Summary:

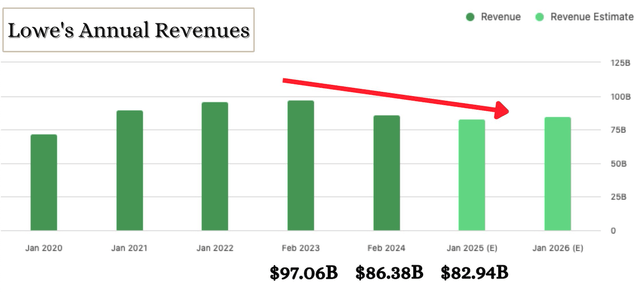

- Lowe’s Companies, Inc. has a strong history of returns and dividend growth but faces challenges like declining revenue and softening consumer demand, warranting a “Hold” rating.

- The Pro segment and digital innovations are growth avenues, but overall sales are down, and future revenue is expected to decline further.

- Despite solid cash flow and smart capital management, the days of 20%+ dividend growth are likely over, with future growth expected in single digits.

- Lowe’s valuation is high, trading at a P/E of 20.9x, suggesting either future growth optimism or overvaluation; wait for a better entry point.

jetcityimage

Thesis

Lowe’s Companies, Inc. (NYSE:LOW) has created excellent returns and decent dividend growth but has been facing challenges in some of its operations, which could affect its future performance. I believe that Lowe’s is doing a good job growing its Pro segment for home improvement projects and its digital innovation. Even though it’s making efforts to increase traffic in stores and online, its revenue is receding, and consumer demand is reduced. The Lowe’s long-term growth plan sounds great, and it could recover in the future, but at this point, I would rather wait for a better opportunity to buy it.

About Lowe’s Companies, Inc.

Lowe’s is a leading American home improvement retailer that traces its history to 1921, when Lucius Smith Lowe opened a hardware store in North Wilkesboro, North Carolina. That tiny shop grew into the world’s second-largest national home improvement chain. Following the Second World War, Carl Buchan took over and reinvented the company’s focus as a home improvement store, betting on the post-war building boom. Lowe’s went public in 1961 and, in the 1980s, began to convert to larger warehouse-style stores to keep pace with rivals.

Following its 1999 acquisition of Eagle Hardware & Garden, Lowe’s further strengthened its national presence. Eventually, it expanded to Canada, Mexico, and Australia, albeit briefly. In 2023, the company sold its Canadian business to Sycamore Partners and merged it with the brand Rona. Lowe’s currently operates more than 1,700 stores in the U.S., where it brings in over $86 billion annually.

Lowe’s Performance

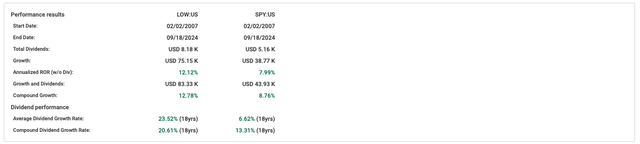

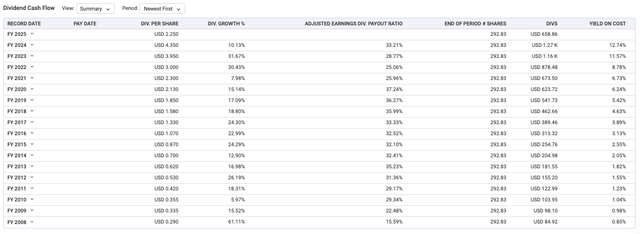

For long-term investors (since 2007), LOW has delivered a solid 12.78% annual return (with dividends), besting the S&P 500’s (SP500) 8.76%. Over 18 years, the average dividend growth rate hit 23.52%, and dividends have been growing at 20.61% annually, far above the S&P 500’s 13.31%.

The dividend yield on cost has exploded too—it went from 0.85% in 2008 to 12.74% in 2024, demonstrating the power of sticking with a strong dividend stock. For longtime investors, Lowe’s has become a high-yield play, even if the current yield looks lower to new buyers.

With that said, looking ahead, the days of 20%+ dividend growth are probably over, but with solid cash flow and smart capital management, LOW should still see high single-digit or low double-digit increases.

