Summary:

- Occidental’s US oil production surged 13.6% in Q2 2024, sequentially driving total sales volumes up by 7.2%.

- Realized oil prices increased 5.1% to $79.89 per barrel in Q2, adding $662 million to revenue growth.

- Geopolitical tensions in the Middle East present a short-to-mid-term catalyst, driving oil prices higher and boosting OXY’s outlook.

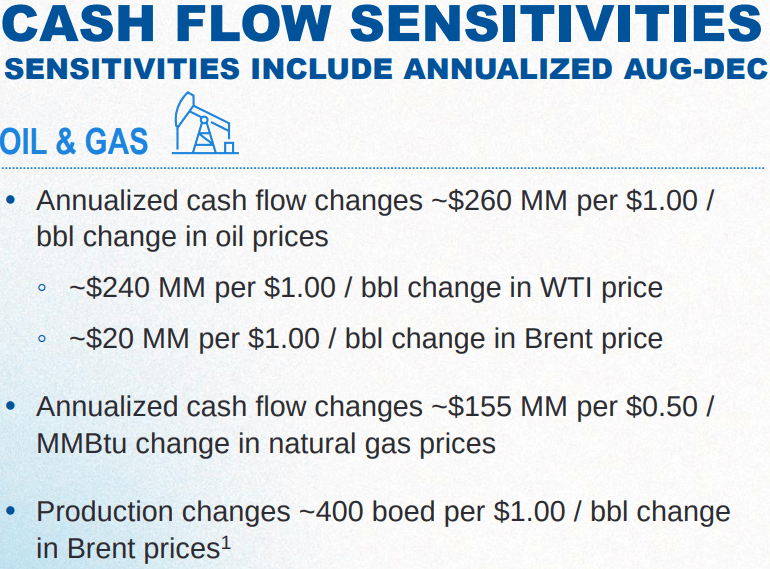

- Every $1 per barrel change in oil prices affects OXY’s annualized cash flow by ~$260 million.

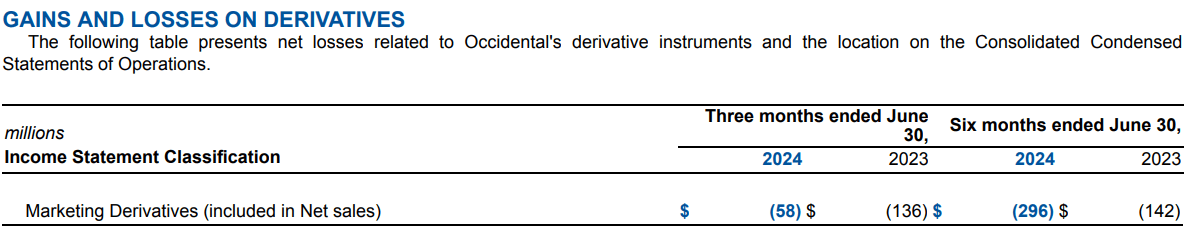

- Derivative losses reached $296 million in H1 2024, nearly doubling the $142 million loss from H1 2023.

Torsten Asmus

Investment Thesis

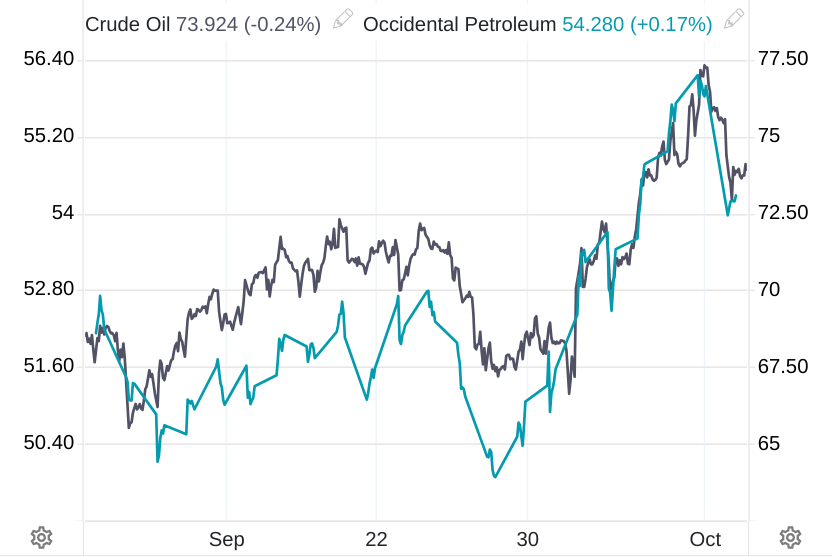

Our latest analysis signaled a potential bottom for Occidental Petroleum (NYSE:OXY) and outlined its technical direction. Since then, Middle East conflicts have driven oil prices higher, positioning OXY for supply concerns. Further, the company’s US oil production increased significantly in Q2 2024, boosting sales volumes and realized oil prices. This solid performance and rising geopolitical tensions support a bullish outlook for OXY’s cash-flow growth, debt reduction, and improved market positioning.

