Mullen Automotive Stock Is Not Worth Your Hard-Earned Money

Summary:

- Mullen isn’t the first automaker I’ve analyzed, but nowhere did I see as many red flags as I did here.

- MULN has >40% of its market cap in cash. But that is about as much as is needed to cover quarterly operating costs. Dilution seems inevitable.

- It’s surprising that the inventory balance only appeared on this year’s balance sheet after acquiring another startup, despite years of development and existence.

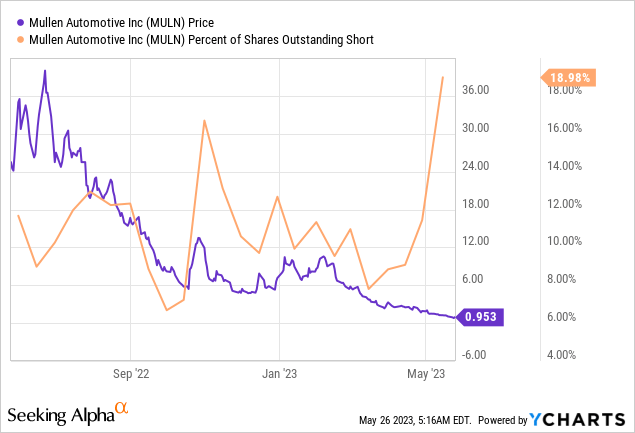

- MULN stock can only be a speculative instrument for short-term trading – the only serious risk to my Sell rating is the percentage of shares outstanding sold short.

- Since the company went public, competition in the market has increased significantly, and now it looks like MULN has lost its chance against this backdrop.

Mario Tama

Mullen Automotive Inc. (NASDAQ:MULN) is an electric vehicle company based in Brea, California. It manufactures and distributes electric vehicles, including passenger and commercial vehicles, according to Seeking Alpha’s description. They’re also known for their solid-state polymer battery technology, which should have changed the concept of electric vehicles a few years ago, judging by articles written by previous authors.

I came across this company rather by accident – one of the articles ended up in Seeking Alpha’s “Trending Analysis” section, and I decided to take a closer look. What I found surprised me, to say the least – MULN isn’t the first automaker I’ve analyzed, but nowhere did I see as many red flags as I did here. Let me explain.

Red Flags Everywhere

My readers know that I don’t specialize in any particular industry, but take a common sense approach to analyzing individual companies and financial instruments. This has both its advantages and disadvantages. Without sufficient industry knowledge, for example, I risk missing some important points – that’s a big minus. On the other hand, with common sense, I can apply classic frameworks and financial logic to my analysis and determine the perspective of the company analyzed, regardless of what it does – that’s definitely a plus because I’m not limiting the range of objects of investigation.

I’m totally convinced that you don’t need to have worked on an auto team at some big-shot investment bank to see that MULN’s corporate developments and balance sheet are looking seriously worrisome.

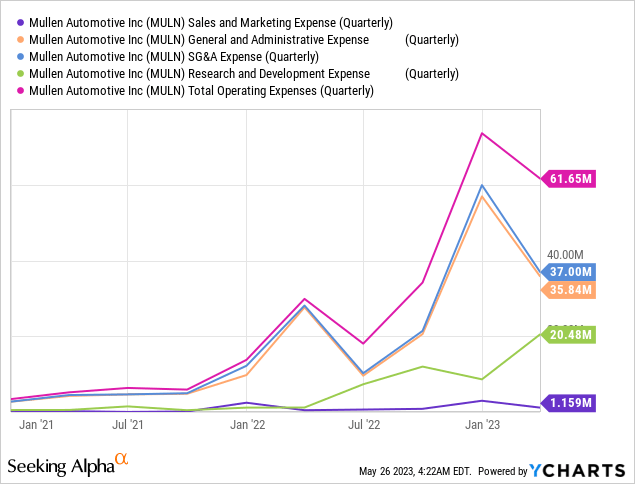

The company is not generating revenues yet, as well as the costs of sales, which is logical. The operating expenses burn a lot of cash from quarter to quarter – the total increase of this income statement item more than doubled in Q2 [10-Q filing].

As you can see, R&D expenses for Mullen Automotive increased significantly by $19.3 million or 1,630% to reach $20.5 million in Q2. These expenses primarily cover engineering, homologation, and prototyping costs. The R&D costs also include $6.8 million representing the fair value of warrants issued for the acquisition of the right to assemble, manufacture, and sell homologated vehicles based on the Qiantu K-50. The ongoing development of electric vehicle programs and the recent acquisition of Bollinger Motors should contribute to further R&D expenses acceleration.

