Summary:

- Morgan Stanley’s strong Q3 performance saw a 17% non-interest revenue increase and a 37% rise in net income attributable to common shareholders.

- The Series E preferred shares offer a fixed 7.125% dividend, but there’s a risk of the bank calling them due to falling interest rates.

- A long position in these preferred shares hinges on Morgan Stanley not calling them soon. Buying close to $25 mitigates call risk.

- I hold a small position in Series E preferred shares and would only consider adding post-ex-dividend date to minimize call risk impact.

hapabapa

Introduction

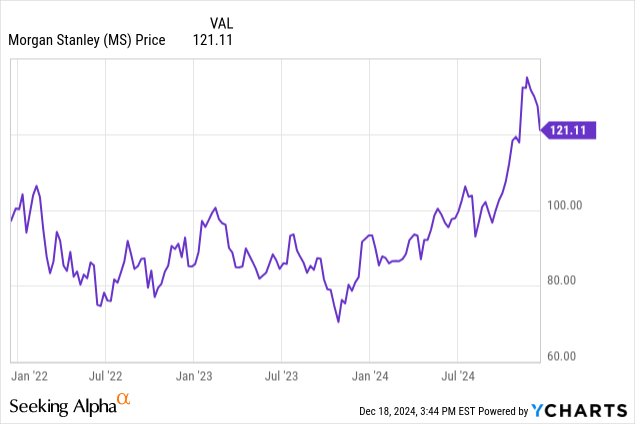

I don’t think Morgan Stanley (NYSE:MS) needs a lengthy introduction as pretty much every investor in the world will at least have heard of the financial institution. In my previous articles I zoomed in on a specific series of the preferred shares issued by Morgan Stanley as the investment bank elected to fix the floating preferred dividend yield into a fixed preferred dividend.

As interest rates are coming down and will likely continue to decrease in the next year, I think the likelihood of Morgan Stanley calling this specific series of preferred shares is increasing as the bank will find cheaper ways to finance its business.

Morgan Stanley still generates very strong profits

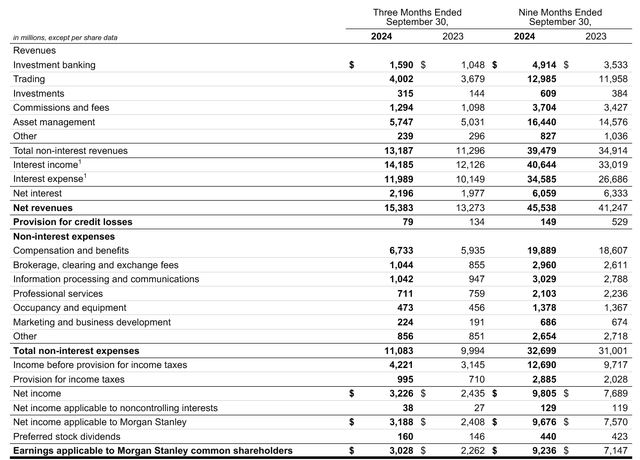

During the third quarter of this year, Morgan Stanley reported a total non-interest revenue of approximately $13.2B, which is an increase of almost 17% compared to the third quarter of 2023. That’s a very impressive increase, and as you can see below, pretty much all divisions performed very well with an increase of in excess of 50% in investment banking revenue while the asset management division saw its revenue increase by almost 15% as well.

Morgan Stanley Investor Relations

This, of course, goes hand in hand with a higher amount of non-interest expenses, but those non-interest expenses increased by just $1.1B so the net amount of non-interest contribution to the pre-tax income result definitely increased. On top of that, as the image above shows, the net interest income increased as well, by just over 10% to $2.2B. Combined with a slight reduction in the loan loss provision (a drop from $134M in Q3 2023 to just $79M in Q3 2024), the pre-tax income increased by about a third to $4.22B, on which approximately $1B in taxes were owed. This resulted in a net profit of $3.23B of which $38M was attributable to non-controlling interests indicating a net attributable income of $3.19B which is an increase of almost a third compared to the $2.41B in net profit in Q3 2023.

The bank paid a total of $160M in preferred stock dividends, which means the net income attributable to the common shareholders of Morgan Stanley was approximately $3.03B for an EPS of $1.91. That’s a very substantial increase of approximately 37% thanks to the combination of a higher net profit with a lower share count, as Morgan Stanley reduced its share count by approximately 2.5% on a year-over-year basis.

As I’m mainly interested in the preferred shares, it goes without saying I’m very pleased to see the investment bank needed just over 5% of its attributable quarterly income to cover the preferred dividends.

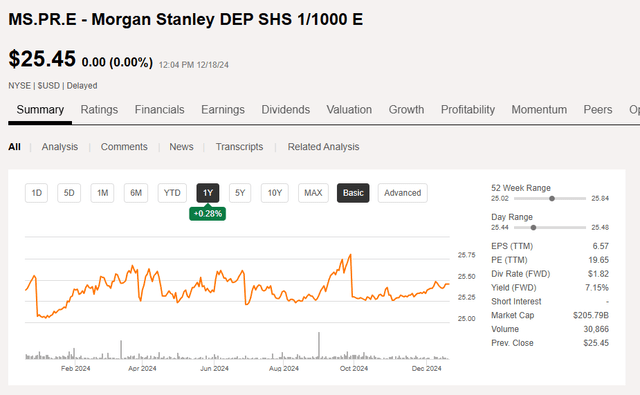

A closer look at the Series E preferred shares

In my previous article on Morgan Stanley I chose to focus on the Series E preferred shares which are trading with ( MS.PR.E) as the ticker symbol. Although this was originally a fix-to-float issue, when the LIBOR benchmark rate was phased out due to the acceptance of the SOFR as new and supposedly more reliable benchmark, Morgan Stanley elected to keep the preferred dividend fixed at the same rate as the initial period rather than letting the preferred dividend float based on the SOFR benchmark. Some investors liked that move, others weren’t a big fan but to be clear: Morgan Stanley definitely was entitled to do so as its prospectus language specifically focused on LIBOR and did not mention a successor benchmark rate.

Seeking Alpha

This means Morgan Stanley will continue to pay the quarterly preferred dividend and recently declared a dividend of $0.455208 per depository share. That being said, keep in mind this preferred security can be called at any time and as 7.125% is relatively expensive these days, investors should be mindful of this risk.

The next scheduled ex-dividend date for the upcoming quarterly dividend is Dec. 31. Morgan Stanley also has to give 30 days notice if and when it wants to call the preferred shares (and of course pay out the preferred dividend on a pro rata basis).

Investment thesis

A long position in this specific series of preferred shares issued by Morgan Stanley is a bet on the investment bank not calling them anytime soon. It’s difficult to predict whether or not and more specifically when Morgan Stanley would call these preferred shares. I think they eventually will, and depending on how the interest rates on the financial markets develop, I think the odds of that happening in 2025 are pretty strong.

That’s why I wouldn’t really want to pay more than the call price of $25 plus the accrued preferred dividend, and of course investors need to take other expenses (transaction fees and dividend taxes) into account when making that decision.

I have a small long position in the Series E preferred shares but would only consider adding to this position right after the ex-dividend date and as close to $25 as possible to reduce the impact of the call risk.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MS.PR.E either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!