Summary:

- Morgan Stanley’s stock returns have underperformed its peers and industry benchmark over the last year.

- Q2 earnings came in very strong, beating expectations. At the same time, its bottom line grew by 44%, thanks in part to higher investment banking fees.

- Despite potential challenges in net interest income and asset management fees, the brighter outlook from capital markets more than offsets these cons, suggesting a buy rating.

abalcazar/iStock Unreleased via Getty Images

Among major financial institutions in the US with investment banking and wealth management divisions, Morgan Stanley (NYSE:MS) has been the clear underperformer for over one year. MS has lagged not only in its peers but also in its industry benchmark, proxied by the SPDR S&P Capital Markets ETF (KCE) by around -5%. On Tuesday 16th, the firm reported Q2 earnings and in this writing, I will be discussing them, to see if there is a change in the bullish analysis that I published in April.

Before starting, let me remind you that Morgan Stanley is divided into three segments which are

- Institutional Securities.

- Wealth Management.

- Investment Management.

The first two, are the primary segments of Morgan Stanley, and both have roughly a similar revenue composition. The remaining, Investment Management, accounted for approximately just 9% of the revenue in Q2.

If you kept wondering, Institutional Securities, include services such as investment baking, capital markets, sales & trading, and research, while the other segments have self-explanatory titles.

How Did Morgan Stanley’s Q2 Earnings Go?

For the second consecutive quarter, Morgan Stanley’s Q2 earnings came in strong, with revenue being beat by 5% and EPS by 10%. This represents Q2 revenue of $15.0 billion vs. the $14.3 billion that Wall Street was expecting and $1.82 EPS vs. $1.65 EPS anticipated by the consensus.

From an aggregation of all three segments, net revenues grew 12% from a year ago and after reducing all expenses and paying preferred dividends, net income applicable to MS common shareholders grew at a stunning 44% YoY.

Over the quarter, tangible book value per common share grew to $42.30, which adds to a ROTCE of 17.5%. The efficiency ratio sat at 72%, which is a 6% improvement from a year ago. Additionally, the CET1 capital remained at the level of 15.2%, exhibiting minor volatility from a year ago.

Analyzing MS’s Q2 Segment by Segment

As many of you know, 2021 is a spectacular year for deal activity and markets in general. In that year, Morgan Stanley reported a net income of $15 billion. After that, in 2022, net income fell by around a third due to opposite conditions in markets and deal activity. However, things have been recovering. Markets are on their highs and deal activity has been picking up again. This explains the 12% YoY top-line growth that Morgan Stanley achieved in Q2.

Now when looking at each segment, Institutional Securities obtained the highest revenue growth at 23% YoY, followed by Investment Management (8%), and finally Wealth Management (2%) which barely moved despite higher market valuations. Similarly, within contribution profit Institutional Securities grew at an astonishing 100%, Investment Management at 30%, and Wealth Management at 7%. All the segments grew their bottom line with the particularity of increasing non-interest expenses from a year ago.

Institutional Securities

Within the principal revenue generator of Morgan Stanley, all business lines improved from the preceding year. Investment Banking was up 51% and benefited from higher M&A transactions, equity, and fixed-income underwritings due to recovery in deal activity, IPOs, private placements, and high-yield issuances. Additionally, the Equity and Fixed Income business lines were up another 18%, and 16%, respectively, due to stronger client management.

Wealth Management

As commented, the Wealth Management segment had minimum revenue growth of 2%, and this was particularly due to a slowdown in income from net interest because of lower average sweep deposits, which was mostly attributable to the seasonality of tax payments in the US. Other than that, asset management revenues hit their record of roughly $4 billion due to elevated asset valuations.

At the same time, there was a significant drop in net new assets. In Q2, $36 billion in net new assets were brought in, which represents a 62% drop from the prior quarter, suggesting lower inflows during higher equity markets.

Investment Management

Last, the investment management business saw an acceleration of asset management-related fees of 6% mainly driven by higher AUM due to higher market levels. At the same time, performance fees soared 238% year over year, but their level of $44 million is too insignificant for it to be meaningful to the income statement.