Lowe’s Growth Metrics

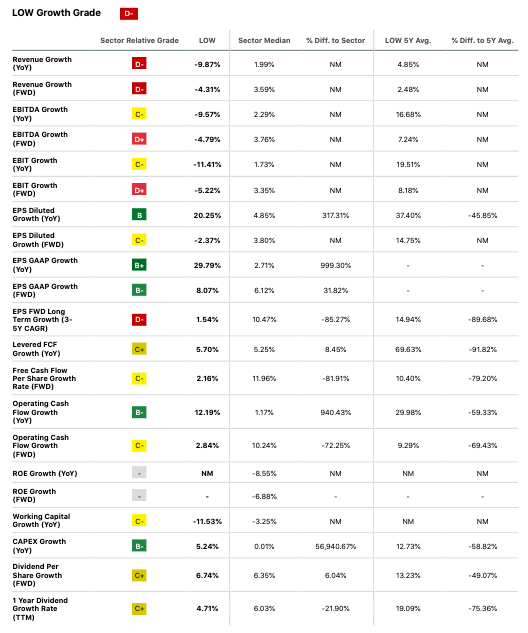

LOW looks to be hitting some rough patches in both revenue and profitability, with a D- growth grade, they’re clearly falling behind their peers:

Seeking Alpha

- Revenue down nearly 10% year-over-year, while the sector is growing.

- Future revenue expected to decline further.

- EBITDA and EBIT are both down ~10-11%, with no expected improvement.

- EPS growth is strong: diluted EPS up over 20% year-over-year vs sector’s 4.85%, likely due to buybacks and cost cuts.

- Forward EPS growth projected to slow to -2.37%.

- EPS GAAP: current growth nearly 30%, future growth only 8%.

- Long-term forward EPS growth (3-5 years) projected at 1.54%, well below sector’s 10.47%, indicating possible structural issues.

- Levered free cash flow up 5.70% year-over-year, slightly better than the sector, but future growth only 2.16%.

- Operating cash flow growth at 12.19%, outpacing sector’s 1.17%, but future growth slows to 2.84%.

Bottom line: Lowe’s may have some short-term wins in EPS growth, but the overall outlook isn’t great.

Lowe’s Growth Strategy

Lowe’s maintains its long-term growth strategy, centered around improving fundamentals such as rising home prices, higher disposable income, and older homes. The average home in the U.S. is more than 40 years old, leading owners to face the need for major repair and renovation work. The maturing housing stock can boost demand, particularly from professional contractors, a key growth avenue for Lowe’s. Pro customers tend to undertake large repair work, which can offset a decelerating DIY market, where inflation is hitting some consumers hard and making them cut back on non-essential spending.

All in all, though, there are risks. Home equity and price growth won’t last forever. Some of the hottest markets are seeing prices level off already or start to drop, and a recession could shrink that cushion. Furthermore, Lowe’s emphasis on Pro customers might come back to bite it: pros have plenty of work now, but an economic slide could postpone projects, leaving Lowe’s overly exposed to a shrinking contractor base.

Still, Lowe’s maintains that the Pro is a bright spot. The company reported mid-single-digit growth in the Pro sector, bolstered by 75% of surveyed contractors who said they could obtain new business.

Partnerships and Efficiency

Partnerships with Klein Tools and loyalty programs (which also help the firm capture additional market share in the important Pro segment) are fueling growth. Lowe’s PPI (Productivity Improvement Initiatives) has offset more than $500 million in inflation headwinds, while supply chain efficiencies (particularly in transportation expenses, given Lowe’s long-term contract pricing) will continue to benefit the company into 2025. These efficiencies, combined with pricing “vendor clawbacks,” are expected to help Lowe’s achieve one of its goals for the year—keeping gross margin flat for the full year, with continually improving margins in the third and fourth quarters.

But some skepticism is in order. Lowe’s is pushing this Pro hype as a counterbalance to the macroeconomic pressures hitting the DIY market more broadly, and it’s clear that even they are struggling with the wider macroeconomic conditions. Overall sales have slowed, with a 5.1% drop in total sales year over year, and Lowe’s was forced to revise down its 2024 earnings guidance. They’re banking on “pent-up demand” for large–scale deferred projects once inflation lags, but this presumes a relatively quick economic recovery – something, however, that’s looking more optimistic in light of yesterday’s rate cut.

Changing Consumer Demands

As a result of the great work-from-home experiment, millennials are now moving into households faster than expected – and those households need upgrading to support that remote work. At the same time, baby boomers are renovating to make their homes more age-friendly. Forecasting this opportunity, Lowe’s changed its supply chain, moving from the hub-and-spoke model to an omnichannel setup — a shift that improved inventory control, sped up deliveries, and raised customer satisfaction.

