Summary:

- Modine Manufacturing is capturing strong demand for its Data Center thermal management cooling solutions.

- The company expects earnings to benefit from an ongoing effort to shift the business toward high-growth and more value-added opportunities.

- Recognizing the positive long-term outlook, we believe valuation is now a near-term headwind following the strong rally over the past year.

XH4D/iStock via Getty Images

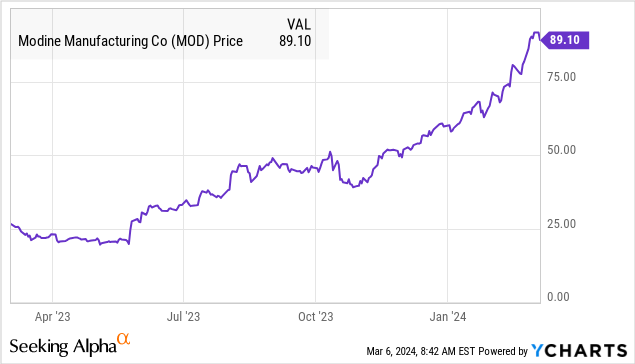

Modine Manufacturing Company (NYSE:MOD) has emerged as a big winner amid the AI-driven tech boom, capturing strong demand for its specialized industrial HVAC solutions. The company’s high-performance cooling systems are critical components for data centers running power-intensive computing.

Indeed, shares are up more than 230% over the past year, with the latest quarterly results highlighted by climbing earnings. We can also point to the company’s thermal management systems for commercial electric vehicles as another growth driver that has gained momentum.

Overall, there’s a lot to like about MOD as a high-quality mid-cap supported by solid fundamentals and a positive long-term growth outlook. At the same time, we’re urging some caution on the stock at the current level following the recent rally. The combination of some mixed indicators and what has evolved into a more pricey valuation can represent headwinds going forward.

MOD Financials Recap

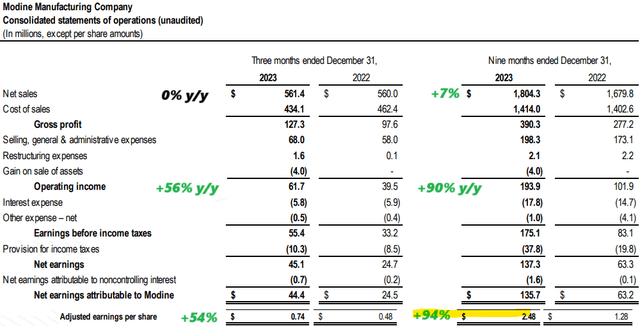

MOD reported its fiscal 2024 Q3 results on January 30 with non-GAAP EPS of $0.74, up 54% from $0.48 in the period last year. While net revenue of $561.4 million was flat year-over-year, the bigger story has been the shifting sales mix and its impact on profitability.

The gross margin of 22.7% was up from 17.4% in the period last year, while the operating margin reached 11% compared to 7.1% in the prior year quarter. The trends through the first nine months of the year are even stronger, with operating income up 90% over the period in 2023.

source: company IR

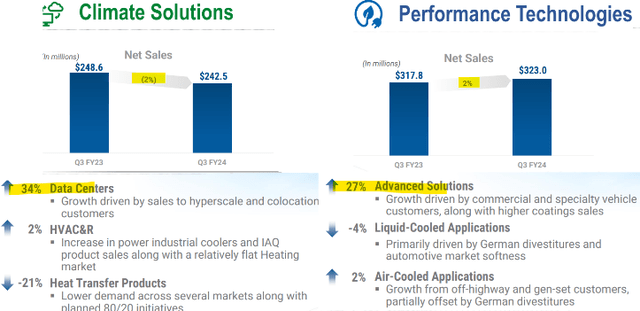

Within the top line, the key point is the particular strength in Data Center climate solutions products with sales up 34% y/y, balancing a softer 2% increase in more traditional HVAC&R products. On the other hand, a -21% decline in Heat Transfer Products reflects some weaker demand alongside an ongoing effort to streamline the operation through an “80/20 implementation”.

The same dynamic is seen in the Performance Technologies group, where Advanced Solutions which includes the EV thermal systems posted sales growth of 27%, but was overshadowed by a -4% decline in Liquid Cooling Applications, as well as softer trends from Air Cooled Applications.

source: company IR

Our takeaway here is that these high-growth segments are very positive, but they need to be viewed in the context of the larger firm-wide operation, where the headline numbers have several moving parts.

Modine Manufacturing ended the quarter with $150 million in cash and cash equivalents, against $333.2 million in total debt. Considering approximately $263 million in adjusted EBITDA over the past year, we view the net leverage ratio of just 0.7x as a strong point in the company’s investment profile. Management has made comments suggesting room for potential strategic acquisitions as part of the long-term growth strategy.

What’s Next For MOD?

