Summary:

- Since November 2022, Modine Manufacturing stock has risen by an impressive 462%, which is phenomenal compared to any broad market index.

- Modine’s management sees significant opportunities in data centers, strategically acquiring TMGcore and Scott Springfield and enhancing cooling technology and capacity.

- I think the rally has gone too far. Despite the clear fundamental growth drivers, the current valuation of the Modine stock can’t be justified by the firm’s expected EPS growth.

- Even if we assume that the company will beat the FY2025 EPS consensus by 10%, the fair value will be approximately $108 per share, which is below the current stock price by ~8.5%.

- I’ve decided to leave my rating unchanged at ‘Hold’ ahead of the company’s report for Q1 FY2025.

designer491/iStock via Getty Images

Intro & Thesis

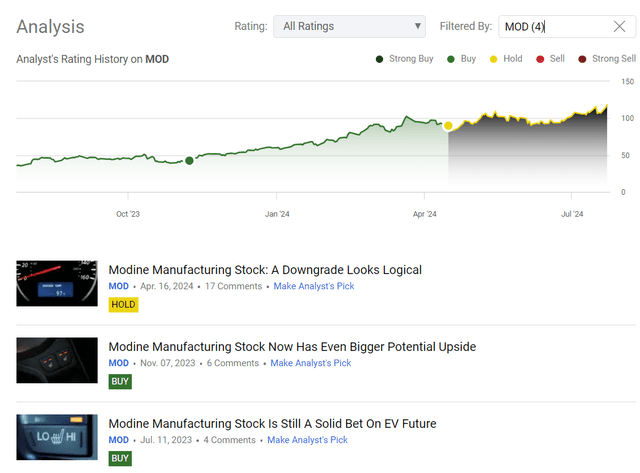

I’ve been covering the Modine Manufacturing (NYSE:MOD) stock here on Seeking Alpha since November 2022. Since then, the stock has risen by an impressive 462%, which is phenomenal compared to any broad market index. However, my bullish rating shifted to neutral in mid-April of this year (despite that, the MOD stock continued to grow further).

Seeking Alpha, my coverage of MOD stock

Anyway, I believe the thesis of my last article remains relevant: I think the rally has gone too far. Despite the clear fundamental growth drivers, the current valuation of the Modine stock can’t be justified by the firm’s expected EPS growth in future periods.

Why Do I Think So?

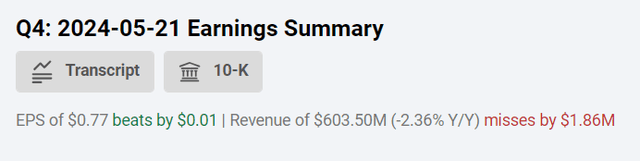

In May 2024, Modine reported its Q4 of fiscal 2024 with revenue of $603.5 million, down 2% YoY because of the $24.2 million impact from businesses divested during the quarter (organic sales were basically flat YoY). Nevertheless, the gross profit surged by 22% YoY with the gross margin improving by 420 b.p. to 22.4% due to the “ongoing 80/20 initiatives, higher average selling prices, lower material costs, and a favorable sales mix”, the management commented in the press release. The SG&A costs ticked down a bit, but because of higher restructuring costs (primarily related to “headcount reductions and consolidation of technical services”), the EBIT amounted to $46.8 million, down 3.5% YoY. However, the adjusted EBITDA, which excludes restructuring expenses and other specific charges, increased by 20% to $78.8 million compared to $65.5 million in the prior year. So as a result, the firm’s net earnings per share amounted to $0.77, plus 15% to what we saw last year. The bottom line result beat the consensus figure marginally by 1 cent, while the top line slightly missed by less than $2 million:

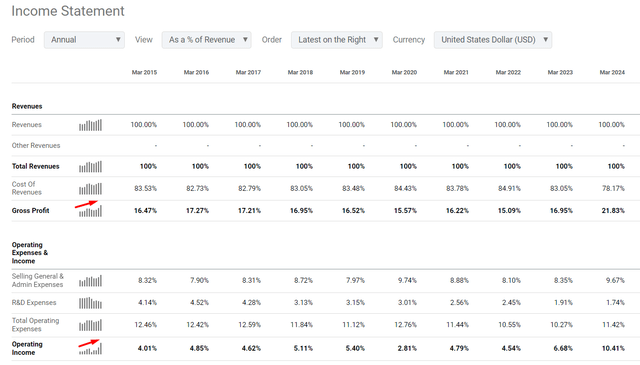

In general, despite the mixed results, looking at the long-term development, it’s impossible not to notice that Modine has continued its qualitative growth and expansion driven both by both top-line expansion and improved margins, a trend I have consistently highlighted since I began covering the company here on SA.

