Summary:

- Etsy is undervalued, with many financial metrics 3x the level of 2019, despite a flat share quote vs. five years ago.

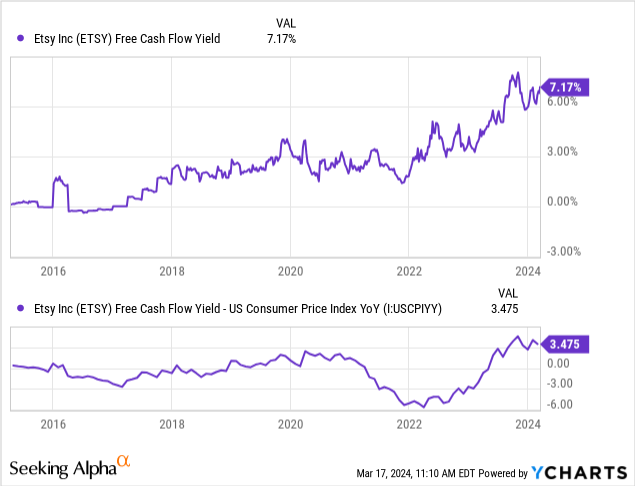

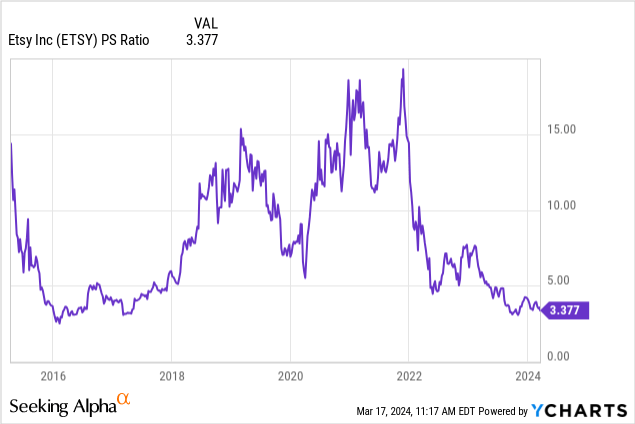

- The price-to-sales ratio is near record lows at the same time as FCF/earnings yields are near record highs.

- Technical indicators suggest a bottoming process is close to ending, where purchasing shares at a lower price could improve future investment performance.

- My trading/investing plan is to buy this leading online retailer on price weakness into April.

grinvalds

This is the third article in a series, where my wife’s favorite pursuits are highlighted as stock buys. I am looking for inexpensive company valuations, on top of strong everyday consumer trends. The first effort discussed the crafting-demand angle for Dollar Tree (DLTR) in September here. My second suggestion was the leading perfume and make-up company Estée Lauder (EL), written in December here. Both have performed admirably, with Dollar Tree initially rising better than +40% in the months after my article was posted.

An old Wall Street adage, pushed by successful investors like Peter Lynch over the years, is to “invest in what you know,” especially when the stock price is worthwhile to consider.

My third choice, and today’s idea, is Etsy (NASDAQ:ETSY), the online retailer of customized and personalized items for special life events or gifts for your loved ones. A decade ago, I worked in the printing industry, where customers would get help from an Etsy business (usually an individual working at home) to create basic printable art for an event. They would send a customized PDF file to the printer, and we would do the rest. Of course, all kinds of creative products are now available on Etsy, and its popularity remains well entrenched.

Etsy.com Homepage – March 17th, 2024

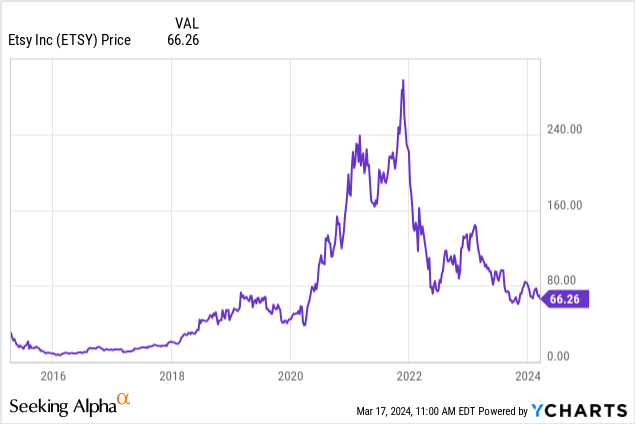

The interesting part of the investment proposition is the stay-at-home spike in business growth during the pandemic has faded. So, many on Wall Street are questioning whether Etsy was more of a fad investment, or once-in-a-lifetime gainer during 2020-21 based on being in the right place at the right time.

