Summary:

- Modine Manufacturing is a hot stock, with the share price doubling over the last six months.

- The company’s profitability has improved due to a more favorable revenue mix, but I consider this as a temporary strength.

- My valuation analysis suggests that MOD stock is more than 10% overvalued.

PPAMPicture

Investment thesis

Modine Manufacturing’s (NYSE:MOD) stock is really hot now, as it has doubled over the last six months. The current sentiment backed by the robust momentum might fuel a further rally, but the stock is already 14% overvalued. MOD’s fundamentals are decent, but they do not demonstrate that the stock deserves any premium to its fair value. Revenue growth is very modest, and MOD’s profitability does not impress. All in all, I assign MOD a “Sell” rating.

Company information

Modine Manufacturing is focused on thermal management solutions, serving diverse markets including automotive, HVAC, and commercial refrigeration.

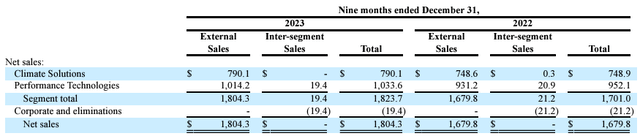

The company’s fiscal year ends on March 31. MOD has two reportable segments: Climate Solutions and Performance Technologies. The latter represented around 58% of the total revenue over the nine months ended December 31, 2023.

Financials

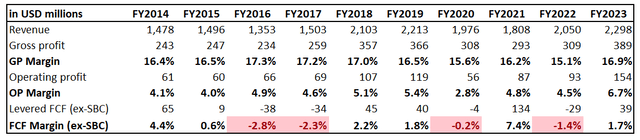

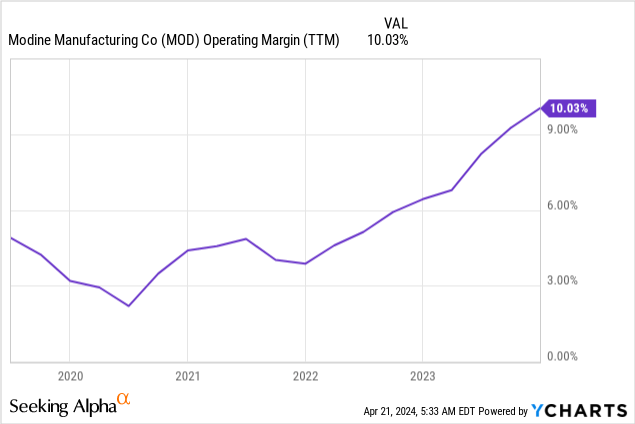

Since MOD is a new company for me, I am starting with zooming out and looking at the company’s financial performance over the last ten years. The company has historically demonstrated a modest revenue growth with a 5% CAGR over the last decade. The operating margin expanded from 4.1% to 6.7% over the same period, which aligns with the modest revenue growth. Despite solid stability in the operating margin, the company’s free cash flow has been volatile and mostly razor-thin.

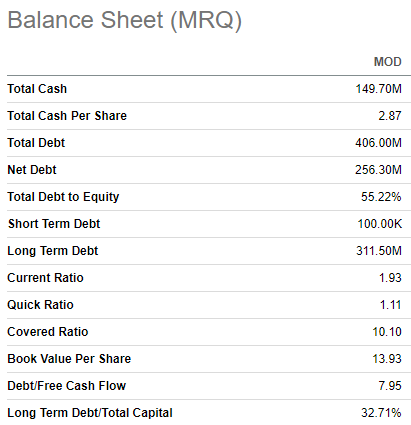

Given the company’s performance over the last decade, I am not surprised that Modine’s balance sheet does not look like a fortress. While most of the metrics [liquidity, leverage, covered ratio] look solid to help the company weather temporary storms, the balance sheet might not be strong enough to endure a crisis which might last longer [a recession, for instance].

Seeking Alpha

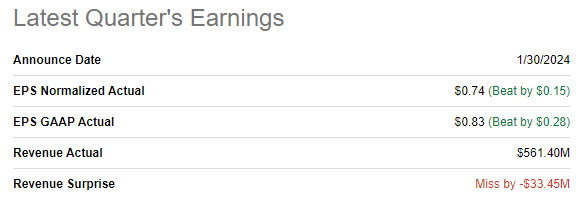

The latest quarterly earnings were released on January 30, when MOD missed consensus revenue estimates but delivered a positive surprise from the bottom-line perspective. Revenue was flat YoY, but the adjusted EPS expanded from $0.48 to $0.74.

Seeking Alpha

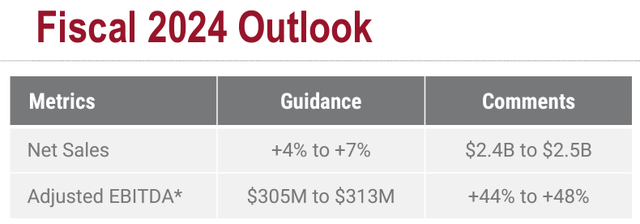

The upcoming earnings release is scheduled for May 24. Consensus estimates expect Q4 revenue to be $606 million, which means a 2% YoY decline. Despite the expected revenue decline, the adjusted EPS is expected to expand from $0.67 to $0.76. There were three upward EPS revisions over the last 90 days, indicating a bullish sentiment around MOD’s upcoming earnings release.

Seeking Alpha

The EPS expansion is a solid positive indicator, especially considering that this improvement has been upgraded thanks to the operating leverage. Margin increase has been achieved thanks to the management’s commercial improvements and productivity enhancements.

