Summary:

- Morgan Stanley is benefiting from a revival in ECM and DCM, and now its advisory businesses are also benefiting from more high ticket M&A where the mid-market has been better.

- In particular, DCM is looking strong as Morgan Stanley is cashing in on ample demand for corporate credit at higher yields, even though credit spreads remain historically low.

- YoY ECM is also up, although the sequential declines despite a strong market show that the business is naturally more fickle and lower visibility.

- Wealth management and asset management are solid, in line with peers, as well as the institutional brokerage business.

- The valuation is probably fair if you impute valuations from some comps, but we prefer more exposure to the eventual return to form of PE and better baseline mid-market growth.

Pgiam/iStock via Getty Images

Morgan Stanley (NYSE:MS) delivered a decent quarter last time, but highlighted the disadvantage of being in the large-ticket markets as opposed to an advisory in the mid-market, which has consistently outperformed. The wealth management business was growing, and the company is claiming that growth in client assets in the broader business will start shifting into advice-based accounts that generate more revenue per dollar of client capital. The shrinking NII as less balances were sitting out doing nothing in this trading cycle means less NII, but the higher rate situation means these figures should have represented a bottom, and are consistent in dynamics with peers – not a negative outlier. The big driver of growth though is the ECM and DCM businesses, which have pretty low visibility, and might be subject to pull forward. However, these concerns don’t matter if the economy continues to perform well, and public equity markets in particular continue to be inviting. PE markets were still entirely frozen, and will be a major boon when it finally thaws, but the thinking was that could still be in several quarters’ time.

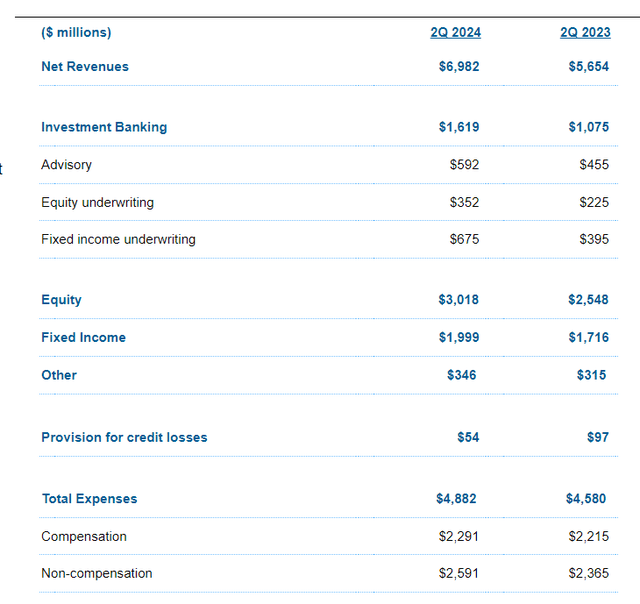

What this quarter has shown is an acceleration in broad-based investment banking income, but with fixed income underwriting coming in more strongly than last quarter which was focused on equity underwriting. Advisory also turned around thanks to easier comps, although there was also an encouraging sequential improvement. Brokerage also picked up but mainly due to base effects. AM stayed consistent in its growth.

In terms of valuation, Morgan Stanley is reasonably valued. An advisory pure play has something like a 18x forward PE multiple, going off Lazard (LAZ), assuming a 10x PE makes sense for asset management and wealth management. Institutional brokerage has something like a 18x PE multiple going off Piper Sandler (PIPR). Blending that means a fair forward multiple for MS is something like 14x PE, 50% AM and WM by revenues, the rest advisory and institutional brokerage. That’s where the stock trades with a forward multiple at 15x. Not a steal but solid value.

Latest Earnings and Industry Trends

Let’s jump straight into it with looking longitudinally at MS results from the last quarter and then those of this quarter, beginning with the advisory and brokerage businesses.

