Summary:

- Modine Manufacturing’s strong margin expansion, fueled by data centers and a sales mix-shift, is seemingly underappreciated by the market.

- This makes the company’s valuation attractive relative to its growth and profitability prospects.

- Yet, as I have concerns about the company’s end-market concentration and dependence on continuing AI-demand, I rate the company a “Hold”.

XH4D

Investment thesis

The company’s stock has done amazingly well, as both Modine Manufacturing’s (NYSE:MOD) management and the market have high expectations for revenue growth and rapid margin expansion based on data center demand and a mix-shift from components to systems.

Modine Manufacturing Overview

Founded in 1916, Modine designs and manufactures thermal management components and systems, these are split into two segments:

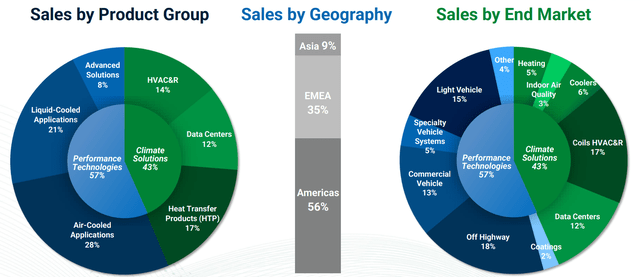

Performance Technologies are mostly used in the automotive and vehicle sectors, with the industry holding a 51% revenue share, as evidenced by the revenue split which is to be seen below. Here, electric vehicles are a major growth driver. They are also employed in industrial and residential applications, however.

Climate Solutions are components for HVAC&R manufacturers or are used to cool buildings, and importantly data centers. These are the current growth and margin expansion drivers for the company. What is important to note is that the sub-segment “Heat Transfer Products” also has some data center exposure.

Modine revenue breakdown by geography, segment and end market (MOD Investor Presentation)

A globally diversified manufacturing network helps the company to not be dependent on a single country, while most sales are in stable geographies, mainly the US and Europe.

The company has stated that as part of its “80/20-strategy”, meaning that 20% of work delivers 80% of the results, it will focus and invest in the parts of the business that can achieve the highest growth and the strongest margin expansion.

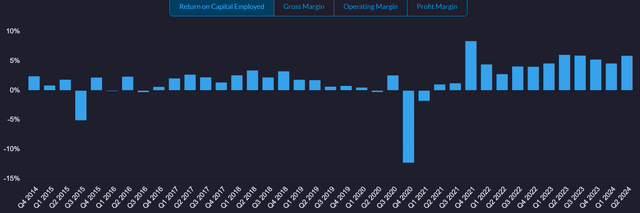

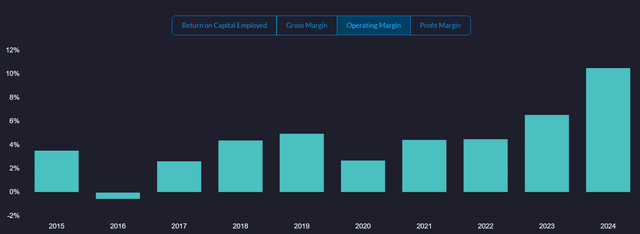

Interestingly, the success of this approach can be seen in its recent returns on capital employed (ROCE), a metric that tracks the returns the company achieves when deploying capital:

Modine’s quarterly ROCE over the last decade (Qualtrim)

Subsequently, as the company aims to increasingly move from merely supplying components to offering entire systems, controls, and software, it has signaled strong margin expansion to the market. This is also the reason its stock price has increased by almost 10x over the last 3 years, despite the company mainly losing value for much of its 20-year public life.

Moat

Scale

Through superior manufacturing scale and its global footprint, the company has more flexibility and resilience to offer to customers who rely on Modine’s components and systems than smaller contenders or competitors from Asia, which might carry geopolitical risks.

Technology

With Modine being the most technologically differentiated manufacturer for some of its sub-segments, I can see a moat based on technology.

However, this is only true for some of its sub-segments, like Air-Cooled Applications, I can therefore not see a significant moat for the entire company. As I also don’t see a commoditization for most of the company’s offerings, as evidenced by the company’s higher value-add and resulting margin expansion, I see MOD’s moat as small or narrow.

