Summary:

- MOD remains a Buy after the recent meltdown/ recovery, thanks to the timely investments and strategic capacity expansions during the data center capex boom.

- Combined with the accretive M&A activities and healthier balance sheet, we believe that the company remains well positioned to report robust profitable growth ahead.

- MOD’s strong earnings results and raised guidance also strengthen its Buy investment thesis.

- With the earnings season still ongoing and the stock unable to break out of its resistance levels, readers may want to observe its movement for a little longer before adding.

alacatr/iStock via Getty Images

We previously covered Modine Manufacturing Company (NYSE:NYSE:MOD) in June 2024, discussing its robust prospects, thanks to the growing demand for zero-emission/ high-density cooling solutions for data center/ EV platforms.

This was significantly aided by the divestiture of low growth/ low margin businesses and the acquisition of liquid cooling technologies, allowing the company to tap into the next-gen Data Center infrastructure trends, triggering our Buy rating upon a moderate retracement.

Since then, MOD has charted new heights in the $120s before drastically pulling back, along with other high growth/ semiconductor stocks/ wider market as we enter the Summer Doldrums with August typically being a slower month.

Even so, we are reiterating our Buy rating here, thanks to its double beat FQ1’25 earnings call, raised FY2025 guidance, growing opportunities/ capacity in the data center segment, and healthier balance sheet, which have triggered the stock’s recovery by +19% afterwards.

While the stock may be trading at a slight premium to our updated fair value estimates, we believe that it continues to offer a compelling investment thesis for growth oriented investors.

MOD’s Investment Thesis Is Even More Compelling After The Recent Pullback

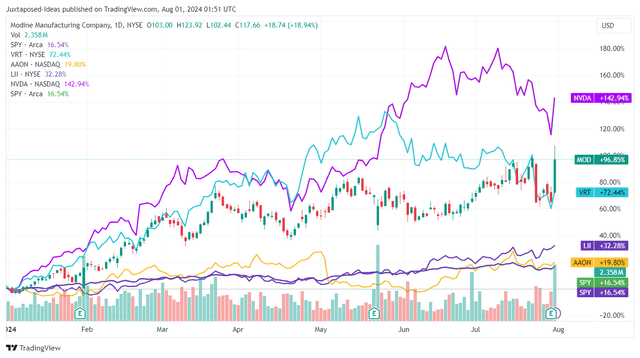

MOD YTD Stock Price

MOD has had a volatile past few weeks indeed, attributed to the ongoing market correction observed in the semiconductor market.

At the same time, with the stock well out performing its thermal management peers and the wider market, the recent pullback has been well warranted, in our honest opinion.

If anything, MOD’s double beat FQ1’25 earnings call, with revenues of $661.5M (+9.6% QoQ/ +6.2% YoY) and adj EPS of $1.04 (+35% QoQ/ +22.3% YoY) continues to imply the robust hyperscaler demand for its thermal management products/ solutions.

Much of its tailwinds are attributed to the Climate Solutions segment with revenues of $357.3M (+35% QoQ/ +10% YoY) and expanding gross margins of 28.2% (+2.3 points QoQ/ +1.8 YoY), due to the higher sales and ASPs – resulting in +138% YoY increase in sales for data center cooling products.

These numbers well balance the ongoing correction observed in the Performance Technologies segment with revenues of $309M (-10.2% QoQ/ -9.9% YoY), attributed to the softer automotive demand.

Even so, we are not overly concerned indeed, since it is apparent that MOD’s management continues to deliver a favorable sales mix as observed in growing bottom-lines, with the recent Scott Springfield acquisition (indoor air cooling in hyperscale and colocation data center) being highly strategic and accretive to its existing portfolio.

The same has been observed in the raised FY2025 midpoint guidance to net sales growth of +8.5% YoY and adj EPS growth to $3.80 (+16.9% YoY), up from the original midpoint guidance of +7.5% YoY and $3.70 (+13.8% YoY), respectively.