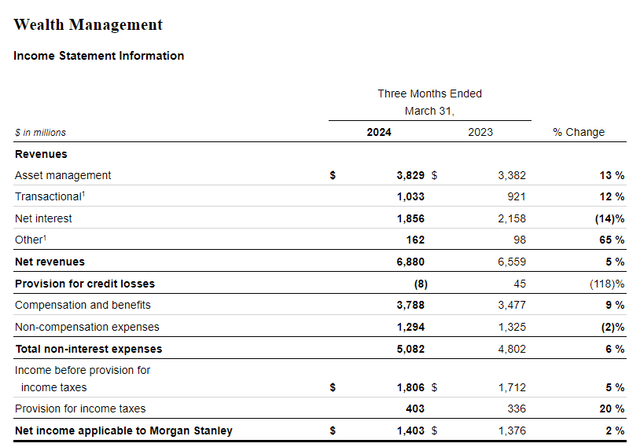

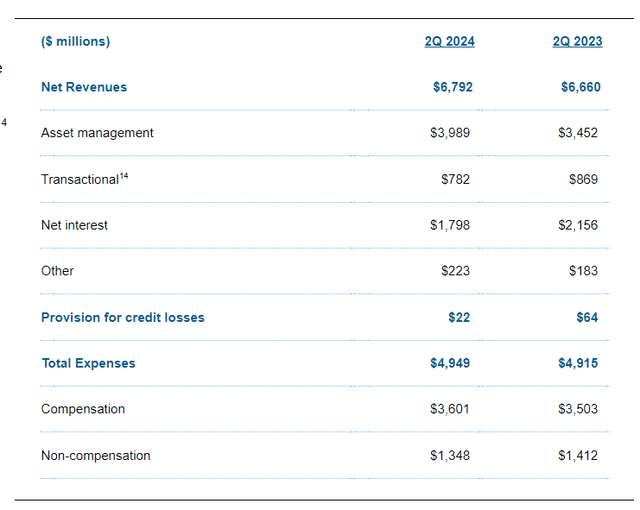

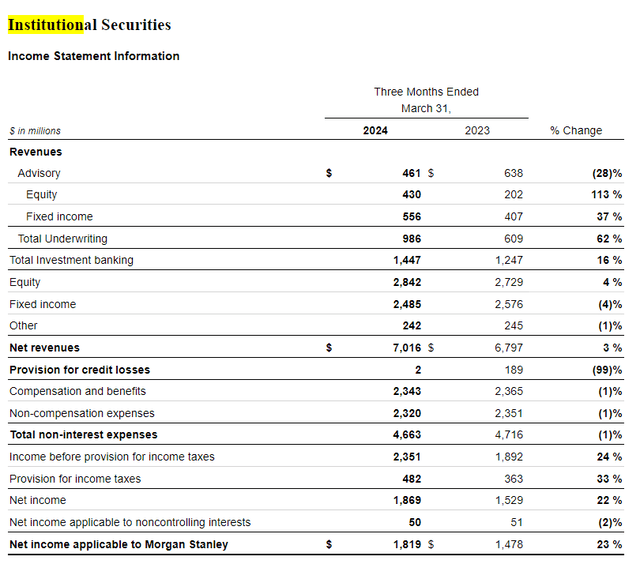

Advisory/Underwriting and Brokerage (10-Q Q1) Advisory/Underwriting Brokerage (8-K Q2)

Underwriting income, connected to issuance of debt and equity securities for clients, was up considerably in the Q1. ECM was a particularly dead market these last couple of years – think about how few IPOs have been happening. Equity markets have been rising, and deferred action is coming in now as the funding conditions have improved showing strong showings for both the Q1 and Q2, but the stronger showing in the Q1 where Q2 had sequential decline and more of a leg up from base effects. This reflects that a lot of deferred activity may have burst through as equity markets finally picked, but that this is ultimately an opportunistic and short visibility business and that institutional take up for IPOs is still pretty selective and limited, which is to be expected in a higher cost of capital environment that doesn’t favour IPO-stage companies.

There was a lot of debt issuance as well in the Q1. A lot of demand even for pretty poor credit, which has had a reflexive and positive effect on the economy by improving precarious balance sheets. Participants have come off the sidelines now that the rate situation has at least peaked, although the latter part of the yield curve continues to translate upwards, which could become a problem in this market. However, so far into Q2, this is not the case. Fixed income underwriting is up sequentially, reflecting the exceptional demand even for poor credit and the stabilising effect this is having on the financial side of the US economy. It probably also solidifies a higher for longer environment though, as there are less systemic risks now with the current rate policy, and inflation remains high.