YCharts – Etsy, Weekly Share Price, Since 2015 IPO

My view is Etsy is here to stay and will gradually expand its consumer reach and retail options over time. If this is true, a clear undervaluation situation has developed in late 2023 and early 2024. Amazingly, the current price is the same as 2019 before the pandemic, despite the fact its finances on sales and earnings have plateaued at a level 3x the numbers of five years ago!

In the end, I believe Etsy is uniquely positioned as a Growth At a Reasonable Price [GARP] selection for new buyers around $66 a share. Let me explain.

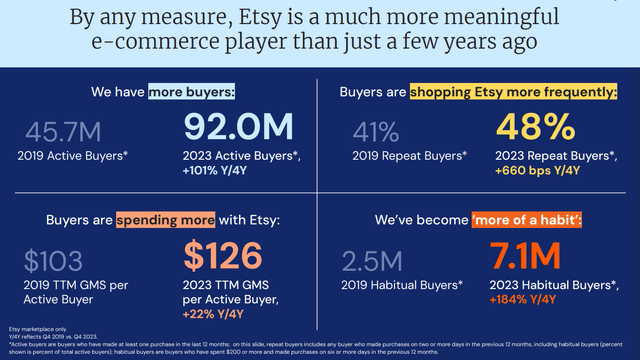

Etsy Q4 Earnings Release – February 21st, 2024

Reasonable Value Proposition

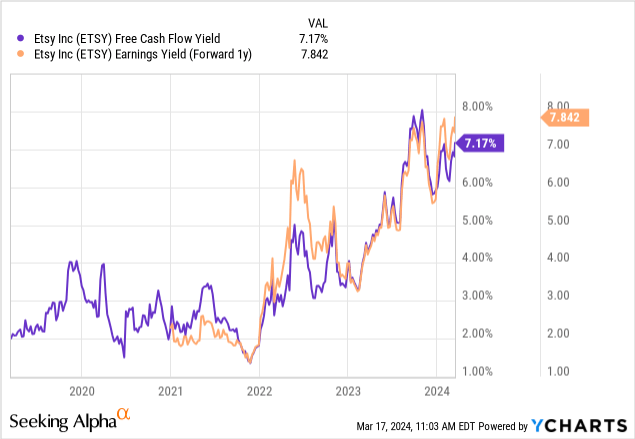

For starters, cash earnings and free cash flow yields are sitting in the 7% to 8% range based on 2023 results and analyst projected numbers for 2024. Excluding stock-based compensation, readings are in the 5% to 6% range.

YCharts – Etsy, Free Cash Flow and Cash Earnings Yields, 5 Years

Either way, against prevailing Treasury yield curve rates of 4.3% to 5.4%, owning a growing brand-name online leader delivering a better than cash investment return upfront is difficult to find today. Another bonus, you can purchase Etsy at its best relative investment yield to the CPI inflation rate since the company went public in 2015. During early 2024, almost every Big Tech leader is priced at a free cash flow yield BELOW inflation, not above it by +3.5%.

YCharts – Etsy, Free Cash Flow Yield vs. CPI Inflation Rate, Since 2015 IPO

The price to sales ratio is hovering just above record lows at 3.38x. This metric is down -85% from the late 2021 high number of 19x. Despite many U.S. tech companies selling for price to sales close to record highs, Etsy is available near record lows!

