Summary:

- New estimates suggest a fair price of $77.38 and a future price of $113.29 for Morgan Stanley’s stock.

- MS stock missed Q4 2023 EPS estimates but exceeded them in Q1 2024, along with beating revenue expectations.

- The firm aims to expand its wealth management business to manage $10 trillion in assets. Currently, it ranks fourth in market share among peers.

- The company is overvalued and likely to decline if earnings estimates are not met. Despite potential short-term gains, I rate the stock as a sell due to significant downside risk.

hapabapa

Thesis

In my previous article about Morgan Stanley (NYSE:MS), I assigned a “hold rating on the stock. This was because the results from both models were very far apart. The first was grounded on the available average estimates, which yielded a fair price of $66.83, and the second was grounded on market trends, which suggested a fair price of $120.91. Since that previous article, the stock has gone up by 0.65%, which demonstrates that the stock was close to being a “sell” at that time.

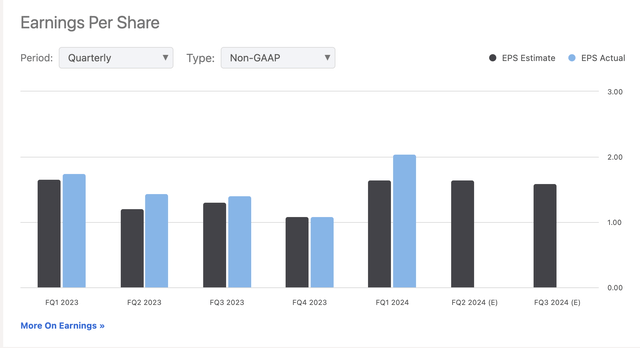

Morgan Stanley released 2 earnings reports, since that previous article. In Q4 2023, Morgan Stanley missed EPS estimates by 17.47% but beat revenue by 0.62%. Then, in Q1 2024, Morgan Stanley reported an EPS of $2.02 which was 21.68% higher than expected. Then it beat revenues by $710M, which means 4.93% higher than expected.

Therefore, in this article, I need to re-evaluate Morgan Stanley. After the valuation, I arrived at a fair price estimate of $77.38 and a future price of $113.29. Therefore, I downgrade the stock from “hold” to “sell”.

Overview

Growth Plan

Morgan Stanley’s growth plan revolves around its wealth management business, which grew from 2.5M clients to 18M. Morgan Stanley has set a goal to manage $10T in client assets, which is 580% higher than the current AUM of $1.47T.

How does Morgan Compare to Peers?

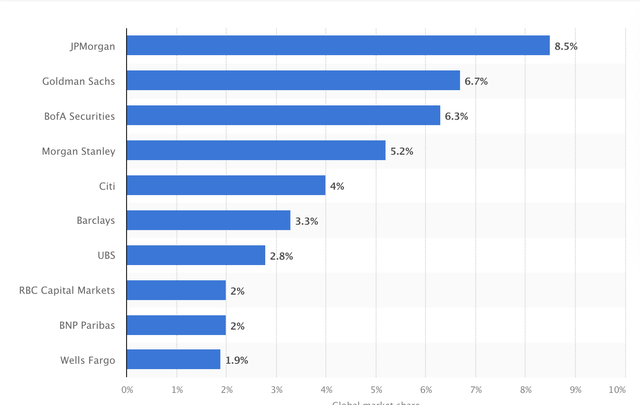

JPMorgan Chase & Co. (JPM) is the leading investment bank with its 8.5% market share. Goldman Sachs comes in second with 6.7%, and Bank of America Corporation (BAC), comes in third with 6.3%. Morgan Stanley comes in fourth place with a market share of 5.2%.

Industry Outlook

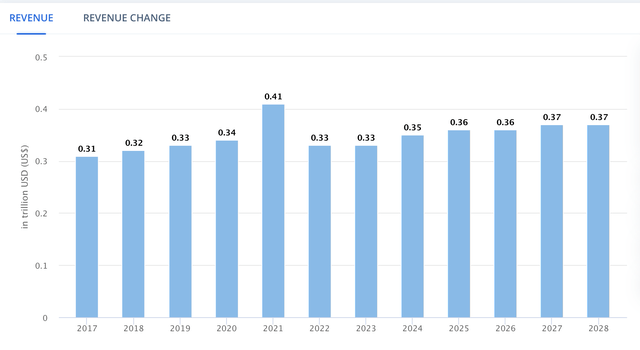

The global investment banking market registered revenues of $330B for 2023, and it’s estimated that for 2028, it will be $370B, showcasing a 1.4% CAGR throughout 2023-2028.

