Summary:

- Modine aims to triple data center cooling revenue to $1.1 billion in three years.

- The strategic 80/20 shift, focusing on high-growth, high-margin businesses, has improved financials, with significant growth in MOD’s Climate Solutions segment.

- Acquisitions like Scott Springfield Manufacturing enhance the Company’s capabilities and competitive advantage in the high-growth data center cooling market.

- Despite potential market risks, Modine’s expanding margins and free cash flow growth make it a buy for long-term investors.

Erik Isakson

Investment Thesis

Modine Manufacturing’s (NYSE:MOD) management sees the potential to generate roughly $1.1 billion in data center cooling revenue within three years. That would triple its current data center sales and nearly double its current total Climate Solutions revenue. It would also put the company somewhere in the range of generating $3.3 billion annually. The incredible growth and continued acceleration of data center cooling sales, a strategic acquisition that, I believe, has given Modine a potential moat or at least a strong competitive advantage, and expanding margins give me confidence that the company can be a winner in the data center cooling space. If Modine can accomplish the type of revenue growth that management speaks about, the stock could be a great value today for long-term investors. After rating MOD a hold in my last article, I now consider Modine a buy and have opened a starter position in the company.

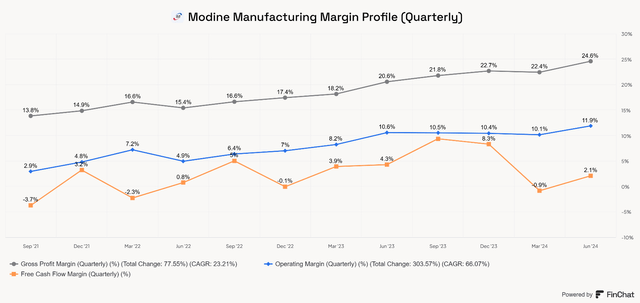

Improving Financial Outlook

Modine is undergoing a strategic shift, which it calls its 80/20 principle. MOD’s 80/20 changes caused a meaningful improvement in its financial trajectory. The company is divesting from underperforming businesses and shifting its focus into higher growth and higher margin businesses. Segment revenue has flipped from being driven largely by Performance Technology to now being driven by Climate Solutions. This is a very positive sign for continued margin expansion. The Climate Solutions business includes data center cooling, which generates significantly higher gross and operating margins. This is the area of the business I am focusing on for the time being, as Modine’s management has mentioned that its target for its data center cooling business is roughly $1.1 billion in about three years’ time. If this happens, I believe Modine can rival the current free cash flow margins of Vertiv (VRT) and Trane Technologies (TT). FCF margins of 13% could support impressive shareholder returns.

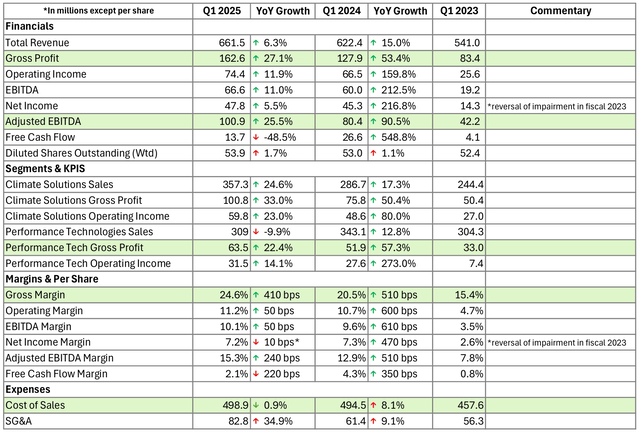

In the table below, you can see that Modine has been able to achieve impressive growth in gross profit and margin, and adjusted EBITDA and margin. Its Climate Solutions (CS) segment experienced incredible revenue growth (24.6% YoY in Q1) and gross profit (33.0% in Q1). The Performance Technologies (PT) segment is being shrunk by selling off underperforming business, however, despite a decline in PT sales, Modine grew PT gross profit by 22.4%, showing increased efficiency from its 80/20 changes. Modine expects a flattish revenue outlook, with higher margins in its PT segment and continued acceleration in its CS segment.

