Summary:

- NetApp’s stock reaches a new high, driven by optimism about opportunities in artificial intelligence.

- This contrasts with what analysts predict as topline estimates for the fiscal year which ends in April this year, and there is also competition for AI-ready storage.

- On the other hand, margins are on the rise and it should benefit from sales of higher-performance disks as corporations try to match the speed of their storage with Nvidia’s accelerator GPUs.

- In this respect, the company benefits from a huge installed base.

- There are short-term volatility risks but the company should be a longer-term beneficiary of artificial intelligence.

klmax/iStock via Getty Images

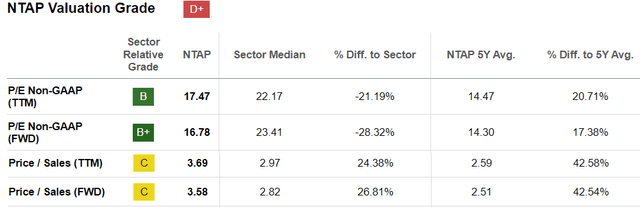

NetApp’s (NASDAQ:NTAP) stock has reached a new high of $109, last reached in October 2000. This was after an 18% upside at the end of February after its CEO expressed optimism about opportunities in artificial intelligence during the earnings call for the third quarter of fiscal year 2024 (Q3). It is now trading at a forward price-to-sales multiple that exceeds the median for the IT sector by nearly 27%.

Price Performance of NTAP (seekingalpha.com)

However, analysts’ estimates for FY’24 point to a revenue decline of 1.7% which leaves doubt about its ability to harvest gains related to intelligent apps in the short term.

Therefore, amid all the AI frenzy, this thesis aims to realistically assess opportunities and show that NetApp should instead emerge as a long-term AI beneficiary. For this purpose, I highlight AI readiness, look into the competition, and show it is prioritizing margins.

First, I provide insights into how this company primarily known for its storage can benefit from the emergence of intelligent applications enabled by Generative AI.

The Data Dimension and AI Readiness

From being a storage provider that popularized the NAS (network attached storage) concept in 2002 which made it possible to bypass the need for a server, NetApp has evolved into more of a data infrastructure company. As such, it has positioned itself as a key storage player in the hybrid cloud environment, enabling corporations to manage data lying both on their premises and in any public cloud with relative ease.

Making the connection with the AI world, the development of intelligent applications like ChatGPT require software algorithms to feed on data, lots of them, but the challenge is that not all of it is located in the same place. In other words, they are siloed. This is occurring at a time when businesses have become data-driven as managers and CEOs rely on information about sales outlook or real-time production capacity to drive their businesses, with the amount of data generated continuing to increase at a frantic pace.

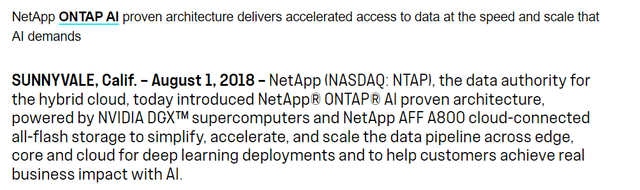

This is where NetApp’s tools become handy for making the data rapidly available for processing, and, with its ability to work with partners, it developed ONTAP AI in 2018, which integrates Nvidia’s (NVDA) DGX systems with its all-flash storage. By being connected to the cloud, the objective is to streamline and aggregate data from the edge to the cloud core to deliver analytics-based applications as part of machine learning, an older flavor of AI.

This was well before the advent of ChatGPT in November 2022 but since the partnership has evolved rapidly with Nvidia’s NeMo Retriever, a set of Gen AI microservices intended to enable organizations to connect their language models to leverage their unstructured data (or documents, images and videos) and rapidly get started in their AI journeys, while also not having to spend much.

Gen AI and the Competition

Noteworthily, as a storage company, the objective behind these partnerships is to capitalize on the AI trend to sell more hardware. In this respect, companies that originally considered flash only for high-performance workloads are currently rethinking what they use as primary storage. Hence, instead of using lower-speed hard disks which may cause bottlenecks and prevent them from benefiting from the full power of Nvidia’s accelerator GPUs, it may be better to opt for flash. For this purpose, it introduced the NetApp AFF C-Series QLC all-flash storage in October 2023.