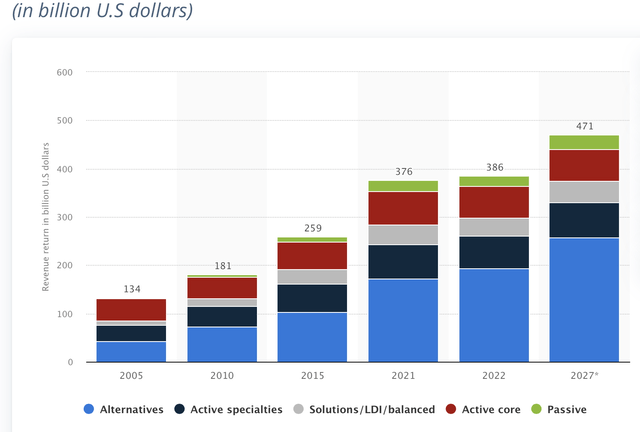

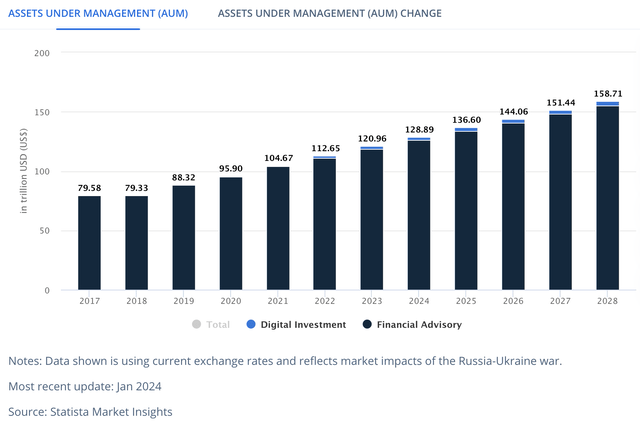

On the other hand, Worldwide Asset Management and Wealth Management are expected to grow, respectively, by 4.40% and 5.90% annually. The TAM for Asset Management stands at $402.98B as of 2023, and for wealth management, it stands at $120.96 in assets.

For the year 2027, the TAM for wealth management is expected to be around $158.71T in assets, and for Asset management, it’s expected to be $471B in potential revenues.

Valuation

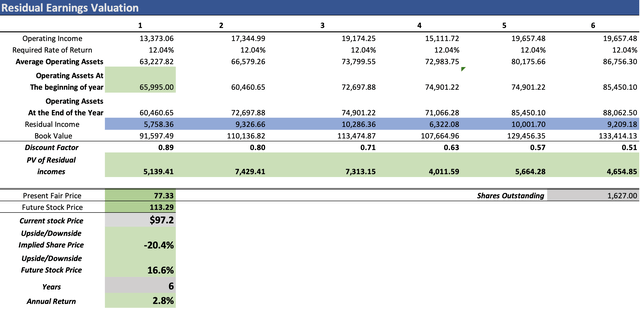

I will value Morgan Stanley through a residual earnings model. The first step is to calculate the Required Rate of Return, for which I will use a CAPM model. The beta is from Marketwatch, and the risk-free rate is the current 10-YR US bond. The result of the calculation was 12.043%.

| CAPM | |

| Risk-Free Rate | 4.322% |

| Beta | 1.26 |

| Market Risk Premium | 6.128% |

| Required Rate of Return | 12.043% |

The next step is predicting operating assets and book value throughout the projection. To do that, I will use a margin tied to revenue performance. First of all, operating assets came out at $102.50B. This was calculated by subtracting total cash reserves in all its forms, as well as current liabilities, from total assets. This gave a result of $65.99K, which is 121.16% of revenues.

Meanwhile, book value does not need much explanation, it’s total assets minus total liabilities. This gave a margin of 183.55% of revenues.

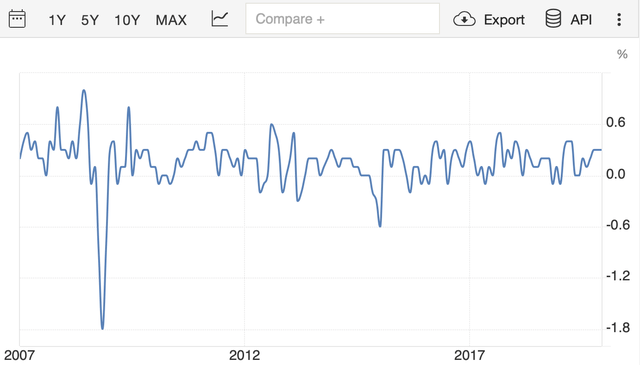

Then, it’s time to calculate revenues. For this, I have found two things: 1) when interest rates are cut, as in 2020-2021 (in this case to counter the effects of the pandemic), revenue increased on average 20.24% and net income margin expanded on average 1.65%. Meanwhile, when interest rates are increased (as in 2022-2023), revenue fell 5.12% on average, and net income margin contracted by 4.11 on average.

