Summary:

- Morgan Stanley has illustrated robust operating performance since the turn of the year.

- MS’s wealth and investment management segments show non-cyclical growth potential, while investment banking might benefit from refinancing activity and supportive secondary markets.

- Despite its strong fundamentals, Morgan Stanley’s price-to-book ratio and economic risks prompted me to suggest that it is a market-perform asset instead of a market-outperform opportunity.

- The bank’s forward dividend yield is attractive, but valuation concerns and economic uncertainty might temper enthusiasm for significant stock appreciation.

hapabapa

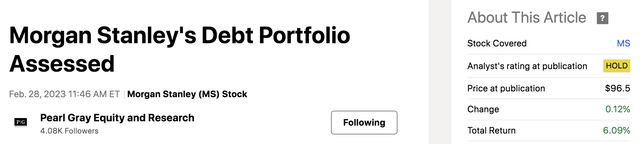

Morgan Stanley (NYSE:MS) is emphasized today as we look at the bank’s latest events and valuation attributes. We covered Morgan Stanley’s stock in February 2023, citing net interest income concerns as a reason to assign a Hold rating. However, time has passed, so I decided to update our thesis.

Pearl Gray’s Previous Rating Of MS (Seeking Alpha)

Herewith are my latest thoughts about Morgan Stanley’s stock.

Revising Morgan Stanley’s Fundamentals

Earnings

Morgan Stanley released its second-quarter earnings in July, revealing quarterly revenue of $15 billion, an 11.6% year-over-year increase. Moreover, the bank’s earnings-per-share settled at $1.82, beating analysts’ estimates by 17 cents.

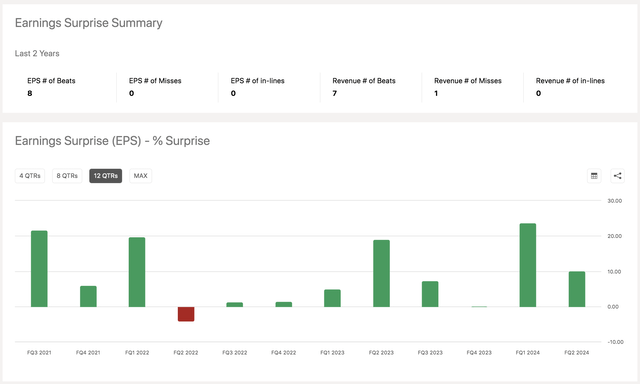

Past Earnings Surprises (Seeking Alpha)

Morgan Stanley’s latest earnings report surprised the market once more as the company achieved yet another earnings beat. However, capital markets are fluid. Therefore, the question becomes: What is in store for Morgan Stanley in late 2024 and early 2025?

