Summary:

- Morgan Stanley has successfully diversified its revenue streams through its world-class wealth management segment, making it more resilient during tough economic conditions.

- The company’s reputation and strong positioning in the investment banking and wealth management industries give it a narrow economic moat.

- Despite a decline in profitability in 2023, Morgan Stanley remains a relatively low-risk investment with potential for long-term growth.

- Current share prices suggest a fair valuation in the stock with little margin of safety for value-oriented investors.

- Hold Rating issued.

Stephen Chernin

Investment Thesis

When it comes to financial services companies, Morgan Stanley (NYSE:MS) remains one of my favorites.

The firm’s post-2008 years have been characterized by diversification of their revenue streams by a strategy of developing a world class wealth management segment to boost margins and revenues.

I believe their current fifty-fifty revenue split between the investment banking and wealth management operations should allow the firm to be more resilient during tougher economic conditions and overall decrease its exposure to a cyclical market environment.

While I really do like the company, their stock is currently fairly priced which provides insufficient margin of safety to warrant building a position from a value perspective.

I rate the stock a Hold at present time.

Company Background

Morgan Stanley is an investment bank and wealth management company that has become one of the most influential players within the industry.

Since the 2008 financial crisis, a focus on diversifying operations by expanding their wealth management and asset management services has decreased their reliance on the more cyclical incomes derived from investment banking.

Nevertheless, Morgan Stanley has not neglected their investment banking business with the firm continuing to actively enhance this segment too.

Ted Pick has recently been promoted to CEO of Morgan Stanley as previous leader James Gorman moved into an executive chairman position in January 2024.

I like that Pick has spent over 30 years in the firm having led multiple hands-on banking divisions and experienced the crisis that occurred in 2008.

While I remain cautiously optimistic about Pick’s ability to continue developing Morgan Stanly, matching Gorman’s excellent track record over the greater part of the last decade may be difficult.

Economic Moat – In Depth Analysis

Morgan Stanley has what I believe is a narrow economic moat. Moatiness is derived from their strong positioning and reputation within the investment banking and wealth management industries.

Investment banking is a capital-intensive business that relies on high volumes of business activity within the economy. Furthermore, the core services provided tend to be quite homogenous between providers which creates relatively small switching costs for prospective clients.

While these characteristics of investment banking may make it harder for businesses to attract customers away from one another, I largely believe the majority of firms are trying to pry clients away from the likes of Morgan Stanley or JPMorgan (JPM), at least in the U.S. marketplace.

Quite simply, Morgan Stanley’s well-established reputation for providing excellent, customer-oriented services that accurately meet their clients’ needs makes it an easy choice for any prospective customers.

The wealth of relationships and connections developed by the firm over the last 40 years has undoubtedly helped cement their position right at the helm of the industry.

I believe Morgan Stanley has carved out a meaningful position within the market for handling mergers and acquisitions along with corporate bonds and loans.

Morgan Stanley’s wealth management business is also reliant upon the firm developing long-term relationships with clients and through the reputation held by the company.

Wealth management as a business is centered around delivering personal guidance with both strategy execution, management and planning being tailored to each and every client individually.

These core business characteristics illustrate how powerful a firm’s reputation and image are to attracting clients as such intangible and undefinable attributes may be difficult to market to prospective customers.

I believe Morgan Stanley’s post-financial crisis acquisition of Smith Barney from Citigroup marked the real shift in focus towards developing a truly world class wealth management business at the bank.

Since then, the firm’s ability to extract real margins and deliver solid topline revenue growth in their wealth management business illustrates Morgan Stanley’s executional prowess within the industry.

Overall, I rate Morgan Stanley as having a narrow yet durable economic moat with their reputation and robust positioning within the investment banking and wealth management markets generating the most competitive advantages for the firm.

The lack of corporate banking operations and greater breadth in their operations is the primary factor limiting my ability to assign the firm with a wide economic moat.

Financial Situation

Morgan Stanley’s running 5Y average (FY23-FY19) ROA and ROE are 1.00% and 12.23% respectively. The relatively low ROA is to be expected given the firm’s capital-intensive investment banking business and the nature of providing wealth management services.

Comparison against key industry rivals Goldman Sachs (GS) and JPMorgan sees Morgan Stanley’s returns beat by both competitors by around 2-3pp.

While these two operations also have significant corporate and retail banking operations, I like Morgan Stanley’s ability to generate real returns from their more focused set of businesses.