Now, the important question: When do I think that the Fed will increase interest rates again? Well, I think that it will happen in 2027. Why? It’s not the same case as in 2008-2019, a period of low inflation since the Great Recession harmed profoundly the US, and therefore it ensured price stability for many years. For instance, as soon as the crisis started, the CPI fell by 1.8%, and thereafter monthly CPI changes never surpassed the 1% level from 2008 to 2019 and in some years, it was even negative.

Meanwhile, Europe took until 2017 to fully recover, and this, of course, was another factor that influenced the Fed interest rate decision, since if the USD became too cheap in comparison with the Euro, US exports would have become less competitive than European ones.

However, in the current scenario, some people expect a “mild recession” instead of a harsh one, and is very probable that as soon as inflation touches the 2.3%-2.6% range, the Fed will cut interest rate, as it has done the Swiss National Bank and as the European Central Bank already did this month.

Now, returning to the projection, I will make the year 2024 revenue fall by 5.12% (in comparison to 2023) to subsequently increase by 20.22% in 2025. Then for 2027 and 2028, the same will happen, respectively.

Then, what will happen with years 2025,2026 and 2029, is that Morgan Stanley’s revenue will grow in pace with the expected CAGR of their respective market.

| Commission and Fees | Trading | Asset Management | Underwriting & Investment Banking | Net Interest Income | Total | |

| 2023 | 4,537.0 | 15,263.0 | 19,617.0 | 4,948.0 | 8,230.0 | 52,595.0 |

| 2024 | 4,304.7 | 14,481.5 | 18,612.6 | 4,694.7 | 7,808.6 | 49,902.1 |

| 2025 | 5,176.0 | 17,412.6 | 22,379.8 | 5,644.9 | 9,389.1 | 60,002.3 |

| 2026 | 5,279.5 | 17,760.8 | 23,532.4 | 5,723.9 | 9,524.3 | 61,820.9 |

| 2027 | 5,009.2 | 16,851.5 | 22,327.5 | 5,430.8 | 9,036.6 | 58,655.7 |

| 2028 | 6,023.0 | 20,262.2 | 26,846.6 | 6,530.0 | 10,865.7 | 70,527.6 |

| 2029 | 6,143.5 | 20,667.5 | 28,229.2 | 6,621.4 | 11,022.1 | 72,683.8 |

| Growth rate % | 2.00% | 2.00% | 5.15% | 1.40% | 1.44% |

Then, I need to calculate net income to sum taxes and obtain operating income. As previously mentioned, during interest rate increases, net income margins contracted by 4.11% on average, and when interest rates were cut, margins increased by 1.65% on average. Therefore, I will make net income margins for the 2024 and 2027 contracts by 4.11% and for the rest of the years, it will expand by 1.65% annually.

| My Net income Margins % | |

| 2024 | 20.97% |

| 2025 | 22.62% |

| 2026 | 24.27% |

| 2027 | 20.16% |

| 2028 | 21.81% |

| 2029 | 23.46% |

Lastly, I calculated what could be the potential stock price for the year 2029. I did this by taking the undiscounted residual earnings which are highlighted in blue and then summing the estimated book value for 2029 which is $3.42B.

As you can see, the estimated present fair stock price for Morgan Stanley stands at $77.33 which is 20.4% below the current stock price of $97.20. The future price for 2029 came out at $113.29 which translates into 2.8% annual returns.

Now, what you can see is that the stock is currently trading near the future value for the year 2029 and what it should be valued in the present. The risk with this is considerable in my opinion, since it means that if Morgan Stanley misses estimates, or revenue starts to decrease, then the stock price could adjust to the present fair price I am estimated (which is a 20.4% downside), which, I think, is very likely. Then, if Morgan Stanley keeps delivering earning beats, what would happen is that the stock will probably trade in a flat pattern.

I think that it’s more likely for the stock to decrease than increase because higher interest rates will ultimately cause a recession in the US that will bring down stock valuations, and Morgan Stanley depends on increasing valuations to earn more through the fees they charge to their Wealth & Asset Management clients. A fixed fee of 2% will earn more if the total portfolio value increases.

Why do I think I’m Correct?

The first thing we can observe from the stock performance since 2021 is that it has remained almost flat. From August 31, 2023, when the stock was trading at $104.43, until today, when the stock is trading at $97.20, the stock has decreased by 6.92%. The ups and downs it has shown are very correlated with the bear rallies during 2022.

However, if we go before in time, precisely from 2017-2019, we will see that the stock increased by 14%, in other words, it delivered annual returns of 4.66%, which is underperforming the market.

Now, observing the whole stock graph, we will observe that Morgan Stanley tends to decrease when the market decreases and increases when the market decreases. Something that sounds too obvious, however, let’s remember that during a recession, food stocks tend to hold their value very well, nevertheless, Morgan Stanley is not that type of stock.

