Summary:

- After lowering my rating from Buy to Hold in April, I am now dropping it to a Sell rating.

- Morgan Stanley, a financial holding company, offers various financial products and services globally through different segments. Balance sheet figures show that Morgan Stanley’s preferred stocks are well covered.

- Here I compare the MS-A with two fixed-rate MS PFDs and a Goldman Sachs PFD with similar features to MS-A. Conclusion: Swap MS-A for MS-E.

Nikada

Introduction

This is an update to my April article on the Morgan Stanley PFD A 1/1000 (MS.PR.A). Viewing its yield compared to all the other Morgan Stanley preferred stocks has me lowering my rating again as the FOMC is on the edge of a rate cutting cycle, which was the concern I emphasized last spring. The company decided to not float the rate on any of their fixed-to-floating preferred stocks outstanding, but as the “A” never was fixed, that cannot happen here.

After comparing features of the MS-A against two other MS preferreds and one from Goldman Sachs, and with the belief rates have peaked, swapping out this floater with a fixed-rate issue makes sense, thus I lowered my rating from Hold to Sell. The Morgan Stanley DEP SHS 1/1000 E (MS.PR.E) fixed is a good replacement choice.

Morgan Stanley review

As the ability to pay both the dividends and face value if Called or defaulted, a brief review of the issuer is important, though I suspect the “too big to fail” tag will prevent another Lehman Brothers disaster. Seeking Alpha provides this description of the firm (edited):

Morgan Stanley, a financial holding company, provides various financial products and services to corporations, governments, financial institutions, and individuals in the Americas, Europe, the Middle East, Africa, and Asia. It operates through Institutional Securities, Wealth Management, and Investment Management segments. The Institutional Securities segment offers capital raising and financial advisory services. This segment also provides equity and fixed income products. The Wealth Management segment offers financial advisor-led brokerage, custody, administrative, and investment advisory services to individual investors and small to medium-sized businesses and institutions. The Investment Management segment provides equity, fixed income, alternatives and solutions, and liquidity and overlay services to benefit/defined contribution plans, foundations, endowments, government entities, sovereign wealth funds, insurance companies, third-party fund sponsors, corporations, and individuals through institutional and intermediary channels. The company was founded in 1924 and is headquartered in New York, New York.

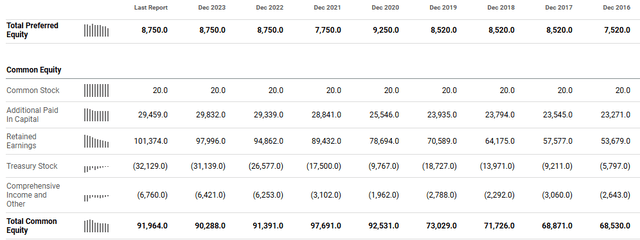

Looking at figures from the Balance Sheet shows the preferred stocks Morgan Stanley still has out are well covered, with the coverage ratio (PFD/TCE) rising from 9X in 2016 to 10.5X in the last Annual Report.

seekingalpha.com Balance Sheet

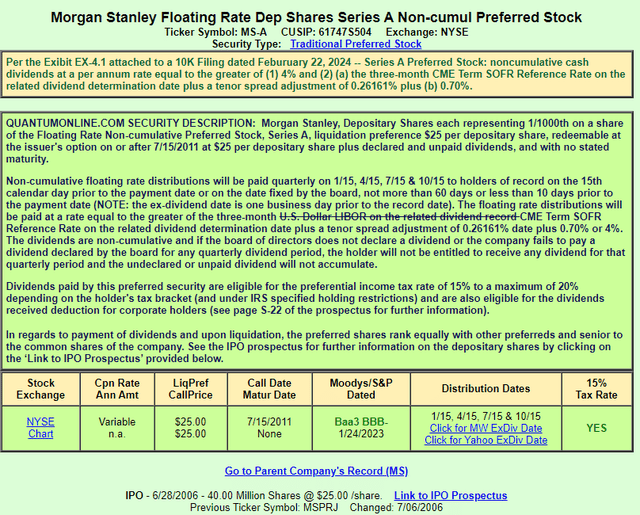

Understanding MS-A

The issue was last rated to be the lowest without losing its investment-grade status. I bought this issue when rates were near zero because of its 4% floor coupon, though that currently doesn’t come into play and would require the SOFR rate to be below 3% to matter. This is what that rate has been since 2018; mostly below that 3% value.

The next chart shows how the quarterly payments have moved as rates have changed.

Notice that the last time the 4% floor wasn’t in effect, predates the GFC and then again with the recent FOMC actions to fight inflation. Payments vary each quarter slightly, since the day count varies slightly.

I found the following chart, where the prediction for this rate will stay above 3% into 2027.

It also projects that holders of this issue should expect their coupon value to drop from roughly 6.3% to that 4% base level, starting when the FOMC cuts the FFR.