Seeking Alpha, MOD’s IS, the author’s notes

The company’s rapid expansion is evident in both its improving margins and overall revenue growth maintained across both the Climate Solutions Segment (CSS) and the Performance Technologies Segment (PTS). In Q4 CSS’ revenue increased by just 1%, but there was an uptick in demand for data center cooling products after the acquisition of Scott Springfield Manufacturing on March 1, 2024 (partially offset by “lower sales of heat transfer products, hence the modest growth rate”). But again, the GP margin went up by 270 b.p. YoY, leading to EBIT soaring by 15% YoY. On the other hand, PTS’s revenue decreased by 5% YoY due to divestitures, but on an adjusted basis PTS would have grown by 2% organically, driven by “higher sales to off-highway and specialty vehicle customers, partially offset by lower sales to automotive customers”. The segment’s GP margin improved even more significantly – by 600 b.p., to 20%.

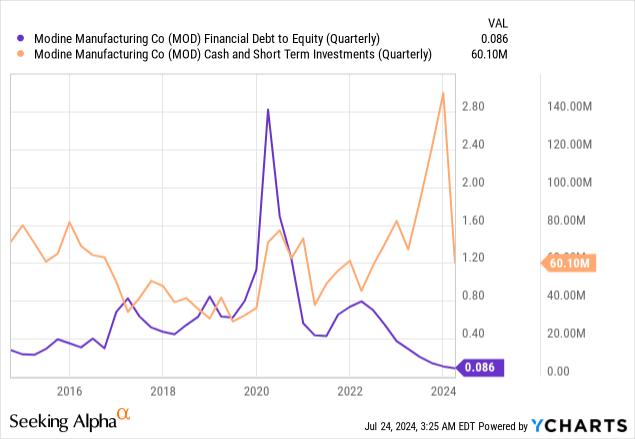

Management definitely sees great opportunity in the development of data centers as during the past few quarters Modine strategically strengthened its core operations acquiring TMGcore and Scott Springfield, thereby bolstering its data center cooling technology and capacity. Simultaneously, following the 80/20 principle, they divested non-core assets, including automotive operations in Germany and coatings businesses in the US, aligning their portfolio with high-margin, high-growth markets. And as we could see from Q4 results, this strategy is indeed working, as margins continue to grow. At the same time, this business shift is taking place against the backdrop of a relatively stable balance sheet condition: the net debt increased by only $86 million (the acquisition of Scott Springfield is to blame here), but on the other hand, we see from the debt-to-equity ratio that Modine’s leverage hasn’t actually increased that much.

While Modine spent on CAPEX a bit more than they initially anticipated due to the purchase of a new UK manufacturing facility, the company anyway generated $127 million of free cash flow in Q4 – that’s an improvement of $70 million compared to the prior year.

I think it’s logical to assume that data centers will be the main growth driver for at least several years into the future. After the company acquired new assets and divested some old ones, I believe its updated revenue structure will lead to more stable growth rates than before.

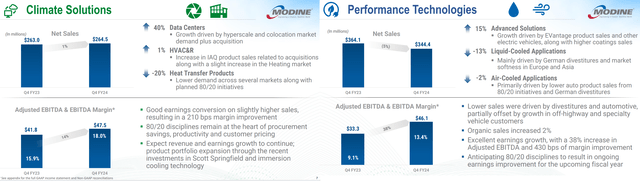

Having such a solid performance behind its back, the management provided forecasts for the 2025 fiscal year, expecting further expansion in sales and anticipating adjusted EBITDA in the region of $365 million to $385 million, which would correspond to an increase of 20% compared to FY2024. They also aim to meet or exceed the FCF of 2024 thanks to a favorable impact from “higher employee compensation, pension contributions, restructuring costs, and potential cash advances from data center projects.”

