Summary:

- I believe NetApp’s better-than-expected results and outlook signal a positive trend in billings, revenue, and all-flash array revenue that’ll extend into FY25.

- The company’s position in the data management and AI market, as well as its expanded flash portfolio, make it well-positioned for top-line growth.

- I think NetApp will be one of the longer-term benefactors of the AI boom, and is undervalued at current levels.

- I hereon share my thoughts on NetApp and why I think it’ll outperform expectations over the coming quarter.

Antonio Correa d Almeida/iStock via Getty Images

Investment Thesis

NetApp (NASDAQ:NTAP) reported the third quarter of 2024 results and outlook last month, with the stock trading higher by +12% in extended trading; I believe NetApp is a name that should be on investors’ radar for 2024. At its core, NetApp is an intelligent data infrastructure company that combines its offerings of unified data storage, integrated data services, and CloudOps solutions to create a silo-free infrastructure and enable superior data management. NetApp rode the dot com bubble back in the 1990s and is now in the midst of getting in on the AI boom, in my opinion.

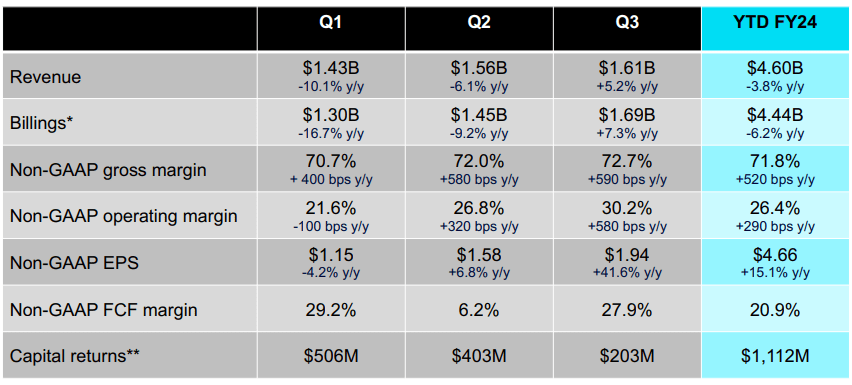

The company reported earnings last month with net revenues of $1.61 billion, ahead of the year-ago quarter’s net revenue of $1.53 billion, accounting for a 5% year-over-year increase and higher sequentially than the $1.56 billion achieved in the second quarter of 2024. NetApp’s results for FY24 thus far reflect a sequential upward trend in billings, revenue, and its all-flash array annualized revenue run rate, mainly driven by the company’s expanded all-flash portfolio, in my opinion. I’m initiating NetApp as a buy because I see this upward trend extending into the next quarter and 1HFY25. NetApp’s results and outlook lead me to believe that the NAND Flash rebound and AI tailwinds will be able to support top-line growth for the company and provide more room for upside to current consensus numbers.

NetApp’s Value Proposition

Data has never been more valuable than it is today, and by extension, storing and managing it in the simplest and most efficient way has never been more of a priority; this is where NetApp’s all-flash portfolio comes into play. NetApp shifted gears since the dot com bubble to provide data-centric solutions in the cloud landscape to hyper scalers, including Amazon (AMZN), Google (GOOG) (GOOGL), and Microsoft (MSFT), among others. In my opinion, its position in the industry and expanded flash portfolio emphasized in this quarter’s earnings call make it among the best-positioned storage names to experience top-line growth supported by AI momentum.

The proof is in management’s outlook for Q4: management is guiding for Q4 revenue in the range of $1.585 billion to $1.735 billion, compared to Street estimates of $1.65 billion in revenue. To top it off, management also raised its full-year 2024 guidance to the range of $6.185 to $6.335 billion. Management’s raised FY24 guidance tells me two things: 1. We’re still in the early phases of generative AI adoption, driving customer needs to scale their foundational data models, and 2. This new and urgent need will reflect positively on the flash business and by extension on NetApp. NetApp has already been recognized for the fifth consecutive year as a leader in the 2023 Gartner Magic Quadrant for Primary Storage and ranked the number one in hybrid cloud IT operations. I believe this will reflect positively on management’s FY25 guidance that is to be announced next quarter. The image below shows NetApp’s earning results for FY24 this far and sets the tone for Q4 results and FY25 outlook.

