Summary:

- Morgan Stanley has underperformed its peers since October lows due to its lower exposure to cyclical industries.

- The company’s business model focuses on institutional securities, wealth management, and asset management, aiming to reach $10 trillion in client assets.

- While the company may rebound in the near future, its valuation is relatively expensive, making it a cautious buy.

Foryou13

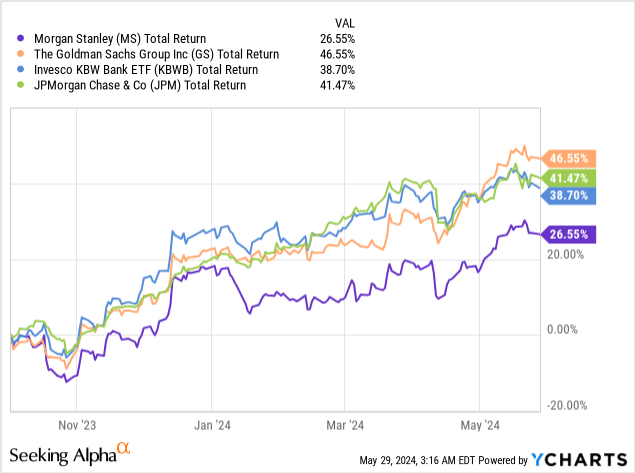

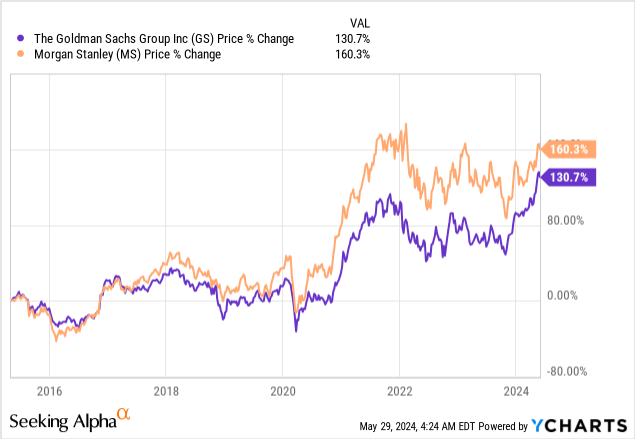

Since the October lows, Morgan Stanley (NYSE:MS) has underperformed its peers Goldman Sachs (GS), JPMorgan (JPM), and the general bank ETF. Despite these relatively poor results, I consider Morgan Stanley a cautious buy to catch up with the other banks in the short term and for good diversification and decent returns over the long term.

Why Morgan Stanley might be underperforming?

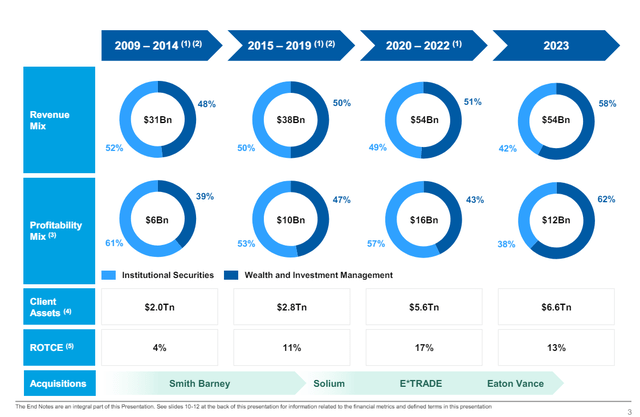

In my opinion, there is one big reason that might explain Morgan Stanley’s underperformance. First, following Morgan Stanley’s latest strategic presentation, the company is considerably less exposed to heavy cyclicality than its peers. From the document, the company explains that its revenues fluctuate between 50% traditional investment banking and 50% wealth management in the buoyant parts of the cycle (2020 to 2022) to 42% traditional investment banking and 58% wealth management in the most recent investment banking slowdown.

Morgan Stanley Revenue Distribution (Morgan Stanley Strategy Update 2024)

In contrast, its peers, Goldman Sachs and JPMorgan are way more exposed to cyclicality. For example, Goldman saw revenues outside of Asset Management of about 70% in its earnings report for the full year 2023, while JPM only saw revenues from its asset management division of around 12.5% of total revenues in its 4Q 2023 earnings report.