The firm’s ROTCE is also a healthy 12.8% which is very positive given increasingly soft macroeconomic environment and higher interest rates impacting banking across the globe.

Morgan Stanley is also quite conservatively financed compared to pre-2008 with the firm having a leverage ratio of 13.22x. It is also important to note that the firm is classified as a bank holding company meaning the firm has access to federal liquidity resources.

While I do not foresee Morgan Stanley having to resort to seeking additional liquidity from these facilities, it is important to note how well capitalized the firm currently is.

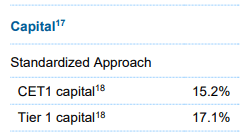

MS FY23 Q4 Earnings Release

The current CET1 capital ratio is 15.2% while the company has a 17.1% Tier 1 capital ratio.

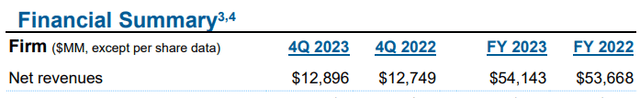

The firm recently reported their Q4 and full-year 2023 results which were largely inline with my expectations.

MS FY23 Q4 & Full-Year Earnings Release

Revenue growth for FY23 was essentially flatline at just 0.6% with net revenues totaling $54.1B.

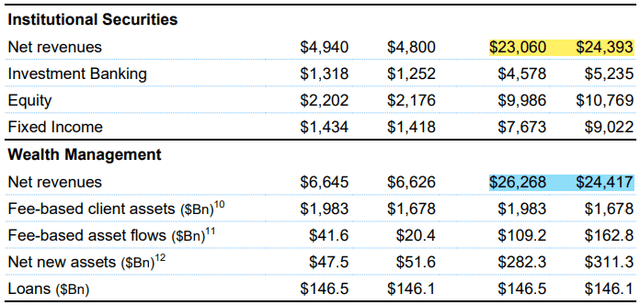

MS FY23 Q4 & Full-Year Earnings Release

Reasonably impressive 7% YoY revenue growth by the wealth management division was almost entirely offset by a 5.7% drop in institutional securities revenues which consists mainly of the firm’s investment banking business.

I also really like the ability for Morgan Stanley to continue growing their wealth management revenues with the 18% YoY increase in FY23 fee-based client assets which illustrates the moatiness I believe accompanies this business.

For context, these two key business segments share what is almost a fifty-fifty split in total revenue volumes which supports my earlier thesis about Morgan Stanley’s successful execution of their post-2008 diversification strategy.

Superb 133% YoY interest income growth was outpaced by growth in interest expenses by almost 100% which left net interest income down 12% YoY.

However, this amounts to just $8B which ultimately was offset by the gains made by the rest of the businesses overall.

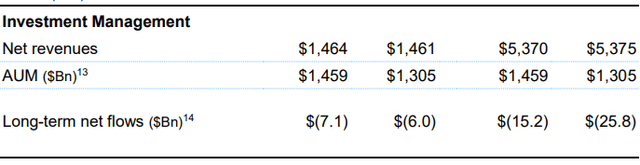

MS FY23 Q4 & Full-Year Earnings Release

The much smaller investment management segment saw flatline revenue growth despite AUM increasing $100M to $1.46B.

MS FY23 Q4 & Full-Year Earnings Release

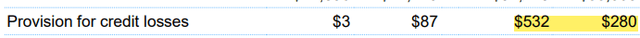

Further compounding these results was the overall increase in provisions for credit losses which increased to $532M from $280M along with substantial 5% increase in both compensation expenses and almost 10% increase in non-compensation expenses.

While these results are indeed less than stellar, I fundamentally remain quite optimistic about the business and believe multiple short-term headwinds have compromised the firm’s 2023 fiscal performance.

The increasingly downward trend the U.S. economy has taken in relation to the business cycle results in decreasing investment banking demand as a result of overall softening business activity.

The less businesses grow, the less these firms will be performing mergers and acquisitions, bond creations and so forth which ultimately are the drivers for Morgan Stanley’s revenues.

Management confirmed this hypothesis with the team highlighting less favorable market conditions and reduced client activity as key drivers for the underperformance of their investment banking business.

Net Income FY23 vs FY22 (MS FY23 Q4 & Full-Year Earnings Release)

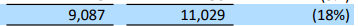

Net income was down 18% YoY to just $9.1B despite the higher net revenues. The total 6% growth in non-interest expenses was caused by significant increases of 7%, 8% and 10% in total compensation, Information processing and professional services expenses.