Over time, with the company shifting to more offerings that add more value to its customers, it’s possible that MOD’s moat evolves as it has in the last few years.

Financials

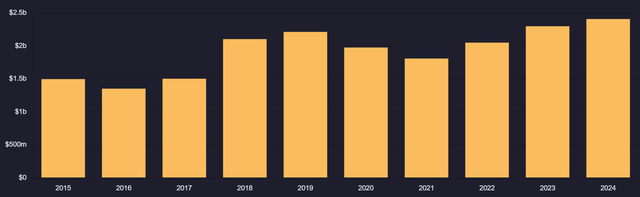

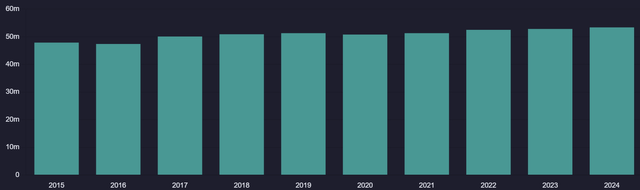

Modine Manufacturing’s revenue has grown nicely over the last decade. Although, as characteristic for industrial companies and suppliers, with a bit of volatility between the cycles:

MOD annual revenue for the last decade (Qualtrim)

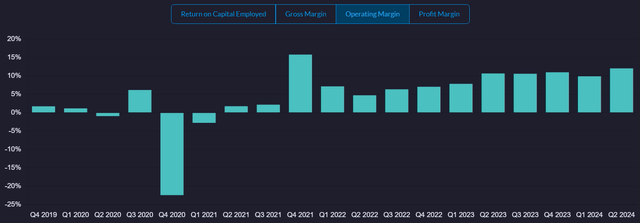

Although looking at Modine’s operating margin development over the last 5 years, it is evident that management has managed to deliver amazing performance regarding margin expansion.

MOD’s quarterly operating margin over the last 5 years (Qualtrim)

It is important to realize how significant this development is. The annual operating margin chart for the last decade should help to visualize this:

MOD’s annual operating margin of the last 10 years (Qualtrim)

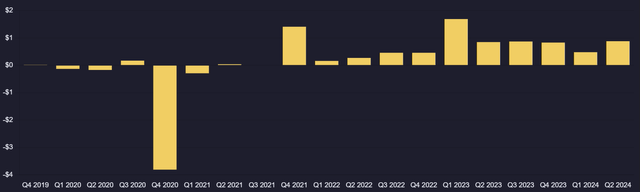

The Earnings per Share (EPS) have consequently closely followed:

MOD’s quarterly EPS over the last 5 years (Qualtrim)

Modine’s long-term debt stands at $404m as of 1Q25, which is the last reported quarter. With $73m in cash and $115m in stock-based compensation adjusted-FCF in the last year, these are acceptable levels, and servicing them should be no problem even if growth stagnates from here on.

While it has not hurt shareholders so far, as shares are up over 1000% in the last 36 months, continuous dilution by about 1% per year is evident, and something investors might want to keep an eye on – especially if growth, and with that likely demand for shares, slows.

Modine Manufacturing shares outstanding (Qualtrim)

Valuation

Analyst EPS estimates (SeekingAlpha)

| Company | Modine Manufacturing Company |

| TTM P/E-multiple | 41.35x |

| 3y Revenue CAGR estimates | 9.1% |

| 3y EPS CAGR estimates | 21% |

| 3y PEG-ratio | 1.97x |

*Using Seeking Alpha’s non-GAAP numbers based on 10/4/24 share prices at closing

Something to note is that I’m using the lower of the two analyst estimates for FY2027, as the average would likely be distorted due to the low number of data points.

Looking at historical metrics makes little sense to me, as the company is more profitable and growing faster than ever. This, at least to some extent, justifies the P/E, P/FCF, and other metrics being multiple times that of where they were before MOD’s breakneck margin expansion.

Therefore, I will take a different approach.