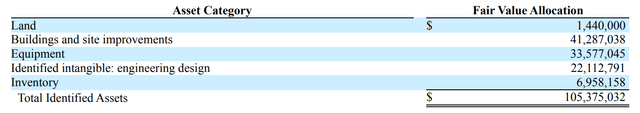

In 2022, Mullen also made a power move by acquiring Electric Last Mile Solutions to ramp up its manufacturing capacity “at a much lower investment than previously expected”, according to the 10-Q. As a result of this acquisition, MULN got the following assets:

During the first half of the fiscal year, Mullen Automotive witnessed a significant outflow of $97.4 million in net cash used for investing activities. This occurred alongside an outflow of approximately $67.6 million in cash used for operating activities. The acquisition of inventories, referred to as “Other current assets” by MULN’s management [which is weird for a car company], contributed to an outflow of approximately $8.9 million in cash from operating activities. On the other hand, the item “Accounts Payable” resulted in an inflow of $8.5 million during the half-year period.

That is, the company has increased its accounts payable, while its inventories most likely consist of submodules, components, raw materials, and tooling.

The company recently entered into a vehicle purchase agreement with fleet leasing provider MGT Lease Company. The agreement includes the purchase of 250 Class 3 all-electric commercial vehicles with cab chassis and a contract value of $15,755,000. Delivery of these vehicles is scheduled to commence in August 2023, and the entire purchase agreement is expected to be fulfilled by December 2023. Shares rose sharply at the time of this news, but then continued to fall anyway – the market didn’t think this deal would be a game changer for the company. And I agree wholeheartedly – imagine MULN will receive nearly ~$18 million in revenue for the year under this deal, giving away the COGS that nobody saw before, which will make the gross profit close to breakeven at best. The cash burn won’t likely go anyway and can even accelerate as MULN hires more personnel.

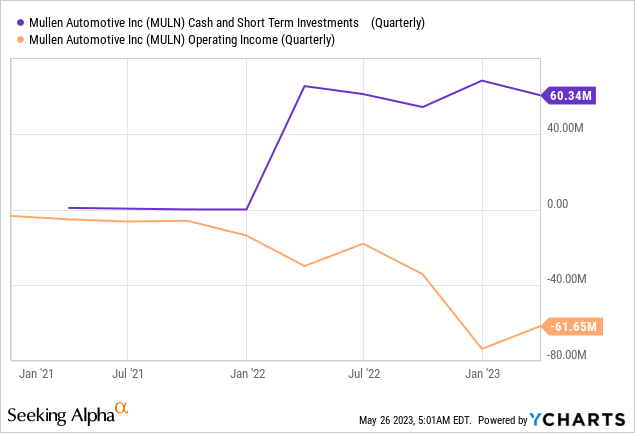

I read somewhere that the fact that MULN has >40% of its market cap in cash makes it undervalued. However, that is about as much as is needed to cover quarterly operating costs, which I understand aren’t expected to be reduced soon despite the new revenue stream.

The company’s complex capital structure against a backdrop of unprofitability only makes MULN stock more confusing and confounding. Actually, it doesn’t really matter what kind of capital goes where in my view – what matters is that it increases the shareholders’ deficit and makes dilution look like an inevitable solution to at least keep paying salaries.

Since the company went public, competition in the market has increased significantly, and now it looks like MULN has lost its chance against this backdrop. To the chagrin of current shareholders, only a takeover by a larger player can save it, if the executives will be able to find a buyer. On its own, the company is unlikely to free itself from the shackles of constant dilution – even if its product is commercialized.

The Bottom Line

In my opinion, MULN stock can only be a speculative instrument for short-term trading – the only serious risk to my Sell rating is the percentage of shares outstanding sold short. If MULN experiences even the slightest positive news or the company’s CEO goes public again with a loud statement like the one about solid-state batteries, the stock will most likely experience a strong short squeeze.

This fire will likely be extinguished by the need to issue new stock to keep the business going.

Maybe I’m missing something in my analysis of the company. That is another risk to keep in mind. But it baffles me that despite years of development and existence, the inventory balance item only showed up on the balance sheet this year – as a result of acquiring another startup. MULN has too many red flags to put hard-earned money at risk – and I haven’t yet pointed out the Hindenburg Research report, which anyone interested in MULN already knows.

I issue a Sell rating this time around and expect the stock to perform exceptionally poorly [maybe except for the short covering period or a buy tender].

Thanks for reading!

Editor’s Note: This article covers one or more microcap stocks. Please be aware of the risks associated with these stocks.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.

Can’t find the equity research you’ve been looking for?

Now you can get access to the latest and highest-quality analysis of recent Wall Street buying and selling ideas with just one subscription to Beyond the Wall Investing! There is a free trial and a special discount of 10% for you. Join us today!

![MULN's 10-Q [author's notes]](https://static.seekingalpha.com/uploads/2023/5/26/49513514-16850922119193604.png)