Summary:

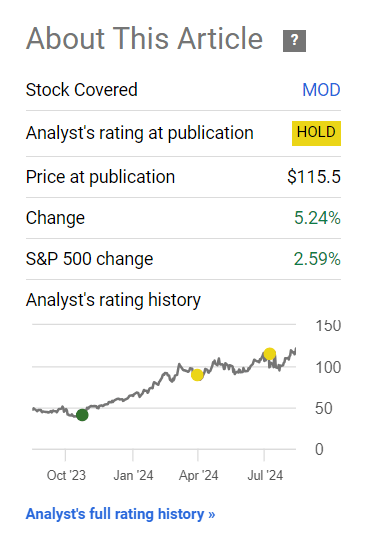

- Modine Manufacturing stock has surged by 478% since I initiated its coverage on SA, significantly outperforming market indices. Initially rated bullish, my stance shifted to “Hold” despite the continued rally.

- I like what I see in Modine’s segment performance in Q1 FY2025. The management anticipates 40-50% organic growth in the data center business for the year.

- Notably, Modine’s leverage ratio improved from 1.2x to 1.1x in the past year. The FCF generation capacity looks great as well.

- Although the momentum is still there, I believe MOD’s potential is likely capped as the stock’s valuation expanded too much, in my opinion, by almost every metric.

- I have decided to reiterate my “Hold” rating today.

hadynyah/E+ via Getty Images

Into & Thesis

I’ve been covering the Modine Manufacturing (NYSE:MOD) stock here on Seeking Alpha since November 2022. Since then, the stock has risen by an impressive 478%, which is phenomenal compared to any broad market index. However, my bullish rating shifted to “Hold” in mid-April of 2024. In my last update (July 2024), I noted significant opportunities Modine had in data centers after it strategically acquired TMGcore and Scott Springfield and enhanced cooling technology and capacity. On the other hand, I assumed that MOD’s rally had gone too far: I calculated that even if MOD beats its FY2025 EPS consensus by 10%, the fair value of the stock would be ~$108/share – a bit below the stock’s price at the time.

Despite that conclusion of mine, the MOD stock continued to grow further, outperforming the S&P 500 index.

Seeking Alpha, my last article on MOD

Although the momentum is still there, I believe MOD’s potential is likely capped as the stock’s valuation expanded too much, in my opinion, by almost every metric.

Q1 FY2025 Results Analysis

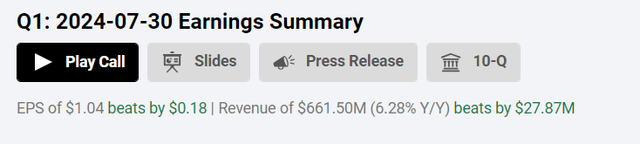

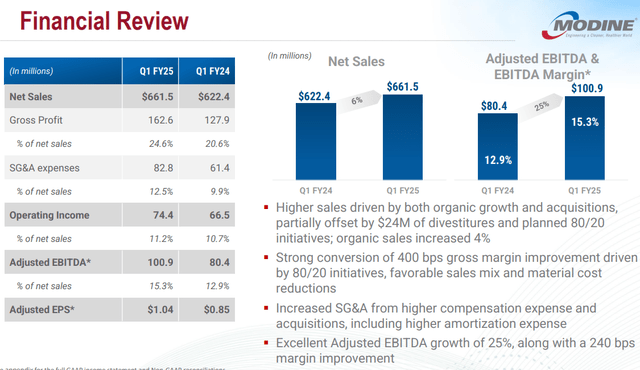

Modine Manufacturing demonstrated great performance during Q1 FY2025: its net sales increased by 6.33% YoY to $661.5 million, driven by both organic expansion and acquisitions, partially offset by $24 million in divestitures and planned 80/20 initiatives. As the IR materials say, the consolidated organic sales grew by 4% YoY, which looks great amid the ongoing margin expansion – gross profit margin expanded from 20.6% to 24.6%, a 400 basis point improvement driven by “80/20 initiatives, favorable sales mix, and material cost reductions.” MOD’s EBIT as a percentage of sales increased from 10.7% to 11.2%, while adjusted EBITDA grew by 25% YoY to $100.9 million (with the margin improving by 240 basis points to 15.3%). So all that led to an adjusted EPS increase of ~22.35% (from $0.85 to $1.04) – way more than Wall Street expected for the quarter:

Seeking Alpha, MOD

I like what I see in Modine’s segment performance in Q1 FY2025.