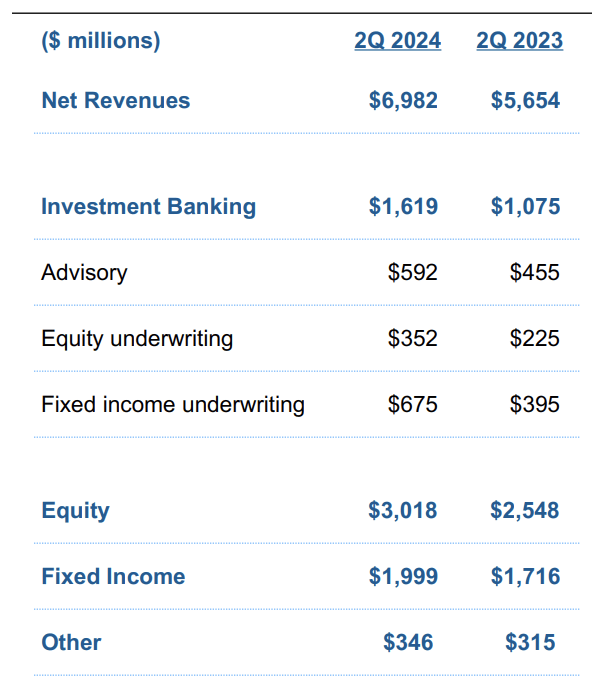

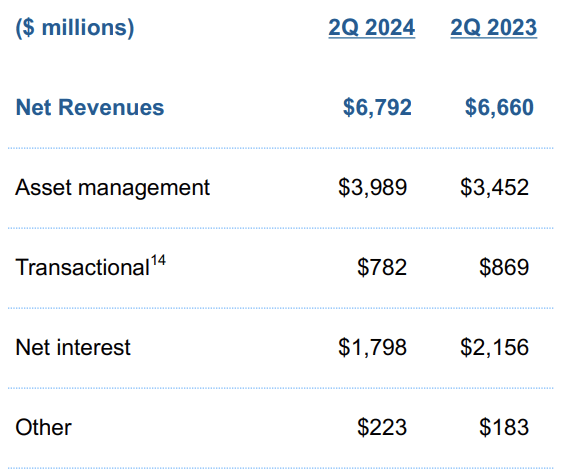

The following diagram summarizes Morgan Stanley’s second-quarter results; a discussion follows.

Revenues (Arundhati Sarkar; Seeking Alpha)

Institutional Securities

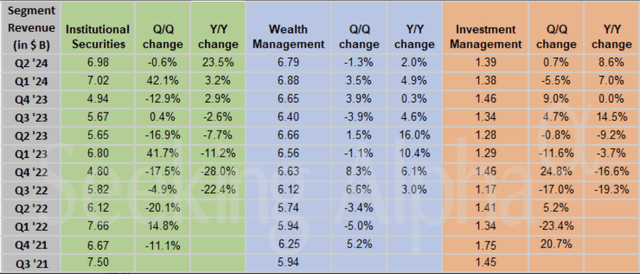

Morgan Stanley’s Institutional Securities segment, which includes investment banking, equity, and fixed-income securities, posted $6.98 billion in net revenue during Q2, a 23.5% year-over-year increase. In addition, the segment achieved $2 billion in pre-tax income, double the amount it posted a year earlier.

Morgan Stanley’s institutional securities segment might experience additional upsides in a supportive investment banking environment. A pending global interest rate pivot will likely introduce refinancing deal flow, while the recent momentum in secondary stock and bond markets can entice primary listings. In fact, Morgan Stanley’s investment banking unit’s revenue surged to $1.62 billion in Q2 (+51% year-over-year), reflecting more robust demand, which supports my argument.

Institutional Securities (Morgan Stanley)

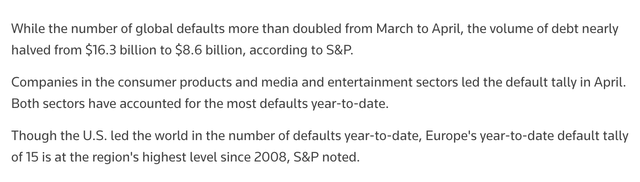

As for equity and debt, I think the factors above will create a more comprehensive environment for intermediation. However, I worry about the segment’s provisions line item. Global economies are slowing, which might introduce higher credit spreads and inflated default rates – an uncompelling scenario, especially if interest rates are expected to decrease.

A Recent Observation Dispensed By The Financial Times (Financial Times)

Aside: The segment’s provision line item settled at $54 million in Q2, compared to $97 million a year earlier.