Following, Investment Management also did poorly in terms of net flows after obtaining just $0.1 billion in Q2 but improving from the negative figure of $-5.3 billion in Q1. The asset class that accumulated most of the negative net flows was Equities, in which the firm lost $-9.2 billion, suggesting that clients began selling in markets that were at their highs.

Morgan Stanley’s Outlook

Reflecting on the Q2 earnings results, these were fantastic in almost every business line. Nonetheless, income from net interest was one of the few revenue sources that got affected, and here, the company announced that in Q3, they intend to make changes to their advisory sweep rates, increasing the rates they pay to some clients’ cash in sweep accounts. To that, management stated that NII in the third quarter could continue to decline modestly due to that expected change that was driven by market dynamics. In addition, the company also said that NII could just inflect higher all the way until 2025 and that drops in NII will be offset by repricing of their proprietary investment portfolio as bonds mature and interest rates drop.

To an extent, although this was the most commented topic during the earnings call, the truth is that for a firm like Morgan Stanley, the revenue generation is predominantly driven by non-interest revenue rather than net interest revenue. Looking at the numbers, net interest income in the Wealth Management segment only constituted 12% of the quarterly revenue, so it is not a significant figure.

From the side of deal activity, the market is closer and closer to that FOMC September meeting, where rates have a 91.7% probability of dropping. Although M&A activity has slowly rebounded, it remains far away from “normalized levels” and being so close to a potential start of a rate cut cycle is a huge tailwind for activity to get where it used to be and, in essence, Morgan Stanley capitalizing from it. At the same time, in private markets, many strategies that require high leverages are paused, since at these rates deals aren’t as profitable as before. Making investment banks to lose in potential revenue.

Now, from the side of Wealth and Investment Management, higher asset valuations have benefited these segments in terms of management fees. Nonetheless, with equity markets, at least, hitting all-time highs (although they have slightly corrected), it’s likely that the momentum will take a break after a YTD with steep growth. If this occurs, drops in management fees would materialize, all else constant.

MS Valuation After Earnings

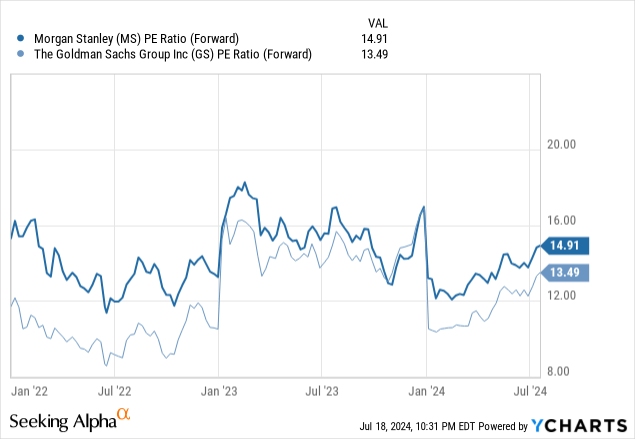

Currently, the stock of Morgan Stanley is priced at 15.0x their forward EPS, which is a multiple slightly above one of its most comparable peers, The Goldman Sachs Group, Inc. (GS) at 14.5x. With these levels, MS stands 23.79% above their 5-year average and GS does it higher at 32.53%. Suggesting that they are slightly overvalued based on their past.

From the side of sell-side analysts, five have updated their price target after earnings (based on the information that I have available). With these, the median price targeted sits at $115, implying a 13% total return appreciation based on a stock price of $104.81 and an expected dividend to be received of $3.7.

Conclusion

Morgan Stanley had fantastic Q2 earnings with remarkable strength in investment banking in which deal activity is still not within normalized levels, and with further room to go. Although their net interest income would be affected in the following quarters, and asset management fees have a high probability of dropping if elevated market levels are correct, tailwinds from being so close to potential drops in rates could continue boosting the Institutional Securities segment. Despite being the underperformer against other major investment banks over the past year and having a stock that’s trading without a clear margin of safety, I reiterate my buy rating on the stock.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.