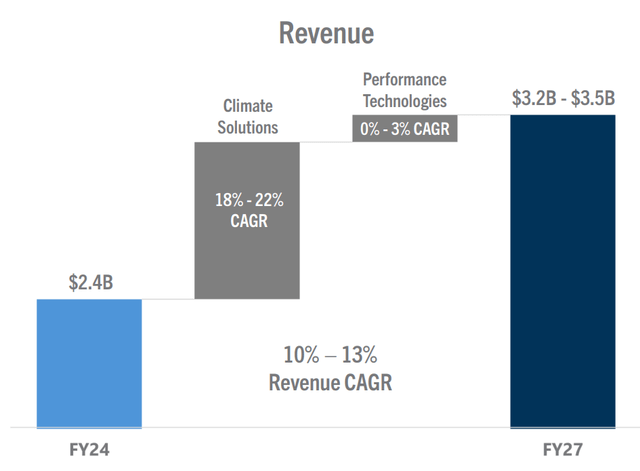

As we can see from the company’s Investor Day presentation, management guides for 11.5% revenue growth at the midpoint – which is more than 2% above the 9.1% analysts currently expect:

MOD Investor Day revenue growth forecasts (MOD Investor Day presentation)

However, what is also visible is just how dependent the company is on data center cooling, the growth of which it estimates at 50% CAGR until 2027.

Further, the company has guided for 20-25% earnings growth at its Investor Day between 2025 and 2027 – also well above analyst estimates.

Taking these two guidance points into account, together with being valued in line with the market which also trades on a PEG-ratio of 2 (30 P/E and 15% earnings growth), I think that Modine is fairly valued here. However, that assumes management can achieve its guidance. Fortunately, management has a good track record of capital allocation and value generation and has a majority of their publicly known investments in the company.

I view the spread between the analyst estimates and management guidance similar to a margin of safety here, which is why I think that the valuation is fair at the current price.

That fair value estimate only takes into account the quantitative part of the valuation. From a qualitative perspective, I see the issue of little downside protection due to hardly any recurring revenue and an enormous spread between the company’s segments that considerably contribute to performance (Climate Solutions) and those that can’t as much (Performance Technologies).

Risks

AI

As most of Modine’s growth, and a lot of its margin expansion, comes from supplying data centers with cooling solutions, the growth and adoption of data centers – and by that AI and data transfers – is very important for Modine. Although the company is still a “good business” without data center exposure, it is priced very ambitiously, and it is impossible for the company to achieve its goals or the market estimates without continued data center demand.

Valuation

Should the company overestimate the growth and profitability it can deliver, it might lead to relative or perceived underperformance on the company’s side, possibly leading to the stock price suffering. This is also a possible scenario should growth or profitability come to a sudden halt.

End-market concentration

Automotive and data centers have different roles for MOD, the former making up the majority of MOD’s existing revenue and the latter being responsible for the majority of the company’s growth and profitability. This means end market concentration risk for investors, as automotive is cyclical and data center demand is hard to predict over the medium term.

Mitigation

A possible way to mitigate valuation risk is to only initiate a partial position in MOD, as drops in its share price – rational or not – are possible and, depending on the reason, could be taken advantage of by quick-moving investors.

Turning to AI as a risk; for investors who are weary of the data center and AI boom, tracking the exposure to these themes across their entire portfolio and actively managing it likely makes the most sense. In my opinion, as the runway is still uncertain for most AI applications, prudent portfolio management implies this regardless.

Conclusion

Although I believe there is a good chance Modine can outperform over the medium term due to high growth, relative to what investors would be paying for it, I rate Modine a “Hold”. This is because I am concerned about the underlying market exposure and performance drivers being highly concentrated. Further, these performance drivers might possibly come to a halt abruptly, should major spenders see too little benefit. Beyond that, I have an aversion for companies that don’t have a very dominant and well-defined moat source as this makes defending and growing the business much harder and increases risk.

Investors who have more belief in AI and data centers continuing their path of high growth over the medium to long term will likely find good value at the current price.

Still, I advise investors to keep an eye on the company’s moat and end markets, as I see those as the highest risk to growth and profitability – which are the fundament the company’s performance is built on. With those concerns, I don’t see MOD as a core position to any portfolio, despite the, in my opinion, good prospects for the company.

However, should the share price drop to more attractive levels, providing a larger margin of safety, I can see Modine be an attractive way to play the AI boom for myself.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Although I aim to always give actionable recommendations based on doing my research to the best of my abilities, this should never be seen as investment advice – please never skip doing your own research.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.