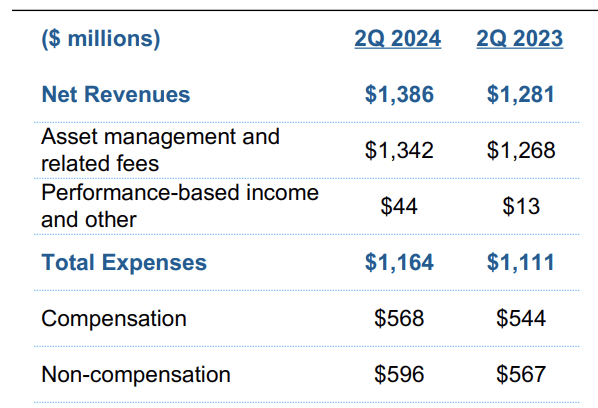

Wealth and Investment Management

I consider wealth management a non-cyclical business, especially for Morgan Stanley, a bank that can leverage its high-net-worth corporate clientele into perpetual fee-based growth.

Much of the segment’s non-cyclical attributes were illustrated during its second quarter, as net revenue rose by merely 2% year-over-year, a subdued figure compared to the firm’s broad-based growth. Nonetheless, I see the segment’s non-cyclical growth resuming throughout the economic cycle.

Wealth Management (Morgan Stanley)

Furthermore, Morgan Stanley’s Investment Management segment might follow a similar trajectory to its Wealth Management activities. I anticipate lower implied interest rates will rejuvenate private market activity and concurrently provide better incentive structures. Moreover, comprehensive ex-post growth in the secondary markets likely raises pricing power on management fees.

Investment Management (Morgan Stanley)

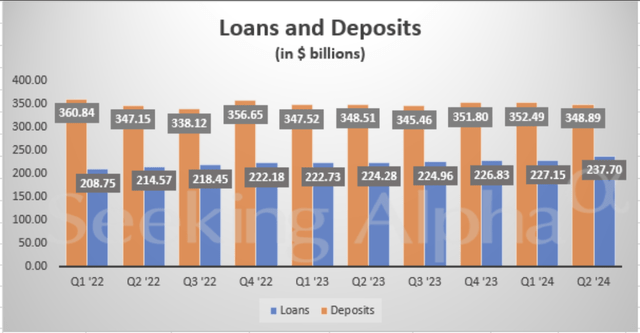

Noteworthy Aspects Of MS’s Asset-Liability Relationship

Another factor worth considering relates to the relationship between Morgan Stanley’s loan book and its funding base. As illustrated below, the bank’s deposits increased during Q2, providing a better short-term liquidity outlook. Moreover, Morgan Stanley’s loan book edged lower, suggesting the bank decreased its duration in Q2 to mitigate risk.

Funding Vs. Loans (Arundhati Sarkar; Seeking Alpha)

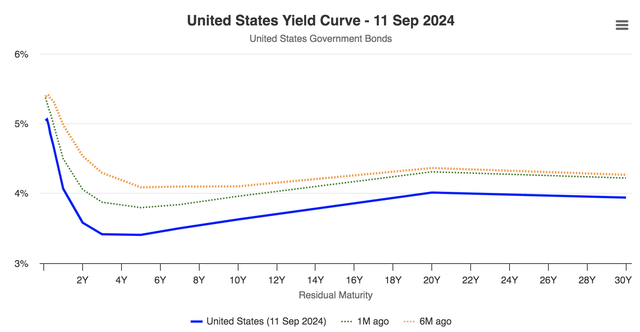

I think deposit growth will exceed loan growth until we see a steeper yield curve and lower short-term interest rates. A steeper curve paired with lower rates might disincentivize cash deposits and incentivize longer-term lending for banks. However, whether such a scenario will occur remains to be seen.

U.S. Yield Curve (worldgovernmentbonds.com)

Risk Metrics

Morgan Stanley’s risk-weighted capital metrics deteriorated slightly compared to a year ago. I expect prolonged economic uncertainty to fuel additional market-based headwinds, in turn damaging the risk-return outlook of certain business units, like trading. As such, I don’t think the bank’s Common Equity Tier-One ratio (CET1) will increase anytime soon.