In general, both ECM and DCM is pretty low visibility. Unlike with complex M&A that the advisory segment deals with, projects are turned around pretty quickly, and they also get cancelled or indefinitely deferred pretty frequently and with low thresholds, as seen with the wave of cancelled IPO activity in 2021-2022. While the outlook remains good, backlogs have little meaning here. Also, a lot of this activity got deferred as corporates waited to sus out the rate situation. Some of it is coming in now as it’s no longer possible to wait and the maturity wall is this year and next, which has particular support over fixed income underwriting as compared to equity underwriting which seems to be reflected in the Q2 results as at least refinancing activity becomes necessary. There might be some windfall activity going on here.

The capital markets group at MS is generally strong and has shown its strength in Q1 and Q2, whereas the advisory activities, which are going to be focused on larger clients and not the mid-market, was actually in decline in Q1 although has picked up in the Q2 sequentially. The mid-market had been resilient these last years, and even started to grow a few quarters ago, with plenty of examples of companies that managed to sustain advisory growth throughout the rising rate cycle. It’s a mature business at MS and is inferior in growth profile to the mid-market advisory peers. M&A activity is driving things here in the Q2 as large ticket M&A comes to life a bit, although it should be mentioned that financial sponsors, i.e., PE, are still entirely on the sidelines, and there continues to be the promise that they come back to transact in markets with companies like MS providing that deal flow. This is the basis of even a supercycle argument that bank executives are trying to sell to markets, since a lot of activity, including ECM, remains below historical levels. Until cost of capital declines, activity is probably precisely where it belongs. Perhaps PE is the only latent driver which could come online as they try to get timing right with rates – but according to Moelis (MC), some decline in rates would first need to be seen.

In terms of the brokerage businesses, again their performance tracked with peers in the Q1, and demonstrates plateauing activity as volatility settles. With markets going in just one direction, these businesses tend to go slower. However, with the exceptional increase in flows and client balances coming back into the market with a strong start to the 2024 year for equity markets, equity is up sequentially into Q2 driven by prime brokerage. Fixed income is down as fund flow intensity, despite the continuing high yields, and volatility dials down. Perhaps more volatility and speculative activity comes into markets ahead of the elections, which tends to be a speculative focal point and can have both corporates and financials dealing in more macro-related bets as well. We should start seeing that into Q3 if it plays into this year at all.

The wealth management and asset management businesses aren’t too complex. The MS strategy is basic and that’s to convert those who trade their products into contributors into advised accounts that make more recurring fees. Revenues are up less than client balances, which signals latent growth in wealth management. They have also had success in bringing new funds from family office clients, which was an initiative started in 2021. About half the flows came from that offering. Into Q2, there was sequential improvement in the asset management figures. Transactional saw sequential declines.

The other thing to notice is the net interest income. It is down despite YoY growth in rates. This is because they have more cash invested into inventory as there is more counterparty activity in the market making business. This reflects trends with peers. Indeed, with client balances continuing to grow into Q2, less is on the side to sweep in low risk high yield. This account will be inverse to speculative activity and open trades in markets.

Bottom Line

Crudely, MS is probably still around fair value, which is what you’d expect from a major, globally covered premier financial pick. To get to this conclusion, we note that Lazard is around 50:50 AM and advisory/underwriting. Their forward PE is around 13x. We usually take AM pure plays to have a 10x PE fair multiple. This implies around a 16-18x forward PE on the advisory/underwriting businesses at Lazard. With Piper Sandler, they are around 1:2 between brokerage and advisory/underwriting. With a forward PE of around 18x, we can imply the brokerage businesses to have around a 18x forward PE as well. MS is around 50:50 AM/WM to advisory/underwriting and brokerage, which means their fair multiple would be something around 14-15x, which is where they are.

In terms of directional considerations, they are a little less levered to advisory, which is where the dormant PE facing businesses are. We probably prefer picks like Lazard and PIPR on an absolute basis in light of this, since there’s a lot of latent earnings growth for when PEs begin to transact again, which may be after some of the first eventual rate cuts – could be a while. While ECM and DCM are back online, these are more fickle businesses, and while MS is great at it, we think the mid-market remains the place to be to obtain greater resilience at a similar valuation to MS.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

If you thought our angle on this company was interesting, you may want to check out our idea room, The Value Lab. We focus on long-only value ideas of interest to us, where we try to find international mispriced equities and target a portfolio yield of about 4%. We’ve done really well for ourselves over the last 5 years, but it took getting our hands dirty in international markets. If you are a value-investor, serious about protecting your wealth, our gang could help broaden your horizons and give some inspiration.