Summary:

- Modine’s stock surged over 250% in the past year, benefiting from the AI infrastructure upcycle.

- The company has expanded its data center cooling solutions and manufacturing capacity to meet growing demand.

- Modine’s technology roadmap and focus on high-potential businesses position it well for future growth in the AI data center market.

- I explain why MOD investors should wait for a better opportunity before buying more, as its valuation no longer seems that attractive.

J Studios

Modine Stock Up Over 250% In One Year

Modine Manufacturing Company (NYSE:MOD) is a $5.4B market cap company. Modine specializes in thermal management solutions. Modine has a well-diversified business model globally. While the US market is its primary geographical segment, it has a growing business in Europe and Asia. However, Modine has faced inventory oversupply challenges in its European heat pump business. As a result, it impacted Modine’s heat transfer product segment in its recently reported fiscal fourth quarter. Modine doesn’t expect a significant recovery “until market conditions stabilize and excess inventory is absorbed.”

Despite that, Modine stock has benefited from the AI infrastructure upcycle. MOD has surged more than 250% in total return over the past year. As a result, Modine has capitalized on its thermal management solutions for data centers linked to hyperscalers and colocation providers. Accordingly, Modine reported a 69% YoY increase in data center revenue while also lifting its adjusted EBITDA. As a result, it has mitigated the impact of divestment of non-core and lower-margin businesses, even as Modine reported a revenue decline of 2.4% YoY. Despite that, Modine delivered an adjusted EBITDA increase of 20% YoY, underscoring the effectiveness of its 80/20 initiatives to focus on the highest potential businesses.

Modine Is Expanding Its Data Center Cooling Solutions

In addition, Modine has capitalized on the surge in data center cooling solutions by expanding its manufacturing capacity. Modine’s recent “purchase of a 14.6-acre manufacturing site in Bradford, UK” is anticipated to bolster the company’s ability to raise “production of precision cooling equipment used in the data center industry.” As a result, it is expected to help Modine leverage the growth in demand for data center cooling solutions. Therefore, it should improve Modine’s execution capabilities to “meet customer demand effectively and ensure timely delivery of precision cooling equipment.”

Modine’s capabilities can also be expanded to liquid cooling, given its astute acquisition of TMGcore’s liquid immersion cooling solutions. We could witness a potentially sharp surge in liquid cooling demand linked to the adoption of Nvidia’s (NVDA) Blackwell AI chips when they ship over the next year.

As a result, it should position Modine well as the company expands its portfolio of cooling solutions to capture market share. In addition, Modine is well-equipped to handle direct-to-chip cooling, which is expected to be the primary liquid cooling technology deployed in the near term, in line. Super Micro employs (SMCI) direct liquid cooling technology as SMCI builds up its AI plug-and-play rack server capacity to cater to the most advanced next-gen AI computing workloads.

Therefore, the expected expansion in new AI data centers and retooling of standard data centers for AI should benefit Modine, given its technology roadmap. Modine targets “technologies like direct-to-chip cooling, single-phase or two-phase liquid cooling, and immersion cooling.” Management highlighted that its direct-to-chip cooling product is “nearing completion, with plans to launch the product to select customers by the end of the fiscal year.”

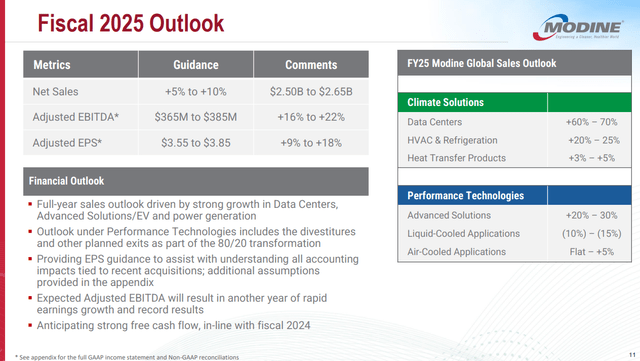

Modine FY2025 guidance and commentary (Modine filings)

Consequently, it should support Modine’s revenue and profitability sustainability, even as it exits lower-performing businesses in line with its 80/20 strategic reallocation.

Modine’s FY2025 guidance suggests continued gains in adjusted EBITDA, with a forecasted growth range of between 15% and 22%. As seen above, data center growth is expected to remain robust, with a revenue surge of between 60% and 70%. Therefore, I assess that Modine’s optimism seems justified, as the AI upcycle has shown no signs of ending.

Is MOD Stock A Buy, Sell, Or Hold?

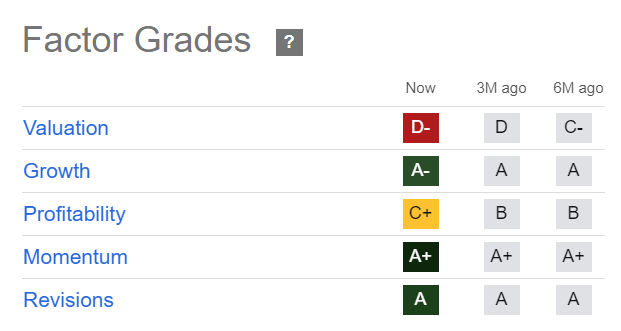

MOD Quant Grades (Seeking Alpha)

Notwithstanding my optimism, MOD is no longer valued as attractively. Its “D-” valuation grade underscores my assessment that the market has already baked in significant optimism. MOD’s forward adjusted PEG ratio of 1.25 is about 18% below its sector median. While still discounted, the valuation bifurcation has closed markedly.

Furthermore, MOD’s forward adjusted earnings multiple is more than 75% above its sector median, suggesting caution is warranted. While I don’t assess red flags indicating a sell signal, given its robust growth grade, adding exposure at the current levels might seem too aggressive.

However, a steep pullback to digest MOD’s recent optimism might provide a more attractive opportunity to add exposure.

Rating: Initiate Hold.

Important note: Investors are reminded to do their due diligence and not rely on the information provided as financial advice. Consider this article as supplementing your required research. Please always apply independent thinking. Note that the rating is not intended to time a specific entry/exit at the point of writing unless otherwise specified.

I Want To Hear From You

Have constructive commentary to improve our thesis? Spotted a critical gap in our view? Saw something important that we didn’t? Agree or disagree? Comment below with the aim of helping everyone in the community to learn better!

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MOD, SMCI either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

A Unique Price Action-based Growth Investing Service

- We believe price action is a leading indicator.

- We called the TSLA top in late 2021.

- We then picked TSLA’s bottom in December 2022.

- We updated members that the NASDAQ had long-term bearish price action signals in November 2021.

- We told members that the S&P 500 likely bottomed in October 2022.

- Members navigated the turning points of the market confidently in our service.

- Members tuned out the noise in the financial media and focused on what really matters: Price Action.

Sign up now for a Risk-Free 14-Day free trial!