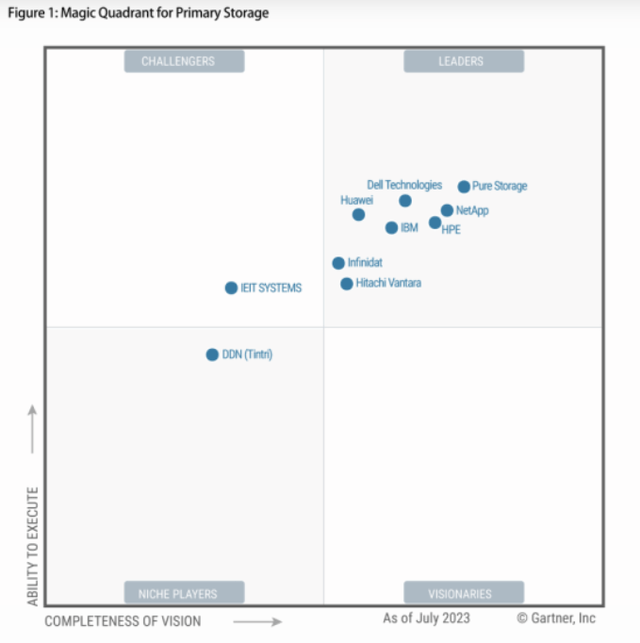

However, as per NetApp’s CEO during Q3’s earnings call, another vendor is also positioned in QLC-based all-flash arrays. Looking across the industry, I noticed Pure Storage (PSTG) with its Flash Array //C introduced around the middle of last year. Furthermore, Gartner’s magic quadrant for 2023 shows other major companies like HPE (HPE), Dell (DELL), and International Business Machines (IBM) are already well positioned in the crowded leadership quadrant as shown below. Given their scale, they could rapidly enhance their products to be AI-ready, either through R&D or acquisitions.

Therefore, the company does not benefit from the near-monopolistic demand conditions as Nvidia for its H100 GPUs. This is why I believe the price surge is not justified, and, in case it does not deliver on AI expectations, expect volatility risks. Moreover, while the management talks about “an expanding range of AI opportunities worth tens of billions of dollars for RAG or Retrieval Augmented Generation, there is no mention of an AI-specific pipeline.

For investors, RAG is cutting-edge and can be viewed as augmenting what an LLM is capable of, by accessing knowledge bases that lie beyond its training data sources, but there is no precision as to a timeline for the opportunities. In this respect, according to research firm Gartner, companies are more likely to plan Gen AI spending this year rather than spending money on the technology.

Still, I am not bearish as the company will more likely be a long-term beneficiary of AI and profitability is on the rise.

Profit and Long-term storage demand

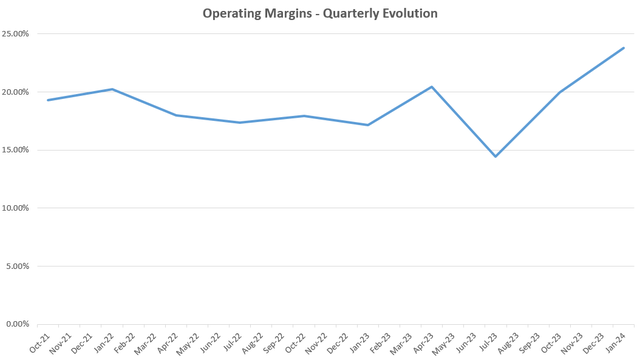

For this matter, its non-GAAP operating profit margin surged to a record 30% in Q3, up from the 27% achieved in the previous quarter. Looking for a trend, GAAP operating margins have also surged as shown in the chart below.

Chart prepared using data from (www.seekingalpha.com)

Thus, the objective seems prioritizing margins, with NetApp’s CFO affirming the strategy has been to grow revenue at a faster rate than operating expenses. This has ultimately improved earnings per share, which came at $1.94 for Q3, also a record.