While Morgan Stanley can Call this issue, I rate those odds low since they haven’t already in this rate cycle.

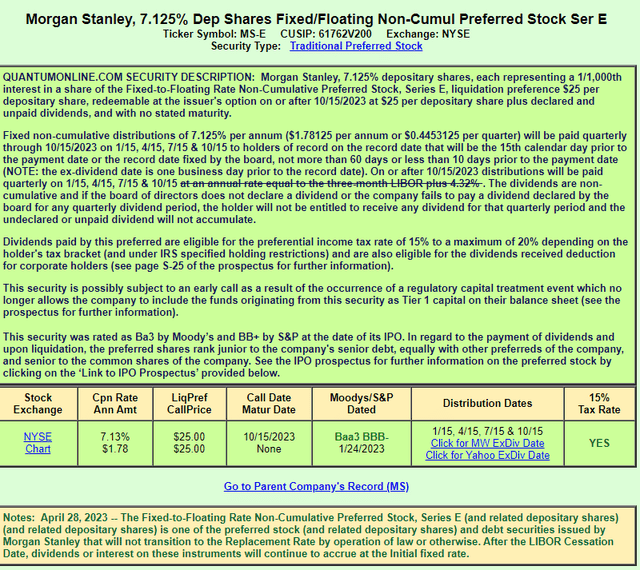

Understanding MS-E

The most important part of this description is the last box that states this issue had its floating provision removed as permitted by the prospectus. Morgan Stanley did this to all their fixed-to-floating issues where it was legally allowed. Note also that its rating has improved since its IPO in 2006, going from the highest “junk” rating to the lowest “investment-grade” rating.

Comparing some options

Here I picked a few issues with common features to help analyze whether the 7+% YOCs are good compared to other choices. Along with the two detailed above, I chose to include the following for this analysis:

- Morgan Stanley 4.250% Depositary Shares Non-Cumulative Preferred Stock, Series O (MS.PR.O)

- Goldman Sachs Group, Dep Shares Float Rate Non-Cumul Preferred Stock, Series D (GS.PR.D)

| Factor | MS A | MS O | MS E | GS D |

| Coupon type | Floats with 4% floor | Fixed | Now Fixed | F Floats with 4% floor |

| Coupon rule | 3mSOFR+ 26.16bps + 70bps | 4.25% | 7.125% | 3mSOFR+ 26.16bps + 67bps |

| Price | $22.14 | $18.70 | $25.26 | $22.43 |

| Yield | 7.17% | 5.67% | 7.13% | 7.29% |

MS-E converted from floating to fixed in April 2023 as many other companies decided to do with their fixed/floating preferred stocks. Since all are currently Callable, YTC values are meaningless, as odds of that happening are near nil. With all but MS-E below Par value, either company would retire their issue by slowly using the open market.

MS and GS go ex-div a month apart and that resulted in GS-D’s last payment being slightly higher than MS-A, which explains the higher yield at the higher price even though they use the same coupon setting formula as both show Forward yields.

The MS-E is the issuer’s most expensive preferred outstanding at this time now that all but the MS-A being fixed coupon, which has a lower cost to MS-E even at today’s rates. If any issue is Called by MS, this should be the first so keep that in mind if it continues to trade above Par.

While the MS-O has the best bump up in price if Called, with a 4.25% coupon, that is not going to happen. I think could be the least costly to MS.

Morgan Stanley has at least four other preferreds with a 6+% coupon, which makes them more likely to be Called than the MS-A as its cost to MS should drop below 6% once the FOMC cuts rates.

As for Goldman Sachs, they are at least two preferred stocks that float with high ad-on values that would be Called before the GS-D issue.

Portfolio strategy

One’s fixed income strategy should be highly correlated to their view on where interest rates are going. Recent data says the FOMC is going to cut and maybe by 100bps before 2025. That means floating-rate preferreds should fare worse than fixed-rate ones. How deep and for how long rates will be down also comes into play if the plan is to not hold the issue for the long haul. The longer the holding period, the less important is knowing where rates are going; YOC then becomes a primary factor.

Default risk matters too, and I see little chance of that as both firms are “too big to fail” and the rules are different from when the FED let Lehman Brothers go under.

After comparing features of the MS-A against two other MS preferreds and one from Goldman Sachs, and with the belief rates have peaked, swapping out this floater with a fixed-rate preferred makes sense, thus I lowered my rating from Hold to Sell.

I like MS-E for its best YOC and the fact that would be fixed unlike the two floating issues. With that though comes the highest, if still small, probability of being Called. Since I do not see that, swapping MS-A for MS-E seems logical at this time and worth getting a Buy rating.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of MS.PR.A either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

After doing this analysis, I will be selling my MS-A positions after the allowed window Seeking Alpha imposes on contributors.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.

With a focus on REITs, ETFs, Preferreds, and ‘Dividend Champions’ across asset classes, members gain complete access to our research and our suite of trackers and portfolios targeting premium dividend yields up to 10%.