Summary:

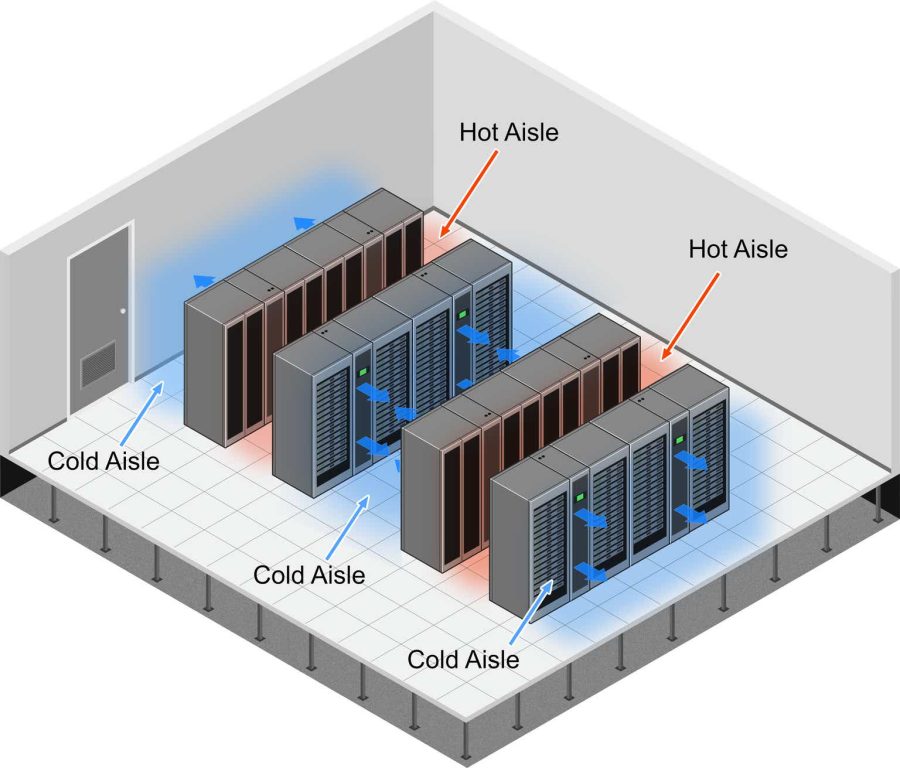

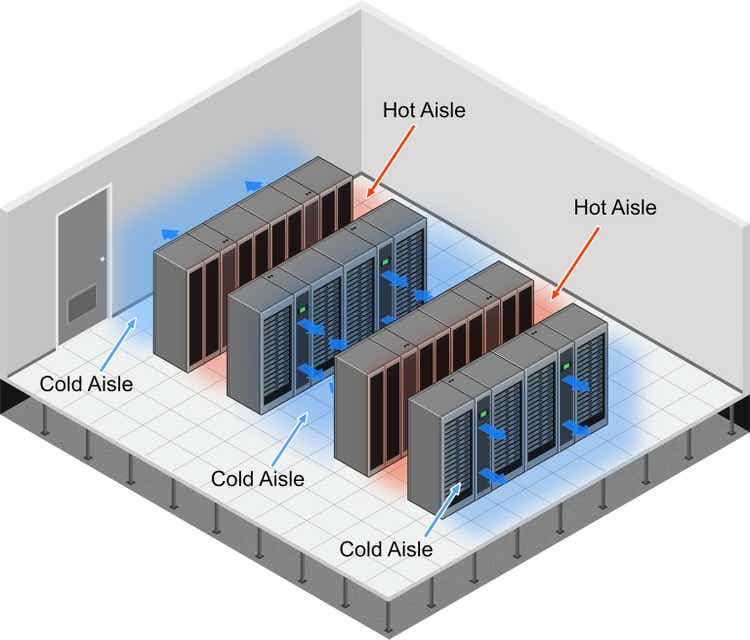

- The company announced to make acquisitions with a focus on data centers rather than automotive industries, which confirmed our previous prediction.

- The acquisition of Scott Springfield Manufacturing aligns with the company’s goals and will expand its reach in high-growth markets and expand customer base.

- The company’s Q3 FY 24 net sales were flat, but improved efficiency led to better gross profit, EBITDA, and EPS. Operating expenses and inventory levels have increased.

befehr/iStock via Getty Images

Investment Thesis

Modine Manufacturing (NYSE:MOD)’s recent announced acquisition focusing on high growth area such as data center confirmed our prediction four months ago. But the latest anemic revenue growth and increasing inventory level shows organic growth hasn’t been in full throttle. The 80/20 rule should eventually lead to more balanced growth. Acquisition is one way to do it, but it could also lead to more divestiture. Either way, there will be costs to pay, which could imply limited scope of further margin expansion until strong top-line growth comes in. The current price run-up is overdone, and we recommend a sell.