Lowe’s might be putting on a brave face, but there’s more to the story, as they’ve been banking on mortgage rates dropping. Higher rates last year and low home sales have created a “rate lock-in,” stalling the market and, moreover, millennials have seen their debt shoot up by 27% in three years ($3.8 trillion). That kind of financial stress could keep them from spending big on home improvement projects.

Digital Innovation

On the innovation side, Lowe’s has significantly upgraded its customer engagement with digital technologies, partnering with Apple and joining forces with other leading AI platforms, such as NVIDIA, OpenAI, and Palantir. Its omnichannel and delivery offerings – Uber Eats is the latest addition to the portfolio of Lowe’s choices, joining the likes of DoorDash, Shipt, and Instacart – have made Lowe’s more accessible to younger, digital-first consumers in urban and suburban markets. More recently, in the past three months, they trialed a new experience in several stores. Customers could try on an Apple’s Vision Pro headset, in partnership with a Lowe’s employee, to explore and customize a kitchen in 3D using items sold by Lowe’s – appliances, fixtures, etc. – using Lowe’s Style Studio app.

Financial Performance

All in all, these initiatives have contributed to better-than-expected results in certain areas. This is indicated by the company’s $2.7 billion in recorded free cash flow — a success due in part due to cost-management programs, including continued “perpetual productivity improvement” programs to mitigate the effects of macroeconomic pressures and an adjusted ROIC of greater than 30%. Also worth mentioning, the company returned value to shareholders by repurchasing 4.4 million shares for $1 billion, distributing $629 million in dividends, and announcing a 5% dividend increase.

Lowe’s Valuation

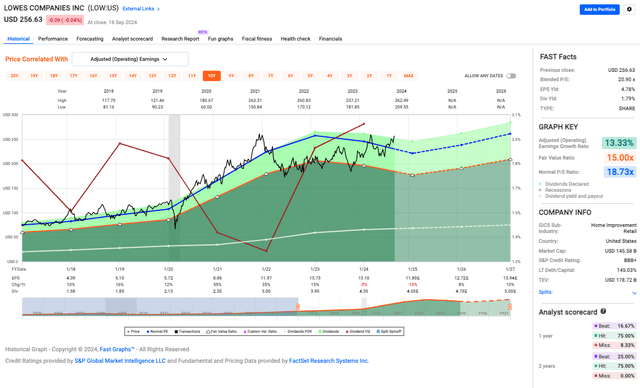

With a blended P/E ratio of 20.9x, LOW’s is trading higher than its usual 15x fair value. Simply put, it means the market either sees future growth or LOW’s is a bit overvalued compared to its typical P/E of 18.73x.

LOW’s EPS yield is solid at 4.78%, showing healthy earnings, and the company’s earnings growth rate of 13.33% also stands out. As for dividends, although I touched on it earlier, I want to zoom in here for new or potential investors and point out that it offers a 1.79% yield. Not huge, but steady, and, well, it has been growing.

Lowe’s Risks & Headwinds

There are some bearish signs in Lowe’s most recent results, especially with big-ticket items that were still struggling and bad weather during key months hurt seasonal sales like lawn and garden.

Additionally, Lowe’s gross margin has been squeezed, decreasing by 19 basis points to 33.5%, driven by continued investments in the supply chain and its operating margin also took a hit, declining by 114 basis points to 14.4%, impacted by sales deleverage and rising expenses. Another concerning factor is the decline in comparable transactions, which fell by 5.9%, reflecting that slowdown in DIY projects and seasonal categories (though this was partly offset by stronger Pro sales).

Overall, the company said consumer sentiment remains soft causing Lowe’s to revise its full-year sales guidance downward, now expecting sales between $82.7 billion and $83.2 billion, with comparable sales projected to decline by 3.5% to 4%.

Lowe’s Rating

I’m opening coverage here on LOW with a “Hold.” I’m recommending it because, while the company has a history of solid performance, including consistent dividend growth and continuous improvement in its Pro segments, its current challenges—namely declining revenue, softening consumer sentiment, and macro slowdowns—make the near-term upside potential minimal. However, Lowe’s remains a solid long-term play. And to new investors here, because of its current rich valuation and slowing growth, I’d wait for a better entry point.

Analyst’s Disclosure: I/we have a beneficial long position in the shares of LOW either through stock ownership, options, or other derivatives. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.