Summary:

- This article is the first in a series on a portfolio comprised of my top defensive picks for a recessionary environment with a strong overall dividend growth profile.

- I examine MCD’s current valuation and dividend strength to determine whether it is a buy at current levels.

- McDonald’s appears slightly overvalued at the moment but remains a top core holding for dividend growth investors.

robas

I maintain two 25-position, equal-weight dividend growth portfolios for my personal investing goals, one with an offensive orientation (my “Ultra High DGI” portfolio) and one with a defensive orientation (my “Defensive DGI” portfolio). Each portfolio has been painstakingly constructed and backtested to maximise risk-adjusted returns and dividend growth based on its respective aim, with the defensive portfolio seeking to minimise drawdowns during difficult periods and thus be as “recession-proof” as possible, and the offensive portfolio seeking to maximise long-term dividend and capital growth. This article marks the first entry in two series examining the holdings of each portfolio.

MCD: A Core DGI Holding For All Markets

McDonald’s (NYSE:MCD) needs no introduction as the largest fast food chain in the world by number of locations, with over 40,000 locations serving 70 million customers each day in nearly 120 countries. With 46 years of consecutive dividend growth, it is just a few years away from becoming one of fewer than 50 Dividend King stocks in the market and the only restaurant stock among this elite group.

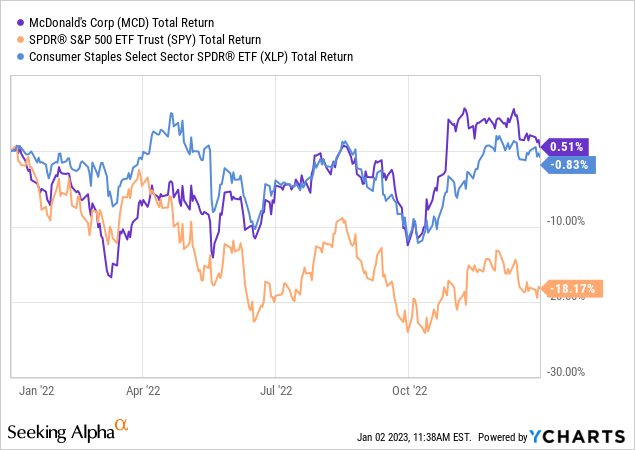

Predictably, McDonald’s stock held up quite well in 2022’s difficult inflationary environment and seems poised to continue performing well in 2023’s expected recessionary environment. In terms of a core holding in my Defensive DGI portfolio, MCD is an obvious choice. For me, the two main questions are whether or not the stock is worth adding to at its present valuation and whether its dividend growth is showing any signs of weakening, as historical dividend CAGRs can often be misleading during times of economic and/or inflationary stress.