Preview & Updates

We previously predicted Modine Manufacturing was going to “make an acquisition or two within the previous purchase price tag range, should an appropriate opportunity arise”. As it announced in February, it was going to make the acquisition of Scott Springfield Manufacturing. We also predicted it would more likely make acquisitions in data centers than in automotive industries, as we stated “In reality, its cooling technology has no problem finding faster growth downstream applications in the Data Centers than in commercial vehicles and automotive industries.” As to the goal of the acquisition, we also speculated “While the previous acquisitions were mostly related to geographical expansion, we expect this coming round will focus more on horizontal integration in specific industries that can consolidate its in-house strength, and vertical acquisitions of some downstream growth to gain more access to customers”. Turns out that Scott Springfield as a “leading manufacturer of air handling units (AHU)”, will “bring Modine a product line and customer base in high-growth markets that fully complement and expand our current reach, including to hyperscale data center operators”. Although we expected one or more deals at a smaller size, just one deal at Scott Springfield’s size can probably make up for them. We feel our predictions four months ago were right on.

According to its acquisition strategies outlined in its presentation, Modine’s “bolt-on target” in FY 2024 has revenue in the range of $25 -100 million. Scott Springfield has revenue of “more than $100 million”. This suggests that this deal is at the top end of its target. It is going to close it with both cash and debt in Q1 of 2024. The company had about $150 million cash-on-hand at the end of December last year. It is likely that when it is done, the cash pile will shrink by a quarter to a half and the debt-to-equity ratio will rise up to above 55%. It is not over-leveraged yet. On the revenue side, gaining $100 million in sales in the data center and similar customer base will likely bring its smallest segment, the data center, to about 10% of its total revenue assuming organic growth within this segment continues. It is still small to make a major impact on its bottom line, let alone not all sales go to the data center segment.

In reviewing its Q3 FY 24, or last calendar quarter of ’23, its net sales were $561.4 million, compared to $560 million a year ago. The flat sales result was boosted by “favorable FX and good growth in target areas, but offset by divestitures and lower HTP sales”. We discussed before that divestitures will increasingly happen given its 80/20 rules to shift focus to the “20” efficient part of the business, while the inefficient 80 will be set up for divestiture. Investors who focus on the gaining of new and more profitable businesses shouldn’t forget about this part.

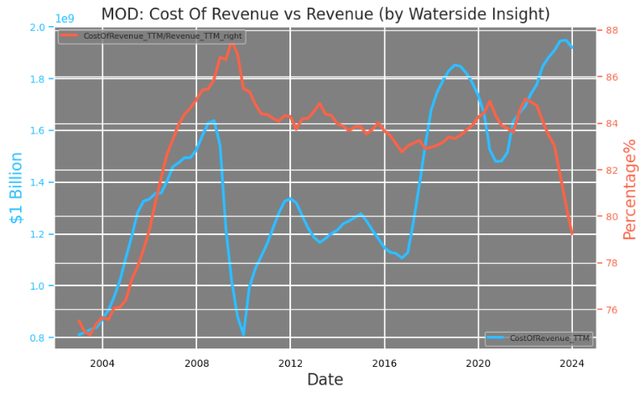

Indeed, the growing gross profit was the direct result of its increased efficiency, or lower cost of revenue for better growth. In turn, this brought in better EBITDA and EPS. How much better can it improve? Twenty years ago, its cost of revenue as a ratio to revenue was as low as about 74% while currently it is at 79%. But its revenue and business scale were much smaller twenty years ago. It took a decisive shift in strategy to shrink it from 85% to 79% in the past two years. The next 5% shrinkage will be much harder to achieve. The reduction in cost of sales comes from sales volume, operating efficiencies and raw material prices, plus FX impact and labor & inflationary costs. Operating efficiencies are only part of it. There is a certain fixture in it that is not only hard to cut down but fluctuates due to the external environment.

Modine: Cost of Revenue vs Revenue (Calculated and Charted by Waterside Insight)

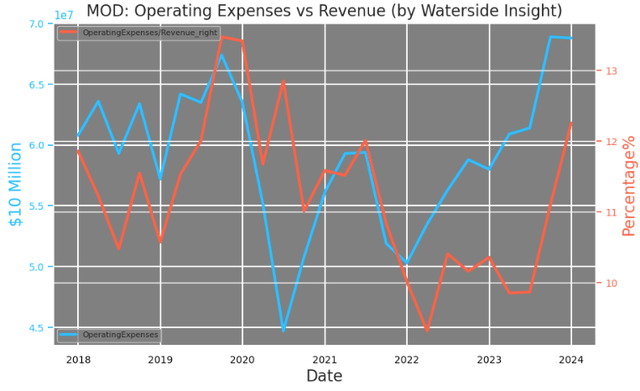

The same reduction cannot be said about its operating expenses. It has risen by almost 40% in absolute value in the past two years or is the highest since 2009. Note that this rise in SG&A expenses is likely to persist regardless of the muted growth of sales, mainly due to employee compensation costs.