YCharts – Etsy, Price to Trailing Sales, Since 2015 IPO

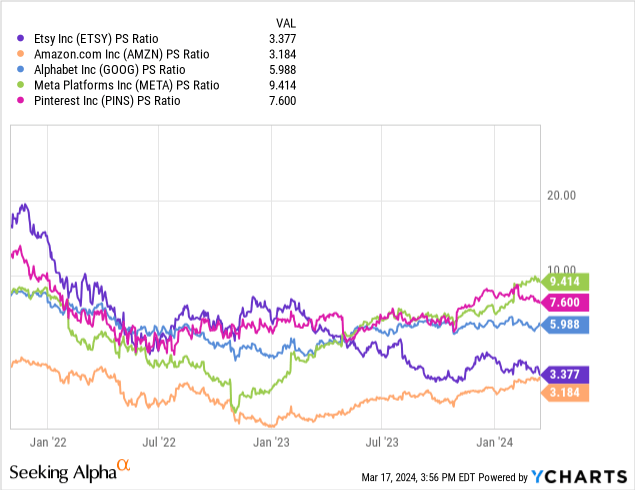

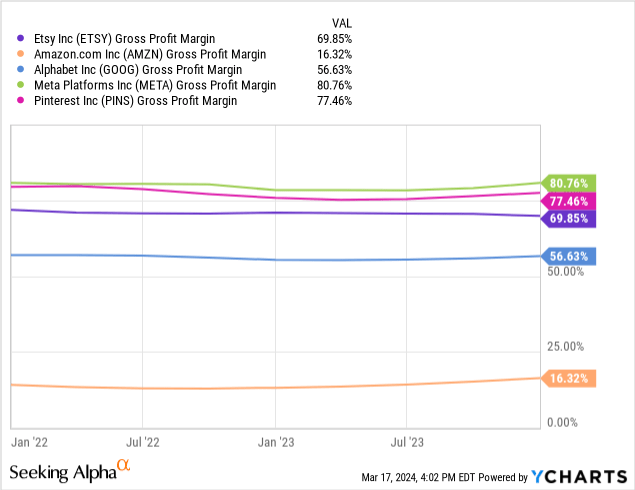

Interestingly, Etsy has moved from one of the highest valuations on price to sales during 2020-22 vs. the robust margin/return online-focused group of Alphabet/Google (GOOG) (GOOGL), Meta Platforms (META), or Pinterest (PINS) to a ratio closer to the weaker-margin Amazon (AMZN) online retail-to-physical-product-delivery business model in March 2024.

YCharts – Etsy vs. High-Margin Online Leaders, Price to Sales, Since Nov 2021

YCharts – Etsy vs. High-Margin Online Leaders, Gross Profit Margins, Since Jan 2022

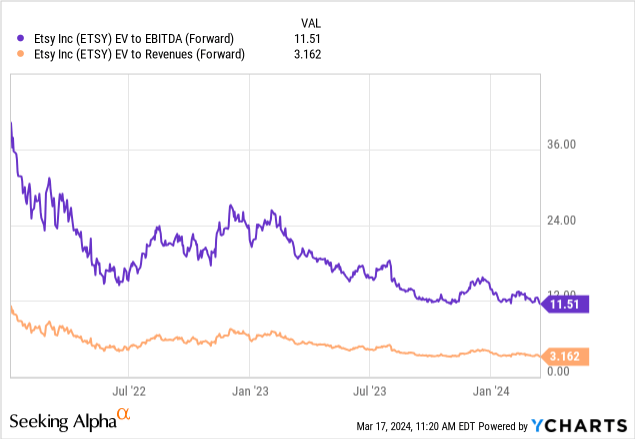

Below is a chart of the massive drop in enterprise valuations (including debt and equity for a buyout number) from Etsy’s December 2021 peak. Since then, share pricing has declined from a top of around $300 all the way back to $66, at the same time as EBITDA and sales have continued to climb or remained elevated. The net effect is you can buy stock today closer to S&P 500-normalized ratios of 11.5x EBITDA and 3.16x sales projected into the middle of 2024.

YCharts – Etsy, Enterprise Valuations on Forward Estimated EBITDA & Sales, Since January 2022

Technical Indications of Approaching Bottom

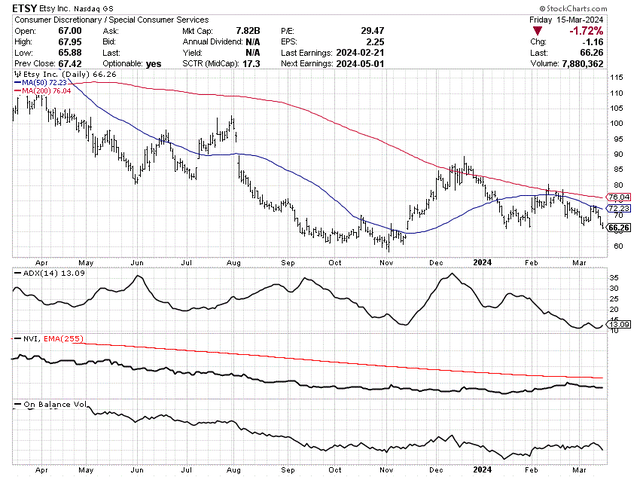

I will say only minor evidence of a bottoming process exists on the technical charts. Can price reverse higher without warning, and cross back above its 200-day average in the $76 area? Sure, but a period of consolidation to somewhat lower quotes may come first.

The good momentum news is the 14-day Average Directional Index reading of 13x is the lowest in years, and highlights a supply/demand balance in share trading over the latest three weeks. Often, a trading bottom is reached in the 10 to 15 ADX range, just like the early November reversal.