Modine’s Q1 Financial and KPI Table (Author-generated table, data from SEC filings and transcripts)

Adjusted EBITDA is a more appropriate measure of Modine’s recent growth due to a reversal of an impairment charge in 2023 and the unwinding of some of its legacy automotive businesses. Adjusted EBITDA margin has expanded from 7.8% in Q1 2023 to 15.3% in Q1 2025. The key thing to look for in Modine’s operational performance will be the magnitude of the shift in revenue towards data center cooling solutions and continued margin expansion.

Growth in Data Center Sales and Expanding Margins

Despite exiting some of its Performance Tech businesses, Modine continues to grow total revenue on the strength of its CS segment, driven by an acceleration in data center cooling revenue.

A good amount of Q1 data center sales growth comes from the Scott Springfield Manufacturing (SSM) acquisition; however, during the Q1 call, management stated that organic data center growth nearly doubled YoY. Modine acquired SSM to gain access to a technology that it couldn’t provide. Now, with the two companies operating together, the benefits of both should kick in. The integration of SSM and its custom air handling units (AHUs) will expand Modine’s capabilities and allow it to better serve hyperscale data centers, strengthening its position in a high-growth vertical. It also gained Modine access to new customer relationships by adding a hyperscale customer, potentially opening the door to new large data center customers now that the company has a seat at the table. These relationships may be one of the most important competitive advantages in the data center cooling market, as significant switching costs may be associated with hybrid data center cooling agreements. Management has essentially told us that the two companies combined will be stronger than each one separately.

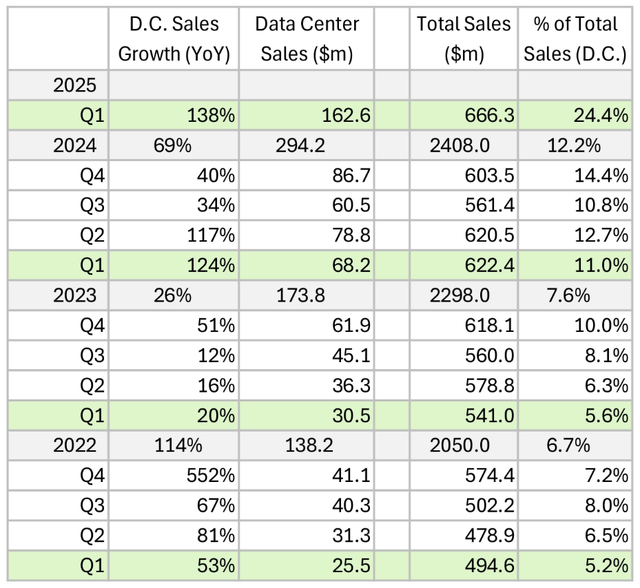

Data center cooling sales have more than 6x’d since Q1 of 2022, with quarterly sales rising at a CAGR of 85.4% over the two-year period shown below. As data center sales have grown, Climate Solutions gross margins have improved from 20.6% to 28.2%, and total gross margin has expanded from 15.4% to 20.4%. Data center sales now make up 24.4% of total revenue. This figure was only 5.2% in the same period three years ago.

Modine’s Data Center Sales Growth (Author-generated table, data from SEC filings and transcripts)

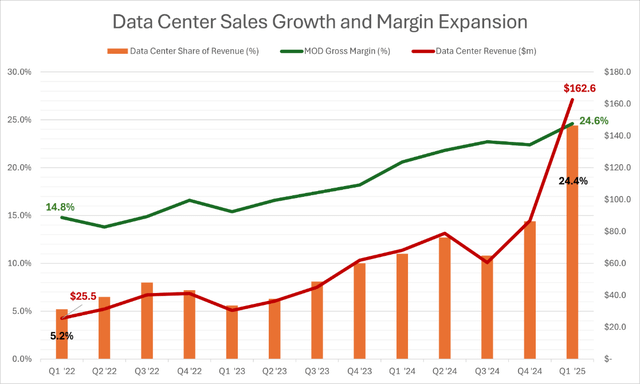

The chart below further illustrates the relationship between data center sales and gross margins. As data center sales (red line) have grown from $25.5 million to $162.6 million, gross margin (green line) has significantly expanded and the share of revenue coming from data center sales (orange bar) has exploded higher.