This discrepancy occurs because, since 2015, management has decided to step down its efforts to maximize cyclical returns and refocus on the more stable, higher margins, somewhat less exciting asset and wealth management industry.

Hence, Morgan Stanley’s revenue volatility has been capped. For example, Goldman Sachs’s investment banking revenues in its Q1 2024 earnings release jumped 53% quarter over quarter and 15% year over year, while Morgan Stanley’s revenues just grew 4% year over year and 17% quarter over quarter. In my opinion, it’s no surprise that in a stock market recovery, like since October, a more solid and stable company like MS would be underperforming its more volatile cyclical peers.

If the company is underperforming, then why is it a buy?

Morgan Stanley’s business model is quite different from that of traditional investment banks. In its latest 10K, MS clarifies its business model into three major categories. The first is called Institutional Securities, which covers traditional investment banking activities, advisory, M&A, equity, and debt underwriting, and financial market making in bonds and stocks. This category accounted for nearly 43% of revenues.

The second and third segments are Wealth Management and Asset Management. Both are in charge of managing assets, of course, but the difference is that clients in Wealth Management tend to be individuals and their advisors, while Asset Management is in charge of providing services as intermediaries for institutions like sovereign funds, foundations, and insurance companies, amongst many others.

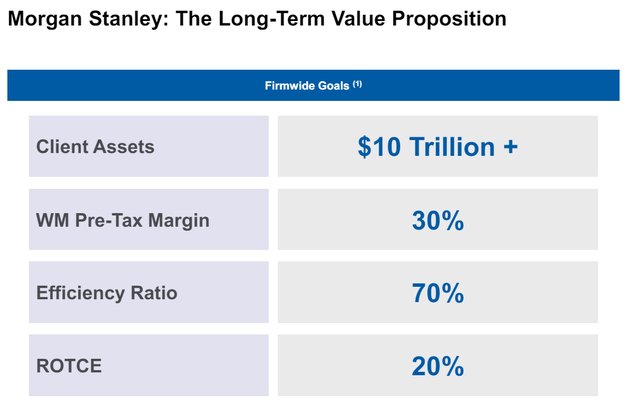

Following this idea, Morgan Stanley’s current goals are to reach $10 trillion in client assets while keeping its efficiency ratio over 70%.

Morgan Stanley Long Term Value Proposition (Morgan Stanley Strategy Update 2024)

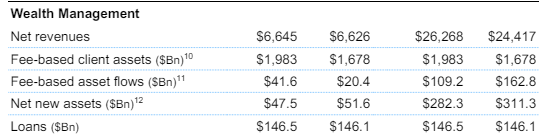

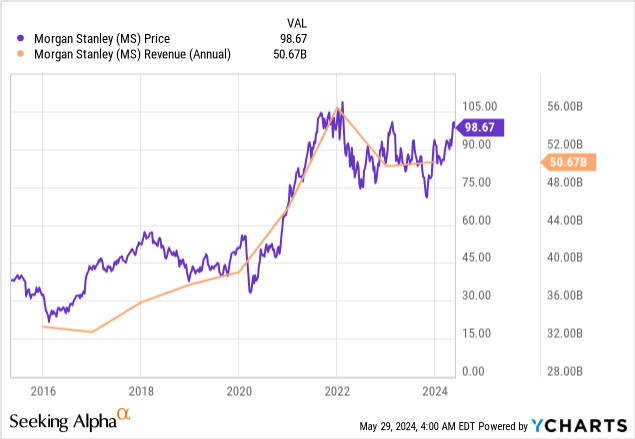

Although that goal is ambitious, it is possible in the mid-term future for Morgan Stanley. Some good achievements have been made; for example, the company has gotten $282 billion in net new assets in 2023 and close to $600 billion over the last two years. At that pace, and without major acquisitions, the company could reach that goal in close to 8 years. Additionally, MS has made some big acquisitions that have been very beneficial for the company’s growth, like acquiring Solium in 2019, E*Trade in 2020, or Eaton Vance in 2021.

Morgan Stanley Wealth Management Metrics 2023 (Morgan Stanley Q4 Earnings Release)

That strategy from MS has allowed them to outperform, for example, Goldman since May 2015, increase its revenues, and grow significantly without needing to be that exposed to market cyclicality.

