriches the overall Microsoft experience for professionals, businesses, and learners, solidifying its place as a key driver of Microsoft’s growth and success.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.