Author-generated table, data from SEC filings and transcripts

How long will this growth continue? Capex into data center new builds and expansions is still ongoing. These are large projects that take time to plan, fund, approve, and build, this process should continue to play out for several years at least. Dominion Energy (D) recently said that new large data centers requiring more than 100 megawatts of electricity would face up to seven-year delays due to the lack of electrical infrastructure support. Importantly, this will not affect projects already in the pipeline. Dominion serves electricity in Virginia, one of the more important places in the USA for data centers. In my article about NextEra Energy (NEE) in June, part of my thesis revolved around the long-term growth pipeline for data center build outs. Perhaps not coincidentally, NEE says that it expects renewables to grow about 3x over the next seven years as compared to the prior seven-year period. This growth in renewables should help support the ability to continue building large data centers beyond the seven-year period Dominion mentioned.

The other thing that should support the ability to build data centers despite the current and near-term limitations of the electrical grid is the adoption of liquid cooling solutions for data infrastructure. For instance, research and industry articles have discussed how advanced cooling technology will help data centers become more efficient and that liquid cooling is a critical part of this shift. This demand should provide an opportunity for Modine to continue building on its recent success in building a company with the capability to offer a full suite of data center cooling technology.

Free Cash Flow Analysis

In Q1, MOD’s FCF (defined simply as OCF minus Capex) was $13.7 million, while TTM FCF was $113.2 million. However, TTM FCF numbers may not be the best measure of the company’s earnings ability because MOD has made significant investments in growth and accelerated revenue from its data center cooling segment. Because of this, the cash flow collection from its data center revenue may be somewhat delayed for now.

In Q1, OCF was negatively impacted by working capital, with changes in accounts receivable (-$18.1 million) and other net operating assets (-$32.6 million) combined to decrease OCF by $50.7 million. On the flip side, MOD only benefitted from $20.6 in other working capital items, such as favorable changes in inventory, accounts payable, and other net operating assets. I don’t like to make bold assumptions about working capital unless I have a really firm grasp of a company’s accounting. Still, in the case of Modine, I feel confident in its potential to improve OCF in the coming quarters because data center cooling sales are accelerating and driving margin expansion. Additionally, FCF was impacted by larger than usual capex related to acquisitions and investments in growth. Capex in Q2 was $26.8 million.

We can count Capex against MOD’s cash flows, but the Capex used to integrate Scott Springfield and TMGCore should be viewed a long-term investment rather than an immediate expense, despite its accounting treatment. Since these are not capitalized, they impact earnings and free cash flow today. However they represent long-term growth investments that, under different accounting treatment, would be capitalized and expensed over their useful life period. Over time, as Capex decreases, earnings and free cash flow should theoretically improve, assuming these acquisitions contribute to growth. Thankfully, there are at least early indicators that the SSM acquisition already is.

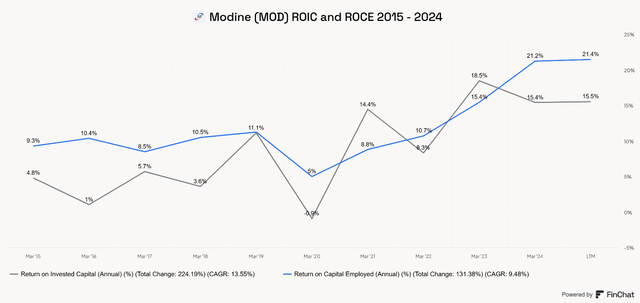

Returns on Invested Capital and Capital Employed

Modine has shown its increasing efficiency through two very important measures, ROIC and ROCE. These capital efficiency metrics will go a long way in indicating if the company is improving the returns it gets on its investments in acquisitions, Capex, and R&D. The company has exhibited healthy and improving ROIC and ROCE, as seen below.

Companies that maintain healthy capital efficiency metrics (particularly ROIC and ROCE) are more likely to deliver strong shareholder returns. Modine has done this, and this should support improving free cash flow generation in the future.