Valuation

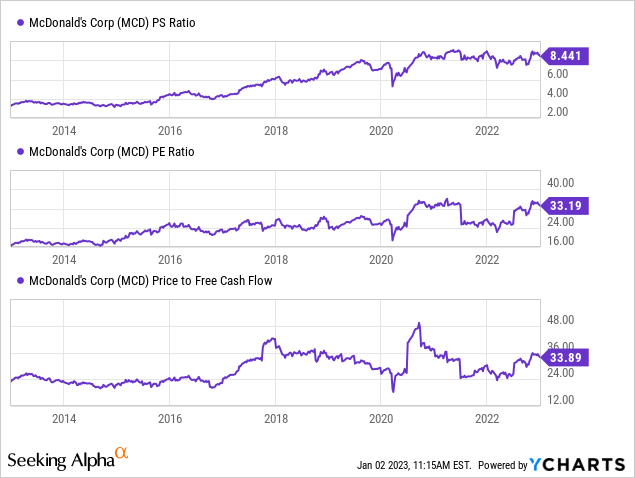

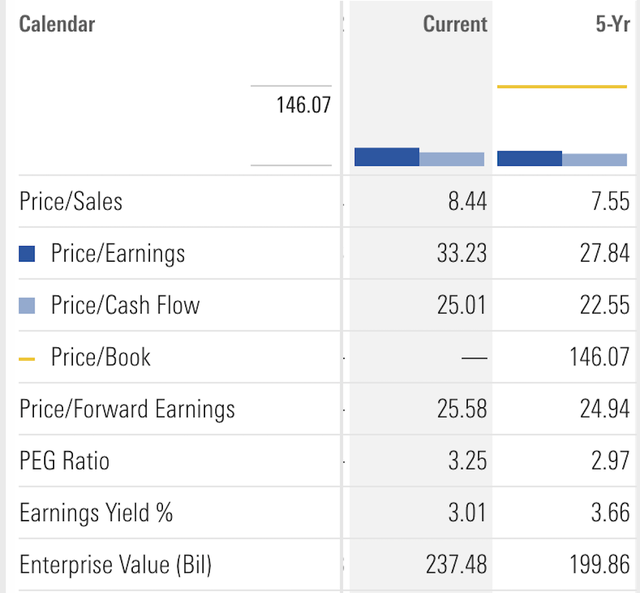

Most valuation metrics such as PE, PS, and Price to FCF suggest that MCD is currently overvalued compared to its historical levels. Looking at the 10-year chart above (and even further back to its inception), we see that MCD’s valuation premium has been growing for a long time and in some cases is at an all-time high. I think this can partly be attributed to the overall market’s multiple expansion and also to the long-term risk-adjusted outperformance of MCD’s shares. It’s clear that MCD deserves a premium valuation based on its brand strength and historical performance, but the stock still looks overvalued relative to its own averages over the past five years:

MCD Current Valuation (Morningstar.com)

As a long-term holder facing a recessionary environment, I’m happy to accept MCD’s 5-term averages as fair value and thus view the stock as approximately 10% overvalued at current levels.

Dividend Strength

Because I intend to hold this portfolio until my wife and I retire in 20+ years, I take a long-term view of the dividend growth potential in each of the stocks we hold. In McDonald’s case, we have a long history of solid growth to look at.

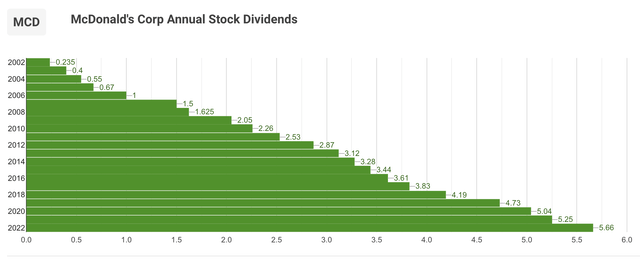

I like looking at dividend visualisations early on when evaluating a stock, and a long string of unbroken raises with a high growth pattern like this are always encouraging. The chart for MCD is a bit lumpy as opposed to a near-perfect exponential growth chart like NEE’s where the dividend is grown at the same percentage each year, but this is forgivable in MCD’s case as we can see that periods of lower dividend growth like from 2013-2017 are offset by large one-time hikes like 2007’s 50% raise and 2018’s 15% raise.

Typically a company slowly reduces its annual dividend growth over time as its overall growth moderates and its focus becomes increasing margins and earnings, so it is important for long-term investors to compare its most recent dividend hikes, payout ratio, and earnings growth outlook to its historical averages rather than extrapolate future dividend growth from the most recent dividend raise.