Modine: Operating Expenses vs Revenue (Calculated and Charted by Waterside Insight)

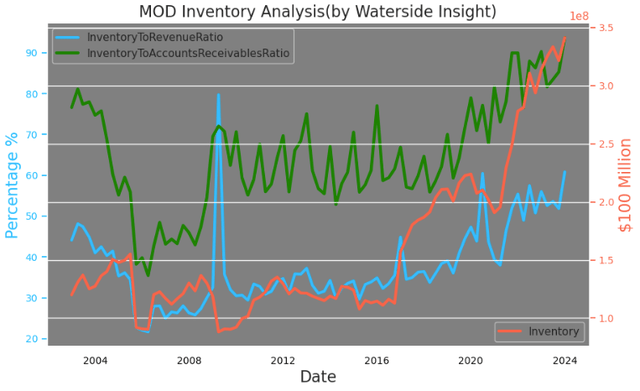

On the other hand, its sales organic growth is not that strong if looking from its inventory point of view. In absolute value, its inventory has grown by almost 75% since the end of 2021. The latest value of inventory has reached about 60% of its revenue and 90% of its accounts receivable. The highest levels in the past twenty years, barring the ’08 period. And if only looking at revenue alone, Modine achieved the current level of revenue back in 2018, but large drops and the subsequent rise-up drove the high volatility in sales in the past six years.

Modine: Inventory Analysis (Calculated and Charted by Waterside Insight)

Getting back to the divestiture if we could, in its presentation, it stated that without the impact of the divestiture, its YoY sales growth in the latest quarter was 3%. It seems the divestiture hasn’t really started yet. On the earnings call, management received similar questions regarding exiting the lower margin business. But the answer was vague. It seems perhaps 4-5% of sales is counted as low margin or another $100 million plus of revenue could be going through simplification. The exact number that could end up being divested is unclear. Even with exiting 5% of sales, it still has 75% contributing 20% of profits. The truth is for the 80/20 rule to show results, a revamp or much larger percentage of divestiture will have to be in order, otherwise it still has 80% inefficient revenue contribution. But management seems reluctant to move further on that yet. Without divestiture, it is likely to hit the ceiling of any more incremental efficiency improvement.

On top of that, its FY ’25 outlook was increasing earnings but lowering full-year sales with a cautious stance. It expects high growth from the data center, which we estimate will not be more than 10% of sales. Over 50% of sales in Performance Technologies will hold up in the new fiscal year but totally 37% of sales in HVAC&R and Heat Transfer Products were expected to have lower sales. Overall it is not a robust top-line growth picture.

Modine wants to do another deal in the range of $300-500 million in FY ’25-’27. That will largely have to be funded by debt, which could bring its debt-to-equity ratio close to 100% or higher, and consume at least $20-30 million of cash. The company’s free cash flow will at least take a hit at first. We want to watch closely whether its top-line organic growth will kick in, because without that, the increase in margin will not last.

Financial Overview & Valuation

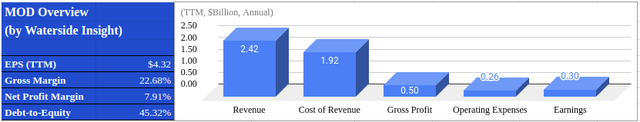

Modine: Financial Overview (Calculated and Charted by Waterside Insight)

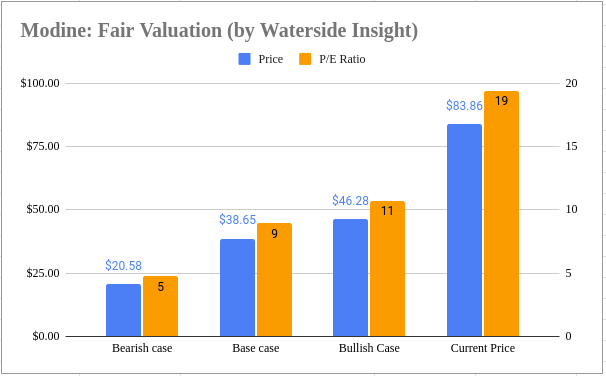

Since our last article, market prices have gone up by another 72%, essentially turning a 2x price increase compared to May 2023 into a 4x jump. We think the market has not fully priced in the impact on its top line from 80% according to its 80/20 rule. Moreover, its organic sales growth is anemic at best, if not taking into account added sales from acquisitions. Modine has done all the right things to boost its growth, but improving efficiency and buying prime assets can only go so far without fully restructuring its assets. The market seems to have run ahead of itself, not only overly optimistic but lopsided in terms of the balance of its growth. Although we are bullish about the stock, the stock price has rich of premium at the moment. We will stick to our previous valuation and consider the current market price overvalued.

Modine: Fair Valuation (Calculated and Charted by Waterside Insight with data from company)

Conclusion

We review the recent updates from Modine Manufacturing and turn our focus to its balance of growth. The fast rise of its inventory is a concern and on top of that we see as potential less room to improve on its margin if it’s only coming from better efficiency without the lead by top line growth. Its stock price’s fast run-up of over 70% in the past four months only strengthens our reason to sell at this point.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.