These numbers are impressive indeed, partly attributed to MOD’s higher capital expenditures of $100.2M over the last twelve months (+80.8% sequentially).

This strategy has already allowed the management to drastically expand its data-center related capacity by double on a YoY basis, thanks to the power hungry server racks requiring highly efficient cooling solutions.

Combined with the “long term strategy of building out capacity for $1 billion,” it goes without saying that MOD remains well capitalized to report robust profitable growth over the next few years, significantly aided by the positive Free Cash Flow generation and healthy balance sheet.

We maintain our belief that generative AI and the resultant data center capex boom remain sustainable despite the recent meltdown observed in the stock market, with the world’s largest semiconductor foundry by market share, Taiwan Semiconductor (TSM), still raising capex to capture growth opportunities.

The same has been reported by data center REITs, such as Digital Realty Trust (DLR) and American Tower (AMT) in their latest earning calls, as they seek to incrementally increase their build outs “to maximize sellable capacity on the back of ongoing record demand.”

As a result, we believe that Gartner’s projections of the global spending on public cloud services growth from $561B in 2023 to $823B by 2025, expanding at a CAGR of +21.1%, with “AI-related workloads driving a significant portion of this growth,” have not been overly aggressive indeed, with these developments continuing to highlight the robust multi-year data-center investment period.

So, Is MOD Stock A Buy, Sell, or Hold?

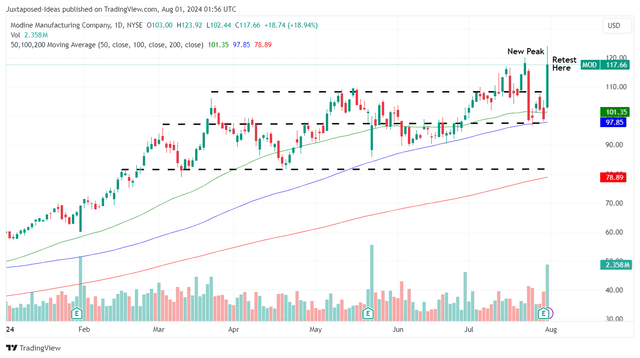

MOD YTD Stock Price

For now, MOD has already recovered most of its recent losses after the excellent FQ1’25 earnings call, while appearing to retest its previous resistance levels in the $117s.

For context, we had offered a fair value estimate of $89.20 in our last article, based on the FY2024 adj EPS of $3.25 (+66.6% YoY) and the FWD P/E valuations of 27.47x.

Based on MOD’s raised FY2025 adj EPS guidance of $3.80 at the midpoint (+16.9% YoY) and the stable P/E valuation of ~27x on a YTD basis, it appears that the stock is finally trading nearer to our updated fair value estimate of $102.60.

There remains an excellent upside potential of +28.5% to our reiterated long-term price target of $151.30 as well, based on the stable consensus FY2026 adj EPS estimates of $5.51.

As a result of the still attractive risk/ reward ratio, we are maintaining our Buy rating for the MOD stock here.

Risk Warning

On the other hand, readers must note that MOD’s short interest continues to grow to 6.56% at the time of writing, up from the start of the year at 4.2% and a year ago at 2.2%, worsened by the ongoing profit taking and market volatility.

With the calendar Q2’24 earning season still ongoing and the stock seemingly unable to break out of its previous resistance levels in the $117s, there may be moderate uncertainty in the near-term as the CBOE Volatility Index remains elevated.

At the same time, while MOD has projected inline FY2025 capex and Free Cash Flow on a YoY basis, readers must also monitor the management’s ongoing acquisition sprees, with any further M&A activities potentially triggering higher debts/ interest expenses in an elevated interest rate environment – triggering potential impact on its bottom-lines.

Therefore, while we maintain our optimism surrounding its robust long-term prospects, investors may want to time their entry point upon a moderate retracement to its previous trading ranges of between the $108s to $98s for an improved margin of safety.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.