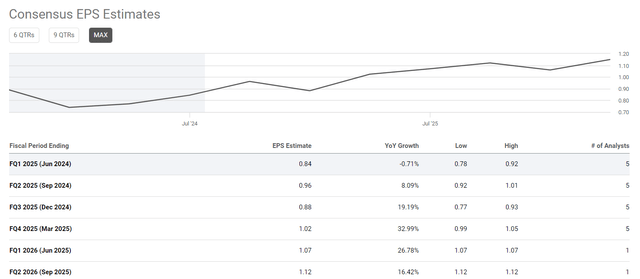

From what I see today, the market has faith in management and expects the company to grow its EPS at a CAGR rate of ~14.1% over the next 3 years. This is fast enough when we look at historical expansion, especially compared to pre-COVID norms. I think these growth rates are feasible given that the data center revenue share ticks up after the newly acquired assets are fully integrated into the existing business ecosystem.

As for the shorter-term outlook, I don’t have the management’s guidance specifically for the first quarter of the fiscal year 2025 (the firm is set to report for it on July 31, 2024). But I believe Modine Manufacturing has a chance to beat the consensus because it looks relatively moderate – the market anticipates a small drop in the company’s EPS on a year-over-year basis. I think that if the business momentum we saw at the end of the 2024 fiscal year continues, even considering seasonality, there’s a good chance of beating.

What confuses me, however, are the relatively high valuation multiples MOD trades at as of today.

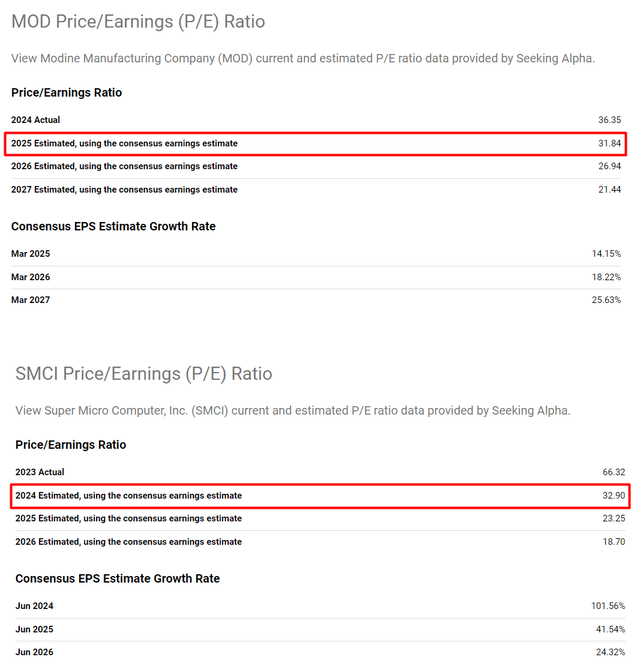

According to Seeking Alpha Premium, Modine Manufacturing is trading at almost 32x its projected earnings per share for FY2025 – this is almost comparable to Super Micro Computer (SMCI), which trades at ~33x next year’s earnings. However, SMCI has a more specific focus on data centers, unlike Modine Manufacturing, so I believe the former should have a larger premium.

Seeking Alpha, the author’s notes

Also noteworthy is the fact that Modine doesn’t have the same level of multiple contraction projected for the next few years ahead as we see in the case of Super Micro. This primarily stems from the fact that Modine’s EPS figures are projected to grow significantly weaker than its more data center-centric peer.

Based on this, I conclude that, most likely, Modine Manufacturing, despite all its strengths, has simply gone too far in terms of valuation. I think a fair value multiple for MOD is in the region of 25-28x. This implies an overvaluation of the current share price by about 20% (if the current consensus in terms of EPS is correct). Even if we assume that the company will beat the FY2025 EPS consensus by 10%, the fair value, will be approximately $108 per share, which is below the current stock price by ~8.5%.

The Bottom Line

The dream of every investor in small and mid-cap companies is to find a company with clear prospects for sales growth that is simultaneously making active efforts to stabilize and expand margins. This is exactly the case with Modine Manufacturing. In my opinion, it’s a very promising company, but whose valuation has gone too far thanks to the strong rally in recent months. I see no reason to pay 30 times net earnings for this company, despite the qualitative change that the 80/20 strategy has brought recently, and the growth potential through the development of the data centers business.

Therefore, in my opinion, Modine should be trading at a discount compared to companies like Super Micro Computer, which is more specialized in data centers. My calculations lead me to the conclusion MOD should only be considered for purchase after a noticeable correction from the current price level. Therefore, I’ve decided to leave my rating unchanged at ‘Hold’ ahead of the company’s report for Q1 FY2025.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!