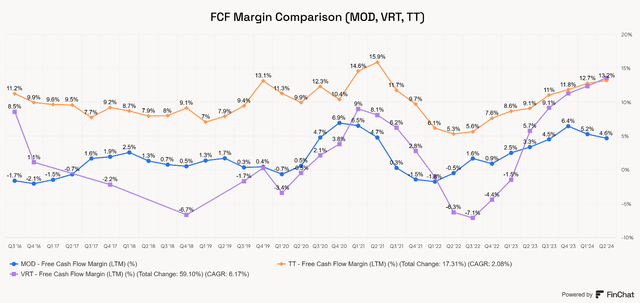

FCF Potential

Perhaps our best comps are Vertiv and Trane Technologies. VRT and TT are different businesses. Trane is established and very diverse, like Modine is. With different business segments that make data center cooling a growing part of its business but not yet a major source of revenue. Vertiv is the faster growing counterpart to Modine, but differs in that it is focused mainly on advanced cooling systems solutions. With the emergence of data center cooling and liquid cooling as a source of revenue for Modine, I see the business aiming to be somewhere between Vertiv and Trane, with a diversified model and an increasing reliance on data center cooling.

Both TT and VRT hold TTM FCF margins just north of 13%. MOD’s TTM FCF margin is only 4.6%, with a peak of 6.4% as of the end of fiscal Q3 of 2024 (12/31/2023). Given the expansion of MOD’s gross and operating margins and the fact that a secular growth trend and rightsizing of its business is pushing this expansion, I see 13% as a reasonable target for FCF margins.

If Modine can get to a 13% FCF margin within the next few years, that would likely make the stock pretty cheap right now. Margin expansion could be supported by continued growth in data center sales, lower integration costs and the synergies or benefits from its recent acquisitions, particularly the Scott Springfield acquisition.

Valuation

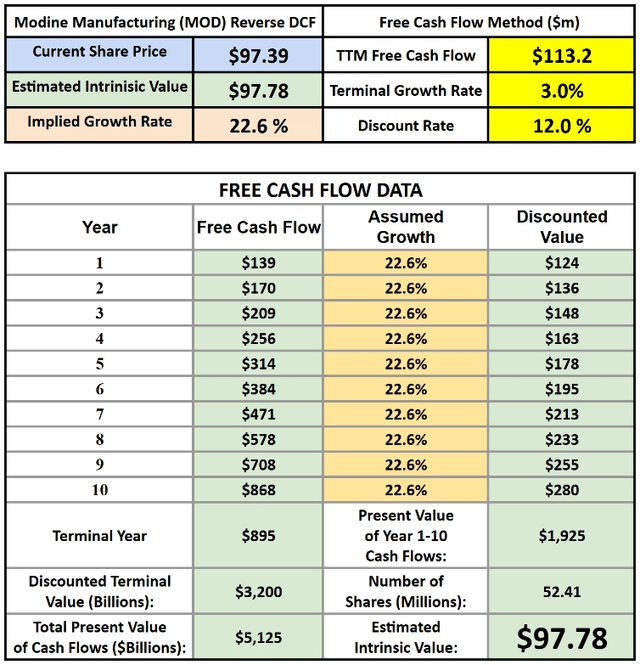

If we use a basic reverse DCF calculator and Modine’s TTM FCF of $113.2 million, a terminal growth rate of 3.0%, and a discount rate of 12.0%, Modine needs to grow free cash flow at 22.6% over a ten-year period. I chose a 12% discount or hurdle rate because I believe that would be a market-beating stock. The terminal rate of 3% while higher than GDP, appears to be reasonable due to the potential tailwinds associated with data center cooling and HVAC/R markets.

Reverse DCF – Modine (MOD) (Author-Generated Reverse DCF)

The simple reverse DCF might overstate Modine’s need to grow free cash flow from its current margins. What if the company can continue to dramatically expand its margins in the next year or two?

Looking at Modine’s recent restructuring for growth and efficiency and the explosion in data center sales, the company does not yet appear to be optimized for free cash flow generation. Let’s go back to my assumption that Modine has the potential to match the 13.0% FCF margin that TT and VRT hold.

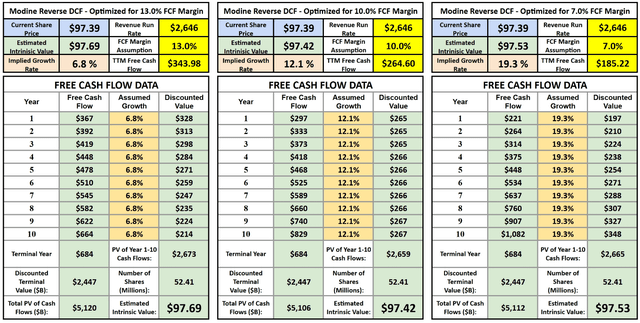

Now, let’s conduct a valuation exercise, pretending that Modine is already optimized for a free cash flow. I believe 7% to 13% is an appropriate range for MOD’s medium-term FCF margin. If we assume that the company was already optimized for FCF margin and that the margin remained steady for ten years, we can estimate the revenue growth rate required for MOD stock to be fairly valued using a reverse discounted cash flow model. I want to stress that this is not an accurate measure of intrinsic value, just an estimate of what would be required under more optimal profitability.

