Summary:

- Microsoft’s recent earnings release disappointed investors with weaker cloud expectations.

- The company is currently trading at a high valuation, which may be at risk in coming quarters.

- Competition is rising in the cloud and AI spaces, with Microsoft’s dominance not assured.

BongkarnThanyakij

Microsoft (NASDAQ:MSFT) has gained around 50% from my last article on the company, but the latest earnings make me want to take the other side of the trade.

Stalled cloud growth is the headline

In the latest earnings report, the big takeaway was a weakened outlook for the company’s Azure cloud segment. Like many firms in the current climate, Microsoft’s year-on-year growth figures look great, but the quarterly picture is more clouded.

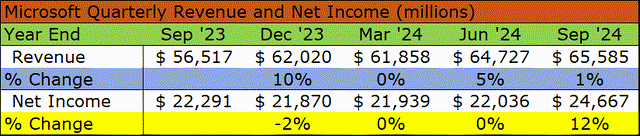

Revenue of $65.6 billion was up 16% over the same period a year ago, but the quarterly improvement from the fourth quarter results was only 1%.

Microsoft Financials (Seeking Alpha)

On a segment basis, More Personal Computing slowed -17% q-o-q, while the Intelligent Cloud segment slowed by -15% to the same level seen in the company’s fiscal first quarter for 2024.

Management also delivered a subdued outlook for future growth in cloud, which has been a key driver in Microsoft’s stock as it powered to record highs in July.

The early explanation for the slowdown at Azure cloud is that Microsoft is struggling to build out its data center infrastructure to meet demand. However, the story is also one of rising competition as the company risks losing ground to tech rivals. Microsoft is currently the number two player in the cloud, behind Amazon’s (AMZN) Web Services cloud service. Google’s (GOOG)(GOOGL) most recent quarter saw growth of almost $3 billion in revenue to $11.35 billion, and the company may close the gap on Microsoft.

As noted, management disappointed investors with its guidance, as Chief Financial Officer Amy Hood said that some data center capacity the company was expecting did not materialize. That is expected to hurt the company’s figures for the current quarter, and that could put the stock price at risk over the next 3–6 months.

Microsoft looks fairly valued at present

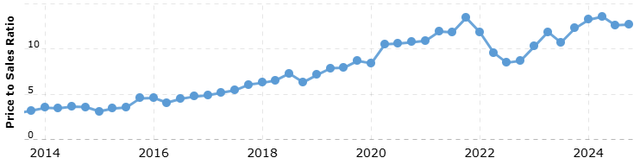

Microsoft’s valuation is trending above historical highs as competition grows in the cloud segment. According to Seeking Alpha data, a forward price/earnings ratio of 31.22x, is now only -1.13% lower than the five-year average of 31.57x.

The story is the same across the board, as forward enterprise value/sales is now 4.18% higher than the five-year average at 10.91x.

However, looking further back over a ten-year period, price/sales at Microsoft is now four times what it was back then. That could begin to catch up with the company’s stock price in the coming quarters.

Microsoft Price/Sales (Macrotrends)

One positive metric for the company is the price/book value, which is currently -18.47% lower over the same period. That is important because the company has been making large capital allocations to build out its data center footprint.

Microsoft has allocated around $60 billion to plant, property, and equipment over the last year and investors will be hoping they can deliver the same five-year return on total assets of 17.5%. However, these assets are different from the company’s traditional business model and the return will depend on AI product competition.

Analysts are now concerned that the recent dip in margins at Microsoft could worsen if the capital expenditures continue.

“Our fear is the more they throw into data center buildout, the more the drag is going to be on margins,” said Gil Luria at D.A. Davidson & Co. “That isn’t happening yet. They’ve been able to cut enough costs elsewhere to still expand margins.”

Microsoft has now claimed the dubious honour of being the largest AI spender relative to sales. Free cash flow has also slipped by -7% year-over-year to $19.3 billion.

Microsoft could be at risk from AI competition

A key factor in Microsoft’s future valuation will come from competition in the AI space. As noted earlier, Google has performed well in the recent quarter and could take market share from Microsoft’s Azure cloud.

While Microsoft has focused on building data centers and leveraging OpenAI’s ChatGPT tool, rivals such as Google and Meta Platforms (META) are building their own tools and could see stronger adoption.

One of the highlights of Meta’s recent earnings release this week was traction in its AI tools.

“We estimate that there are now more than 3.2 billion people using at least one of our apps each day — and we’re seeing rapid adoption of Meta AI and Llama, which is quickly becoming a standard across the industry,” CEO Mark Zuckerberg said.

Microsoft benefited from the early adoption of ChatGPT, but the sector is still fluid and other tools may dominate the industry, reducing the outlook for Microsoft in consumer-driven AI.

Further financial considerations

Microsoft’s recent revenue growth from the same period a year ago was around $11 billion, but the company saw a $4 billion rise in its cost of revenue.

Data also shows that Net income stalled at Microsoft for three quarters, before a 12% quarterly surge in the recent earnings release. Much of that improvement came from a $1.1 billion improvement in investments and a $1.4 billion improvement in ‘other comprehensive income’.

Another issue to consider is that enterprise revenue could come under pressure in the event of an economic downturn. Revenue at Microsoft during the period from Q4 2021 to Q1 2023 rose only 8%. That was after the onset of the Ukraine conflict, which brought a hike in interest rates and ahead of the ChatGPT release.

Downside risks to the thesis

The latest quarter raised a red flag on cloud growth, but there was a strong performance in the company’s core Productivity and Business Processes segment. A gain of almost 40% quarter-on-quarter was driven by demand for the 365 productivity suite as early AI adoption boosted sales. Microsoft has seen some healthy early adoption by businesses for its Copilot personal assistant product.

“Copilot Enterprise customers increased 55% quarter-over-quarter,” Satya Nadella said in the earnings call.

But he added that “nearly 70% of the Fortune 500 now use Microsoft 365 Copilot, and customers continue to adopt it at a faster rate than any other new Microsoft 365 suite.”

At 70%, I would argue that the company could reach its growth peak more quickly than expected, and many of the customers using Copilot are doing so on trials and not yet committing to long-term revenue streams.

The other opportunity is the $60 billion investment in data centers, and if the company can monetize both over the next two quarters, then the stock price may improve.

The discrepancy between commercial and consumer was highlighted with a 13% improvement year-over-year in 365 Commercial, versus only 5% for Consumer. There is upside potential for both, but as noted earlier, companies like Meta are seeking the consumer crown ahead of ChatGPT.

Conclusion

Microsoft’s latest earnings disappointed investors, and management have also poured cold water on the next quarter by stating there were bottlenecks in its data centers. With the company now trading at the high end of its historical valuations, I believe it is a good time to sell in order to gain further information. Margins could suffer in the next 1–2 quarters, and there are also risks to Microsoft’s long-term ability to dominate in consumer AI. I believe a larger correction is possible in the stock and the risks are to the downside with the current valuation.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.