This trend means that the best time to buy Morgan Stanley’s stock is when the market is down because when those ups and downs are already priced in, the stock tends to deliver very little annual returns. The only possible way to correct this trend is if Morgan Stanley starts acquiring competitors and massively expanding at a worldwide scale, and let’s be honest, the FTC (and probably the EU regulators) will not let Morgan Stanley mass acquire competitors.

Why Does the Stock Price Continue to Increase Despite Morgan Stanley being Overvalued?

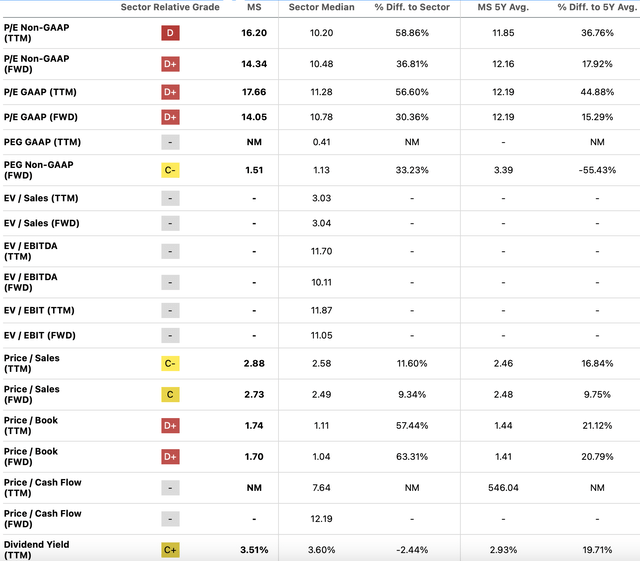

When observing the current multiples of Morgan Stanley, you will observe that they are very high when compared to the median, as well as to their 5-year average. For instance, P/E is 36.78% more than the 5-year average, and 58.86% higher than the median.

Even the price-to-book ratio of 1.70, which almost always follows the trend of the stock price, is 20.79% higher than the 5-year average of 1.41. Morgan Stanley has no reason to have such high multiples, since its net income contracted by 26.64% in 2022, then by 17.61% in 2023, and on a TTM basis, it has grown by 4.75%.

The risk here is real, since if a mild recession does occur and there is an earnings recession in the S&P500, then it’s almost guaranteed that Morgan Stanley will not be able to sustain that TTM 4.75% net income growth.

The late employment numbers show that unemployment has ticked up to 4%, and inflation is still above the 3% level, which means that interest rates could be kept higher for more time, and higher interest rates are detrimental to M&A, IPOs, and every other activity that involves passing through investment bankers. Nevertheless, after this occurs, historically a huge opportunity always opens.

Risks to Thesis

The main risk to my thesis is that Morgan Stanley suddenly beats estimates by an ample margin (according to my calculations this would require EPS estimates that are 68.47% higher than the average consensus), in that case, the stock at its current price could become fairly valued.

| Average Consensus |

Required EPS For a fair price of $102.76 and a future price of $151.28 |

% Difference | |

| FY 2024 | 6.75 | 10.73 | 59.04% |

| FY 2025 | 7.54 | 12.91 | 71.19% |

| FY 2026 | 8.25 | 13.30 | 61.20% |

| FY 2027 | 7.64 | 12.62 | 65.16% |

| FY 2028 | 8.37 | 15.17 | 81.37% |

| FY 2029 | 9.16 | 15.64 | 70.72% |

| 68.47% |

The other risk is that historically, when interest rates are cut, this has a positive effect on Morgan Stanley’s stock. Therefore, if the Fed cuts interest rates by year-end as I am suggesting, Morgan Stanley’s stock could still increase despite it being overvalued. Nevertheless, as previously said, the ultimate result of higher interest rates (and especially when they are as high as today) is a recession, be it mild or harsh, which ultimately will cause stock valuations to decrease, and therefore.

Nevertheless, these are mostly sentiment-based risks, I still maintain my belief that Morgan Stanley is overpriced and that if this positive sentiment is broken, then the stock has a high probability of going down.

Conclusion

In conclusion, Morgan Stanley is currently trading at a non-sustainable valuation. This has been caused by a huge 23.63% beat on Q1 2024 earnings, which of course boosted the optimism and pushed earnings revisions upwards. Price to Book, for example, is 20.79% higher than the 5-year average of 1.41.

According to my estimates, the present fair price for Morgan Stanley stands at $77.33, which is 20.4% above the $97.20. Additionally, the future stock price for the year 2029 stands at $113.29, which translates into 2.8% annual returns throughout 2029.

For these reasons, I downgrade Morgan Stanley to “sell”. In the future quarter, I will see if Morgan Stanley is capable of delivering more earnings power, to escape from that 20% potential downside. Nevertheless, that will require a lot, more specifically EPS targets that are 68.47% higher than the average consensus.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.