Short-to-Mid-Term Boom in Oil and Gas Prices Due to Geopolitical Tensions

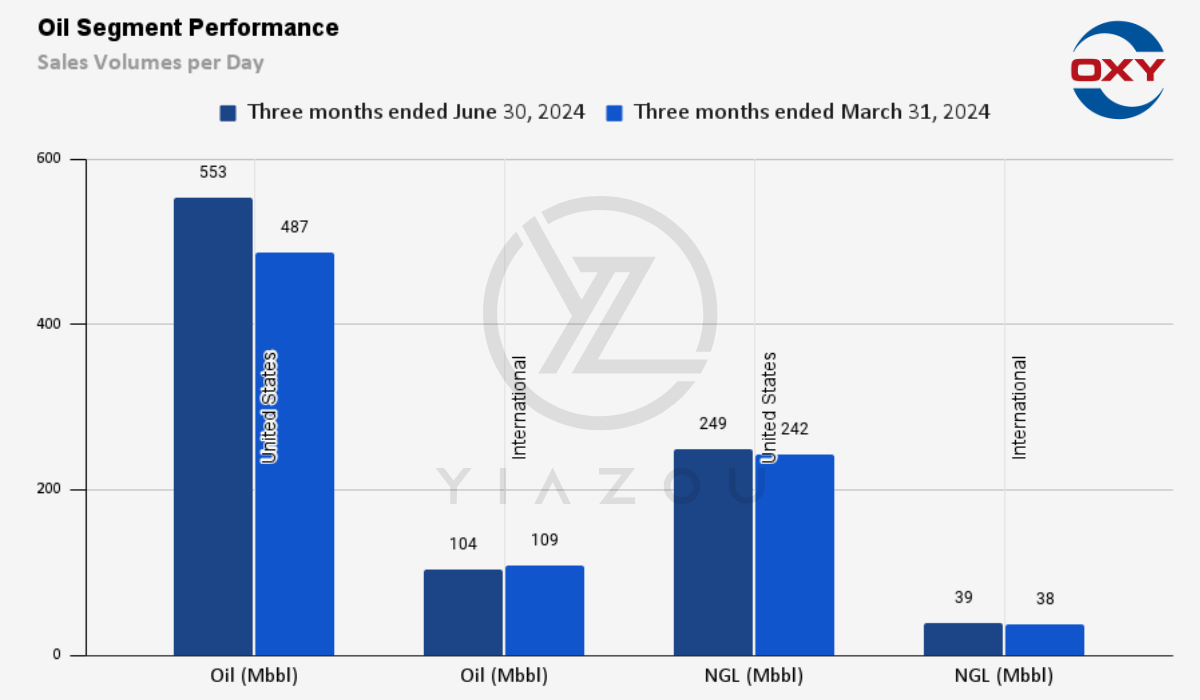

Occidental’s sales volumes for Q2 2024 showed sequential growth across its oil, NGL, and natural gas production. In oil sales, the US output rose from 487 thousand barrels per day (Mbbl) in Q1 2024 to 553 Mbbl in Q2, an increase of ~13.6%. Its International oil production slightly declined from 109 Mbbl to 104 Mbbl, but the US production strength offset this.

In NGL (natural gas liquids), US output grew from 242 Mbbl to 249 Mbbl, reflecting a more modest 2.9% increase. International NGL production had a minor rise from 38 Mbbl to 39 Mbbl. Meanwhile, US natural gas volumes increased ~7% from 1,284 million cubic feet (MMcf) to 1,371 MMcf. Meanwhile, international natural gas sales increased from 511 MMcf to 518 MMcf, +1.4% sequentially.

Yiazou

Fundamentally, these growth trends in sales volumes point to recent shifts in Occidental’s increasing production capabilities. The combined sales volumes rose to 1,260 barrels of oil equivalent per day (boe/d) in Q2. This sequential increase of 7.2% is positive under the ongoing geopolitical tensions that may further boost oil and gas prices.

On the pricing part, Occidental’s Average Realized Prices in oil sharply increased from Q1 to Q2 2024. This reflects the company’s exposure to oil market price trends. For instance, in the US, the realized price per barrel uplifted from $75.54 to $79.79 (+5.6%). International realized prices climbed from $78.29 to $80.40 per barrel (+2.7%). Overall, the total worldwide average realized oil price rose from $76.04 to $79.89 per barrel (+ 5.1%).