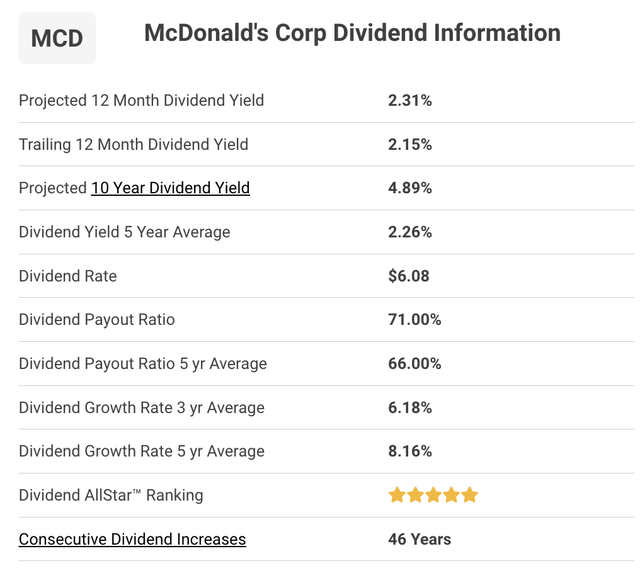

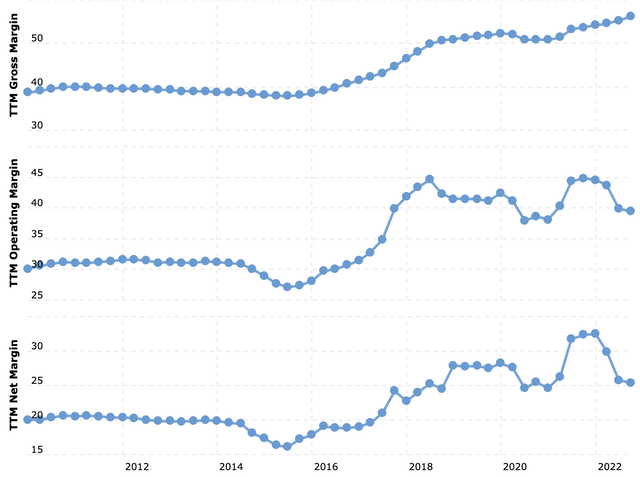

In this case, the near-term outlook is quite promising. MCD’s most recent dividend hike in October 2022 was 10%, higher than its 3-year and 5-year averages and a strong sign of confidence going into a potential recession after a challenging year of high inflation, commodity and wage growth. Despite a couple short-term contractions in its operating and net margin, MCD’s gross margin has expanded significantly over the years, leaving the company in a great position to return cash to shareholders.

MCD Margin Growth (Macrotrends.com)

It’s current payout ratio is 71%, which is at the high end of its historical average. This is admittedly a bit worrying given MCD’s threefold increase in long-term debt over the last decade, but their industry-leading 25% net profit margin combined with a forward revenue growth estimate of 7.3% and a whopping 20% estimated forward EPS growth give me confidence that the recent 10% dividend hike was not a major blip, and, as long as the business continues to execute its growth and modernisation plans, McDonald’s outlook supports a long-term dividend growth CAGR of at least 7-8% going forward.

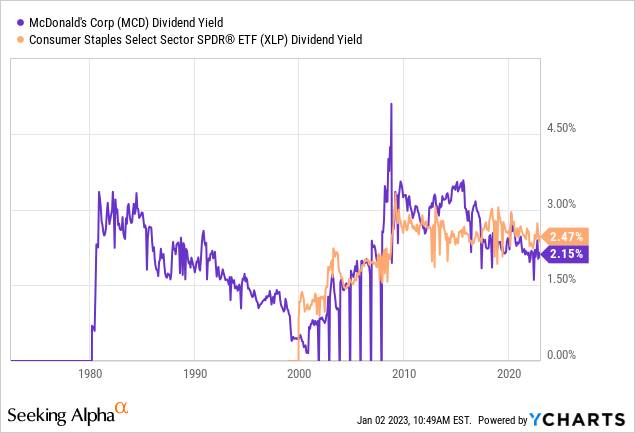

Lastly, MCD sports a forward yield of 2.31%, already down significantly from the 2.46% forward yield it had at the time of its last dividend announcement. This is about average for the stock historically and in line with its 5-year average of 2.29%, though lower than its 3%+ levels from 2008-2016, which isn’t surprising considering that the stock price was mostly stagnant from 2008-2009 and from 2011-2015. Its current yield is also slightly lower than the largest consumer staples ETF’s (XLP) current yield of 2.47%. Note that MCD is technically considered part of the consumer discretionary sector and thus held in XLY instead of XLP, but because of its historical performance, economic resilience, and yield (XLY yields just 1%) I think XLP is a much more apt comparison.

Conclusion

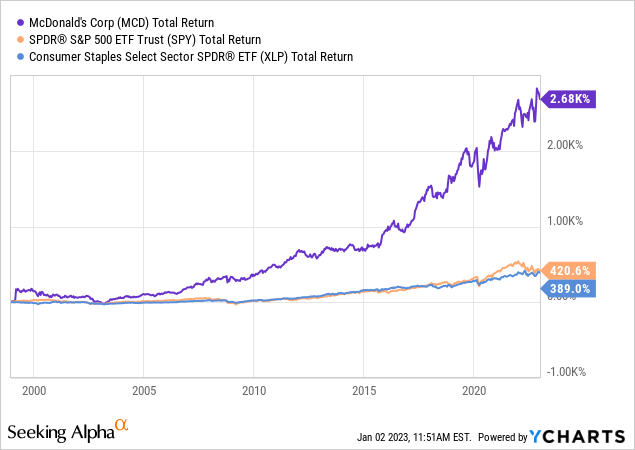

I don’t need to extol the virtues of McDonald’s management, business model, or historical risk-adjusted stock performance to the Seeking Alpha community. One look at its 20-year total return chart tells the story of why this “slow growth” stock should be at the top of any DGI investor’s list:

Given that we’re heading into a recessionary environment for some if not all of 2023 and defensive stocks will likely continue to be afforded a premium by the market, I think MCD’s 5-year average valuation metrics are a good proxy for fair value and view the stock as 10% overvalued at the current share price of $263.

With this in mind, I rate MCD a hold at present levels, safe to add shares below $250 (5% below the current price), and a strong buy below $237 (10% below the current price).

Disclosure: I/we have a beneficial long position in the shares of MCD either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.