NetApp third quarter of FY24 presentation

NetApp is already getting traction for its position at the crossover between data management and AI. On the quarter’s earnings call, CEO George Kurian communicated NetApp’s strong position in AI through customer wins this quarter, including “large NVIDIA SuperPOD and BasePOD deployments.” Kurian noted, “several eight-figure deals in Q3, one of the world’s largest oil and gas companies build their AI supercomputer…, one of the world’s largest genomics company relying on our [NetApp’s] technology to speed up genomic analysis with NVIDIA and NetApp, one of the world’s largest media companies is using us to drive some of the early phases of their Generative AI work.” I highlight this because we’re at a moment in time when everyone wants to get on the AI wagon, regardless of whether they have real AI growth, and this is reflected in how often TMT companies mention AI tailwinds on their earnings calls. The difference with companies like NetApp is that I see the AI tailwinds reflected in deals and customer traction.

Equally important, I see NetApp use its strength data management capabilities to “do things like model versioning, security for your mission-critical data, and be able to deploy and connect data pipelines from production back into training.” Hence, NetApp’s Q3 results should not be seen as a one-time home run or a window to count profits and exit the stock, but rather as a signal of a longer upward trend supported by AI and the NAND flash rebound.

Adapting Through Industry Transitions

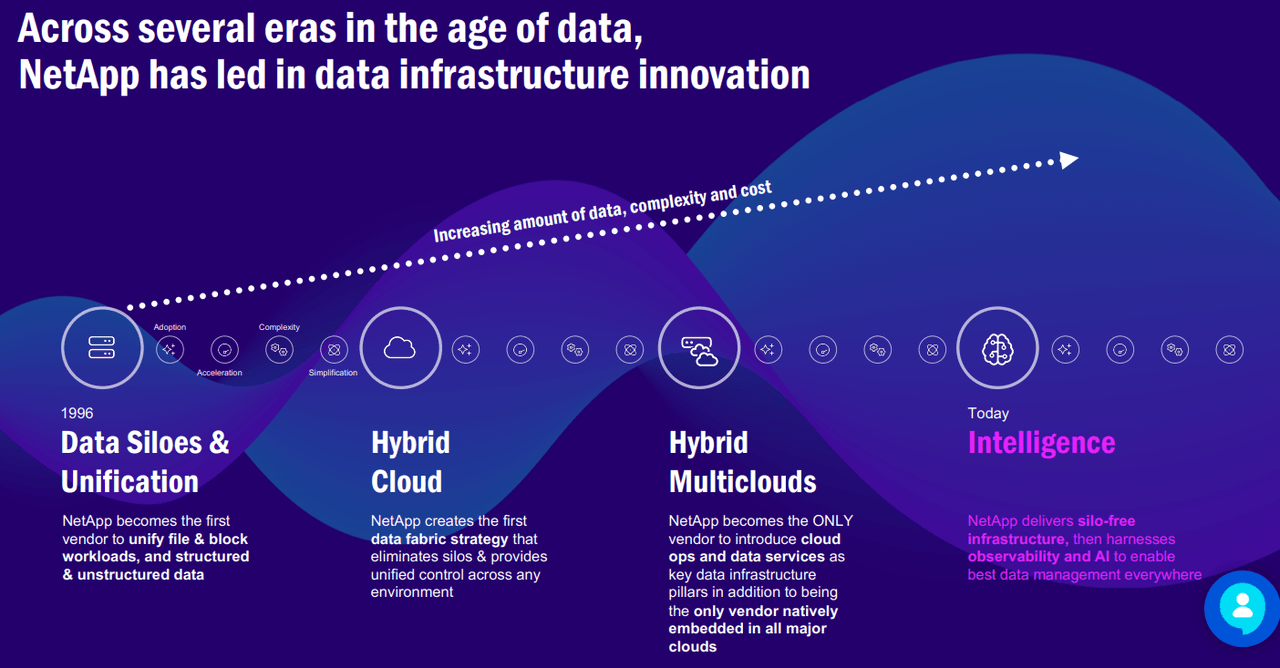

Another reason I seek to put NetApp on the radar for longer-term investors is that I believe NetApp’s position in the storage market and its evolution alongside the industry inspires confidence in the company’s ability to ride the upward trend in demand for intelligent data infrastructure triggered by the AI boom. In the 1990s, most of NetApp’s revenue came from the sale of “network filers and cache appliances,” with the company known as one of the original network-attached storage or NAS filers. NetApp adapted to the quickly changing environment with the dot com bubble and began selling storage products to internet-based companies and surged during the dot com bubble up until 2002, of course. Since NetApp has rebounded, shifting gears to focus on the transition to hybrid cloud, hybrid multiclouds, and now intelligence.