The Climate Solutions segment had another exceptional quarter, significantly benefitting from the Scott Springfield and Napps acquisitions. CS’s Data Center sales saw a remarkable increase of 138% YoY, with new data center capacity expected to come online later in the year. The management says Modine is responding to the growing demand for hybrid data center solutions that combine air and liquid cooling products “to optimize cooling efficiency and minimize energy consumption.” Modine is also launching a new Cooling Distribution Unit (CDU) that should integrate with their other data center products, with first shipments anticipated in Q4 FY2025. I definitely like the fact that the Data Centers have now completely offset any weaknesses in the Heat Transfer Products sub-segment (the sales there are down over 20% YoY in Q1) – diversifying and re-focusing on the higher-margin and higher-growth areas does its job; the 80/20 program initiatives seem to be working well.

Looking at the Performance Technologies segment, I see that its sales volumes keep suffering driven primarily by “German divestitures and lower end market demand across auto”. On the other hand, the segment is experiencing a strategic shift and evolving product mix, which is driving substantial margin improvements: amid organic sales being down 1% YoY, the adjusted EBITDA margin went up by 25% (+390 b.p. in margins, YoY). The company also announced the launch of the Evantage Advanced Cabin Climate System, “designed to provide cabin heating and cooling for commercial, off-highway, and specialty electric vehicles.” So as Modine continues to reduce costs related to legacy businesses and is exploring opportunities to accelerate exits where possible, I think that today’s temporary operational weaknesses in select business areas shouldn’t impede overall growth in earnings and free cash flow going forward.

MOD’s IR materials

By the way, speaking about Modine’s ability to generate FCF: last quarter they made a positive free cash flow of $14 million, which I believe was a promising start to the fiscal year. This cash generation contributed to a $9 million reduction in net debt, bringing the total to $363 million as of June 30. Notably, Modine’s leverage ratio improved from 1.2x to 1.1x for the past year, which is also a great sign not just for the business’s creditworthiness, but also for the stock’s valuation (less leverage typically leads to higher valuation premium to peers).

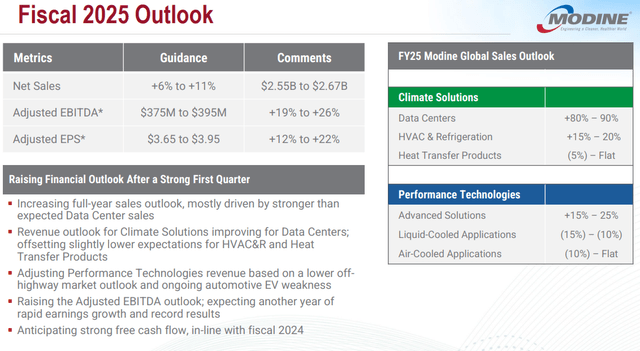

On the earnings call, we found out that the Performance Technologies segment may see a dip in Q2 and Q3 “due to seasonal factors and softness in off-highway markets”, but on the other hand, the company raised its full-year guidance, with Climate Solutions expected “to have relatively consistent revenue for the rest of the year”:

MOD’s IR materials

It’s encouraging to see that the management expects 40-50% organic growth in the data center business for the full year, while the new manufacturing capacity is being “added in line with the market CAGR over the next 3 years”. So based on what I see, it’s clear to me that the business is developing very actively, which, against the backdrop of the continuation of the 80/20 initiative (they’re still targeting ~$100 million of revenue rationalization each year), could lead, if not to an acceleration, then at least to the maintenance of high EPS growth rates over the next 2-3 years.

But what about Modine’s valuation?

Valuation Update

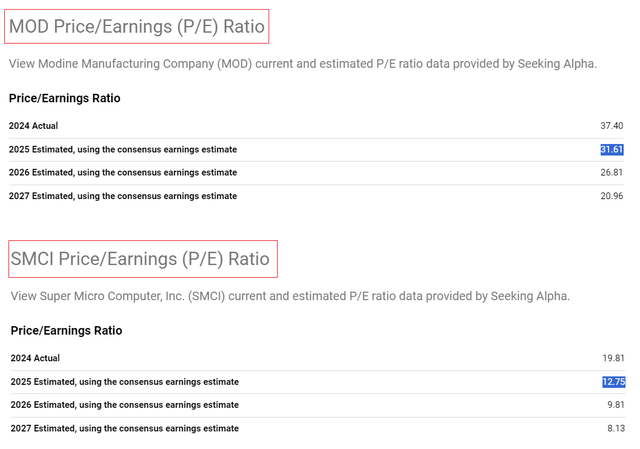

Modine stock is now trading at one of the most expensive multiples in its public history, while the other peers are clearly struggling to maintain their valuation premium. According to Seeking Alpha Premium, Modine is currently trading at ~31.6x its projected EPS for FY2025 – this is >2.5x more compared to Super Micro Computer (SMCI), which trades at only 12.75x next year’s earnings. However, SMCI has a more specific focus on data centers, unlike Modine Manufacturing, so I believe the former should have a larger premium.