But there is still one question to be answered, and I found it in Morgan Stanley’s Q1 2024 earnings call, and that is if the company is acquiring all those new assets under management, where is the monetization of that growth? Fortunately, the CFO, Sharon Yeshaya, responded that the business model idea for every new money that enters that segment is to monetize it via some kind of advisory or additional service in the near future. That means, in my opinion, that eventually, as time goes on, the company should be able to grow in a secular way instead of just booms and busts like the traditional investment bankers.

What is next for Morgan Stanley?

In the near future, if macroeconomic conditions permit, MS should be able to rebound revenues as demand for investment banking and financial market-making recovers. In the same earnings call, the current CEO expressed that the company expects some stabilization in the next 3 to 5 years, which is quite optimistic, in my opinion. If that assumption is correct, the company should see a brighter future relatively soon and, with that, a better stock price. Nonetheless, I still consider this stock a cautious buy because valuation might be expensive in the short term.

Valuation

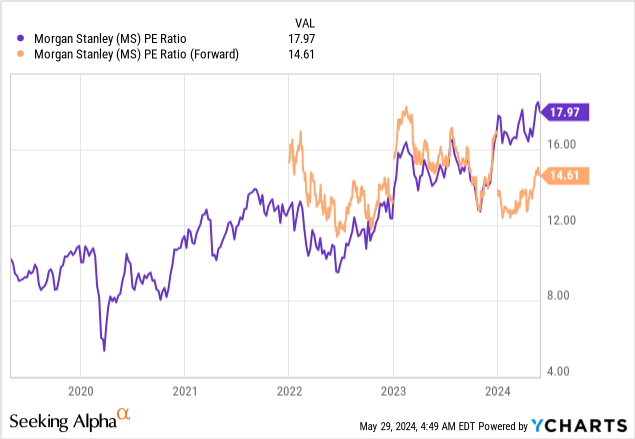

Currently, Morgan Stanley has been relatively expensive to itself in the past, with a PE ratio of close to 18. Fortunately, the Forward PE ratio is still at decent levels, although it is not properly cheap. The major discrepancy between these two metrics is that the company is expected to grow earnings this year in a good fashion, which could lead to a lower PE ratio in the near future.

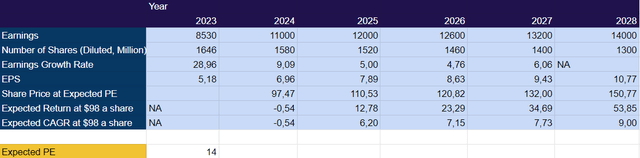

For this valuation model, I use an earnings growth rate of close to 5% after the normalization year 2024. Additionally, I consider Morgan Stanley to buy back around 60 million shares a year, which is what it bought in 2023, even though it is far from the 100 million shares buyback done in 2022. That projection gives an EPS of around $10.8, which, multiplied by the current PE of 14, would mean a CAGR of 9% to 2028, without dividends that might come at 2% after taxes, outpacing by little the SP500 usually expected CAGR of 9%. This is the reason why, in my opinion, the company is barely a buy. For investors who can wait for better prices in cash, it might be better to wait a little for entry points.

Image created by the author based on 10K projections (Author)

Risks

There are some risks that MS could face between now and 2028. The first is almost always a big problem for a financial institution: the macroeconomic environment. If the economy significantly deteriorates, many of the company’s possible revenues from cyclical sources can be compromised. Additionally, if the deterioration is strong enough, it can even hit the wealth and asset management businesses.

Secondly, and as a special case for the first group of risks, a significant deterioration in geopolitics could cause disruption in the economy and, therefore, also end up hitting Morgan Stanley.

The third risk I see might come from the new management, as James Gorman, MS CEO for many years, has left the charge, although he is still executive chairman, he will eventually be leaving the company. Fortunately, the new CEO, Ted Pick, seems to be aligned with the $10 trillion in assets objective, but the future is uncertain.

Conclusion

Morgan Stanley is an excellent company with a demonstrated track record and a good transformation to a hybrid between asset manager and investment banking. Currently, the company seems not cheap, but also not really that expensive, which means that if execution for the next years is adequate, shareholders could see some decent capital appreciation plus some good dividends. Still, the company is not a screaming buy.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.