While the company gets a bit of backlash for being late to the NAND flash moment, I focus on the company’s forward-looking risk-reward profile, which I believe, at current levels, is attractive. I believe NetApp’s silo-free infrastructure provides the adaptive operations, flexibility, and security requirements to achieve high product traction in the current AI-driven market. The image below from the company’s earnings presentation for its third quarter results outlines NetApp’s innovative position in data infrastructure across the past two decades.

NetApp third quarter of FY24 earnings presentation

Attractive Valuation

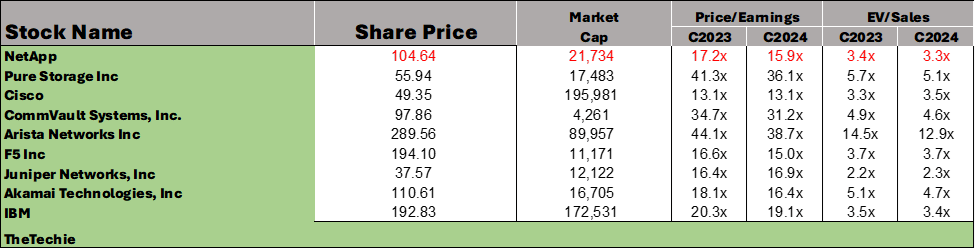

Based on a relative methodology of valuing stocks within my coverage, NetApp provides an attractive investment opportunity for its position in data management and the AI market. NetApp stock trades at a ratio of 16.3 for CY2024, which is relatively lower than its peer group average ratio of 27.1, according to data from Refinitiv shown in the table below. A similar relative valuation is shared by NetApp’s EV/Sales ratio for CY2024, which currently stands at a ratio of 3.3, again lower than the peer group average. I still see a favorable risk-reward profile for the stock due to its AI exposure in 2024 and argue that NetApp is largely undervalued for the position it holds in the market today.

Image created by The Techie with data from Refinitiv

What Could Go Wrong?

While NetApp provides an attractive risk-reward profile, risks remain present. NetApp operates in the data storage hardware and management software business. What this means is that the company sells storage equipment to enterprises and service providers to “store and to share large amounts of digital data across physical and hybrid cloud environments.” The company derives the majority of its revenue, around 90%, from its Hybrid Cloud Segment at $1,455 million this quarter and the remaining from its Public Cloud Segment, which achieved $151M in net revenues for the quarter.

The biggest concern for the company at the moment is lackluster growth in its Public Cloud segment, which achieved a 1% year-over-year growth this quarter. I’m not too concerned about the slower rate of growth there because NetApp made it clear to investors on the earnings call that the company “anticipate[s] approximately $20 million in ARR headwinds from unrenewed subscriptions. This will create minimal revenue impact and should be largely offset by growth in first-party and marketplace services.” Another factor easing my concern is that the company is entering Q4 and FY25 in a stronger position than in FY24, during which NetApp and the broader storage market faced issues from NAND pricing pressure and weak end demand. I see more room for customer appetite for high-performance file storage solutions to train AI/ML workloads amid the AI boom to offset other near-term headwinds.