Apart from cost efficiencies, the operating margin also benefitted from a more favorable revenue mix. The company’s legacy business, heat transfer products, experiences softness in demand due to the uncertain macro environment and recorded a 21% revenue decline in Q3. This substantial dip has been offset by growth in data center revenue and advanced solutions [specialty vehicle customers and coating sales]. The management expects data center revenue to grow by 65% in the full fiscal 2024 and advanced solutions to grow by 30%.

Modine’s latest earnings presentation

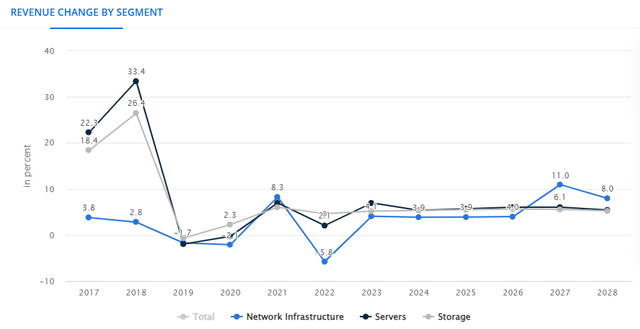

Recent developments are quite positive, but it is highly likely that all the positives are already priced in. Moreover, it is crucial to understand that the data center market is maturing and in the below chart we see that no market size growth spikes are expected by 2028. In these circumstances, I expect Modine’s data center revenue growth to moderate, as I consider the current spike in this market as temporary.

All in all, the company’s fundamentals are decent and demonstrated improvement in previous quarters. However, a 10% TTM operating margin is still relatively thin, and any adverse disruptions might send it back to mid-single digits. The improvement in revenue mix looks promising, but a spike in data center revenue growth is likely to moderate as the end market is expected to demonstrate steady growth without any spikes. Modine’s balance sheet is decent as well, but it is definitely not a fortress to conclude that the company has a vast financial flexibility potential. Overall, I am neutral about Modine’s fundamentals and would better look at how the next few quarters will unfold.

Valuation

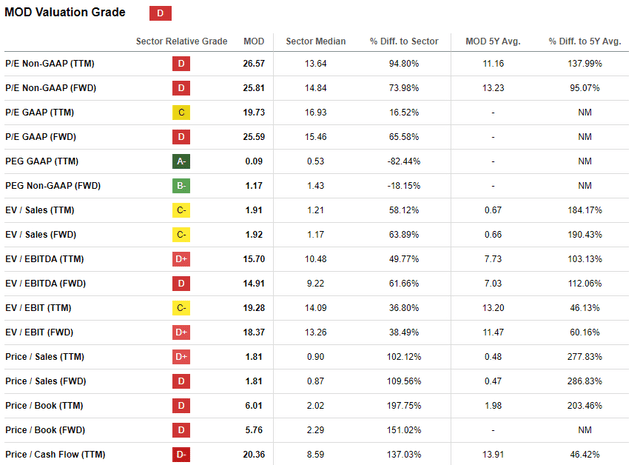

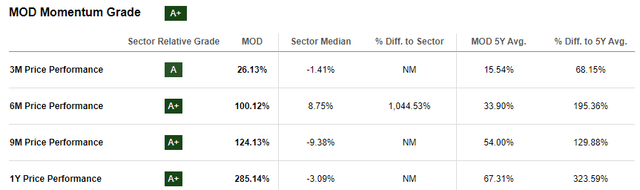

MOD skyrocketed by 285% over the last 12 months, substantially outperforming the broader U.S. stock market. The start of 2024 has also been robust with a 40% YTD rally. As a result, valuation ratios expanded notably and are currently significantly higher than historical averages. This might indicate overvaluation.

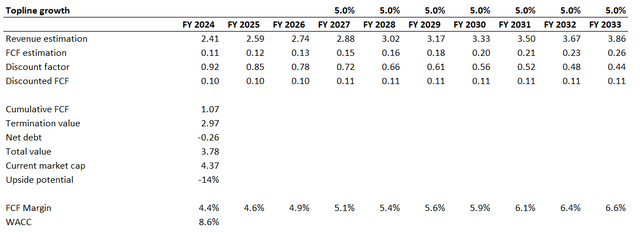

However, to get more conviction, I must simulate the discounted cash flow [DCF] model. I use an 8.6% WACC, which is recommended by valueinvesting.io. I have revenue consensus estimates available for 2024-2026. For the years beyond, I incorporate MOD’s historical 5% revenue CAGR. I use a TTM 4.4% FCF ex-SBC margin and project a steady 25 basis points expansion each year. I am conservative regarding the FCF expansion because MOD’s historical FCF has been very volatile and never close to double digits.

According to my DCF simulation, the fair value of the business is $3.78 billion. This is 14% lower than the current market cap, meaning that MOD is notably overvalued. Since the company does not demonstrate any exceptional profitability or growth pace, I do not think that Modine’s stock deserves such a premium.

Risks to my bearish thesis

We should not underestimate the strength of the momentum. Despite overvaluation, the stock is still unstoppable, and the share price has doubled over the last half year. While my valuation analysis suggests that the rally has gone too far, there is a probability that the extreme bullishness around the stock might continue pushing it up even despite overvaluation.

As I mentioned above, the company reports its quarterly earnings in late May, and there is always a probability that earnings release can be a solid catalyst for the share price. Should the company deliver a strong consensus estimates beat coupled with a notable guidance boost, this might send the stock even higher. However, given all the risks I have described in the “Financials” section, I think that the probability of such a scenario is low.

Bottom line

To conclude, MOD is a “Sell”. The stock is notably overvalued, and the company’s growth or profitability profiles do not suggest there should be any premium to the stock price. The recent improvement of the company’s financial performance has been solid, but the operating margin is still relatively thin and growth in promising niches has been offset by the dip in legacy business.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.