This highlights how Morgan Stanley’s 2023 results have suffered from the persistently inflationary macroeconomic environment being experienced in the U.S.

Increasing pricing levels for inputs combined with wage inflation has hurt Morgan Stanley’s bottom line despite resilient topline performance.

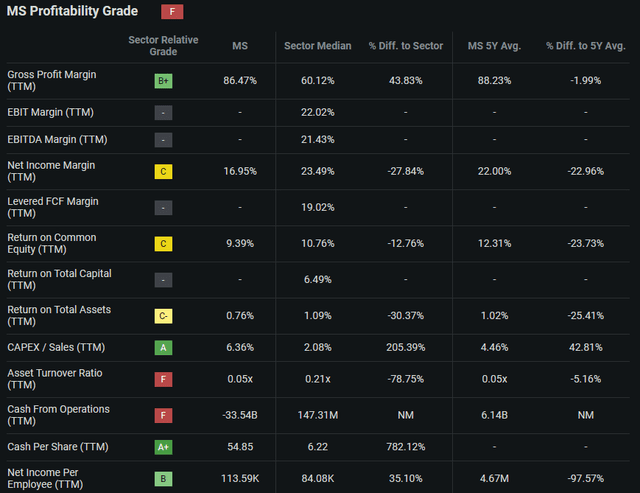

Seeking Alpha | MS | Profitability

Seeking Alpha’s Quant calculates an “F” profitability rating for Morgan Stanley which I believe is an excessively pessimistic representation of the firm’s overall financial health.

Gross and net margins of 86% and 17% respectively are still very healthy in my opinion even despite the contraction of net margins from 5Y averages by around 20%.

Moody’s credit ratings agency affirmed a solid “A1” credit rating for Morgan Stanley’s LT Issuer Rating and affirmed a “P-1” rating for their domestic commercial paper. The outlook remains stable.

Moody’s classifies “A1” ratings as being of “upper-medium grade” and classifies the “P-1” rating as being of the highest short-term debt quality.

Finally, I want to mention the excellent dividend paid out to MS stockholders. The current FWD yield is 3.98% with a payout ratio of 58.55% which I believe is sustainable for the firm.

I really like the 5Y growth rate of 23% and believe their 10-year growth streak serves as a great illustration of the firm’s newfound desire to tangibly reward shareholders.

The final quarter of 2023 also saw Morgan Stanley repurchase $1.3B worth of shares for an average price of $74.23 which I view as an excellent decision.

Valuation

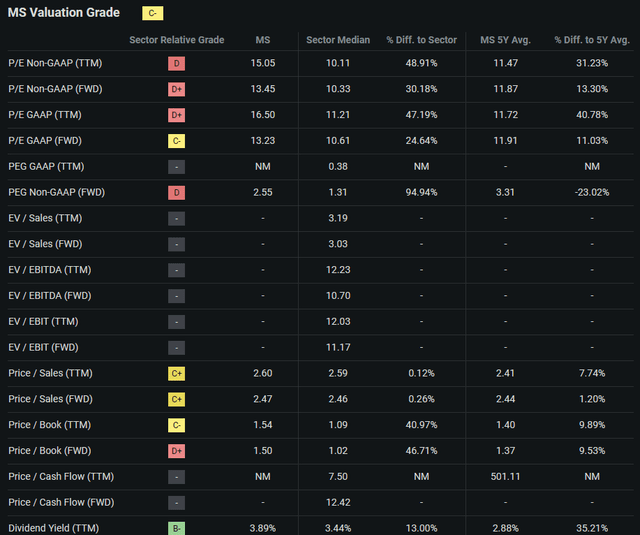

Seeking Alpha | MS | Valuation

Seeking Alpha’s Quant currently assigns Morgan Stanley with a “C-” Valuation grade. I believe this is largely speaking an accurate representation of the current value present within MS stock.

The firm currently trades at a P/E GAAP TTM ratio of 16.50x. This represents a pretty steep 41% increase relative to MS’s 5Y average and has come primarily as a result of the degradation in earnings witnessed in 2023.

Morgan Stanley’s 2.60x Price/Sales TTM ratio is also quite elevated and illustrates that a reasonably large amount of sales growth is already priced-in to the stock.

Given the firm’s EPS growth estimates for the upcoming four years average around 6%, these relatively elevated ratios may indicate a fair valuation at best given the firms mature status.