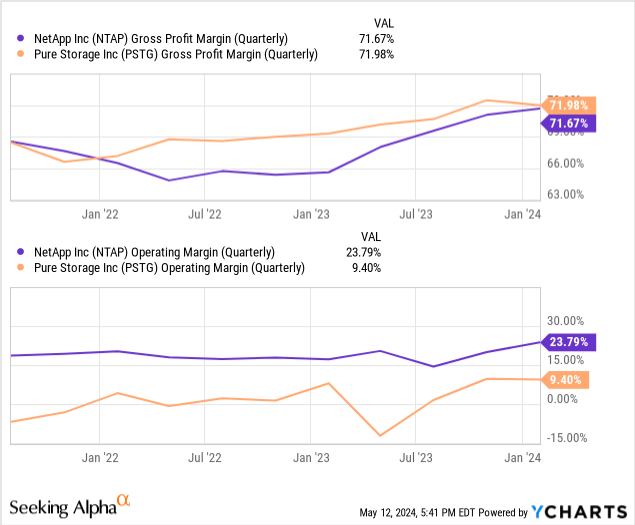

Now, performing a comparison with Pure Storage confirms that while these two companies have seen about the same gross margins, NetApp’s operating margins have fared better as shown in the chart below.

Furthermore, while revenue is expected to decline on a YoY basis for the fiscal period ending in April 2024, analysts estimate EPS to grow by 15.72%.

I believe that this can be achieved due to the company benefiting from the storage mix in data centers shifting from hard drives to higher-priced flash. As a result, the company expects a higher product gross margin, up from the mid-50s to the upper-50s. However, achieving this target will also depend on factors like commodity prices, quarterly product mix variation, and the pricing environment. In this case, while not deteriorating, macroeconomic conditions remain tight with both inflation and interest rates remaining high.

In this respect, two key drivers for success are how the company adapts its product portfolio to emerging requirements like AI and target markets. First, it is AI-ready and as for the target market, NetApp is focused on both hyperscaler marketplace and cloud storage services.

Valuation and Volatility Risks

Therefore, the company deserves better, and since its trailing price-to-earnings multiple of 17.47x is trading at a discount of 21% relative to the IT sector. Thus, adjusting its share price of $108.15 accordingly, I obtained a target of $131.

Valuation metrics (seekingalpha.com)

This target depends on the company continuing to prioritize margins, which means also spending the same relative amounts on product development (R&D) and sales capacity. However, things may change in case the priority changes to driving more product revenue, and, this is at the expense of profits in response to the competition.

For this purpose, it is important to understand that competition not only emanates from other storage suppliers as to make data available for Gen AI’s algorithm, there is also the network approach depending on use cases. In this case, two technologies are contending for a leading position in AI backend network, InfiniBand and Ethernet. First, InfiniBand which is a proprietary standard and comes bundled with Nvidia processes remains better suited for data-intensive applications but Ethernet is fast catching up and could emerge as the preferred connectivity mode for enterprises.

Therefore, we are still at an early stage when it comes to the way AI is going to play in the data center and the speed at which NetApp’s sales benefit will benefit depends on how AI algorithms are used (trained and used for inference purposes. Here, the risk is that the market goes ahead of itself when expectations are overblown and investors lose money. There are also volatility risks related to interest rates in case the Federal Reserve does not cut interest rates and its RSI of 63.5 indicates that it is in overbought territory. Therefore, risk-averse investors may wait for the company to quantify its AI pipeline or raise guidance before investing.

Now, for those ready to stomach short-term volatility, the stock makes for a valid long-term investment. In this case, the advantage of NetApp compared to others is its huge installed base of appliances and the unstructured data they contain, which puts it in a strong position to benefit from companies wanting to feed these into developing AI and ML applications. Also, by AI- enabling its ONTAP management software for all organizations, it creates opportunities to benefit from storage tailwinds, especially for enterprises that cannot afford the costs of aggregating data using InfiniBand or Ethernet and opt for a more measured approach to developing intelligent applications.

Finally, with cash and equivalents of $2.92 billion versus debt of $2.66 billion, the balance sheet remains strong. Moreover, with an FCF margin of 18.5% which exceeds the IT sector by 83%, the business model is strong at generating cash.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

This is an investment thesis and is intended for informational purposes. Investors are kindly requested to do additional research before investing.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.