Summary:

- Modine Manufacturing remains a compelling Buy, thanks to its growing hyperscaler partnerships and growing global manufacturing capacity during the data center capex boom.

- As more advanced chips are released, we expect data center cooling and server liquid cooling systems to be increasingly vital during the next cloud super cycle.

- MOD’s attractive investment thesis is also exemplified by its ability to finance their growth organically through Free Cash Flow generation, as observed in its stable balance sheet health.

- Despite the triple-digit stock price YTD outperformance, the stock remains reasonably valued compared to the sector median and its thermal management competitors.

- With MOD successfully bouncing off its new support levels of $119s and the trend pointing to a potential next leg up to $132s, we are reiterating our Buy rating here.

D-Keine

MOD Remains Attractively Valued Despite The Monstrous YTD Rally

We previously covered Modine Manufacturing Company (NYSE:MOD) in August 2024, discussing its timely investments and strategic capacity expansions during the data center capex boom.

Combined with the accretive M&A activities and healthier balance sheet, we believed that the company remained well positioned to report robust profitable growth ahead, resulting in our reiterated Buy rating upon a moderate retracement to its previous trading ranges of between the $108s to $98s for an improved margin of safety.

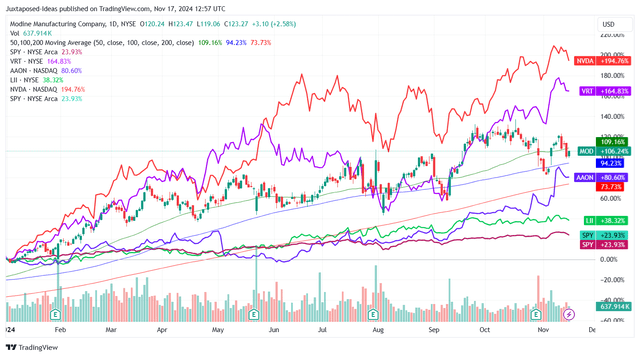

MOD YTD Stock Price

Since then, our Buy point has materialized by September 2024, with the MOD stock also recovering by +30% by the time of writing – a trend similarly observed in its direct peers to varying degrees.

Part of the rally is also attributed to the double beat FQ2’25 earnings performance, with revenues of $658M (inline QoQ/+6% YoY), richer adj EBITDA margins of 15.1% (-0.1 points QoQ/+2.1 YoY), and adj EPS of $0.97 (-6.7% QoQ/+8.9% YoY).

Much of MOD’s recent tailwinds are naturally tied to its ability to capitalize on the data center boom and the resultant insatiable demand for advanced cooling solutions as AI chips consume higher power and server racks emit more heat.

This development has already triggered its data center related sales growth to $158.9M (-2.2% QoQ/+101.6% YoY) and expansion in the Climate Solutions segment’s adj EBITDA margin by +3 points YoY.

While the outperformance has been partly negated by the demand headwinds in the heat transfer/legacy automotive end markets along with the impact of divestitures, as observed in the single digits YoY overall growth, there is no denying its robust prospects in the intermediate term indeed – with the manufacturing company seemingly on track to growing its data center business from $500M in annual sales to $1B over the next three years.

Therefore, while MOD has reiterated their FY2025 guidance, readers may look forward to continued outperformance as similarly hinted by the management:

Our outlook for the data center business continues to improve, driven by strong organic growth and the strategic actions taken over the past year, including the acquisition of Scott Springfield… We are gaining share with both colocation and hyperscale customers and continue to expand our product offering and our manufacturing capacity to meet market demand. (Seeking Alpha)

The same has been observed in its H1’25 results, with revenue growth by +12.9% sequentially/+5.6% YoY and adj EPS growth by +33.1% sequentially/+15.5% YoY, with an FY2025 bottom-line beat on the midpoint guidance of +7.5% YoY and +13.8% YoY, respectively, very likely in our opinion.

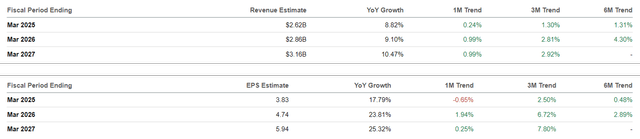

The Consensus Forward Estimates

These reasons may also be why the consensus has upgraded the forward estimates, with MOD expected to generate accelerated top/bottom-line growth prospects at a CAGR of +9.5%/+22.3% through FY2027.