Similarly, for Q2 NGL Average Realized Prices, the US saw a modest drop from $21.17 to $20.19 per barrel. Meanwhile, international prices held steady at $28.11 against $28.33. However, Natural gas Average Realized Prices displayed the most significant fluctuation. The average realized price per million cubic feet (Mcf) in the US dropped from $1.61 to $0.54. Whereas International gas prices remained relatively stable at $1.91 per mcf, the volatility in Occidental’s US natural gas realized pricing is primarily based on the domestic market. This price improvement (particularly in oil) indicates the company’s leverage to rising energy prices fueled by geopolitical tensions.

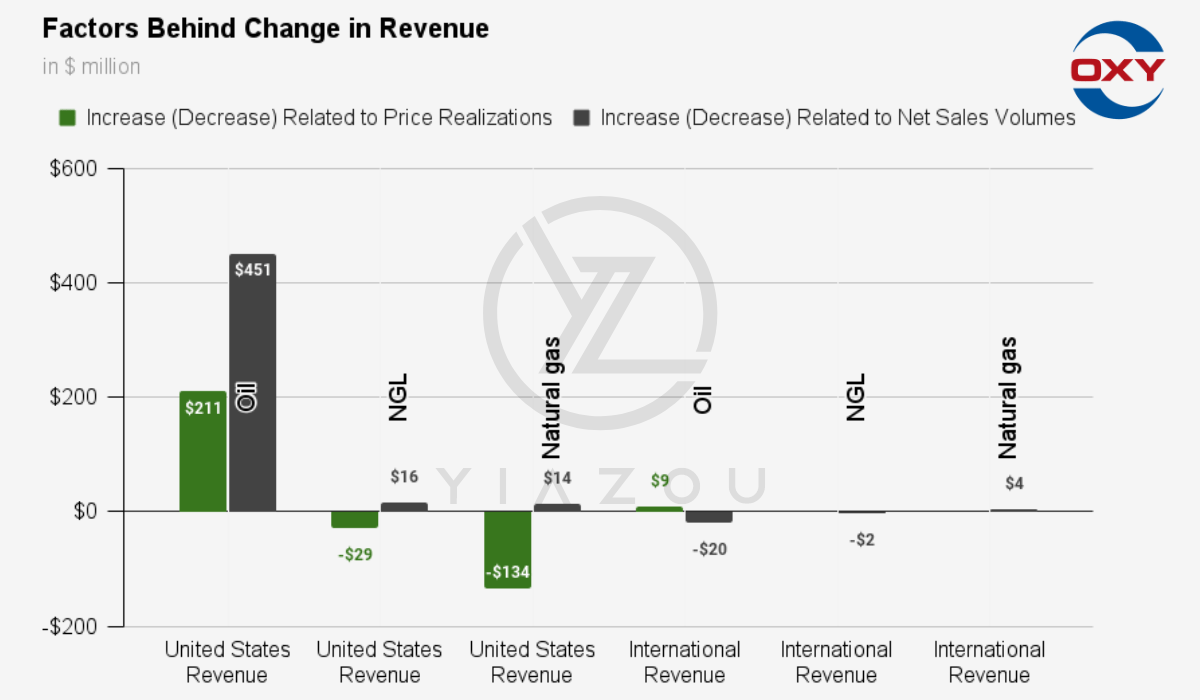

Financially, Occidental’s capability to realize higher prices may continue to support its top-line growth and boost cash flow generation even without increasing production levels. Occidental’s top-line had solid growth between Q1 and Q2 2024 based on higher sales volumes and improved realized prices. In the US, revenue from oil sales increased considerably to $4.011 billion in Q2 (from $3.349 billion in Q1). This is a rise of $662 million, +19.8% quarter-over-quarter. This was based on $211 million due to price realizations and $451 million from increased sales volumes.

Moreover, NGL revenues in the US slightly declined from $416 million to $403 million, which was more than offset by the rise in oil revenue. Finally, Natural gas revenue fell sharply, declining from $187 million in Q1 to just $67 million in Q2 based on the sharp decline in US realized natural gas prices.