Seeking Alpha Premium’s data, the author’s notes

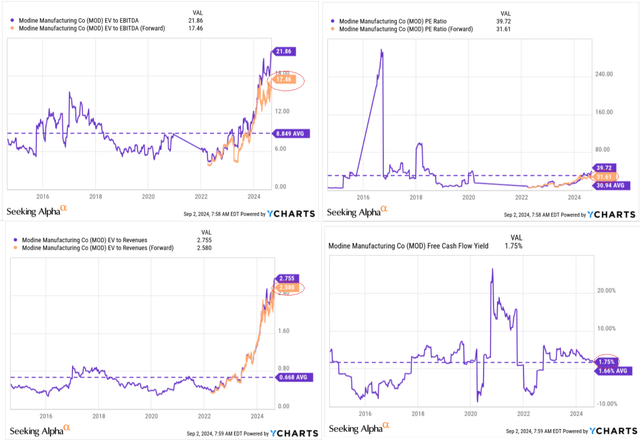

Modine’s overvaluation is also evident from the EV/EBITDA and EV/Sales multiples, which exceed 17x and 2.5x, respectively, based off of next year’s consensus numbers – which is quite high on an absolute basis.

YCharts, the author’s notes added

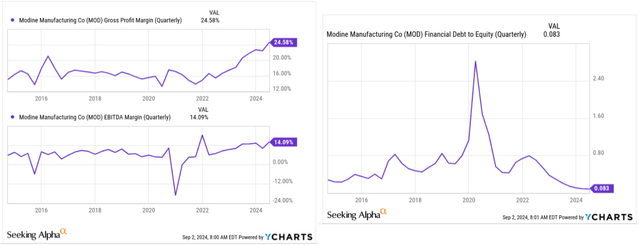

But of course, there’s a logical explanation for this: MOD’s margins and overall profitability ratios have skyrocketed in recent years, while the leverage ratio (D/E) continues to fall (which, as I wrote above, also provokes the emergence of a valuation premium).

YCharts, the author’s notes added

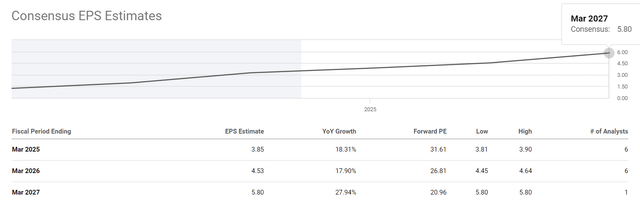

At the same time, in my opinion, the market is already pricing in the lion’s share of future growth, the prospects for which I write about in the first part of my article today. According to today’s consensus estimates, MOD’s 3-year EPS CAGR should be 14.6%, which looks pretty impressive.

Seeking Alpha, MOD

I’m not saying that these growth rates will be impossible to achieve – I’m just saying that they may be already in the stock price. Modine has already reached its all-time highs in margins, and while other companies are struggling to increase (or at least maintain) their marginality levels, MOD’s 80/20 strategy continues to work. But how long the positive effect will last, nobody knows. I think the earnings per share growth rate should begin to decline by the end of 2025 or early 2026 as the company has reached a consistently high margin and its sales don’t expand by much; all that should theoretically lead to multiple contraction. But that’s just my guess, of course.

The Bottom Line

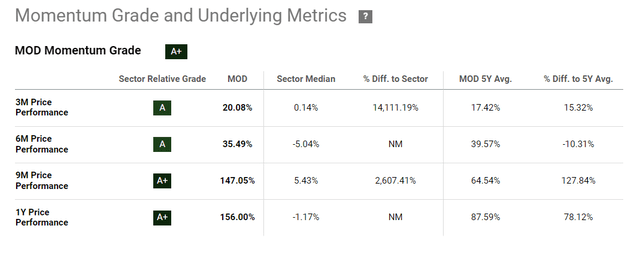

I really like the way the company has grown and developed over the last few quarters. Obviously, my mid-April 2024 downgrade was a bit premature, as the Q1 FY2025 report made it clear that cost optimization efforts keep going amid attempts to settle on the data center market. However, I don’t like the multiples at which the stock is trading today: 17x EV/EBITDA seems too high to me, even taking into account that EBITDA margins continue to rise. Perhaps the stock’s upside potential is not yet exhausted – the momentum factor looks stunning.

Seeking Alpha, MOD’s Momentum Factor

However, from a fundamental analysis perspective, I fear that MOD is close to a natural plateau in terms of margins. If so, the current EPS consensus is probably too optimistic, which could put pressure on the stock in the medium term. With this in mind, I have decided to reiterate my “Hold” rating today.

Thank you for reading!

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Hold On! Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!