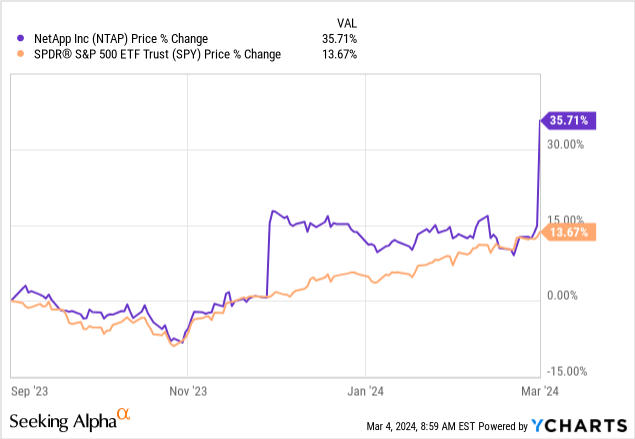

Still, I warn investors to be cautious when exploring entry points into the stock. I believe a lot of the positive sentiment surrounding the NAND Flash rebound and AI tailwinds have already been priced into the stock after management’s earnings call. The stock is up roughly 36% over the past six months, outperforming the S&P 500, which was up only 14% during the same period, as shown in the graph below. Investors should explore entry points within the high $80 range, in my opinion.

YCharts – SeekingAlpha

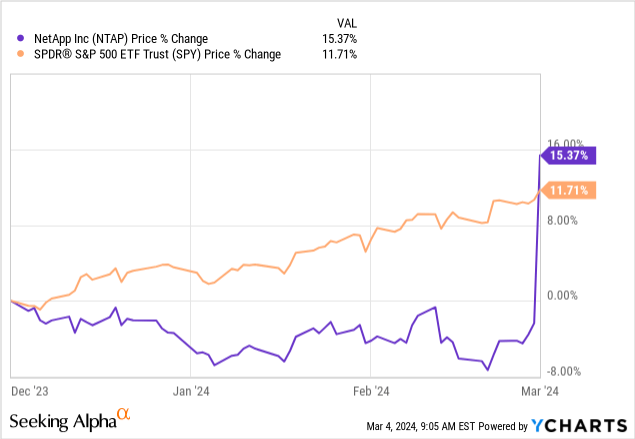

The stock price has only slightly outperformed the S&P 500 over the past three months. NTAP stock is up 15% over the past three months, while the S&P 500 is up 12% during the same period, as demonstrated in the graph below. I think NetApp has more upside to current consensus numbers due to its position within the enterprise data management and storage solution market, showing a solid sequential rebound in share gains due to its all-flash solutions alongside AI momentum and better NAND Flash demand and pricing dynamics. I think NetApp is uniquely positioned to ride this upward trend in NAND Flash recovery, as the company’s 3Q24 quarter reflects strong momentum.

YCharts – SeekingAlpha

What’s Next?

In my opinion, NetApp should be on investors’ watchlist for 2024. The company provides mature and developed data management capabilities. It is in bed with strategic partnerships that’ll allow it to leverage its capabilities into top-line growth amid the AI boom moment. I expect NetApp to make up for its lack of growth in the past through its expanded all-flash portfolio, and I already see proof of this in the company’s deal wins this quarter and raised guidance for FY24.

I understand investors’ concern that the stock price performance will be vulnerable to market sentiment regarding AI tailwinds. Still, I argue that NetApp will be a longer-term benefactor of the AI boom in FY25. I see more upside to current consensus numbers and expect the stock to trade higher towards 2H24, as enterprises and service providers visibly increase their AI-related capex investments this year in relation to last year.

Analyst’s Disclosure: I/we have no stock, option or similar derivative position in any of the companies mentioned, and no plans to initiate any such positions within the next 72 hours. I wrote this article myself, and it expresses my own opinions. I am not receiving compensation for it (other than from Seeking Alpha). I have no business relationship with any company whose stock is mentioned in this article.

Seeking Alpha’s Disclosure: Past performance is no guarantee of future results. No recommendation or advice is being given as to whether any investment is suitable for a particular investor. Any views or opinions expressed above may not reflect those of Seeking Alpha as a whole. Seeking Alpha is not a licensed securities dealer, broker or US investment adviser or investment bank. Our analysts are third party authors that include both professional investors and individual investors who may not be licensed or certified by any institute or regulatory body.