Summary:

- Morgan Stanley’s Q2 results showed a decrease in total revenue and net profit but strong coverage for preferred dividends.

- Preferred shares remain a strategic part of my income-focused portfolio, despite being non-cumulative.

- Series E preferred shares pay a fixed dividend but may be called at any time, presenting a call risk for investors.

GordonBellPhotography/iStock Editorial via Getty Images

Introduction

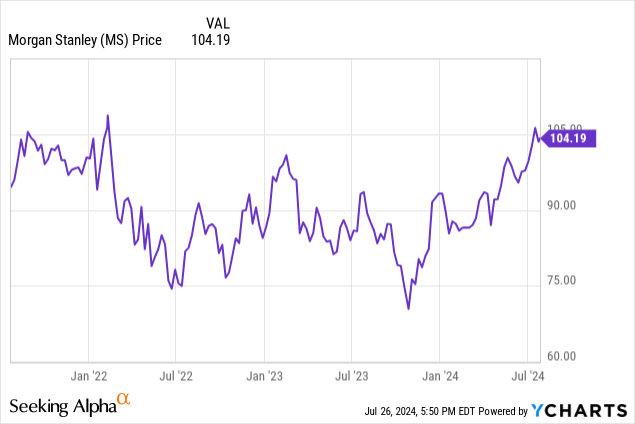

I like Morgan Stanley (NYSE:MS) as an investment bank and I have had a long position in the past as I usually try to get in the stock by writing put options and selling out by writing call options. As such, Morgan Stanley’s common shares are a “trading vehicle” for me, while I consider some of its preferred shares to be a strategic portion of my income-focused portfolio (despite the preferred equity being non-cumulative).

As it has been a while since I had a look at Morgan Stanley and the bank has reported on two additional quarters since my previous article was published, I wanted to hold my position up to the light to see if I need to take action and to see if the preferred dividends are still safe.

The Q2 results: A mixed bag, but the preferred dividends enjoy good coverage

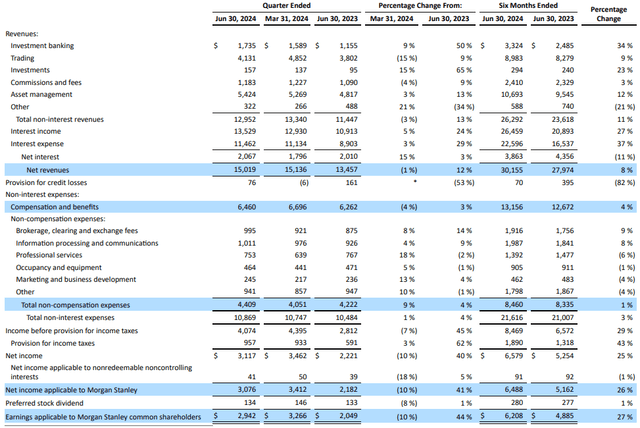

As the situation on the financial markets improved, Morgan Stanley was also able to record a strong result. The investment bank reported a total revenue of in excess of $15B of which almost $13B is generated from its banking and asset management division, while the net interest income added just $2.1B to the total revenue. That being said, we shouldn’t snub that net interest income as it increased by almost $300M on a QoQ basis.

MS Investor Relations

As the income statement above shows, there was a rather substantial increase in the investment banking revenue, although this was not sufficient to cover the impact of the 15% lower trading revenue on a QoQ basis. And the lower trading income is the main reason why total revenue decreased by 1% on a QoQ basis.

But there was good news as well. The total amount of compensation and benefits decreased by 4% and this would have been sufficient to mitigate the impact of the lower revenue but unfortunately the other non-compensation expenses increased resulting in a 1% increase in the overall expenses.

This resulted in a $4.07B pre-tax income which is approximately $321M lower than in the first quarter of this year. A portion of this difference is also caused by the $76M in loan loss provisions recorded in Q2 vs. a $6M reversal in the first quarter of the year.

But in any case, from the perspective of a preferred share investor, I’m not too worried. Morgan Stanley’s net income was $3.12B of which $41M was attributable to non-controlling interests, leaving $3.08B on the table. As you can see in the income statement above, the total amount of preferred dividends paid was $134M.

This means Morgan Stanley needed less than 4% of its attributable net income to cover its preferred dividends. And although the preferred equity is non-cumulative in nature (Morgan Stanley does not have to make up for missed preferred dividend payments if it skips a quarterly payment), I think the payout ratio is sufficiently low to protect the preferred shareholders. Not in the least because the reputational damage of skipping preferred dividend payments would have a very negative impact on Morgan Stanley.

The implications for the preferred shares

In my previous article on Morgan Stanley I chose to focus on the Series E preferred shares (MS.PR.E). Although this was originally a fix-to-float issue, when the LIBOR-based floating rate would no longer be applicable due to the acceptance of the SOFR as benchmark, Morgan Stanley elected to keep the preferred dividend fixed at the same rate as the initial period rather than letting the preferred dividend float based on the SOFR benchmark. Some investors liked that move, others called it a “breach of contract” although Morgan Stanley definitely was entitled to do so as its prospectus language specifically focused on LIBOR and did not mention a successor benchmark rate.

Seeking Alpha

This means Morgan Stanley will continue to pay the quarterly preferred dividend of $0.4453125 (for an annual dividend of $1.78125 for a 7.125% preferred dividend yield) but keep in mind this preferred security can be called at any time. This means it wouldn’t be smart to pay too much over the principal value of $25 exactly because of that call risk. And I think the odds of seeing the security being called are increasing as the interest rates on the financial markets have started to move down. This means it may become increasingly interesting for Morgan Stanley to effectively call the shares as it can find cheaper sources of funding.

Investment thesis

I currently have a small long position in the Series E preferred shares issued by Morgan Stanley, as the preferred dividends are very well covered. I acknowledge there is a call risk, so if/when I try to add to my position, I usually try to do it right after an ex-dividend date to buy the stock as close to the $25 principal as possible.

After a relatively strong second quarter and seeing how the bank remains on track to report an EPS north of $7/share this year, I may try to find a new entry point for the common shares as well. I haven’t decided yet on the best approach, but the option premiums for a P95 or P92.5 expiring in October are relatively attractive with an option premium of $1.50 for the former.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MS.PR.E either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Consider joining European Small-Cap Ideas to gain exclusive access to actionable research on appealing Europe-focused investment opportunities, and to the real-time chat function to discuss ideas with similar-minded investors!