Yiazou

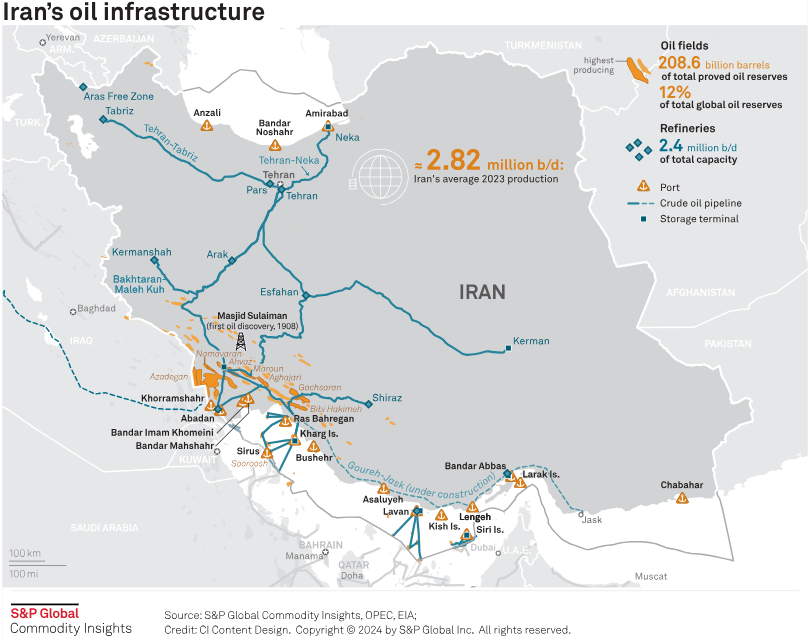

In short, despite the minor international decline, the overall revenue growth of $529 million from Q1 to Q2 marks the company’s edge in leveraging US production increases and price improvements. Furthermore, geopolitical issues, like the rising tensions between Israel and Iran, present a short-to-mid-term catalyst for Occidental Petroleum. Escalating conflicts in the Middle East that threaten oil infrastructure can drive oil prices higher based on possible supply disruption risks. This can be observed in the jump in Brent Crude prices after Iranian missile attacks in early October.

Amid US oil and gas production at historical highs, the recent price spike for benchmark US crude was the biggest single-day gain after the Israel-Hamas war (October 2023). Any significant military operations affecting upstream or midstream oil assets, like attacks on Iranian production or crude export facilities, will elevate oil prices further. Why? Iran (an OPEC member) has the largest refining capabilities in the Middle East, with ~2.4 million b/d in 2023 (on 10 main sites). It exports ~50% of its 3.3 million barrels of oil production per day. Although immediate disruptions may not happen, recent market reaction points to a growing concern in the street (for a longer escalation).

spglobal.com

As Occidental’s top-line growth is attached to US oil price fluctuations, it may capture price increases from Middle East supply disruptions based on growing production volumes and capitalizing on price realizations. If the US steps in to meet supply gaps, domestic energy prices will rise. Geopolitical tensions may boost oil prices (at least in the short term). Thus, higher oil prices may improve cash flow to support additional CapEx, debt reduction, and OXY’s market valuation.

Trading Economics

Cash Flow Sensitivities And Losses On Derivatives

On the downside, Occidental Petroleum’s core strength serves as a core weakness, ’highly sensitive to fluctuations in oil and gas prices.’ The company’s cash flow changes rapidly based on relatively small shifts in oil and gas prices.

Specifically, for every $1 per barrel change in oil prices, Occidental’s annualized cash flow is affected by ~$260 million. This includes a sensitivity of ~$240 million for changes in the WTI oil price and ~$20 million for changes in the Brent price. Furthermore, a $0.50/MMBtu change in natural gas prices results in an annualized cash flow change of ~$155 million. The scale of these sensitivities highlights how external market conditions can massively impact the company’s financials.

If oil prices normalize as usual and fall considerably, Occidental will lose billions in annualized cash flow, constraining its ability to fund CapEx and debt from acquisitions. Occidental’s profitability would be severely compromised in a low oil price environment. This dependence on market volatility weakens its stock’s ability to sustain bullish trends as cash flow and bottom-line volatility introduce uncertainty in valuations.

For instance, consider a scenario where WTI oil prices decline by $5 per barrel. Occidental would then face a reduction in its annualized cash flow of approximately $1.2 billion ($240 million per $1/bbl multiplied by $5). If Brent prices also drop, the additional reduction in cash flow could further tighten the company’s top-line, liquidity, and bottom-line. Moreover, If natural gas prices decline by just $1/MMBtu, Occidental would see its annualized cash flow drop by $310 million ($155 million per $0.50/MMBtu multiplied by 2).

OXY Q2 2024

Additionally, production changes with prices are also a structural weakness for Occidental. For every $1/bbl change in Brent prices, Occidental’s production alters by ~400 barrels of oil equivalent per day. Although this production change seems modest per barrel, it can significantly impact total output and revenue over a year. A sustained decline in Brent prices would lead to reduced production, lowering revenue generation from lower sales volumes.

Finally, Occidental’s exposure to Derivatives used to hedge against oil price volatility has shown consistent losses. For instance, over the six-month ending June 30, 2024, Occidental incurred derivative losses of $296 million, ~2X the $142 million loss in H1 2023. These derivative losses directly reduce profitability and further strain OXY’s valuations. The ~$300 million loss in H1 2024 points to ineffective hedging positions that have backfired during oil market volatility.

OXY 10Q

Takeaway

Occidental is set to benefit from rising oil prices driven by Middle East tensions. The company’s strong US production growth and increased oil prices have boosted revenue and cash flow, positioning OXY to capitalize on global supply concerns.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in OXY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.