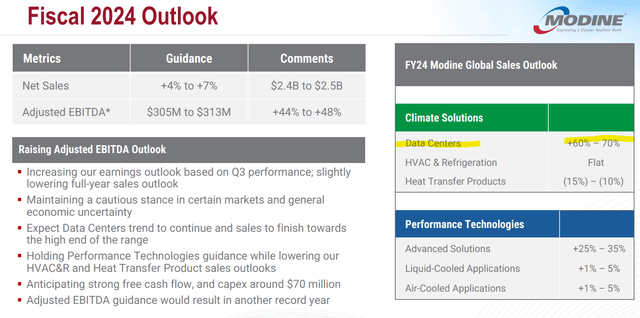

For the fiscal year 2024 which ends on March 31st, management is guiding for net sales growth between 4% and 7%, which implies approximately 5% y/y growth in Q4. The full-year target for adjusted EBITDA is around $309 million, if confirmed would represent a ~46% increase over 2023.

In many ways, this outlook represents a continuation of Q3 with the momentum in Data Centers and Advanced Solutions balancing weaker trends in the other product groups.

source: company IR

Keep in mind that a major strategy focus for the company is to shift the overall business toward these faster-growing and more value-added opportunities. That includes re-tooling manufacturing sites to support data center growth, which naturally comes at the expense of the “legacy” products. The idea here is to sustain higher margins and more consistent earnings going forward.

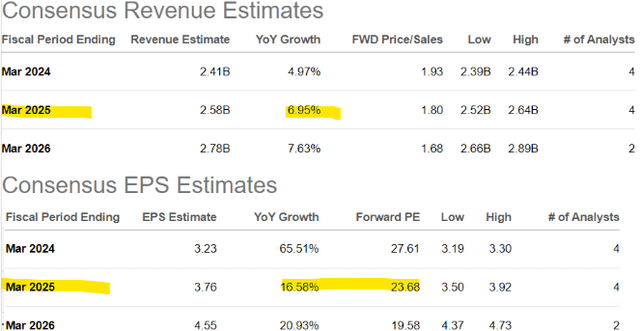

According to consensus, from the 5% revenue growth and 66% earnings upside expected this year, the outlook for fiscal 2025 is for a bit stronger top-line in the 7% range, while earnings growth of 17% faces a high baseline of comparison. We can look ahead to the Q4 earnings report in late May for updated management guidance, which will likely include 2025 targets.

Putting it all together, what we have here is a stock that is on track to deliver mid-single-digit revenue growth, while EPS is seen stronger in the double-digit range. By this measure, a 1-year forward P/E of 24x is reasonable, although we would question if there is room for that multiple to reach levels above 30x and beyond.

Seeking Alpha

The bullish case for MOD will be that top-line growth re-accelerates, with the ability to outperform expectations on the earnings side. On the other hand, this segment of hardware manufacturing introduces some logistical constraints in what remains a capital-intensive industry with intense competition.

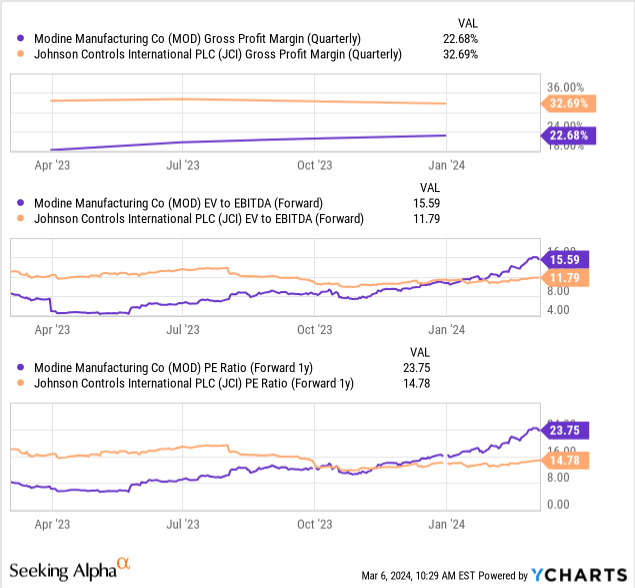

Larger HVAC players including Johnson Controls International Plc (JCI) and Trane Technologies (TT) are noted as targeting the same data center opportunities with alternative cooling solutions. Similarly, Dana Inc (DAN), and Borg Warner Inc (BWA) are also commercializing EV thermal management technologies.

Recognizing each of these companies has key differences, the point here is to question whether Modine has a technological advantage that would support its ability to significantly grow market share beyond the recent surge of industry activity. There are also uncertainties as to how the demand for data center infrastructure will evolve over the next few years.

Compared to JCI, while MOD may have been seen as a “value pick” from levels in late 2023, the more recent leg higher in the stock has to flip a previous valuation discount into a premium even as JCI remains technically more profitable through higher margins.

Final Thoughts

We rate MOD as a hold with a sense that the stock price momentum should consolidate recent gains, already pricing in many of the positives in the data center growth story.

Investors that got in early have hit a proverbial home run, while anyone just looking at the stock today is probably late to the party. In our view, a pullback in the stock toward $70 would offer a more attractive entry point on a risk-adjusted basis.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Add some conviction to your trading! Take a look at our exclusive stock picks. Join a winning team that gets it right. Click for a two-week free trial.