This is compared to the original estimates of +8.5%/+19.2% and the historical growth at +1.7%/+15.7% between FY2019 and FY2024, respectively.

If anything, based on MOD’s completed capacity expansions in the UK, ongoing expansion in Canada, and planned expansion in India, we believe that the consensus forward estimates appear to be rather conservative compared to the management’s long-term sales target growth at a CAGR of +11.5% and adj EBITDA margins of 17% by FY2027 (compared to the current 15.1%).

Despite the naturally elevated capex, it is also important to highlight the manufacturer’s ability to finance their growth organically through its Free Cash Flow generation, as observed in its stable balance sheet health at a leverage ratio of 0.9x in the latest quarter (compared to 1.1x in FQ1’25 and 0.8x in FQ2’24).

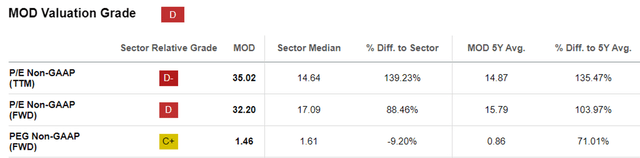

MOD Valuations

This is also why we believe that MOD is not overly expensive at FWD P/E non-GAAP valuations of 32.20x, despite the notable upgrade from its 5Y mean of 15.79x, 10Y mean of 12.57x, and the sector median of 17.09x.

This is attributed to its relatively cheap FWD PEG non-GAAP ratio of 1.20x, based on the CAGR of +26.7% between the management’s FY2025 adj EPS guidance of $3.70 at the midpoint and the consensus FY2027 adj EPS estimates of $5.94.

While elevated compared to its 5Y mean of 0.86x and the 10Y mean of 0.78x, MOD remains reasonably valued compared to the sector median of 1.61x and its direct thermal management competitors, including Vertiv (VRT) at 1.31x, Lennox International Inc. (LII) at 1.73x, and AAON, Inc. (AAON) at 3.42x, respectively.

So, Is MOD Stock A Buy, Sell, Or Hold?

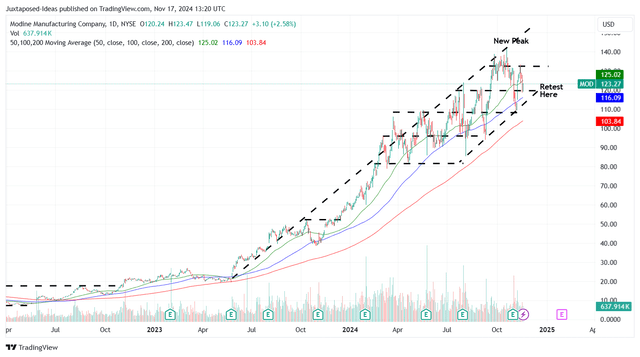

MOD 2Y Stock Price

For now, MOD has continued to chart higher highs and higher lows as observed in the robust uptrend since mid-2023, as it also trades higher than its 200-day moving averages.

For context, we had offered a fair value estimate of $102.60 in our last article, based on the management’s FY2025 adj EPS guidance of $3.80 at the midpoint (+16.9% YoY) and the stable P/E valuation of ~27x on a YTD basis, implying the stock’s premium trading prices at current levels of $120s.

Even so, based on the consensus FY2027 adj EPS estimates of $5.94, there remains an excellent upside potential of +30% to our long-term price target of $160.30, despite the significant YTD rally by +106%.

If anything, MOD’s new hyperscaler contract wins are likely to trigger new tailwinds to long-term growth, with the management already “building a relationship with the third (hyperscaler) and expect to get our first order in this quarter,” building upon its existing growth from “both colocation and hyperscaler customers.”

As a result, we are maintaining our Buy rating here, as the MOD stock also successfully bounced off its new support levels of $119s, with it supporting its next leg up to $132s ahead.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

The analysis is provided exclusively for informational purposes and should not be considered professional investment advice. Before investing, please conduct personal in-depth research and utmost due diligence, as there are many risks associated with the trade, including capital loss.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.