Other bullish developments include Negative Volume Index and On Balance Volume readings moving in more constructive zigzags since January. Nevertheless, based on the overbought condition of Wall Street equities in general and my negative immediate view of the overall market’s direction this spring, I cannot rule out a retest of the $60 price area (late October’s low). Such would outline a type of double bottom pattern to build off the rest of 2024.

StockCharts.com – Etsy, 12 Months of Daily Price & Volume Changes

Final Thoughts

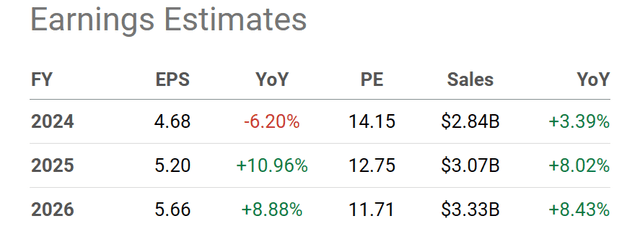

Because technical momentum is lacking at the moment in Etsy, my bullish view is basically a valuation call. I do suspect analyst estimates for EPS/sales will prove on the conservative side. If operating results impress, a tremendous amount of upside is now inherent and building in shares.

Seeking Alpha Table – Etsy, Analyst Estimates for 2024-26, Made March 17th, 2024

Etsy has become an integral part of the modern Gig economy, where smaller creative art tasks and unique gifts in small quantities are marketed directly to consumers on the Internet. Etsy provides a way for independent workers and mom-and-pop businesses to earn money while opening all kinds of shopping experiences for users of the site. My wife is a crafter and a painter. She appreciates the consumer options, with literally thousands of great purchase ideas added daily.

Upside targets of $75 to $100 seem appropriate in 12-18 months. Not a spectacular gain from today, but a nice +25% to +65% price appreciation off $60 as a forecast low soon. Such would represent ratios of 25x to 30x on GAAP EPS in 2025, and multiples of 15x to 20x free cash flow generation from this high profit margin (25% FCF margin on sales), and high return on assets (30% FCF on total assets) business model.

Downside risks do remain. If analyst forecasts prove correct, limited growth in sales and income is coming over the next few years. For sure, low growth should mean lower-than-usual valuations, which is where we stand today. And, a recession could weaken results further, keeping the share quoted in the $50 to $70 range during the next 12 months of trading (primarily capping the valuation on declining overall operating results).

Yet, assuming a bearish scenario for the stock market and economy, I do believe Etsy will be able to “outperform” the S&P 500 index, which is heavily weighted toward overvalued Big Tech names entirely unprepared in price for an economic downturn. From my vantage point, I am forecasting shares will beat the S&P 500 for a total return over the next 12-18 months. Some growth and a low valuation make better sense to own than chasing high-flyers sitting at gross overvaluations, potentially sliding into a recession. Pulling all the investment pros and cons together, I rate Etsy a Buy in the mid-$60s, with Strong Buy feelings in the upper-$50s, should we get there.

If you can acquire shares under $65 in the coming weeks, even as low as $60, the compounding math will improve further in your favor. That’s my personal investment plan in a nutshell. I plan to buy shares on weakness.

Thanks for reading. Please consider this article a first step in your due diligence process. Consulting with a registered and experienced investment advisor is recommended before making any trade.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, but may initiate a beneficial Long position through a purchase of the stock, or the purchase of call options or similar derivatives in ETSY over the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This writing is for educational and informational purposes only. All opinions expressed herein are not investment recommendations and are not meant to be relied upon in investment decisions. The author is not acting in an investment advisor capacity and is not a registered investment advisor. The author recommends investors consult a qualified investment advisor before making any trade. Any projections, market outlooks, or estimates herein are forward-looking statements based upon certain assumptions that should not be construed as indicative of actual events that will occur. This article is not an investment research report, but an opinion written at a point in time. The author's opinions expressed herein address only a small cross-section of data related to an investment in securities mentioned. Any analysis presented is based on incomplete information and is limited in scope and accuracy. The information and data in this article are obtained from sources believed to be reliable, but their accuracy and completeness are not guaranteed. The author expressly disclaims all liability for errors and omissions in the service and for the use or interpretation by others of information contained herein. Any and all opinions, estimates, and conclusions are based on the author's best judgment at the time of publication and are subject to change without notice. The author undertakes no obligation to correct, update or revise the information in this document or to otherwise provide any additional materials. Past performance is no guarantee of future returns.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.