Seeking Alpha | MS | 5Y Advanced Chart VS SPY

The last five years has seen MS stock generate solid earnings for its shareholders with the company’s stock outperforming the ever-popular S&P 500 tracking SPY index fund (SPY) by around 15%.

Seeking Alpha | MS | 1Y Advanced Chart VS SPY

However, since 2021 the stock has experienced a downward trend in returns with the last year seeing MS stock underperform the wider market by over 35%.

This underperformance – despite what I still think is a really nice dividend paid out by Morgan Stanley– has soured investor sentiment towards the firm with many possibly seeing the weak performance in 2023 as further evidence that the company has lost its way.

The Value Corner

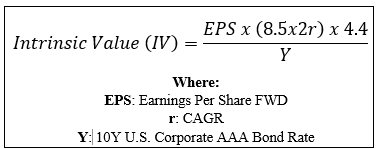

To develop a more objective understanding of the value present in MS stock we can use The Value Corner’s quantitative-based Intrinsic Valuation Calculation.

By inputting the current share price of $86.05, an estimated 2024 EPS of $6.36, a realistic “r” value of 0.04 (4%) and the current Moody’s Seasoned AAA Corporate Bond Yield ratio of 4.87x, I derive a base-case IV of $94.80. This represents just a 9% undervaluation in shares.

Using a bear-case CAGR value for r of 0.02 (2%) to reflect an outcome where a recession halts Morgan Stanley’s revenue growth, shares are valued at $71.80 representing a 20% overvaluation at present time.

In the short term (3-12 months), I find it difficult to say what may happen to valuations. Persistently sticky inflation, the prospect of higher rates for longer and a looming CRE credit crisis means excessive risks exist in the current market environment to confidently define a direction for MS stock in 2024.

I also see Morgan Stanley’s current business model as being untested in a true recessionary environment. Therefore, I would caution that significant downside potential may exist in the near term should a recessionary macro emerge.

In the long-term (2-10 years), I do like the prospects of Morgan Stanley’s business. Their increased focus on wealth management should allow for long-term margin expansion along with potentially less exposure to the cyclicality of investment banking returns.

Morgan Stanley Risk Profile

Morgan Stanley has a low risk profile in my view with the primary threats arising from exposure to a cyclical market environment along with some governance concerns.

Almost all financial services firms are exposed to the overall health of the wider economy and the prevailing global macroeconomic conditions. Investment banks in particular rely on high volumes of business activity in order to generate revenues.

I find it quite likely that Morgan Stanley would see shrinking revenues and net incomes should a recessionary market environment develop in the U.S.

This hypothesis already appears to be supported by the weaker 2023 earnings generated by the firm amid an inflationary and higher interest rate driven economic slowdown.

While Morgan Stanley does not face any monumental ESG concerns, I would like to highlight the relationship most financial services companies hold with regulators.

Financial services companies all operate within a complex regulatory environment. The consequence for massive businesses such as Morgan Stanley is that quite often, these firms will find themselves in non-compliance of one or more regulations resulting in fines.

Furthermore, new regulatory proposals (such as the Basel III capital requirements) may pose challenges to businesses and potentially limit short-term profitability.

Still, I believe the overall lack of major ESG concerns would make Morgan Stanley an excellent pick for a more ESG conscious investor.

Of course, opinions may vary and I implore you to conduct your own ESG and sustainability research if these matters are of concern to you.

Summary

Morgan Stanley is still one of my favorite businesses. I like the company’s focus on diversifying revenues by expanding the wealth management business all the while continuing to grow their investment banking operations too.

I admired previous CEO Gorman for his character and leadership ability in turning the bank around post-2008. I look forward to learning more about Ted Pick and at least from initial impressions, believe he is a suitable choice.

Profitability in 2023 was undeniably poor considering previous years. However, I actually believe the recent results illustrate how resilient and moaty the firm’s operations are even amidst an economic slowdown.

Nevertheless, current valuations suggest the firm is trading between a slight undervaluation at best and an overvaluation given a bear-case scenario.

Therefore, and while I really do like the company, I feel insufficient margin of safety exists to warrant building a position in this great enterprise.

I rate Morgan Stanley a Hold at present time and will wait for a more attractive entry-position in the coming months.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

I do not provide or publish investment advice on Seeking Alpha. My articles are opinion pieces only and are not soliciting any content or security. Opinions expressed in my articles are purely my own. My opinions may change at any time and without notice. Please conduct your own research and analysis before purchasing a security or making investment decisions.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.