Summary:

- Mullen Automotive is conducting a 1-for-9 reverse stock split, its second in 2023 as dire market confidence towards its medium-term ability to remain a going concern drives shares to lows.

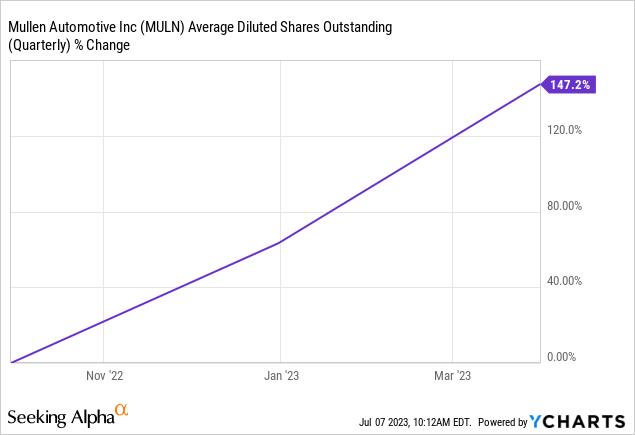

- The EV upstart is set to buy back its stock even as its outstanding share count has risen by 147% over the last year.

- Its large cash position is countered by steep free cash outflows and what’s set to be continued near-term losses even as the company begins vehicle production.

Mario Tama

Mullen Automotive (NASDAQ:MULN) requires another look after what’s been a marked rally over the last few days after the Brea, California-based EV upstart came out with a raft of market updates, including a decision to buyback $25 million worth of its common shares in the open market. I warned investors to avoid Mullen twice, with the company down 90% since my last update back in February. Critically, such an aggressive price action signals that the market seriously doubts the company’s ability to remain a going concern. This going concern risk is further highlighted by the dramatic collapse that followed the company’s 1-for-25 reverse stock split in May. Mullen has engineered a second reverse stock split with its shareholders set to receive 1 share for every 9 shares they own.

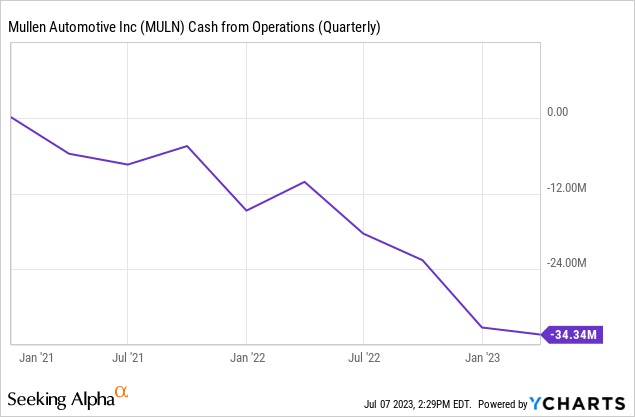

Dilution and cash burn. None of these factors have yet to be addressed since February, with the stock buyback an odd and perhaps myopic development against shares outstanding that are up by 147% over the last year. To be clear, Mullen had 82.4 million shares outstanding as of the end of its last reported fiscal 2023 second quarter, up sequentially from 54.4 million shares in the fourth quarter. The company has been highly dependent on monetizing its stock to plug a trailing 12-month liquidity gap, or free cash outflow, of $206.8 million as of the end of its second quarter. Mullen flagged that its buybacks were due to it being undervalued versus its cash position. However, against intense cash burn from operations, the company failed to share what other metric or what basis was used to decide on the deployment of cash in a way that lends credence to the bearish thesis.

Cash And Equivalents Currently Form A Limited Runway

Here are the core metrics. Firstly, cash and equivalents position, including restricted cash, was $86.3 million as of the end of its second quarter. This was down sequentially by $20.75 million from $107.5 million in the prior first quarter. Keep in mind that cash flow used in operating activities during the second quarter was actually $34.3 million, an increase from $33.2 million in the first quarter, and a material 238% year-over-year increase from an operating outflow of $10.2 million. Hence, why is the company looking to use around 29% of its end-of-second-quarter total cash position for share buybacks when its cash runway is already so precarious?

Critically, this is a short-term adrenaline boost to a fast-collapsing stock price that actually heightens the existential threat facing the company. This threat is real. Ohio-based EV peer Lordstown Motors (RIDE) recently filed for Chapter 11 bankruptcy after its niche commercial EV trucks failed to gain traction and cash ran out against a difficult macroeconomic backdrop to efficiently tap the capital markets. Canoo (GOEV) is teetering on the brink and Arrival (ARVL) recently scrapped its reSPAC transaction that was meant to provide an economic lifeline to the struggling Oxford, England-based commercial EV upstart.

A Sisyphean Effort To Stem Cash Outflows

The second core metric, and perhaps the most important, is that Mullen essentially recorded revenue of $0 for its second quarter. Gross profit was negative at $200,000. The company has touted several purchase orders, this was recently a large $63 million order for 1,000 of its Class 3 EV low cab forward trucks from Randy Marion, a car dealership based out of Mooresville, North Carolina. Randy has become Mullen’s first recorded sales with 22 EV cargo vans sold in late June for revenue that will be recorded for Mullen’s third quarter ending June 30, 2023.

Mullen is now firing off a series of salvos against Chapter 11 commentary. The company has been able to raise its post-period end cash position to $116.1 million and has stated that they stand to tap as much as $45 million in committed capital, with a further update during the share buyback announcement stating its cash position is now higher. Against these two positive developments, Mullen has come out to concretely state that it has sufficient capital for at least 12 months. The company’s current market cap is less than half of its cash position, especially with total debt of $14 million as of the end of the second quarter. However, this valuation is only relevant if cash burn was not running so high against what’s expected to be revenue of just $310,000 for its third quarter. The company began vehicle production from its Manufacturing Center in Tunica, Mississippi in July to further increase near-term cash demand. Hence, Mullen’s cash position stands to be besieged by consecutive quarters of cash burn, with further equity sales rendered comparatively more difficult against the collapse of its stock price. This is to be avoided.

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.