| Metric | Q2 2024 | Q2 2023 |

| CET 1 -Standard | 15.2% | 15.5% |

| CET 1 – Advanced | 15.3% | 15.8% |

| SLR | 5.5% | 5.5% |

Source: Morgan Stanley

Valuation and Dividends

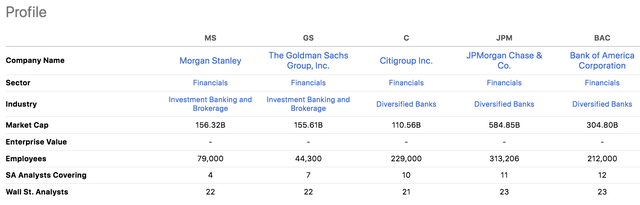

I compared Morgan Stanley to Goldman Sachs (GS), Citigroup (C), JPMorgan Chase (JPM), and Bank of America (BAC) to gain a better understanding of its valuation outlook.

Investors often emphasize price-to-book values when assessing banks, as banks have marked-to-market prices on most of their assets and liabilities. Moreover, observing a bank’s return on equity provides a solid guidepost if you’re interested in its profitability.

Most large U.S. banks have rallied year-over-year, inflating their price-to-book ratios above 1x. Moreover, Morgan Stanley’s price-to-book ratio is the second highest among the U.S.’s big five banks, which isn’t met with an outlying ROE ratio. Therefore, I see little value in the stock for now.

| Bank | P/B | ROE |

| Morgan Stanley | 1.7x | 10.40% |

| Goldman Sachs | 1.46x | 9.49% |

| Citigroup | 0.58x | 4.04% |

| JPMorgan Chase | 1.85x | 16.55% |

| Bank of America | 1.14x | 8.49% |

Source: Seeking Alpha

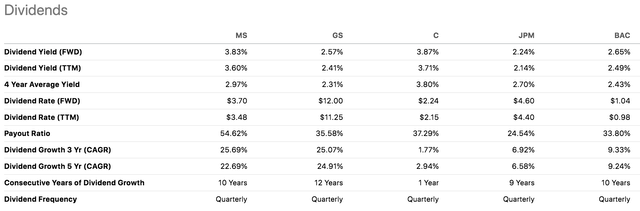

Morgan Stanley’s forward dividend yield is best-in-class, and its four-year average dividend yield reflects consistency. Although I’m worried about cyclicality, I think Morgan Stanley has a compelling dividend.

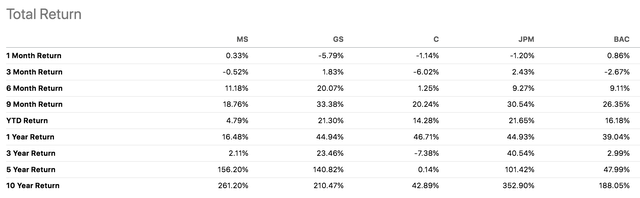

Furthermore, Morgan Stanley has underperformed its peer group since the turn of the year, while outperforming it throughout its latest operating cycle (5 years). This communicates a possible pairs trade opportunity, especially as Morgan Stanley hasn’t suffered structural disadvantages during its underperformance.

Despite conveying a potential pairs opportunity and an attractive dividend, Morgan Stanley’s price-to-book ratio is of concern. Although other valuation metrics might contradict the measure, I outline it as a risk factor, given the risks embedded in today’s economy.

Final Word

I find Morgan Stanley’s fundamental performance commendable and anticipate sustained growth within its investment banking unit. Furthermore, the bank’s wealth and investment management activities flash signs of throughout-the-cycle growth, which adds to the company’s prowess.

However, despite its respectable fundamental results, Morgan Stanley’s peer-based and absolute valuation outlook is questionable. Therefore, I maintain my Market Perform outlook on the stock instead of deeming it a Market Outperform asset.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Kindly note that our content on Seeking Alpha and other platforms doesn't constitute financial advice. Instead, we set the tone for a discussion panel among subscribers. As such, we encourage you to consult a registered financial advisor before committing capital to financial instruments.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.