If FCF margin were already 13%, given its twelve-month revenue run rate of $2,646 million in revenue, Modine would be generating $344 million in FCF and only need to grow revenue at a 6.8% CAGR to be trading at its estimated intrinsic value. If Modine were optimized for 10.0% FCF margins, the required revenue growth rate would be 12.1% annually, and at 7.0% FCF margin, Modine would have to grow revenues at a 19.2% CAGR. Each model uses a 12.0% discount rate and 3% terminal growth rate.

I need to explicitly state that this model makes assumptions that could look ridiculous in either direction in the future, and should be considered a tool to evaluate the potential valuation of Modine under optimal profitability that has yet to be attained.

3-Scenario Optimized Reverse DCF – Modine (MOD) (Author-Generated Reverse DCF)

Combining the two models used points to, Modine as a potential market-beating performer in the coming years. Because I believe margins will continue expanding dramatically in the coming years and revenue will grow from here, I think the potential lies somewhere between the traditional reverse DCF model used and the 3-scenario optimized for free cash flow reverse DCF model I created.

Given the expansion of margins that Modine is seeing with the explosion in data center cooling sales, it seems reasonable to assume margins continue to expand. The question is, how wide can they expand? That may depend on Modine’s ability to create or maintain a moat.

Modine’s Moat

My willingness to put faith into the long-term investment thesis for Modine is dependent on the company’s ability to create a moat. In MOD’s case, competitive advantages could come from large customer relationships, patented technology, and switching costs. MOD is experiencing rapid growth from its advanced cooling division, led by incredible growth in its data center cooling business and bolstered by the acquisition of SSM.

It’s hard to determine if Modine actually has the potential to develop a moat in liquid cooling. I don’t think this is a winner-take-all industry, but it’s important to determine if MOD has the potential to at least gain and maintain a leading position in the advanced cooling market.

The market has several key players, such as LiquidStack (with investments from TT) and Vertiv, as well as a host of other competitors, some of whom lack the advanced capabilities of those mentioned above. The market is also experiencing massive capital inflows from big tech. This bodes well for the liquid cooling industry and Modine, but it also might invite increased competition. Because of this, it is important for Modine to hold some kind of moat to maintain its leading position in the market.

To me, a moat is such a strong competitive advantage that it can be sustained over time, even when attacked by other companies. The sources of competitive advantages for Modine could come from the amount of R&D required to enter the liquid cooling market. This could limit entry into the space for new competitors and discourage larger, diversified HVAC/R companies from getting directly involved in the process. Another competitive advantage might come from relationships with data center providers or one or two hyperscale companies actively spending massive amounts of money to build their data center capabilities. Switching from one cooling provider to another may require steep switching costs in the way of expense and downtime.

Conclusion and Risks

I believe Modine has strong competitive advantages in all of the forms cited above, but I need to learn more about how sustainable this may be. This is what prompted me to take a starter position in the company following its recent pullback below $100 per share.

The risks to my thesis are that the data center cooling market lacks sustainable growth if high-performance computing applications fail to deliver adequate returns on investment for hyperscalers. However, it appears that these investments are being made and will not slow down for several years. Once those investments are in place, I believe Modine’s growth inflection will have taken place.

I understand the risk that MOD’s stock price could pull back further as market sentiment may sour from here, especially considering the slowing of growth rates seen in Nvidia (NVDA) and the realization that generative AI stocks aren’t going to grow linearly.

However, after digging deeper into MOD’s investment thesis, I see greater potential for the company to continue expanding margins and growing free cash flow, and I believe the market may not fully realize this potential right now. I rate the stock a buy for long-term investing strategies and would consider upgrading to a strong buy if the share price falls further without my investment thesis being compromised.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MOD, TT, NEE either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.